CM BANK(03968)

Search documents

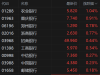

智通AH统计|10月22日

智通财经网· 2025-10-22 08:21

Core Insights - The article highlights the top and bottom AH premium rates for various stocks as of October 22, with Northeast Electric, Hongye Futures, and Andeli Juice leading in premium rates, while CATL, Heng Rui Medicine, and China Merchants Bank lag behind [1][2]. AH Premium Rate Rankings - The top three stocks by AH premium rate are: - Northeast Electric (00042) with a premium rate of 847.37% - Hongye Futures (03678) with a premium rate of 248.83% - Andeli Juice (02218) with a premium rate of 248.39% [2] - The bottom three stocks by AH premium rate are: - CATL (03750) with a premium rate of -18.20% - Heng Rui Medicine (01276) with a premium rate of 0.15% - China Merchants Bank (03968) with a premium rate of 1.60% [2] Deviation Values - The top three stocks by deviation value are: - Guanghe Tong (00638) with a deviation value of 81.35% - Shandong Molong (00568) with a deviation value of 38.55% - Changfei Optical Fiber (06869) with a deviation value of 35.75% [1][2] - The bottom three stocks by deviation value are: - Shanghai Electric (02727) with a deviation value of -23.77% - Chalco International (02068) with a deviation value of -22.62% - China National Foreign Trade (00598) with a deviation value of -17.07% [1][3]

【您收到来自招商银行信用卡的申卡邀请】

招商银行App· 2025-10-22 06:37

Group 1 - The article promotes various credit card offerings with attractive rewards for new users, including brand luggage and membership benefits [6][7][8] - Special promotions are available for referrals, where both the referrer and the referred can receive rewards upon meeting certain criteria [14] - Existing cardholders can apply for additional credit cards, but the new cards will share the credit limit with existing ones and will not qualify for new user rewards [15][16] Group 2 - The article highlights the convenience of managing payments, investments, and loans through a single app, emphasizing the integrated services offered [20] - There are promotional offers such as fee waivers and discounts on dining for new cardholders, enhancing the appeal of the credit card products [11]

险资再度增持银行股 热情或将持续

Jin Rong Shi Bao· 2025-10-22 06:04

Core Viewpoint - Insurance capital is actively increasing its holdings in bank stocks, driven by high dividend yields and stable returns, particularly in a low-interest-rate environment [1][3][4]. Group 1: Recent Activities of Insurance Capital - On October 10, Ping An Life increased its holdings in China Merchants Bank H-shares by 2.989 million shares, raising its total to 781 million shares, which accounts for 17% of the bank's H-shares [1]. - On the same day, Ping An purchased 6.416 million shares of Postal Savings Bank, bringing its total holdings to 17.01% [1]. - As of September 30, Ping An Life had acquired 39.634 million shares of Agricultural Bank H-shares, increasing its stake to 17.03%, with total holdings across its subsidiaries exceeding 19% [2]. Group 2: Reasons for Increased Investment in Bank Stocks - The high dividend yields and stable returns of bank stocks make them an ideal choice for insurance capital, especially in a declining interest rate environment [3]. - Regulatory encouragement for insurance capital to enter the market and new accounting standards promoting high-dividend asset allocation are also driving this trend [3]. - Current valuations of bank stocks are at historical lows, providing a favorable investment opportunity with cyclical resilience and policy support [3]. Group 3: Growth in Equity Allocation by Insurance Capital - A joint initiative by six departments aims to guide long-term funds, including insurance capital, to increase their market participation [4]. - As of the second quarter of 2025, the total investment balance of insurance companies exceeded 36 trillion yuan, with stock investments rising by 26.38% year-on-year [4]. - The five major listed insurance companies reported a total stock investment balance of 1.8 trillion yuan by mid-2025, reflecting an increase of over 400 billion yuan from the previous year [4]. Group 4: Market Outlook and Challenges - Insurance capital is expected to benefit from equity investments, enhancing investment returns and optimizing portfolio performance [5]. - However, challenges include the inherent volatility of the stock market, necessitating improved risk management and investment proportion control [5]. - Increased instances of insurance capital acquiring stakes may lead to market discussions regarding their impact [5].

港股异动丨内银股普涨,农业银行涨超1%再创新高,录得10连阳

Ge Long Hui· 2025-10-22 01:56

Group 1 - The core viewpoint is that Hong Kong bank stocks are experiencing a bullish trend, with Agricultural Bank of China reaching a new historical high and achieving a 10-day consecutive rise [1] - Morgan Stanley anticipates that after a seasonal adjustment in Q3, there will be good investment opportunities in Q4 and Q1 of the following year for domestic bank stocks [1] - Factors supporting the revaluation of Chinese banking stocks include upcoming dividend distributions, stabilized interest rates, a 500 billion RMB structural financial policy tool, and a more sustainable policy path [1] Group 2 - Agricultural Bank of China saw an increase of 1.04%, reaching a latest price of 5.820 [2] - Other banks also recorded gains, including Chongqing Bank (+0.91%), Zhengzhou Bank (+0.78%), and Zhejiang Bank (+0.77%) [2] - The overall trend indicates a positive performance across various banks, with notable increases in share prices for several institutions [2]

“存三年不如存一年” 中小银行存款降息步伐加快

Zhong Guo Zheng Quan Bao· 2025-10-21 23:21

Core Viewpoint - Recent adjustments in deposit interest rates by several small and medium-sized banks indicate a trend towards lowering rates, particularly for long-term deposits, to optimize liability structures and manage funding costs amid a declining interest rate environment [1][5][6] Group 1: Deposit Rate Adjustments - Suzhou Bank plans to lower its three-year deposit rate by 10 basis points to 2.1% starting October 22, with new customers still eligible for a 2.2% rate [1][2] - Other regional banks, such as Pingyang Pudong Development Village Bank and Fujian Huato Bank, have also announced significant reductions in deposit rates, with some long-term rates dropping by as much as 80 basis points [2][3] - The frequency of rate adjustments has increased, with some banks like Huixian Zhujiang Village Bank making multiple changes within a short period [3] Group 2: Interest Rate Inversion - A notable phenomenon of interest rate inversion is emerging, where short-term deposit rates exceed long-term rates across various banking institutions [4] - For instance, China Construction Bank offers a three-year deposit rate of 1.55%, while the five-year rate is lower at 1.3% [4] - This inversion is prevalent among state-owned banks, joint-stock banks, and rural commercial banks, indicating a broader trend in the banking sector [4] Group 3: Factors Influencing Rate Changes - Industry experts attribute the inversion of deposit rates to expectations of further interest rate declines and the need for banks to adjust their liability structures [5][6] - The pressure on the liability side is prompting banks to lower long-term deposit rates to reduce funding costs and improve their financial stability [5] - Analysts predict that the central bank may implement further interest rate cuts, which could compel banks to continue lowering deposit rates to manage their interest margins [6]

中小银行存款降息步伐加快

Zhong Guo Zheng Quan Bao· 2025-10-21 20:18

Core Viewpoint - The recent trend of lowering deposit rates among small and medium-sized banks is driven by the need to optimize liability structures and control funding costs, amidst a backdrop of anticipated interest rate declines and the phenomenon of inverted deposit rates for different maturities [1][2][3][4] Group 1: Deposit Rate Adjustments - Several small and medium-sized banks, including Suzhou Commercial Bank and Pingyang Pudong Development Village Bank, have announced reductions in deposit rates, with some three-year and five-year rates decreasing by as much as 80 basis points [1][2] - Suzhou Commercial Bank will lower its three-year deposit rate from 2.2% to 2.1% starting October 22, with a minimum deposit requirement of 100,000 yuan [1] - The trend of rate reductions is not isolated, as multiple banks have made similar announcements, indicating a broader industry shift [2] Group 2: Inverted Deposit Rates - The phenomenon of inverted deposit rates, where shorter-term deposit rates exceed those of longer-term deposits, is becoming increasingly common across various types of banks, including state-owned and joint-stock banks [2][3] - For instance, China Construction Bank offers a three-year deposit rate of 1.55%, which is higher than its five-year rate of 1.3% [3] - This inversion is attributed to market expectations of further interest rate declines, leading banks to adjust their deposit offerings accordingly [3] Group 3: Liability Structure Adjustments - Industry experts suggest that the inverted deposit rates are linked to banks' efforts to adjust their liability structures in response to increasing pressure on the funding side [3][4] - Banks are actively lowering long-term deposit rates to optimize their funding costs and mitigate the impact of narrowing net interest margins [3] - The anticipated future decline in interest rates is prompting banks to reassess their deposit strategies to maintain operational efficiency [4]

易方达中证卫星产业交易型开放式指数证券投资基金基金份额发售公告

Shang Hai Zheng Quan Bao· 2025-10-21 19:34

Fund Overview - The fund is named "E Fund Zhongzheng Satellite Industry Exchange-Traded Open-Ended Index Securities Investment Fund" with a code of 563530 and a subscription code of 563533 [19] - It is an exchange-traded, stock-type index fund with an indefinite duration [19] - The fund's initial share value is set at 1.00 RMB [19] Fund Launch Details - The fundraising period is from October 27, 2025, to October 31, 2025, with options for online cash subscription and offline cash subscription [19][22] - The maximum fundraising limit is 2 billion RMB, excluding interest and subscription fees [3] - If the total valid subscription exceeds 2 billion shares, a proportionate confirmation method will be used to control the scale [3][4] Subscription Process - Investors must have a Shanghai Stock Exchange A-share account or a securities investment fund account to participate in subscriptions [6][39] - The subscription fee will not exceed 0.80% of the subscribed shares [7][24] - For online cash subscriptions, each order must be in multiples of 1,000 shares, with a maximum of 99,999,000 shares [10][26] Index Information - The fund tracks the Zhongzheng Satellite Industry Index, which includes companies involved in satellite platform and payload manufacturing, satellite launching, and applications like satellite communication and navigation [8][11] - The index sample space is the same as that of the Zhongzheng All Index, with a selection of the top 50 companies based on average daily trading volume [9][10] Fund Management - The fund is managed by E Fund Management Co., Ltd., with the custodian being China Merchants Bank [1][58] - The fund's investment objective is to closely track the performance of the underlying index while minimizing tracking deviation and error [20] Investor Information - The fund is open to individual investors, institutional investors, qualified foreign investors, and other investors permitted by law [21] - Investors can make multiple subscriptions during the fundraising period, and there is no upper limit on the total subscription amount for individual investors, subject to regulatory compliance [10][21]

招商银行发生4笔大宗交易 合计成交5163.54万元

Zheng Quan Shi Bao Wang· 2025-10-21 13:39

招商银行10月21日大宗交易平台共发生4笔成交,合计成交量123.00万股,成交金额5163.54万元。成交 价格均为41.98元。 进一步统计,近3个月内该股累计发生16笔大宗交易,合计成交金额为52.93亿元。 10月21日招商银行大宗交易一览 | 成交量 | 成交金 | 成交价 | 相对当日收盘 | | | | --- | --- | --- | --- | --- | --- | | (万 | 额(万 | 格 | 折溢价(%) | 买方营业部 | 卖方营业部 | | 股) | 元) | (元) | | | | | 36.00 | 1511.28 | 41.98 | 0.00 | 兴业证券股份有限公司 | 中国国际金融股份有限公司北 | | | | | | 上海锦康路证券营业部 | 京建国门外大街证券营业部 | | 34.00 | 1427.32 | 41.98 | 0.00 | 广发证券股份有限公司 广州环市东路证券营业 | 中信证券股份有限公司总部 (非营业场所) | | | | | | 部 | | | 34.00 | 1427.32 | 41.98 | 0.00 | 广发证券股份有限公司 | 中信 ...

招商银行10月21日现4笔大宗交易 总成交金额5163.54万元 溢价率为0.00%

Xin Lang Cai Jing· 2025-10-21 10:12

Summary of Key Points Core Viewpoint - On October 21, China Merchants Bank's stock closed at 41.98 yuan, with a rise of 1.35%, and recorded four block trades totaling 1.23 million shares and a transaction amount of 51.6354 million yuan [1][2]. Trading Activity - The first block trade occurred at a price of 41.98 yuan for 360,000 shares, amounting to 15.1128 million yuan, with a premium rate of 0.00% [1]. - The second block trade also priced at 41.98 yuan involved 340,000 shares, totaling 14.2732 million yuan, with a premium rate of 0.00% [1]. - The third block trade was for 190,000 shares at the same price, resulting in a transaction amount of 7.9762 million yuan, maintaining a premium rate of 0.00% [1]. - The fourth block trade matched the previous prices and involved another 340,000 shares, amounting to 14.2732 million yuan, with a premium rate of 0.00% [2]. Recent Trading Trends - Over the past three months, China Merchants Bank has seen a total of 16 block trades, with a cumulative transaction amount of 5.293 billion yuan [2]. - In the last five trading days, the stock has increased by 1.75%, while the main capital has experienced a net outflow of 973 million yuan [2].

股份制银行板块10月21日涨0.33%,招商银行领涨,主力资金净流出9.73亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-21 08:30

证券之星消息,10月21日股份制银行板块较上一交易日上涨0.33%,招商银行领涨。当日上证指数报收于3916.33,上涨1.36%。深证成指报收于 13077.32,上涨2.06%。股份制银行板块个股涨跌见下表: 以上内容为证券之星据公开信息整理,由AI算法生成(网信算备310104345710301240019号),不构成投资建议。 相关ETF A50ETF (产品代码: 159601) ★ 跟踪:MSCI中国A50互联互通人民币指数 | 代码 | 名称 | 收盘价 | 涨跌幅 | 成交量(手) | 成交额(元) | | --- | --- | --- | --- | --- | --- | | 600036 | 指商银行 | 41.98 | 1.35% | 75.99万 | 31.84亿 | | 661698 | 中信银行 | 7.75 | 0.52% | 51.96万 | 4.01亿 | | 600015 | 华夏银行 | 6.86 | 0.29% | 80.06万 | 5.48 Z | | 000001 | 平安银行 | 11.43 | 0.09% | 76.12万 | 8.70亿 | | 60000 ...