HZBank(600926)

Search documents

杭州银行(600926) - 杭州银行独立董事候选人声明与承诺(赵骏)

2025-10-30 10:43

(二)《中华人民共和国公务员法》关于公务员兼任职务的 规定(如适用); (三)中国证监会《上市公司独立董事管理办法》、上海证 券交易所自律监管规则以及公司章程有关独立董事任职资格和 条件的相关规定; 杭州银行股份有限公司 独立董事候选人声明与承诺 本人赵骏,已充分了解并同意由提名人杭州银行股份有限公 司董事会提名为杭州银行股份有限公司第八届董事会独立董事 候选人。本人公开声明,本人具备独立董事任职资格,保证不存 在任何影响本人担任杭州银行股份有限公司独立董事独立性的 关系,具体声明并承诺如下: 一、本人具备上市公司运作的基本知识,熟悉相关法律、行 政法规、部门规章及其他规范性文件,具有 5 年以上法律、经济、 会计、财务、管理或者其他履行独立董事职责所必需的工作经验。 二、本人任职资格符合下列法律、行政法规和部门规章以及 公司规章的要求: (一)《中华人民共和国公司法》关于董事任职资格的规定; 三、本人具备独立性,不属于下列情形: (一)在上市公司或者其附属企业任职的人员及其配偶、父 母、子女、主要社会关系(主要社会关系是指兄弟姐妹、兄弟姐 妹的配偶、配偶的父母、配偶的兄弟姐妹、子女的配偶、子女配 偶的父母等 ...

杭州银行(600926) - 杭州银行独立董事提名人声明与承诺(赵骏)

2025-10-30 10:43

杭州银行股份有限公司 独立董事提名人声明与承诺 1 辞去公职或者退(离)休后担任上市公司、基金管理公司独立董 事、独立监事的通知》的规定(如适用); (五)中共中央组织部《关于进一步规范党政领导干部在企 业兼职(任职)问题的意见》的相关规定(如适用); 提名人杭州银行股份有限公司董事会,现提名赵骏为杭州银 行股份有限公司第八届董事会独立董事候选人,并已充分了解被 提名人职业、学历、职称、详细的工作经历、全部兼职、有无重 大失信等不良记录等情况。被提名人已同意出任杭州银行股份有 限公司第八届董事会独立董事候选人(参见该独立董事候选人声 明)。提名人认为,被提名人具备独立董事任职资格,与杭州银 行股份有限公司之间不存在任何影响其独立性的关系,具体声明 并承诺如下: 一、被提名人具备上市公司运作的基本知识,熟悉相关法律、 行政法规、规章及其他规范性文件,具有 5 年以上法律、经济、 会计、财务、管理或者其他履行独立董事职责所必需的工作经验。 二、被提名人任职资格符合下列法律、行政法规和部门规章 的要求: (一)《中华人民共和国公司法》关于董事任职资格的规定; (二)《中华人民共和国公务员法》关于公务员兼任职务的 规 ...

杭州银行针对《微信渠道用户隐私保护协议》文本进行修订完善

Jin Tou Wang· 2025-10-30 03:23

Core Points - Hangzhou Bank announced the revision of the "Hangzhou Bank WeChat Channel User Privacy Protection Agreement" to enhance user privacy protection and ensure compliance with operational standards in WeChat mini-programs [1][2] Summary by Sections Revision Details - The revision expands the scope of the agreement from the original single login channel of WeChat Business Hall to include WeChat channels, which now encompasses both WeChat Business Hall and WeChat mini-programs [2] - A new list of third-party SDKs and marketing authorization agreements has been added to the agreement [2] - Modifications have been made to align with the newly revised "Children's Personal Information Protection Rules," specifically regarding the handling of minors' information [2] Implementation - The updated "Hangzhou Bank WeChat Channel User Privacy Protection Agreement" will take effect on October 31, 2025, requiring customers to re-sign the new agreement upon logging into Hangzhou Bank's WeChat channels [2] - Customers who do not agree with the updated terms can request to terminate their services with Hangzhou Bank [2]

银行视角十五五规划建议稿解读:金融强国目标不变,兼顾发展与安全

Yin He Zheng Quan· 2025-10-29 12:55

Investment Rating - The report suggests a positive outlook for the banking industry, indicating a shift from homogeneous competition to differentiated development, which opens up new business opportunities [4]. Core Insights - The report emphasizes the goal of building a modern financial system that balances resilience, efficiency, inclusiveness, and security, aligning with the high-quality development needs of the economy [4]. - It highlights the importance of enhancing the central bank's role in macroeconomic regulation and financial stability, with a focus on preventing systemic financial risks [4]. - The report identifies five key areas for financial supply-side structural reform: technology finance, green finance, inclusive finance, pension finance, and digital finance, which are seen as major sources of new business for banks [4]. - It discusses the need for banks to transform their operating models, particularly in technology finance, and to address challenges such as product homogeneity and risk management [4]. - The report notes that regulatory constraints will remain strict, with an emphasis on risk prevention and resolution, particularly in key areas like real estate and local debt [4]. Summary by Sections Central Bank and Macro-Prudential Management - The report advocates for a robust macro-prudential management framework to mitigate systemic risks and enhance the central bank's regulatory capabilities [4]. Financial Supply-Side Structural Reform - The focus is on developing various financial sectors to guide resources to critical areas, fostering new productive forces and expanding credit opportunities [4]. Differentiated Development of Banks - Different types of banks are encouraged to adopt tailored strategies, with state-owned banks focusing on national strategies and regional banks serving local economies [4]. Regulatory Environment - The report anticipates stricter and more efficient regulatory measures, with an emphasis on the application of regulatory technology and accelerated financial legislation [4]. Investment Recommendations - The report recommends specific banks for investment, including Industrial and Commercial Bank of China, Agricultural Bank of China, Postal Savings Bank of China, Jiangsu Bank, Hangzhou Bank, and China Merchants Bank, highlighting their potential for recovery and transformation [4].

解密主力资金出逃股 连续5日净流出490股

Zheng Quan Shi Bao Wang· 2025-10-29 09:03

Core Insights - A total of 490 stocks in the Shanghai and Shenzhen markets have experienced net outflows of main funds for five consecutive days or more as of October 29 [1] - The stock with the longest continuous net outflow is Zhongju Gaoxin, with 31 days of outflows, followed by Hengshen New Materials with 21 days [1] - The largest total net outflow amount is from China Merchants Bank, with a cumulative outflow of 3.093 billion yuan over 12 days [1] Group 1: Stocks with Longest Net Outflows - Zhongju Gaoxin has seen net outflows for 31 days, with a total outflow of 559 million yuan and a cumulative decline of 6.91% [1] - Hengshen New Materials has recorded net outflows for 21 days, totaling 197 million yuan, with a decline of 9.80% [3] - China Merchants Bank has the highest net outflow amount of 3.093 billion yuan over 12 days, with a net outflow ratio of 6.98% and a cumulative increase of 1.65% [1] Group 2: Other Notable Stocks - Guotai Junan has experienced net outflows for 10 days, amounting to 1.877 billion yuan, with a net outflow ratio of 7.89% and a cumulative increase of 2.70% [1] - Shengbang Co. has seen net outflows for 12 days, totaling 1.826 billion yuan, with a net outflow ratio of 9.52% and a cumulative decline of 10.65% [1] - Huajian Group has recorded net outflows for 6 days, with a total outflow of 1.713 billion yuan and a significant decline of 40.29% [1] Group 3: Stocks with Significant Outflow Ratios - Jianan Intelligent has the highest net outflow ratio at 14.74%, with a decline of 2.98% over the past 5 days [1] - Other notable stocks with high outflow ratios include Huayi Development at 11.91% and Pianzaihuang at 11.84% [1] - The overall trend indicates a significant outflow of funds from various sectors, reflecting investor sentiment and market conditions [1]

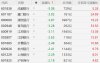

城商行板块10月29日跌2.43%,成都银行领跌,主力资金净流出7.42亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-29 08:41

Core Viewpoint - The city commercial bank sector experienced a decline of 2.43% on October 29, with Chengdu Bank leading the drop, while the overall stock market indices showed an increase [1][2]. Market Performance - The Shanghai Composite Index closed at 4016.33, up 0.7% - The Shenzhen Component Index closed at 13691.38, up 1.95% [1]. Individual Stock Performance - Chengdu Bank saw a significant decline of 5.74%, closing at 17.07 - Other notable declines included Xiamen Bank (-4.90%), Jiangsu Bank (-3.84%), and Qingdao Bank (-3.66%) [2]. - Chongqing Bank was one of the few gainers, with a slight increase of 0.84%, closing at 10.76 [1]. Trading Volume and Turnover - Chengdu Bank had a trading volume of 1.298 million shares, with a turnover of 22.27 million yuan - Jiangsu Bank had a trading volume of 2.039 million shares, with a turnover of 2.164 billion yuan [2]. Capital Flow Analysis - The city commercial bank sector saw a net outflow of 742 million yuan from institutional investors, while retail investors contributed a net inflow of 410 million yuan [2]. - The data indicates that speculative funds had a net inflow of 331 million yuan [2]. Individual Stock Capital Flow - Qingdao Bank had a net inflow of 61.11 million yuan from institutional investors, while it experienced a net outflow of 59.42 million yuan from speculative funds [3]. - Nanjing Bank also saw a net inflow of 43.97 million yuan from institutional investors, but a net outflow of 34.08 million yuan from speculative funds [3].

A股银行股集体下跌:成都银行跌5%,浦发银行跌超3%

Ge Long Hui A P P· 2025-10-29 04:03

Group 1 - The A-share market saw a collective decline in bank stocks, with Chengdu Bank dropping by 5% and several others, including Xiamen Bank, Shanghai Pudong Development Bank, and Qingdao Bank, falling over 3% [1] - Specific declines included Jiangyin Bank, Qilu Bank, Hangzhou Bank, Shanghai Bank, and Hu Nong Commercial Bank, all experiencing drops exceeding 2% [1] Group 2 - Chengdu Bank's market capitalization is reported at 72.9 billion, with a year-to-date increase of 5.28% despite the recent decline of 5.08% [2] - Xiamen Bank has a market capitalization of 18.1 billion, with a year-to-date increase of 24.69%, but it fell by 3.92% today [2] - Shanghai Pudong Development Bank's market capitalization stands at 396.7 billion, with a year-to-date increase of 19.25%, experiencing a decline of 3.87% [2] - Qingdao Bank's market capitalization is 29.2 billion, with a year-to-date increase of 33.50%, and it dropped by 3.28% [2] - Jiangsu Bank has a market capitalization of 194.5 billion, with a year-to-date increase of 13.38%, and it fell by 3.11% [2] - Other banks like Jiangyin Bank, Qilu Bank, Hangzhou Bank, Shanghai Bank, and Hu Nong Commercial Bank also reported declines, with respective market capitalizations of 11.8 billion, 36.4 billion, 114.4 billion, 133.3 billion, and 82.1 billion [2]

杭州银行跌2.04%,成交额1.58亿元,主力资金净流出2648.06万元

Xin Lang Cai Jing· 2025-10-29 02:04

Core Viewpoint - Hangzhou Bank's stock has experienced fluctuations, with a recent decline of 2.04% and a year-to-date increase of 10.54%, indicating volatility in its market performance [1]. Financial Performance - As of July 31, Hangzhou Bank reported a net profit of 11.662 billion yuan for the first half of 2025, reflecting a year-on-year growth of 16.66% [2]. - The bank has distributed a total of 19.099 billion yuan in dividends since its A-share listing, with 9.705 billion yuan distributed in the last three years [3]. Shareholder Information - The number of shareholders for Hangzhou Bank reached 60,900 as of July 31, an increase of 3.19% from the previous period [2]. - The average number of circulating shares per shareholder is 119,107, which has decreased by 2.99% compared to the previous period [2]. - As of June 30, 2025, Hong Kong Central Clearing Limited is the fifth-largest circulating shareholder, holding 310 million shares, an increase of 4.855 million shares from the previous period [3]. Stock Market Activity - On October 29, Hangzhou Bank's stock price was 15.84 yuan per share, with a trading volume of 158 million yuan and a turnover rate of 0.14% [1]. - The stock has seen a net outflow of 26.4806 million yuan in principal funds, with significant selling pressure observed [1].

行业深度报告:零售风险及新规影响有限,兼论信贷去抵押化

KAIYUAN SECURITIES· 2025-10-27 05:44

Investment Rating - The investment rating for the industry is "Positive" (maintained) [1] Core Insights - The report highlights that retail non-performing loan (NPL) rates and generation rates are currently high, indicating ongoing pressure on bank profitability. Despite a low overall NPL rate, the retail sector shows signs of risk, with a marginal increase in the NPL rate to 1.28% [14][15] - The transition period for new risk regulations is nearing its end, with concerns about the impact on banks' provisioning levels. However, the report suggests that the actual impact may be less severe than market expectations [16] - The trend of de-collateralization in bank lending is evident, driven by both business characteristics and strategic choices made by banks to reduce reliance on collateralized loans [17] Summary by Sections 1. Retail NPL and Generation Rates - The retail NPL rate has increased to 1.28%, with a steepening curve indicating ongoing risk. The generation rate for retail loans remains high, with significant increases noted in certain banks [14][18] - The report indicates that while the overall NPL rate is low, the divergence between overdue and NPL indicators suggests underlying risks in the retail sector [19] 2. Impact of New Risk Regulations - The new risk regulations will require banks to classify impaired loans as NPLs, potentially increasing reported NPL rates. However, the report anticipates that the actual provisioning pressure may be manageable [16][17] 3. De-Collateralization in Lending - The report notes a significant decline in the proportion of collateralized loans, with banks shifting towards non-collateralized lending strategies. This shift is influenced by the need to manage risk more effectively [17][18] 4. Investment Recommendations - The report recommends certain state-owned banks due to their customer base advantages and manageable retail risk pressures. It also highlights specific banks such as CITIC Bank and Agricultural Bank of China as beneficiaries of this trend [6]

银行股三季报陆续披露 多家银行业绩均有改善 银行业净息差或企稳(附概念股)

Zhi Tong Cai Jing· 2025-10-27 02:12

Core Viewpoint - The A-share listed banks are expected to show overall revenue and net profit growth in the third quarter of 2025, with improvements in asset quality and a narrowing decline in net interest margins [1][2][3]. Group 1: Financial Performance - Huaxia Bank reported operating income of 64.881 billion yuan, a year-on-year decrease of 8.79%, and net profit attributable to shareholders of 17.982 billion yuan, down 2.86%, with a narrowing decline of 5.09 percentage points compared to the first half of the year [1]. - Chongqing Bank achieved operating income of 11.740 billion yuan, a year-on-year increase of 10.40%, and net profit of 5.196 billion yuan, up 10.42% [2]. - Ping An Bank reported operating income of 100.668 billion yuan, a year-on-year decrease of 9.8%, and net profit of 38.339 billion yuan, down 3.5%, with a narrowing decline compared to the first half of the year [2]. Group 2: Market Trends - Ten banks have seen shareholding increases from shareholders and executives this year, indicating a positive outlook for the banking sector amid macroeconomic stabilization and easing monetary policy [3]. - Analysts expect cumulative revenue and net profit for listed banks in the first three quarters of 2025 to grow by 0.4% and 1.1% year-on-year, respectively, driven by a narrowing decline in net interest margins and reduced credit costs [3]. Group 3: Interest Margin Outlook - Zhongtai Securities suggests that the net interest margin for banks may stabilize in the third quarter due to reduced re-pricing pressure on assets and a greater decline in deposit rates compared to the Loan Prime Rate (LPR) [4]. - The projected increase in net interest margin for the third and fourth quarters is 0.7 basis points and 0.3 basis points, respectively, indicating stability in the banking sector [4]. Group 4: Related Stocks - Goldman Sachs reported that the A-shares and H-shares of major banks have recorded absolute returns of 12% and 21% year-to-date, driven by improvements in asset quality and narrowing declines in net interest margins [5]. - Ping An Insurance increased its stake in Postal Savings Bank, acquiring 6.416 million shares at an average price of 5.3638 HKD per share [6].