Shaanxi Heimao(601015)

Search documents

陕西黑猫股价涨5.19%,华商基金旗下1只基金位居十大流通股东,持有791.94万股浮盈赚取158.39万元

Xin Lang Cai Jing· 2025-10-20 06:08

Core Insights - Shaanxi Black Cat Coking Co., Ltd. experienced a stock price increase of 5.19%, reaching 4.05 CNY per share, with a trading volume of 309 million CNY and a turnover rate of 3.82%, resulting in a total market capitalization of 8.272 billion CNY [1] Company Overview - Shaanxi Black Cat was established on November 18, 2003, and went public on November 5, 2014. The company is located in the Yellow River Mining Building in Hancheng, Shaanxi Province [1] - The company's main business includes the production and sale of coking products, coal chemical products, and coal products. The revenue composition is as follows: - Coking coal: 72.06% - Coal tar: 6.15% - LNG: 5.78% - Coking coal: 3.51% - Synthetic ammonia: 3.42% - Crude benzene: 3.14% - Methanol: 2.80% - BDO: 0.95% - Medium coal: 0.92% - Other: 0.78% - Other product revenue: 0.50% [1] Shareholder Information - Huashang Fund has a presence among the top ten circulating shareholders of Shaanxi Black Cat, with the Huashang Selected Return Mixed A Fund (010761) newly entering the top ten in the second quarter, holding 7.9194 million shares, which is 0.39% of the circulating shares. The estimated floating profit today is approximately 1.5839 million CNY [2] - The Huashang Selected Return Mixed A Fund was established on January 19, 2021, with a current scale of 2.261 billion CNY. Year-to-date returns are 37.8%, ranking 1470 out of 8234 in its category; the one-year return is 39.96%, ranking 1670 out of 8095; and since inception, the return is 99.71% [2]

煤炭板块延续强势,大有能源6天5板

Mei Ri Jing Ji Xin Wen· 2025-10-17 02:05

Group 1 - The coal sector continues to show strong performance, with companies like Dayou Energy achieving five consecutive trading limits in six days [1] - Antai Group has seen two consecutive trading limits, indicating positive market sentiment [1] - Other companies such as Yunwei Co., Yunmei Energy, and Shaanxi Black Cat are also experiencing upward trends in their stock prices [1]

煤炭开采加工板块延续活跃 大有能源4连板

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-17 01:43

Core Viewpoint - The coal mining and processing sector remains active, with several companies experiencing significant stock price increases, indicating a positive market sentiment towards this industry [1] Company Performance - Dayou Energy has achieved a four-day consecutive increase in stock price [1] - Antai Group has reached its daily limit up [1] - Other companies such as Yunmei Energy, Electric Power Investment Energy, Pingmei Shenma Energy, Shaanxi Black Cat, and Liaoning Energy have also seen their stock prices rise [1]

焦炭板块10月16日涨2.01%,安泰集团领涨,主力资金净流入2.24亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-16 08:27

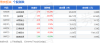

Core Insights - The coke sector experienced a 2.01% increase on October 16, with Antai Group leading the gains [1] - The Shanghai Composite Index closed at 3916.23, up 0.1%, while the Shenzhen Component Index closed at 13086.41, down 0.25% [1] Sector Performance - Antai Group's stock price rose by 10.20% to 2.70, with a trading volume of 1.8985 million shares and a transaction value of 500 million yuan [1] - Baotailong's stock price increased by 10.03% to 3.95, with a trading volume of 3.8671 million shares and a transaction value of 1.456 billion yuan [1] - Shanxi Coking Coal's stock price rose by 1.70% to 4.18, with a trading volume of 521,600 shares and a transaction value of 217 million yuan [1] - Shaanxi Black Cat's stock price increased by 1.56% to 3.90, with a trading volume of 789,100 shares and a transaction value of 306 million yuan [1] - Yunnan Coal Energy's stock price rose by 1.23% to 4.12, with a trading volume of 386,400 shares and a transaction value of 159 million yuan [1] - Yunwei Co.'s stock price increased by 0.28% to 3.61, with a trading volume of 215,000 shares and a transaction value of 77.4935 million yuan [1] - Meijin Energy's stock price decreased by 0.60% to 5.00, with a trading volume of 778,800 shares and a transaction value of 389.7 million yuan [1] Capital Flow - The coke sector saw a net inflow of 224 million yuan from main funds, while retail funds experienced a net outflow of 113 million yuan and 111 million yuan respectively [1] - Baotailong had a main fund net inflow of 131 million yuan, while retail funds saw a net outflow of 90.41 million yuan [2] - Antai Group experienced a main fund net inflow of 60.25 million yuan, with retail funds seeing a net outflow of 44.32 million yuan [2] - Shanxi Coking Coal had a main fund net inflow of 29.04 million yuan, with retail funds experiencing a net outflow of 8.61 million yuan [2] - Shaanxi Black Cat saw a main fund net inflow of 12.34 million yuan, while retail funds had a net inflow of 0.33 million yuan [2] - Yunnan Coal Energy had a main fund net inflow of 7.76 million yuan, with retail funds seeing a net inflow of 0.86 million yuan [2] - Yunwei Co. experienced a main fund net outflow of 2.72 million yuan, while retail funds had a net inflow of 0.26 million yuan [2] - Meijin Energy had a main fund net outflow of 13.91 million yuan, with retail funds seeing a net inflow of 1.78 million yuan [2]

煤炭行业2025年三季报业绩前瞻:煤价回升,看好四季度煤企业绩进一步修复

Shenwan Hongyuan Securities· 2025-10-14 13:13

Investment Rating - The report maintains an "Overweight" rating for the coal industry, indicating a positive outlook for the sector's performance relative to the overall market [32]. Core Insights - Domestic raw coal production increased by 2.8% year-on-year to 3.165 billion tons from January to August 2025, while coal imports fell by 11.1% year-on-year to 35 million tons from January to September 2025 [4][18]. - In Q3 2025, both thermal coal and coking coal prices rebounded, with the average price of 5500 kcal thermal coal at ports rising to approximately 673 CNY/ton, a 6.75% increase from Q2 2025, despite a 20.66% decrease year-on-year [4][23]. - Key companies in the coal sector are expected to report varying performance in their Q3 2025 earnings, with China Shenhua and Shaanxi Coal achieving better-than-expected results, while Shanxi Coking Coal and Huai Bei Mining are projected to meet expectations [4][25]. Supply and Demand Dynamics - The supply of coal remains tight due to production capacity checks, while demand is robust, leading to a rebound in coal prices during Q3 2025 [4][23]. - The report highlights that major coal-producing regions like Shanxi and Shaanxi have shown production increases, while Inner Mongolia experienced a slight decline [10][18]. Price Trends - The report details significant price fluctuations in coal types, with thermal coal prices showing a rebound in Q3 2025 compared to Q2 2025, while coking coal prices also saw increases due to supply constraints [21][24]. - The average price of Shanxi's main coking coal at the port was reported at 1564 CNY/ton, reflecting a 19.09% increase from Q2 2025, despite a year-on-year decrease [24]. Company Performance Forecast - The report provides earnings forecasts for key coal companies, indicating that China Shenhua is expected to report an EPS of 1.97 CNY, while companies like Shaanxi Coal and Shanxi Coking Coal are projected to have EPS of 1.29 CNY and 0.25 CNY, respectively [25]. - The report identifies companies with strong earnings potential, recommending investments in undervalued stocks such as Shanxi Coking Coal and Huai Bei Mining, while also suggesting stable dividend-paying stocks like China Shenhua and Shaanxi Coal [4][25].

焦炭板块10月13日涨1.48%,宝泰隆领涨,主力资金净流出5131.55万元

Zheng Xing Xing Ye Ri Bao· 2025-10-13 12:45

Core Insights - The coke sector experienced a 1.48% increase on October 13, with Baotailong leading the gains [1] - The Shanghai Composite Index closed at 3889.5, down 0.19%, while the Shenzhen Component Index closed at 13231.47, down 0.93% [1] Sector Performance - Baotailong (601011) closed at 3.60, up 10.09% with a trading volume of 449,300 shares and a transaction value of 162 million yuan [1] - Antai Group (600408) closed at 2.42, up 2.11% with a trading volume of 494,300 shares and a transaction value of 117 million yuan [1] - Yunwei Co. (600725) closed at 3.60, up 1.12% with a trading volume of 217,500 shares and a transaction value of 76.66 million yuan [1] - Meijin Energy (000723) closed at 4.99, up 0.60% with a trading volume of 1,890,300 shares and a transaction value of 439 million yuan [1] - Shaanxi Black Cat (601015) closed at 3.74, up 0.54% with a trading volume of 470,700 shares and a transaction value of 174 million yuan [1] - Yunmei Energy (600792) closed at 3.99, up 0.50% with a trading volume of 226,200 shares and a transaction value of 89.03 million yuan [1] - Shanxi Coking Coal (600740) closed at 4.10, down 0.73% with a trading volume of 362,400 shares and a transaction value of 1.47 billion yuan [1] Capital Flow - The coke sector saw a net outflow of 51.32 million yuan from institutional investors and 39.11 million yuan from retail investors, while retail investors had a net inflow of 90.43 million yuan [1] - Baotailong had a net inflow of 8.45 million yuan from institutional investors, but a net outflow of 8.79 million yuan from retail investors [2] - Yunwei Co. experienced a net inflow of 1.48 million yuan from retail investors despite a net outflow from institutional and speculative investors [2] - Shaanxi Black Cat had a net outflow of 5.27 million yuan from institutional investors but a net inflow of 15.40 million yuan from retail investors [2] - Yunmei Energy saw a significant net outflow from institutional and speculative investors, but a net inflow of 13.40 million yuan from retail investors [2] - Antai Group and Shanxi Coking Coal both experienced net outflows from institutional and speculative investors, with retail investors providing some support [2]

煤炭行业周报(10月第1周):南热北寒需求旺,煤炭红利避险优选-20251012

ZHESHANG SECURITIES· 2025-10-12 03:45

Investment Rating - The industry investment rating is "Positive" [1] Core Viewpoints - The coal sector has shown a rise, outperforming the CSI 300 index by 4.81 percentage points, with a weekly increase of 4.3% as of October 10, 2025 [2] - The report anticipates that winter coal prices could reach 800 RMB/ton, with expectations of price increases during the heating season [6][25] - The supply-demand balance is expected to gradually improve in the fourth quarter, leading to a steady rise in coal prices [6][25] Supply Side Summary - Key monitored enterprises reported an average daily coal sales volume of 6.55 million tons from October 3 to October 9, 2025, a week-on-week decrease of 13% and a year-on-year decrease of 13.6% [2] - The average daily coal production from key monitored enterprises was 6.74 million tons, with a week-on-week decrease of 100% [2] - Total coal inventory (including port storage) reached 25.36 million tons, with a week-on-week increase of 4.4% and a year-on-year decrease of 9% [2][23] Demand Side Summary - Cumulative coal consumption in the power and chemical industries has decreased by 2.9% and increased by 15.4% year-on-year, respectively [2] - Iron and steel production has seen a year-on-year increase of 1.4% [2] Price Summary - The price of thermal coal (Q5500K) in the Bohai Rim was 677 RMB/ton, with a week-on-week increase of 0.15% [3] - The price of coking coal at major ports remained stable, while the price of metallurgical coke increased by 3.18% [4] - The report indicates that coal prices are expected to rise, particularly during the heating season [6][25] Sentiment Summary - The report highlights that the current coal asset dividends are reasonable, with a positive fundamental outlook [6][25] - The report suggests focusing on flexible thermal coal companies and coking coal companies undergoing turnaround [6][25]

突发回调!半导体板块重挫!发生了什么?

Zheng Quan Shi Bao· 2025-10-10 09:24

Market Overview - The Chinese asset market experienced a collective pullback, with the A-share market declining significantly after a strong opening on the first trading day post-holiday. The Shanghai Composite Index fell approximately 1% to below 3900 points, while the ChiNext Index dropped over 5% before slightly narrowing its losses at the close [1] - The total trading volume in the Shanghai and Shenzhen markets decreased by 137.8 billion yuan compared to the previous day, totaling 253.45 billion yuan [1] Sector Performance - The semiconductor sector saw a substantial decline, with companies like Aojie Technology and Dongxin Co. dropping over 10%, and SMIC falling nearly 8% [2][3] - Conversely, resource sectors such as gas, coal, steel, and oil experienced gains, with companies like Dazhong Public Utilities and Hongtong Gas hitting the daily limit up [2][7] - The coal sector is expected to see improved performance in Q3 due to rising coal prices, with potential further increases in Q4 as winter demand rises [8] Semiconductor Sector Insights - Analysts suggest that the recent adjustment in the semiconductor sector is a short-term fluctuation driven by profit-taking, rather than a fundamental shift in the industry's long-term growth prospects. The trend of domestic substitution remains a key focus [3][5] - Domestic wafer fabs are progressively establishing high levels of localization, particularly in advanced storage, with expectations for stable expansion needs through 2025 and rapid growth anticipated by 2026 [5] Brokerage Sector Dynamics - The brokerage sector showed strong performance, with stocks like Guosen Securities reaching their daily limit. The sector's growth is supported by favorable policies, improved market confidence, and a shift towards high-value-added services [9][10] - The current environment is seen as enhancing the brokerage sector's profitability outlook, making it an attractive investment opportunity [10]

焦炭板块10月10日涨2.59%,宝泰隆领涨,主力资金净流入4026.59万元

Zheng Xing Xing Ye Ri Bao· 2025-10-10 08:52

Core Insights - The coke sector experienced a 2.59% increase on October 10, with Baotailong leading the gains, while the Shanghai Composite Index fell by 0.94% [1] Group 1: Market Performance - Baotailong's stock price closed at 3.27, reflecting a 10.10% increase with a trading volume of 835,300 shares and a transaction value of 270 million yuan [1] - Other notable performers included Shanxi Black Cat, which rose by 4.49% to 3.72, and Yunmei Energy, which increased by 3.93% to 3.97 [1] - The overall trading volume for the coke sector was significant, with Baotailong leading in both price increase and transaction value [1] Group 2: Capital Flow - The coke sector saw a net inflow of 40.27 million yuan from main funds, while retail funds experienced a net inflow of 231,000 yuan [1] - Baotailong attracted a net inflow of 80.73 million yuan from main funds, despite a net outflow of 30.20 million yuan from speculative funds [2] - The capital flow data indicates a mixed sentiment among retail investors, with significant outflows from several companies, including Meijin Energy and Antai Group [2]

焦炭板块10月9日涨3.76%,山西焦化领涨,主力资金净流入2836.05万元

Zheng Xing Xing Ye Ri Bao· 2025-10-09 09:00

Core Insights - The coke sector experienced a significant increase of 3.76% on October 9, with Shanxi Coking leading the gains [1] - The Shanghai Composite Index closed at 3933.97, up 1.32%, while the Shenzhen Component Index closed at 13725.56, up 1.47% [1] Sector Performance - Shanxi Coking (600740) closed at 4.07, with a rise of 4.63% and a trading volume of 338,500 shares, amounting to 1.35 billion yuan [1] - Meijin Energy (000723) closed at 4.93, up 4.45%, with a trading volume of 1,083,800 shares, totaling 526 million yuan [1] - Baotailong (601011) closed at 2.97, increasing by 3.12%, with a trading volume of 514,000 shares, amounting to 150 million yuan [1] - Yunwei Co. (600725) closed at 3.53, up 2.92%, with a trading volume of 210,400 shares, totaling 73.25 million yuan [1] - Shaanxi Black Cat (601015) closed at 3.56, increasing by 2.89%, with a trading volume of 236,900 shares, amounting to 83.36 million yuan [1] - Antai Group (600408) closed at 2.31, up 2.21%, with a trading volume of 302,700 shares, totaling 68.88 million yuan [1] - Yunmei Energy (600792) closed at 3.82, increasing by 2.14%, with a trading volume of 128,500 shares, amounting to 48.63 million yuan [1] Capital Flow - The coke sector saw a net inflow of 28.36 million yuan from main funds, while retail funds experienced a net inflow of 13.28 million yuan [1] - The main funds for Shanxi Coking showed a net inflow of over 8.59 million yuan, while retail funds had a net inflow of 1.00 million yuan [2] - Baotailong had a net inflow of 5.86 million yuan from main funds, but a net outflow of 6.44 million yuan from retail funds [2] - Meijin Energy experienced a net inflow of 4.38 million yuan from main funds, with a significant net outflow of 25.14 million yuan from retail funds [2] - Shaanxi Black Cat had a net inflow of 5.17 million yuan from main funds, while retail funds showed a net outflow of 3.06 million yuan [2]