专利悬崖

Search documents

默沙东用科伦博泰资产部分权益置换7亿美元

Mei Ri Jing Ji Xin Wen· 2025-11-09 13:50

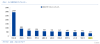

Core Viewpoint - Merck's decision to exchange part of its future sales rights for the antibody-drug conjugate sac-TMT for $700 million in R&D funding from Blackstone reflects the pressures of patent expirations and high R&D costs faced by major pharmaceutical companies, despite having over $8 billion in cash [2][3][4]. Financial Performance - In the first three quarters of this year, Merck reported total revenue of $48.611 billion, which is roughly flat compared to the same period last year [3]. - Keytruda, Merck's leading product, generated sales of $23.303 billion, showing an 8% year-over-year growth, but its growth rate is slowing [4]. - The sales of the HPV vaccine Gardasil/Gardasil 9 fell by 40% year-over-year, totaling $4.202 billion in the first three quarters [5]. Strategic Moves - Merck's agreement with Blackstone involves a non-refundable payment of $700 million to fund sac-TMT's development until the end of 2026, with Blackstone entitled to a low to mid-single-digit royalty on net sales after regulatory approval [3][4]. - Merck plans to cut $3 billion in annual spending by the end of 2027, reallocating these savings to support new product launches and R&D investments [6]. Pipeline and Future Outlook - Sac-TMT, developed by Chinese company Kelun-Botai, is a key asset for Merck, with ongoing Phase III clinical trials across multiple indications, indicating Merck's confidence in the drug [7][9]. - The global pharmaceutical industry is facing significant patent cliff risks from 2023 to 2028, prompting companies like Merck to strategically manage resources and investments [6].

过去三年 投资创新药“真的非常爽” | 海斌访谈

Di Yi Cai Jing· 2025-11-06 14:27

Core Insights - The biopharmaceutical industry in China is experiencing a recovery, with significant increases in stock indices and market valuations, indicating a positive shift after a challenging period [1][2][3]. Industry Overview - The Hang Seng Biotechnology Index has risen by 80% this year, while the Shanghai Stock Exchange's STAR Market Biopharmaceutical Index has increased by 40% [2]. - Despite some companies not returning to their 2021 market highs, recent valuations have reached new highs for 2025 [2]. - The year 2023 is viewed as a turning point for the Hong Kong biotechnology index, with investors seeing nearly double returns from investments made this year [2]. Investment Climate - The capital market's recovery has improved the financing environment for biopharmaceutical companies that have recently emerged from a downturn [2]. - Investment firms that remained active during the downturn are now reaping the benefits, as the valuation of innovative drugs has become more favorable [3]. Global Partnerships and Transactions - The number of overseas licensing deals for Chinese innovative drugs has significantly increased, with total amounts exceeding $100 billion and upfront payments surpassing $5 billion [4]. - Major global pharmaceutical companies are actively seeking assets in China, with significant transactions reported with companies like Takeda, Merck, and AstraZeneca [4]. Patent Cliff Concerns - The urgency among multinational pharmaceutical companies to acquire new products is driven by the impending patent cliff, which is expected to begin in 2026 and last for about ten years [5]. - It is estimated that over $100 billion in revenue from existing drugs will be at risk due to patent expirations, prompting the need for new product development [5]. Clinical Development Advantages - China offers significant advantages in clinical trial costs and efficiency, with costs for patient enrollment being approximately one-third of those in the U.S. and enrollment speeds being four to five times faster [6][7]. - The improvement in clinical standards and resources in China has positioned it as a leading location for high-quality clinical trials [6]. Future Outlook - Chinese biopharmaceutical companies are moving towards global collaboration rather than merely licensing out their innovations, as seen in the strategic partnership between Innovent Biologics and Takeda [8]. - The ongoing reforms in drug approval processes and the development of a robust talent pool are expected to lead to the emergence of Chinese multinational pharmaceutical companies in the future [8][9].

过去三年,投资创新药“真的非常爽” | 海斌访谈

Di Yi Cai Jing· 2025-11-06 14:19

Core Insights - The biopharmaceutical industry in China is experiencing a resurgence, with significant increases in stock indices and market valuations, indicating a recovery from previous downturns [1][3][4] Group 1: Market Performance - The Hang Seng Biotechnology Index has risen by 80% this year, while the Shanghai Stock Exchange's Sci-Tech Innovation Board Biomedicine Index has increased by 40% [3] - Notable companies like BeiGene have reached three-year highs in market capitalization [1] - Investment returns have nearly doubled for those who invested in the Hong Kong Biotechnology Index in 2023 [3] Group 2: Investment Climate - The capital market's recovery has improved the financing environment for biopharmaceutical companies that recently emerged from a downturn [3] - Venture capitalists are now more optimistic, as the previous valuation declines and lack of exit channels have eased [3][4] Group 3: Global Interest and Collaborations - Chinese pharmaceutical companies have engaged in overseas business development (BD) deals exceeding $100 billion this year, with upfront payments surpassing $5 billion [4] - Major global pharmaceutical companies, including Takeda and Merck, are actively seeking assets in China due to impending patent cliffs [5] - The upcoming patent cliff, expected to start in 2026, could affect over $100 billion in revenue for multinational companies, creating a demand for new products [5] Group 4: Clinical Development and Cost Efficiency - China's clinical trial costs are significantly lower than those in the U.S., with an average cost of $25,000 per patient compared to $70,000 in the U.S. [8] - The speed of patient enrollment in clinical trials is also faster in China, with centers enrolling approximately 0.5 patients per month compared to 0.1 in the U.S. [8] Group 5: Future Outlook - Chinese biopharmaceutical companies are moving towards global collaboration models, as seen in the $11.4 billion strategic partnership between Innovent Biologics and Takeda [9] - The expectation is that more Chinese companies will evolve into global biopharmaceutical firms over the next decade, with a projected increase in the proportion of new drugs approved by the FDA coming from China [9][10]

英伟达进军制药领域,联手礼来以千亿算力打造AI药物研发工厂,制药行业步入AI军备竞赛

3 6 Ke· 2025-11-05 10:52

Core Insights - The collaboration between Nvidia and Eli Lilly aims to establish the world's first dedicated "AI super factory" for the pharmaceutical industry, leveraging advanced computing power to revolutionize drug development throughout its lifecycle [1][4][30] Group 1: Nvidia's Technological Advancements - Nvidia has announced the creation of the DGX SuperPOD supercomputer, built with 1000 B300 GPUs, which enhances computational density by three times compared to traditional supercomputers, significantly reducing model training time from weeks to hours [4] - This supercomputer will be operated by Eli Lilly, providing the necessary computational power for their AI factory to develop, train, and deploy AI models for drug discovery [4][30] Group 2: Eli Lilly's Financial Performance - Eli Lilly reported a third-quarter revenue of $17.6 billion for 2025, a 54% increase year-over-year, with a net profit of $5.58 billion, marking a staggering 475.34% growth [12] - The company’s total revenue for the first nine months of 2025 reached $45.89 billion, a 46% increase compared to the previous year, prompting an upward revision of its full-year revenue forecast to between $63 billion and $63.5 billion [1][12] Group 3: AI Integration in Drug Development - Eli Lilly's AI platform, TuneLab, which includes 18 AI models, will be deployed in the AI factory, enhancing drug discovery efficiency [5] - The AI factory is expected to reduce the early drug discovery cycle by 40% and lower preclinical development costs by 30%, while also enabling the design of novel molecular structures [20][30] Group 4: Industry Context and Competitive Landscape - The collaboration reflects a broader trend in the pharmaceutical industry, where companies are increasingly investing in AI, with many raising their AI R&D budget to over 20% of total R&D expenses [27] - The partnership signifies a shift from traditional drug development methods to a data-driven, intelligent assembly line approach, which may require substantial capital investment [30] Group 5: Long-term Strategic Considerations - Eli Lilly's focus on AI drug development is a strategic response to short-term growth pressures and long-term survival challenges, particularly in light of the impending patent cliff for its key products [13][14] - The company is racing against time to develop new blockbuster drugs before the expiration of key patents, which could significantly impact its revenue base [16][17]

前三季度对外授权交易超千亿美元,国产创新药迎来新的定价期

Cai Jing Wang· 2025-10-30 11:14

Core Insights - The Chinese innovative drug sector has seen a remarkable increase in licensing deals and collaborations, with significant financial transactions occurring in 2025's first three quarters [1][2] Group 1: Licensing and Collaboration Trends - In 2025's first three quarters, the total amount for Chinese innovative drug licensing agreements has surpassed $1 trillion, driven by notable deals such as the $750 million upfront payment from Roche to Qianxin Biotech for the global rights to QX031N [1][2] - The collaboration between Innovent Biologics and Takeda has set a new record for Chinese innovative drug licensing, with an upfront payment of up to $1.2 billion and a total deal value potentially reaching $11.4 billion [1][2] - The report from Yao Medicine Cube indicates that global pharmaceutical transactions have increased in both quantity and value, with 682 deals totaling $191 billion, surpassing the total for 2024 [1][2] Group 2: Market Dynamics and Investment Trends - Major multinational pharmaceutical companies are actively seeking acquisitions due to the "patent cliff" and their substantial cash reserves, which exceed $1.2 trillion [2] - The oncology sector is particularly targeted, with drugs valued at approximately $67 billion set to lose patent protection, prompting large pharmaceutical firms to look for external assets to enhance their pipelines [2] - The interest of multinational companies in Chinese assets is evident, with top 10 global pharmaceutical firms conducting regular research and negotiations in China [2] Group 3: Strategic Approaches and Future Outlook - The strategies for international expansion among innovative drug companies are diversifying from simple licensing to co-development and joint ventures [4] - Successful international projects require a clear understanding of potential partners' strategic needs and ensuring products have distinct advantages [4] - The investment logic in the innovative drug sector has shifted significantly since 2015, focusing more on innovation value rather than just net profits, with the market expected to reach a valuation of over 1 trillion RMB by the end of the year [5]

播客上新|家庭资产配置,如何把握全球科技浪潮机会?

天天基金网· 2025-10-29 09:40

Group 1 - The underlying logic of family asset allocation is being restructured, moving away from reliance on single assets to a diversified global asset allocation approach [1] - The podcast discusses how families can leverage global technological trends for asset management [1] Group 2 - The Hong Kong stock market, particularly in the technology sector, is gaining attention due to improved fundamentals and positive expectations, making it a valuable long-term investment [4] - Many companies listed in Hong Kong are familiar to mainland investors, providing a sense of comfort and understanding [4] Group 3 - High volatility in technology assets requires investors to be aware of potential pitfalls and to adopt strategies that align with their risk tolerance [5] - A systematic investment approach, such as dollar-cost averaging, may yield better results in volatile markets [5] Group 4 - The innovative pharmaceutical sector is experiencing a reversal after two years of stagnation, driven by changes in payment policies and ongoing support from the government [6][7] - Chinese innovative drug companies are positioned as a "pharmaceutical supermarket" globally, benefiting from lower costs and a wide range of products, particularly in oncology [7] Group 5 - The lithium battery sector is witnessing a second growth curve due to explosive growth in energy storage demand, driven by technological advancements and new applications [9][10] - Recent policy changes, such as capacity pricing, are further boosting the demand for energy storage batteries [10] Group 6 - India is emerging as a new focus for global investment due to its stable currency, young population, and low labor costs, indicating a high potential for economic growth [11]

GSK要大干一场了

Ge Long Hui· 2025-10-28 10:55

Core Viewpoint - GSK is undergoing a leadership change with the appointment of Luke Miels as the new CEO, effective January 1, 2026, amidst challenges in its core vaccine business and a goal to exceed £40 billion in total sales by 2031 [1][15]. Group 1: Leadership Transition - GSK announced the appointment of Luke Miels as CEO candidate, succeeding Emma Walmsley, who has led the company since September 2016 [1][2]. - Under Walmsley's leadership, GSK focused on biopharmaceuticals, successfully splitting its consumer healthcare business and prioritizing specialty medicines and vaccines [2][3]. Group 2: Financial Performance - GSK's total revenue for 2024 is projected to grow by only 3% to £31.376 billion, falling out of the top ten global pharmaceutical companies due to a decline in its core vaccine business [1][4]. - In 2023, GSK reported total revenue of £30.328 billion, a 5% increase year-over-year, with the vaccine segment growing by 25% [4][10]. Group 3: Business Segments - The specialty medicines segment showed strong growth, contributing £11.81 billion in 2024, with a year-over-year increase of 19% [7][13]. - The vaccine segment faced challenges, with revenues declining by 4% in 2024, while the oral and respiratory segments showed mixed results [10][11]. Group 4: Strategic Focus - GSK aims to find new growth drivers, particularly in oncology and respiratory/inflammation areas, where Miels has previously contributed significantly [15][16]. - Recent acquisitions and partnerships, including a $2 billion acquisition of Boston Pharmaceuticals, indicate GSK's strategy to enhance its pipeline and product offerings [16][21]. Group 5: Future Outlook - GSK's success in achieving its £40 billion sales target by 2031 will depend on the successful execution of its innovative pipeline and addressing challenges in its vaccine and HIV segments [22].

Should You Buy Pfizer Stock Before Nov. 4?

Yahoo Finance· 2025-10-27 16:15

Core Viewpoint - Pfizer's stock has significantly declined due to patent expirations and concerns about long-term growth, despite offering a high yield [1][2]. Group 1: Stock Performance - Pfizer's stock has decreased nearly 30% over the past five years, and despite its low valuation, investor interest remains low [2]. - The company trades at a price-to-earnings ratio of 13, compared to the S&P 500 average of 25, indicating it is undervalued [4]. Group 2: Earnings and Guidance - Pfizer has reported solid results in recent quarters and raised its guidance in August, with the third-quarter earnings report expected on November 4 [2][5]. - A strong outlook and positive earnings performance may be necessary to attract investors and improve stock performance [6]. Group 3: Market Conditions - Investor hesitance in healthcare stocks is attributed to uncertainties surrounding tariffs and government policies, with the Health Care Select Sector SPDR Fund only up over 5% compared to the S&P 500's nearly 15% increase [9]. - Recent government actions, including a landmark agreement with Pfizer to lower drug prices and a commitment to invest $70 billion in U.S. research and development, may influence future investor sentiment [5].

“减肥药巨头”诺和诺德裁 9000 人,跨国药企裁员风暴来袭,中国市场凭创新成“破局密钥”

Hua Xia Shi Bao· 2025-10-24 02:32

Core Insights - The global pharmaceutical industry is facing a significant downturn, with a total of 190 layoffs in the biopharmaceutical sector in the first three quarters of 2023, approaching the total of 192 expected for the entire year of 2024 [2][3] - Major companies like Merck and Novo Nordisk are leading this wave of layoffs, with Merck cutting 6,000 jobs and Novo Nordisk planning to lay off 9,000 employees, reflecting a broader industry trend [3][4] - The layoffs are driven by a combination of factors including patent cliffs, market competition, and inefficiencies in research and development [7][10] Layoff Trends - In Q3 2023, there were 62 layoffs in the global biopharmaceutical sector, with over 20,000 jobs cut in the second half of the year alone [2][3] - Merck's layoffs are part of a strategy to save $3 billion by 2027, while Novo Nordisk aims to save $1.26 billion by the end of 2026 [3] - Smaller companies are also affected, with companies like Biogen and Moderna announcing significant layoffs [4][5] Regional Focus: China - The Chinese market is experiencing unique adjustments, with companies like Gilead and Sumitomo Pharma restructuring their resources, while AstraZeneca is increasing its R&D investment by $2.5 billion [2][6] - The layoffs in China reflect a targeted approach, with Gilead confirming layoffs related to the integration of resources for a new HIV drug [4][6] - The Chinese market is becoming a critical area for innovation, with a significant increase in licensing deals for innovative drugs [6][10] Industry Dynamics - The underlying logic of the layoffs is attributed to pressures from patent expirations, low R&D efficiency, and intense market competition [7][10] - Companies are increasingly focusing on core therapeutic areas and optimizing resource allocation to adapt to changing market conditions [3][7] - The Chinese market is seen as a potential solution to these challenges, with lower clinical trial costs and a shift towards local innovation [7][10] Future Outlook - The ongoing layoffs are reshaping the industry landscape, with a notable talent migration from multinational companies to local firms in China [8] - The rise of CDMO (Contract Development and Manufacturing Organization) companies in China is facilitating the outsourcing of production by multinational firms [8] - The transformation of the industry is expected to continue, with China emerging as a core hub for innovation and development in the pharmaceutical sector [10]

中外药企将在更高维度展开竞争

Zheng Quan Ri Bao· 2025-10-22 16:40

Core Viewpoint - The recent cancellation of 80 drug registration certificates by the National Medical Products Administration reflects routine business decisions by companies in response to market changes, particularly due to the impact of generic drugs and evolving market dynamics [1][2]. Group 1: Drug Registration Cancellations - The cancellation includes drugs such as Loratadine tablets from Fresenius Kabi and Doxorubicin hydrochloride injection from Pfizer, indicating a shift in the market landscape [1]. - The cancellations are attributed to factors such as patent expirations leading to reduced profit margins, supply chain issues, and unclear commercial prospects for certain drugs in the domestic market [1][2]. Group 2: Market Mechanisms and Competition - The cancellations are a result of market mechanisms, with sufficient alternative supplies available domestically, including 35 approved Loratadine tablet products and 33 approved inhalation solutions of Salbutamol [2]. - The rise of high-quality generic drugs has provided patients with more accessible and affordable medication options, demonstrating the improvement of China's pharmaceutical industry and supply chain resilience [2]. Group 3: Shift in Pharmaceutical Strategy - The trend reflects a broader shift in the pharmaceutical industry, where multinational companies are adjusting their product lines in response to intense domestic competition and the "patent cliff" effect, leading to the replacement of original drugs by more cost-effective generics [2]. - The era of relying on profits from expired patents is ending, giving way to a new ecosystem driven by innovative drugs, as policies like centralized procurement and drug price negotiations push for rational pricing and resource allocation towards clinically valuable innovative drugs [2]. Group 4: Investment in Innovation - Multinational pharmaceutical companies are increasing their investment in innovative drug research in China, with Boehringer Ingelheim announcing over 5 billion yuan in R&D investment over the next five years [3]. - Companies like AstraZeneca, Pfizer, and Novartis are expanding collaborations with Chinese biotech firms, indicating a competitive landscape focused on innovation and clinical value [3].