资本市场回暖

Search documents

证券行业报告(2026.01.26-2026.01.30):上市券商业绩呈现“普涨+分化”特征

China Post Securities· 2026-02-02 08:57

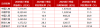

Industry Investment Rating - The industry investment rating is Neutral, maintained [1] Core Insights - The report highlights a "general increase with differentiation" in the performance of listed securities firms, with a median year-on-year net profit growth rate exceeding 60% for 26 firms. Leading firms like CITIC Securities and Guotai Junan achieved growth rates of 38.5% and 111%-115% respectively, supported by comprehensive, international, and merger integration advantages. Smaller firms showed even higher growth rates due to low base effects and unique business breakthroughs [4][16] - The report notes that despite strong fundamentals, the securities sector underperformed last week, with the Shenwan Securities II Index declining by 0.68%, lagging behind the CSI 300 Index by 0.77 percentage points. Current valuations remain significantly behind the pace of profit recovery [4][10] - The report emphasizes that the current market liquidity is abundant, with the SHIBOR 3M rate stable at a historical low of 1.59%. The A-share market remains active, with an average daily trading volume of 3.70 trillion yuan, reflecting a 7.63% increase compared to the previous week [5][21] Summary by Sections 1. Performance of Listed Companies - The report indicates that the securities industry experienced widespread high growth in 2025, driven by a favorable capital market environment, core business synergy, and policy resonance. The head firms benefited from scale effects and comprehensive service capabilities, while smaller firms achieved aggressive growth through mergers and unique business focuses [16][17] 2. Industry Fundamentals Tracking 2.1 SHIBOR 3M Rate - The SHIBOR 3M rate was reported at 1.59% as of January 30, 2026, indicating a stable and abundant liquidity environment [5][20] 2.2 Stock Fund Trading Volume - The average daily trading volume of A-share stock funds reached approximately 37,040 billion yuan, reflecting a significant increase of about 7.63% compared to the previous week [21][22] 2.3 Margin Trading Situation - The margin trading balance was reported at 27,393.63 billion yuan, maintaining a historical high level. The balance fluctuated slightly but remained above 27 trillion yuan [24][23] 2.4 Bond Market Index and Trading Volume - The bond market showed a "trading cooling, index rising" pattern, with a daily average trading volume of 30,927.60 billion yuan, reflecting a slight increase of about 3% compared to the previous week [27][28] 2.5 Stock-Bond Spread - The average yield of 10-year government bonds was reported at 1.82%, showing a slight decrease, while the stock-bond spread remained stable at an average of 4.90% [29][30] 3. Market Review - The Shenwan Securities II Index underperformed the CSI 300 Index, ranking 12th among 31 first-level industries. The report notes that the securities sector's performance over the past year was significantly lower than that of the CSI 300 Index [31][33]

资本市场回暖推动私募业绩走高

Xin Lang Cai Jing· 2026-01-25 22:24

Core Insights - In 2025, private securities products demonstrated strong performance, with 89.74% of 9,934 products achieving positive returns and an average return rate of 25.68% [2] - The management scale of private funds reached a historical high of 22.09 trillion yuan by the end of November 2025, driven by the growth of private securities investment funds [2] Market Environment - The outstanding performance of private securities products in 2025 is attributed to three main factors: a favorable macro environment, strong liquidity support, and strategic alignment with market structure [3] - The A-share market experienced an overall upward trend, supported by innovations in AI and new energy sectors, which boosted market confidence [3] Strategy Performance - Among various strategies, the stock strategy led in returns, with 90.19% of 6,298 products achieving positive returns and an average return rate of 29.99% [3] - Quantitative long strategies showed remarkable performance, with a positive return rate of 95.81% among 1,360 products and an average return rate of 39.51% [4] - Multi-asset strategies achieved a positive return rate of 90.61% among 1,321 funds, with an average return rate of 22.06%, demonstrating strong risk management capabilities [4] Specific Strategy Insights - Combination funds, which diversify investments across different strategies and managers, achieved a positive return rate of 96.19% among 315 funds, catering to conservative investors [4] - Bond strategies maintained stable performance, with 89.93% of 745 bond products achieving positive returns, serving as a reliable asset allocation choice for low-risk investors [5]

上市险企首份业绩预告出炉:中国太平去年净利预增超2倍

Nan Fang Du Shi Bao· 2026-01-20 03:19

Core Viewpoint - China Taiping Insurance Holdings Limited is the first listed insurance company to announce a significant profit increase forecast for 2025, projecting a net profit growth of 215-225% compared to 2024, with estimates ranging from HKD 181.28 billion to HKD 189.72 billion [2][4]. Group 1: Performance Drivers - The substantial profit increase is attributed to two main factors: steady improvement in net investment performance compared to 2024 and a one-time positive impact from new corporate income tax policies introduced by the tax authorities for the insurance industry [4]. - The announcement reflects positive signals in the market, indicating that leading insurance companies are experiencing accelerated profit elasticity due to a recovering capital market and supportive policies [4]. Group 2: Market Context - Since the fourth quarter of 2024, the A-share market has seen a clear valuation recovery, with the Shanghai Composite Index rising, which has directly enhanced the investment returns of insurance funds [4]. - In 2024, China Taiping's stock price increased by over 60%, providing strong support for its profit growth [4]. Group 3: Management Changes - As of the end of 2025, China Taiping announced management adjustments in its core business segments, with Wang Xuze appointed as the new Party Secretary and proposed General Manager of Taiping Life Insurance, bringing over 30 years of experience in the life insurance sector [5]. - Peng Yunping, a female executive from the 1970s, is proposed to be the General Manager of Taiping Property Insurance, succeeding Zhu Jie, who will no longer hold the position [5]. Group 4: Asset Management Developments - China Taiping continues to deepen its asset management strategy, with its subsidiary, Taiping Asset Management Co., Ltd., receiving approval to establish Taiping (Shenzhen) Private Securities Investment Fund Management Co., Ltd., increasing the number of insurance-related private securities fund management companies to six [5]. - As of the end of 2024, the total asset scale of Taiping Asset Management surpassed RMB 1.5 trillion [6].

三位普通理财人的2026心愿清单

Zhong Guo Zheng Quan Bao· 2026-01-07 20:50

Core Insights - The wealth management market in China is experiencing significant growth, with the bank wealth management market size surpassing 32 trillion yuan in 2025, marking a historical high [1] - Ordinary investors are increasingly seeking stable returns in a low-interest-rate environment, leading to a shift from traditional savings to diversified investment products [1][2] Group 1: Investor Perspectives - Cheng, a nearly sixty-year-old investor, plans to maintain a mix of long-term closed-end wealth management products and short-term daily open products in 2026, aiming for a stable return above 3% [1][2] - Zhang, a young professional, expresses a desire for more transparent investment products that prioritize investor interests, having faced disappointing returns from pure bond funds in 2025 [3][4] - Yang, an experienced investor, anticipates a recovery in the equity market in 2026, hoping for better returns from his mixed-asset wealth management products [4] Group 2: Market Trends - The shift towards "fixed income plus" products is evident, as investors like Zhang seek stable yet enhanced returns without needing to actively manage their portfolios [3][4] - The experiences of these investors reflect a broader trend in the wealth management industry, where the focus is on achieving steady profits amidst market fluctuations [4]

资本市场回暖助推险企业绩增长

Jing Ji Ri Bao· 2025-11-08 21:53

Core Viewpoint - Recent quarterly performance reports from several listed insurance companies indicate an unexpected growth trend, reflecting a positive outlook for the industry and improved operational efficiency [1][2]. Group 1: Performance Highlights - China Life achieved total investment income of 368.55 billion yuan, a year-on-year increase of 41%, with an investment return rate of 6.42%, up 104 basis points [1]. - China Property & Casualty reported total investment income of 86.25 billion yuan, a 35.3% increase year-on-year, with an investment return rate of 5.4%, up 0.8 percentage points [1]. - New China Life's annualized total investment return rate reached 8.6%, with total assets exceeding 1.8 trillion yuan, an increase of 8.3% from the end of the previous year [1]. Group 2: Market and Investment Strategy - The recovery of the capital market is a key driver for the performance growth of insurance companies, with stock assets exceeding 1.8 trillion yuan, a nearly 30% increase from the previous year [1][2]. - Insurance companies are expected to adopt a more rational investment strategy, focusing on stable assets such as high-dividend stocks to enhance the stability of asset returns [2]. - The "reporting and operation integration" reform is seen as a significant factor in improving the quality of life insurance business, promoting cost reduction and efficiency enhancement [2][3]. Group 3: Policy Environment and Long-term Outlook - Continuous optimization of the policy environment has supported profit improvement for insurance companies, with enhanced liquidity in the capital market and increased investor confidence [3]. - Regulatory policies have laid a solid institutional foundation for the long-term stable development of the industry, shifting focus from scale to efficiency [3]. - Despite the high growth in profits, it is cautioned that this should not be interpreted as the beginning of a new profit cycle, as current profit increases are primarily driven by investment rather than fundamental improvements in operational capabilities [3].

交通银行:信贷投放将重点聚焦“两重”、“两新”

Quan Jing Wang· 2025-11-07 12:05

Core Viewpoint - The performance of Bank of Communications in the first three quarters of 2023 shows a positive trend in non-interest income, with a notable increase in commission and fee income, indicating a recovery in the capital market and strong performance in wealth management [1][2] Group 1: Financial Performance - In the first three quarters, the bank achieved net commission and fee income of 29.398 billion yuan, a year-on-year increase of 0.15%, with an improvement of 2.73 percentage points compared to the first half of the year [1] - Other non-interest income reached 19.639 billion yuan, with a year-on-year growth of 25.4%, driven by a significant increase in wealth management services [1] - Investment income and fair value changes totaled 20.363 billion yuan, a decrease of 13.55% compared to the same period last year, primarily due to a decline in bond and interest rate derivative valuations [1] Group 2: Strategic Focus - The bank plans to consolidate its growth momentum in commission and fee income by expanding capital market-related businesses, enhancing payment and settlement services, and leveraging its international and comprehensive operational advantages [2] - The bank will focus on key areas such as manufacturing, inclusive finance, green development, technological innovation, and rural revitalization, aligning with national economic development directions and policy guidance [2] - The bank aims to enhance its financial supply capacity and explore potential business opportunities by utilizing structural monetary policy tools and new policy measures, particularly in small and micro enterprises, private enterprises, and new real estate development models [2]

财通证券(601108):营收整体回暖,自营驱动利润增长

Shanxi Securities· 2025-11-05 06:54

Investment Rating - The report maintains a "Buy-A" rating for the company [8] Core Views - The company has experienced a significant recovery in revenue, driven by its brokerage and investment businesses, with a notable increase in profits [5][8] - The company is expected to benefit from the recovery of the capital market, with substantial improvements in brokerage and proprietary trading [8] Summary by Sections Market Performance - The company's stock closed at 8.50 yuan, with a year-to-date high of 9.56 yuan and a low of 6.96 yuan [2] Financial Performance - For the first three quarters of 2025, the company achieved operating revenue of 50.63 billion yuan, a year-on-year increase of 13.99%, and a net profit attributable to shareholders of 20.38 billion yuan, up 38.42% [4] - In Q3 alone, the company reported operating revenue of 21.03 billion yuan, a 48.58% increase year-on-year, and a net profit of 9.54 billion yuan, up 75.10% [5] Business Segments - The brokerage business saw a net income from fees of 13.85 billion yuan in the first three quarters, a 66.32% increase year-on-year, with Q3 revenue reaching 5.75 billion yuan, up 119.11% [5] - Investment income for the first three quarters was 14.85 billion yuan, a 25.30% increase year-on-year [5] - The company faced challenges in its investment banking and asset management businesses, with net income from investment banking fees down 29.20% to 2.77 billion yuan [6] Future Projections - The company is projected to achieve net profits of 28.49 billion yuan, 33.53 billion yuan, and 38.69 billion yuan for the years 2025, 2026, and 2027, respectively, reflecting year-on-year growth rates of 21.75%, 17.70%, and 15.39% [8][12]

合赚4260亿,五大上市险企三季报详细解读

Xin Lang Cai Jing· 2025-10-31 10:49

Core Insights - The five major listed insurance companies in China reported a total operating income of 23,739.81 billion RMB for the first three quarters of 2025, representing a 13.6% increase compared to the same period in 2024. The net profit reached 4,260.39 billion RMB, a year-on-year growth of 33.54% [1][3] Group 1: Company Performance - China Life Insurance maintained its leading position in the life insurance sector with a premium growth of 25.9%, achieving a net profit of 1,678.04 billion RMB, up 60.5% [3][4] - Ping An Insurance reported an operating income of 8,329.40 billion RMB, with a net profit of 1,328.56 billion RMB, reflecting an 11.5% increase [3][4] - China Pacific Insurance achieved a net profit of 457 billion RMB, a growth of 19.3%, with an operating income of 3,449.04 billion RMB [3][4] - New China Life Insurance saw a significant net profit increase of 58.0%, totaling 328.57 billion RMB, with a premium growth of 28.3% [3][4] - China Property & Casualty Insurance reported a net profit of 468.22 billion RMB, up 28.9%, with an operating income of 5,209.90 billion RMB [3][4] Group 2: Premium Growth and Channels - The life insurance sector is experiencing a recovery, with total premiums and new business premiums showing double-digit growth across multiple companies [4][6] - China Life achieved total premiums of 6,696.45 billion RMB, a 10.1% increase, with renewal premiums growing by 10.0% [4][6] - New China Life reported a 59.8% increase in first-year premiums for long-term insurance [4][6] - The bancassurance channel has become a significant growth driver, with China Pacific Insurance's bancassurance premiums reaching 583.10 billion RMB, up 63.3% [6][7] Group 3: Investment Performance - All five companies highlighted significant increases in investment income as a key driver of profit growth, benefiting from a recovering capital market [10][11] - China Life's total investment income reached 3,685.51 billion RMB, a 41.0% increase, with an investment return rate of 6.42% [10][11] - Ping An's investment portfolio exceeded 6.41 trillion RMB, with a non-annualized comprehensive investment return rate of 5.4% [10][11] - China Property & Casualty Insurance reported total investment income of 862.50 billion RMB, a 35.3% increase [10][11] Group 4: Asset Growth - The total assets of the five major insurance companies reached 27.82 trillion RMB, an 8.3% increase from the end of 2024 [12][13] - Ping An's total assets amounted to 13.65 trillion RMB, a 5.3% increase, while China Life's total assets reached 7.42 trillion RMB, growing by 9.6% [12][13]

资负共振,新华25Q3利润与NBV显著增长

Ping An Securities· 2025-10-31 07:28

Investment Rating - The industry investment rating is "Outperform the Market" [4] Core Insights - Xinhua Insurance reported significant growth in profit and new business value (NBV) for Q3 2025, with a year-on-year increase in net profit of 88.2% and a total premium income of 172.7 billion yuan, reflecting an 18.6% increase [2][3] - The long-term insurance business is experiencing rapid growth, with first-year premiums reaching 54.57 billion yuan, a 59.8% year-on-year increase, although the growth rate is slowing compared to previous quarters [3] - The investment income continues to grow significantly, with a total investment income of 99.12 billion yuan for the first three quarters, marking a 40.3% increase year-on-year [3] Summary by Sections Industry Overview - The insurance sector is benefiting from a low-interest-rate environment, with strong demand for savings products and a competitive edge for major insurers [3] Financial Performance - For Q3 2025, Xinhua Insurance's net profit reached 18.06 billion yuan, a substantial increase of 88.2% year-on-year, while the total net profit for the first three quarters was 32.86 billion yuan, up 58.9% [2][3] Business Segments - Long-term insurance first-year premiums showed a significant increase, with a notable rise in individual insurance channels, which grew by 48.5% year-on-year [3] - The investment segment reported an annualized total investment return of 8.6%, up 1.8 percentage points year-on-year, indicating a robust performance in the capital markets [3] Market Outlook - The report suggests that if the equity market continues to improve, Xinhua Insurance and China Life are recommended for long-term investment due to their asset flexibility and stable dividend levels [3]

中金:维持中国光大控股(00165)跑赢行业评级 上调目标价至10港元

智通财经网· 2025-09-04 02:03

Core Viewpoint - The report from CICC maintains the earnings forecast for China Everbright Holdings (00165) for 2025 largely unchanged, while introducing a new profit forecast of 2.49 billion HKD for 2026, reflecting a positive market sentiment and steady operational recovery [1] Group 1: Financial Performance - The company's net revenue for the first half of 2025 was 1.89 billion HKD, with a net profit attributable to shareholders of 400 million HKD, marking a turnaround from a loss of 1.28 billion HKD in the same period last year [2] - Earnings per share for the first half of 2025 stood at 0.24 HKD, aligning with CICC's expectations [2] Group 2: Investment Business Recovery - Investment income for the first half of 2025 reached 1.69 billion HKD, a significant recovery from a loss of 390 million HKD in the previous year, with unrealized investment income contributing 980 million HKD [3] - The improvement in investment income was driven by better project fundamentals and a recovering capital market, with self-owned fund investments generating 1.1 billion HKD in unrealized income [3] - The company’s fund management business saw a notable reduction in unrealized investment losses, down to 120 million HKD from 740 million HKD year-on-year, indicating effective active management of the investment portfolio [3] Group 3: Asset Management Growth - The company's assets under management (AUM) increased by 2% to 119.4 billion HKD by the end of the first half of 2025, attributed to strategic fundraising adjustments [4] - New funds established during the first half of 2025 raised 2.74 billion HKD, showcasing the company's robust fundraising capabilities despite a 15% year-on-year decline in client contract revenue [4] Group 4: Cash Flow and Liquidity - The company achieved a cash return of 2.02 billion HKD through project exits in the first half of 2025, with complete exits from companies like Xiaopeng Motors and Taboola [5] - As of the end of the period, the company maintained a cash balance of 8.1 billion HKD and had approximately 4.9 billion HKD in unused bank credit, ensuring strong liquidity [5]