算力租赁

Search documents

智云国际控股附属与Pansemi订立租赁服务协议以购买算力

Zhi Tong Cai Jing· 2025-10-31 12:40

Core Viewpoint - Zhiyun International Holdings (08521) has announced a leasing service agreement to purchase computing power from Pansemi (Singapore) Pte. Ltd, with a total payment of $3.9 million for the service period from November 1, 2025, to October 31, 2026 [1] Group 1 - The agreement involves a total payment of $3.9 million, which must be paid in full within three calendar days after signing the leasing service agreement [1] - The supplier will allocate and deliver a computing power of 897,726 trillion hashes per second to the buyer upon receipt of the full payment [1] - The service period for the computing power lease is set for one year, starting from November 1, 2025, to October 31, 2026 [1]

A股算力租赁跨界:有梦想照进现实也有一戳就破的泡沫|焦点

Tai Mei Ti A P P· 2025-10-31 04:44

Core Insights - The recent failure of Qunxing Toys in the computing power rental sector marks another setback for traditional companies attempting to diversify into this field, highlighting the challenges faced by many A-share companies in pursuing new growth avenues amidst stagnating core businesses [1][2]. Industry Overview - The surge in generative AI since 2024 has led to an exponential increase in demand for computing power, creating a rapidly growing market that many A-share companies are eager to enter as they seek new growth opportunities [2][10]. - A diverse range of companies, from toy manufacturers to construction firms, have announced their entry into the computing power rental business, driven primarily by the need to overcome growth bottlenecks in their core operations [2][3]. Company Examples - Qunxing Toys reported a nearly 500% year-on-year revenue increase in 2024 but still faced significant losses, prompting its entry into the computing power sector through a planned acquisition of a computing service provider [2]. - Hainan Huatie, previously focused on construction equipment rental, announced a significant investment of 10 billion in computing power and secured a contract worth nearly 3.7 billion, indicating a strong push for transformation [3]. - Lianhua Holdings, despite facing losses in its computing power business, managed to achieve a breakeven point in the first half of 2025, although it still contends with rising interest expenses [7]. Market Reactions - The capital market has responded positively to announcements related to computing power, with stock prices of companies involved in this sector experiencing significant increases following such news [4][6]. - However, as the initial excitement wanes, a clear differentiation is emerging among companies based on their actual performance and the sustainability of their computing power ventures [6][11]. Future Outlook - The computing power rental market is projected to grow at a compound annual growth rate of 53% over the next three years, with the market size expected to reach 1,346 EFlops by 2027, supported by national strategic initiatives [10][12]. - Despite the promising outlook, the industry presents high barriers to entry, including the need for stable supply chains, strong operational capabilities, and effective financial management [11][12].

新窗口指导大范围取消补贴;智算中心建设先算亏多少;已过会GPU公司成立新业务组;头部大厂收缩服务器供应商丨算力情报局

雷峰网· 2025-10-30 08:06

Core Viewpoint - The article discusses the impact of recent regulatory changes and market dynamics on the domestic AI chip industry, particularly focusing on the shift towards domestic chips and the evolving landscape of computing power rental and supply chain management. Group 1: Regulatory Changes and Market Dynamics - A new "window guidance" document mandates that projects with local subsidies must exclusively use domestic chips, prohibiting the use of foreign GPUs like H20 in new market-oriented projects [2] - Projects outside the "national hub computing power facility cluster" will not receive financial or electricity subsidies, leading to the cancellation of existing local policies [2] - The ban on foreign chips and the push for domestic alternatives create a favorable environment for domestic AI chip manufacturers [3] Group 2: Computing Power Rental Market - Major companies in East China are paying significantly higher rental prices for computing power, which benefits both the companies and their IDC partners by enhancing cloud business collaboration and easing financial pressures [5] - The rental market is seeing a shift, with a model company planning to lease 60 H200 servers, indicating a trend towards smaller, more flexible rental agreements that align with technology upgrade cycles [8] - GPU rental prices have drastically decreased, with H100 prices dropping from 60,000-80,000 yuan to around 40,000 yuan, while H200 is priced at 60,000 yuan, making it a more attractive option for companies [9] Group 3: Supply Chain and Vendor Management - Leading companies are tightening their supplier networks, imposing penalties exceeding 100 million yuan on non-compliant suppliers, indicating a move towards a more stable and closed supply chain [6] - The construction of computing centers is now focused on calculating potential losses rather than profits, reflecting a more cautious approach in project planning due to delayed subsidy disbursements [7] Group 4: Emerging Trends in Chip Technology - Domestic RISC-V chip companies are expected to aggressively enter the server market next year, with several firms already developing high-performance RISC-V server chips [10][11] - The storage chip market is experiencing price increases driven by strong demand from AI and high-performance computing sectors, with distributors adopting strategies to hold inventory until prices rise further [12]

通信板块调整,CPO光模块概念重挫,新易盛领跌云计算50ETF(516630)一众持仓股

Mei Ri Jing Ji Xin Wen· 2025-10-30 05:48

Group 1 - A-shares indices declined on October 30, with the ChiNext index dropping over 1%, led by sectors such as telecommunications, media, and electronics [1] - New Yi Sheng reported a Q3 2025 revenue of 16.505 billion yuan, a year-on-year increase of 221.70%, and a net profit of 6.327 billion yuan, up 284.38% year-on-year [1] - The Q3 revenue showed a quarter-on-quarter decline of 4.97%, while net profit increased by 0.63% quarter-on-quarter, attributed to the impact of major customer delivery schedules and material shortages [1] Group 2 - Dongxing Securities noted that the "14th Five-Year Plan" draft suggests a shift in national investment towards efficient development of communication and computing networks, indicating continued expansion in related markets [2] - The cloud computing 50 ETF tracks an index with a high AI computing content, covering popular concepts such as optical modules, computing leasing, and data centers [2]

第五次跨界重组再失败 “炒壳王”控制下的群兴玩具将何去何从?

Xin Lang Cai Jing· 2025-10-23 02:27

Core Viewpoint - The company, Qunxing Toys, has announced the termination of its fifth major asset restructuring attempt since its listing, primarily due to failure to reach consensus on key terms of the transaction [1][7]. Group 1: Company Background and History - Qunxing Toys was established in 1996 and initially focused on toy research and production, but has since attempted multiple cross-industry transformations, all of which have failed [1][8]. - The company’s revenue peaked at 493 million yuan in 2011 but plummeted to 54 million yuan by 2017, and further declined to 19 million yuan in 2018 [2][8]. - Wang Sanshou became the actual controller of Qunxing Toys in November 2018, but his tenure was marred by personal financial issues that worsened the company's situation [2][3]. Group 2: Restructuring Attempts - Qunxing Toys has made five unsuccessful attempts at cross-industry restructuring since its listing, targeting various sectors including mobile gaming, nuclear equipment, energy technology, and electronics [7][8]. - The latest attempt involved acquiring at least 51% of Hangzhou Tiankuan Technology Co., which was terminated due to disagreements on transaction pricing and terms [1][9]. Group 3: Financial Issues and Management Changes - Wang Sanshou's management led to significant financial mismanagement, with 327 million yuan misappropriated, representing 44% of the company's net assets as of 2019 [2][3]. - Zhang Jincheng took over as chairman and general manager in late 2020, successfully stabilizing the company and shifting its focus to alcohol sales, which contributed 337 million yuan to revenue in 2024 [3][5]. Group 4: Future Prospects and Strategic Moves - Following the restructuring failure, Qunxing Toys is exploring acquisitions in high-tech fields like artificial intelligence, despite skepticism about the viability of its current computing power business [1][10]. - The company has begun emphasizing its computing power leasing business, which has attracted new investors, although it currently operates at a loss [10][11].

“玩具第一股”沦为重组失败专业户,群兴玩具路在何方?

Di Yi Cai Jing· 2025-10-21 10:44

Core Viewpoint - The company, Qunxing Toys, has attempted five mergers and acquisitions over the past decade, all of which have failed, with the latest attempt to acquire Tian Kuan Technology officially terminated due to disagreements on key terms [1][7]. Group 1: Mergers and Acquisitions Attempts - Qunxing Toys announced on October 20 that it would terminate its plan to acquire at least 51% of Tian Kuan Technology due to a lack of consensus on core issues [1]. - The company has a history of pursuing acquisitions in various sectors, including gaming, nuclear power, military, power batteries, and consumer electronics, but has not succeeded in any of these attempts since its listing in 2011 [1][2]. - The latest acquisition attempt was part of a strategy to enter the computing power leasing industry, which the company began exploring last year [2]. Group 2: Financial Performance and Business Transition - After its listing, Qunxing Toys experienced a decline in net profit from 52 million yuan in its first year to 14.87 million yuan in 2014, prompting a search for quality assets to enhance its business [3]. - The company has gradually shifted away from toy manufacturing to focus on other sectors, including alcohol sales, property leasing, and smart computing power leasing, as indicated in its 2024 annual report [8][9]. - The transition has led to periods where the company had zero revenue from its original toy business, highlighting the challenges of maintaining a coherent business strategy [9]. Group 3: Current Ownership and Control - Following multiple failed acquisitions, the original controlling shareholders, Lin Weizhang and Huang Shiqun, sought to transfer control to strategic investors, ultimately resulting in a change of control to Wang Sanshou in 2018 [6]. - As of September 2024, Qunxing Toys has no controlling shareholder or actual controller, with ownership highly dispersed among individual shareholders [9].

深夜又一A股公司曝算力计划泡汤!群兴玩具五追“风口”并购皆告失败

Zhong Jin Zai Xian· 2025-10-21 00:31

Core Viewpoint - The company, Qunxing Toys, announced the termination of its plan to acquire at least 51% of Hangzhou Tiankuan Technology due to failure to reach consensus on key terms such as transaction price and party arrangements [1][2]. Group 1: Acquisition Details - The acquisition was initially announced on February 26, leading to a surge in stock prices, but ultimately did not progress as planned [1][2]. - Qunxing Toys stated that the transaction was still in the planning stage and had not been submitted for board or shareholder approval [1]. - The company committed to not planning any major asset restructuring for at least one month following the announcement [1]. Group 2: Financial Performance - Qunxing Toys reported a revenue of 5.79 billion yuan for Tiankuan Technology in 2024, with approximately 58% of that revenue coming from its core business of AI computing center construction and operation [2]. - The company’s stock price has decreased by 24.84% over the past eight months, with a year-to-date decline of 14.44% [3]. - In the first half of the year, the AI computing business generated revenue of 18.11 million yuan, accounting for 10.32% of total revenue, but incurred a net loss of 18.61 million yuan [4]. Group 3: Historical Context - This acquisition attempt marks the fifth restructuring effort by Qunxing Toys since its listing, with previous attempts also failing despite targeting popular sectors [2]. - The company has previously attempted to diversify into various sectors, including mobile gaming and environmental technology, but these efforts have not been successful [2]. - The company’s main revenue source remains alcohol sales, which accounted for over 80% of its revenue, with a low gross margin of 2.32% [5].

群兴玩具,终止筹划重大资产重组

Zhong Guo Zheng Quan Bao· 2025-10-20 23:22

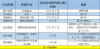

Core Viewpoint - The acquisition of at least 51% stake in Tian Kuan Technology by Qunxing Toys has been terminated due to failure to reach an agreement on key terms such as transaction price and scheme [1][3]. Group 1: Acquisition Details - Qunxing Toys signed a framework agreement on February 25 to acquire at least 51% of Tian Kuan Technology for cash, which would make Tian Kuan a subsidiary of Qunxing Toys [3]. - Tian Kuan Technology's main business includes the construction and operation of artificial intelligence computing centers, providing digital transformation solutions, and offering products in the smart security field [3]. - In 2024, Tian Kuan Technology achieved revenue of 579 million yuan and a net profit of approximately 40.3 million yuan, with revenue distribution across computing center construction (58%), digital services (27%), and smart security (15%) [3]. Group 2: Financial Implications - The estimated value for 100% of Tian Kuan Technology was set at no more than 800 million yuan, implying that Qunxing Toys' planned acquisition of at least 51% would correspond to an estimated value of around 400 million yuan [4]. - In contrast, Qunxing Toys reported a revenue of 370 million yuan and a net loss of approximately 18.4 million yuan for 2024, with cash reserves of only 30.2 million yuan as of December 31, 2024 [4]. Group 3: Market Reaction - The announcement of the acquisition termination led to a "limit-up" trend in Qunxing Toys' stock price, indicating a positive market reaction prior to the termination [5]. Group 4: Business Diversification - Qunxing Toys had previously entered the computing power leasing industry by signing a contract with China Mobile on January 18, 2024, which attracted market attention due to its shift from its original business of liquor sales and property management [6]. - The Shenzhen Stock Exchange issued an inquiry to Qunxing Toys regarding the necessity and rationality of its cross-industry investment in computing power leasing, as well as its potential impact on the company's operations [6]. - Despite the diversification efforts, Qunxing Toys' smart computing business generated only 18.1 million yuan in revenue in the first half of the year, accounting for 10.32% of total revenue [6].

巨额算力合同解约 海南华铁经受冲击波

经济观察报· 2025-10-19 07:30

Core Viewpoint - The termination of a significant 36.9 billion yuan computing power contract by Hainan Huatie raises questions about the authenticity of the contract and the explanations provided for its cancellation, particularly regarding market conditions and supply-demand changes [3][4]. Group 1: Contract Termination Details - Hainan Huatie announced the termination of a computing power service agreement with a total value of 36.9 billion yuan, which represented approximately 70% of the company's projected revenue for 2024 [3]. - The company stated that since the signing of the agreement, no purchase orders had been received, and the reasons for termination included significant changes in market conditions and supply-demand dynamics [3][14]. - The Shanghai Stock Exchange issued a regulatory letter to Hainan Huatie regarding the termination of this major contract, and the China Securities Regulatory Commission has initiated an investigation for suspected violations of information disclosure laws [4]. Group 2: Company Background and Financials - Hainan Huatie, formerly known as Huatie Emergency, primarily engages in equipment leasing, with a focus on high-altitude work platforms and construction support equipment [6]. - The company's revenue grew from 2.607 billion yuan in 2021 to 5.171 billion yuan in 2024, but net profits showed volatility, with figures of 498 million yuan, 640 million yuan, 801 million yuan, and 605 million yuan over the same period [6]. - In 2024, the company underwent a change in actual control, with the Hainan Provincial State-owned Assets Supervision and Administration Commission becoming the new controller, prompting a shift towards the computing power leasing sector [6]. Group 3: Market Context and Trends - The computing power leasing market has seen a surge in demand, particularly from major internet companies investing heavily in AI infrastructure, with Alibaba planning to invest over 380 billion yuan in cloud and AI hardware over the next three years [11]. - The rental model for computing power has gained traction due to the high costs and supply constraints of high-end AI chips, making it a more viable option for companies [12]. - The cancellation of Hainan Huatie's contract is not an isolated incident, as other companies have also faced similar challenges, indicating a broader trend of contract terminations in the computing power leasing market due to macroeconomic factors and supply issues [16].

巨额算力合同解约 海南华铁经受冲击波

Jing Ji Guan Cha Wang· 2025-10-18 02:49

Core Viewpoint - The termination of a significant 36.9 billion yuan computing power service agreement by Hainan Huatie has raised concerns about the company's operational integrity and the overall market environment for computing power services [1][3]. Group 1: Contract Termination - Hainan Huatie announced the termination of a 36.9 billion yuan computing power service agreement with Hangzhou X Company, which was expected to account for 70% of the company's projected revenue for 2024 [1][3]. - The company stated that since the signing of the agreement, no purchase orders had been received, and the market conditions had changed significantly since the contract was signed [1][3]. - The Shanghai Stock Exchange has issued a regulatory letter to Hainan Huatie regarding the termination of this major contract, and the China Securities Regulatory Commission has initiated an investigation for suspected violations of information disclosure laws [1][3]. Group 2: Company Background and Business Transition - Hainan Huatie, previously known as Huatie Emergency, primarily engaged in equipment leasing, with revenue growing from 2.607 billion yuan in 2021 to 5.171 billion yuan in 2024, although net profits showed significant fluctuations [2]. - Following a change in actual control to the Hainan Provincial State-owned Assets Supervision and Administration Commission in 2024, the company shifted its focus towards the computing power leasing industry to explore new growth opportunities [2][3]. - The company had signed a total of 24.75 billion yuan in computing power service orders by the end of 2024, with nearly 700 million yuan in asset delivery completed [3]. Group 3: Market Context and Trends - The computing power leasing market has seen a surge in demand, particularly from major internet companies investing heavily in AI infrastructure, with Alibaba planning to invest over 380 billion yuan and Tencent increasing its capital expenditure significantly [5][6]. - Analysts suggest that the current global shortage of high-end AI chips has led to a shift towards leasing rather than purchasing computing power, as this model is more cost-effective and adaptable [6]. - The computing power industry is experiencing a bifurcation in demand, with high-end computing power remaining in high demand while low-end computing power faces challenges in rental agreements [8].