存储芯片

Search documents

A股收评:三大指数齐涨,沪指剑指4000点续创十年新高,创业板指涨近2%,存储芯片、可控核聚变板块走高!超3300股上涨,成交2.36万亿放量3650亿

Ge Long Hui· 2025-10-27 07:22

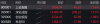

Market Performance - The three major A-share indices collectively rose, with the Shanghai Composite Index reaching a ten-year high, approaching 4000 points, closing at 3996.94, up 1.18% [1] - The Shenzhen Component Index increased by 1.51%, while the ChiNext Index rose by 1.98% [1] - Total market turnover was 2.36 trillion yuan, an increase of 365 billion yuan compared to the previous trading day, with over 3300 stocks rising [1] Index Summary - Shanghai Composite Index: 3996.94 (+46.63, +1.18%) [2] - Shenzhen Component Index: 13489.40 (+200.22, +1.51%) [2] - ChiNext Index: 3234.45 (+62.89, +1.98%) [2] - Total A-shares Index: 6395.73 (+75.32, +1.19%) [2] Sector Performance - The storage market experienced unprecedented price increases, with storage chips and semiconductor sectors surging, leading to stocks like Zhaoyi Innovation and Demingli hitting the daily limit [1] - The controlled nuclear fusion sector also saw gains, with stocks such as Antai Technology and Xiamen Tungsten hitting the daily limit [1] - The CPO concept remained active, with stocks like Jingwang Electronics hitting the daily limit [3] - The photolithography sector achieved breakthroughs, resulting in stocks like Wanrun Technology hitting the daily limit [3] - Sectors such as wind power equipment declined, with Haili Wind Power dropping over 8% [3] - The gaming and esports sectors weakened, with Youzu Network leading the decline [3]

存储芯片板块大爆发

财联社· 2025-10-27 07:18

Market Overview - The A-share market experienced a volatile upward trend, with the Shanghai Composite Index rising over 1% and approaching the 4000-point mark, reaching a ten-year high [1] - The total trading volume in the Shanghai and Shenzhen markets was 2.34 trillion yuan, an increase of 365.9 billion yuan compared to the previous trading day [1] Sector Performance - Storage chip concept stocks showed strong performance throughout the day, with companies like Demingli achieving consecutive gains and hitting new highs, while Jiangbolong and Xiangnong Chip Innovation also reached record levels [3] - Computing hardware concept stocks maintained their strength, with Huylv Ecological achieving four gains in six days and reaching a new high, while companies like Xinyisheng and Zhongji Xuchuang also hit historical highs [3] - The nuclear power sector was active, with Dongfang Tantalum achieving two gains in three days, and several stocks, including Antai Technology, hitting the daily limit [3] - Conversely, the wind power sector saw a collective decline, with Haili Wind Power experiencing a significant drop [3] Index Performance - By the end of the trading session, the Shanghai Composite Index rose by 1.18%, the Shenzhen Component Index increased by 1.51%, and the ChiNext Index gained 1.98% [3]

收评:沪指涨超1%逼近4000点,两市放量超3600亿

Feng Huang Wang Cai Jing· 2025-10-27 07:16

Market Overview - The market experienced a strong upward trend, with the Shanghai Composite Index rising over 1% and reaching a ten-year high, approaching 4000 points [1] - The total trading volume in the Shanghai and Shenzhen markets was 2.34 trillion, an increase of 365.9 billion compared to the previous trading day [1] Sector Performance - Leading sectors included storage chips, CPO, and controllable nuclear fusion, while gaming and wind power equipment sectors saw declines [2] - Notable stocks in the storage chip sector, such as Demingli and Jiangbolong, reached new highs, with several stocks in the computing hardware sector also performing strongly [2] Stock Movement - A total of 3361 stocks rose, while 217 remained unchanged, and 63 stocks hit the daily limit up [5] - The market heat index was recorded at 56, indicating a moderate level of market activity [5] Limit-Up Performance - The limit-up performance showed a sealing rate of 63%, with a high opening rate of 74% and a profit rate of 2.73% [6] - The number of stocks hitting limit-up included 38 on the first board, 6 on the second, and 3 on the third [6]

收盘丨沪指放量涨超1%逼近4000点,存储芯片概念持续爆发

Di Yi Cai Jing· 2025-10-27 07:12

Core Viewpoint - The A-share market shows strong upward momentum with significant trading volume and a broad increase in stock prices, indicating a potential shift towards a more vibrant market phase driven by policy support and restored investor confidence [2][4][7]. Market Performance - The total trading volume in the Shanghai and Shenzhen markets reached 2.34 trillion yuan, an increase of 365.9 billion yuan compared to the previous trading day [4]. - The Shanghai Composite Index rose by 1.18%, closing at 3996.94 points, while the Shenzhen Component Index increased by 1.51% to 13489.40 points, and the ChiNext Index gained 1.98%, reaching 3234.45 points [2][3]. Sector Performance - The storage chip sector experienced a surge, with multiple stocks hitting the daily limit, including Zhaoyi Innovation, which reached a new high [3]. - Other strong-performing sectors included consumer electronics, CPO, and circuit board concepts, while gaming, Hainan, and oil and gas sectors faced declines [3]. Capital Flow - Main capital inflows were observed in the communication, non-ferrous metals, and public utilities sectors, while there were outflows from battery, banking, and gaming sectors [6]. - Notable net inflows were recorded for Industrial Fulian, Shenghong Technology, and Hengbao Co., with net inflows of 1.768 billion yuan, 1.016 billion yuan, and 867 million yuan, respectively [6]. Institutional Insights - According to Citic Securities, the Shanghai Composite Index's approach to the 4000-point mark signifies the market entering a new, more dynamic phase, although sustained upward momentum will depend on solid economic fundamentals and improved corporate earnings [7]. - Qianhai Rongyue Asset Management suggests that the next resistance level for the Shanghai Composite Index may be around 4100 points [8]. - Guo Cheng Investment indicates that the market's continued upward trend should be monitored, particularly around the 4200-point resistance level for the Shanghai Composite Index [9].

收评:沪指放量涨1.18%逼近4000点再创10年新高,存储芯片板块持续爆发

Xin Lang Cai Jing· 2025-10-27 07:09

板块题材上,存储芯片、小金属、可控核聚变、钢铁、算力硬件股涨幅居前;风电设备、游戏、海南自贸区、深圳、文化 传媒板块跌幅居前。盘面上,存储芯片板块今日持续爆发,江波龙、拓荆科技、兆易创新、伟测科技、佰维存储多股盘中创出 历史新高,大为股份、德明利、时空科技等股封板。小金属板块集体走高,厦门钨业、东方钽业双双涨停。算力硬件保持活 跃,新易盛、生益科技创新高,胜宏科技、东田微、环旭电子涨幅居前。此外,可控核聚变、钢铁、福建本地股盘中均有所异 动。另一方面,游戏板块多股调整,游族网络、巨人网络、恺英网络等股下挫。风电设备板块同样表现落后,海力风电、盘古 智能、金雷股份跌幅居前。 A股三大指数今日集体上涨,截至收盘,上证指数涨1.18%,深证成指涨1.51%,创业板指涨1.98%,北证50跌0.2%。沪深 京三市全天成交额23566亿元,较上日放量3650亿元。全市场超3300只个股上涨。 ...

A股收评:沪指放量涨1.18%逼近4000点再创10年新高,存储芯片板块持续爆发

Xin Lang Cai Jing· 2025-10-27 07:02

Core Points - The three major A-share indices collectively rose today, with the Shanghai Composite Index increasing by 1.18%, the Shenzhen Component Index by 1.51%, and the ChiNext Index by 1.98%, while the Northbound 50 fell by 0.2% [1] - The total trading volume in the Shanghai and Shenzhen markets reached 23,566 billion yuan, an increase of 3,650 billion yuan compared to the previous day [1] - Over 3,300 stocks in the market experienced gains [1] Sector Performance - The storage chip sector saw significant gains, with stocks like Jiangbolong, Tuojing Technology, Zhaoyi Innovation, Weic Technology, and Baiwei Storage hitting historical highs [1] - The small metals sector also performed well, with Xiamen Tungsten and Dongfang Tantalum both reaching the daily limit [1] - The computing hardware sector remained active, with stocks such as Xinyisheng and Shengyi Technology reaching new highs, while Shenghong Technology, Dongtianwei, and Huanxu Electronics showed notable increases [1] - Other sectors that showed movement included controllable nuclear fusion, steel, and local stocks from Fujian [1] Underperforming Sectors - The gaming sector experienced adjustments, with stocks like Youzu Network, Giant Network, and Kaiying Network declining [1] - The wind power equipment sector also lagged, with companies such as Haili Wind Power, Pangu Intelligent, and Jinlei Co., Ltd. showing significant declines [1]

沪指逼近4000点,两市成交额破万亿,电子化学品领涨

Yang Zi Wan Bao Wang· 2025-10-27 06:27

Market Performance - The Shanghai Composite Index experienced strong fluctuations in the morning session, reaching a ten-year high and approaching 4000 points [1] - The total trading volume in the Shanghai and Shenzhen markets for the half-day was 1.57 trillion, an increase of 337.2 billion compared to the previous trading day [1][3] - Over 3500 stocks in the Shanghai and Shenzhen markets rose, with the total trading volume exceeding 1 trillion for the 103rd consecutive trading day, and expected to surpass 2.5 trillion for the entire day [3] Sector Highlights - The computing hardware sector showed strong performance, with stocks like Dongtian Micro (301183) hitting the 20% daily limit up, and others like Xinyisheng (300502), Huilv Ecology (001267), and Zhongji Xuchuang (300308) reaching historical highs [1] - The electronic chemicals, minor metals, energy metals, photolithography, and storage chip sectors saw significant gains, with notable stocks such as Tongcheng New Materials (603650) and Aisen Co. rising over 10% [3] - The controlled nuclear fusion concept stocks were actively traded, with Dongfang Tantalum (000962) achieving a historical high after two consecutive days of gains [5] Notable Stocks - Stocks related to photolithography opened significantly higher, with Tongcheng New Materials hitting the daily limit up and other companies like Aisen Co. and Jingrui Electric Materials (300655) also showing strong performance [3] - Fujian local stocks surged, with Haixia Innovation hitting the daily limit up and Pingtan Development (000592) achieving five gains in seven days [5]

午报沪指涨超1%逼近4000点,算力硬件方向延续强势,福建本地股集体走强

Sou Hu Cai Jing· 2025-10-27 06:19

Market Overview - The Shanghai Composite Index experienced a strong upward trend, reaching a ten-year high and approaching the 4000-point mark, with a half-day trading volume of 1.57 trillion yuan and over 330 billion yuan in turnover [1] - The market saw rapid rotation of hot sectors, with significant performance in computing hardware, controlled nuclear fusion concepts, and local stocks from Fujian province [1][6] - The three major indices all rose over 1%, with the Shanghai Composite Index increasing by 1.04%, the Shenzhen Component Index by 1.26%, and the ChiNext Index by 1.54% [1][9] Sector Performance Computing Hardware - The computing hardware sector continued to show strength, with stocks like New Yisheng hitting historical highs and several companies in this sector experiencing significant gains [1][3] - The demand for 1.6T optical modules has been continuously revised upward, with overseas clients increasing their procurement plans from 10 million to 20 million units due to the rapid growth in AI training and inference network bandwidth requirements [3] Controlled Nuclear Fusion - Stocks related to controlled nuclear fusion saw notable gains, with companies like Antai Technology and Xiamen Tungsten rising to their daily limits [4][6] - The Chinese government is pushing for the development of nuclear fusion energy as a new economic growth point, as highlighted in recent policy discussions [6] Storage Chips - The storage chip sector became active again, with major suppliers like Samsung and SK Hynix planning to raise DRAM and NAND flash prices by up to 30% in response to surging AI-driven demand [3][11] - Companies such as Yingxin Development and Dawi Co. saw their stocks hit the daily limit due to their involvement in the storage chip market [12] Local Stocks - Local stocks from Fujian province experienced a surge, with Hai Xia Innovation and Yongfu Co. both hitting their daily limits, and Pingtan Development achieving five consecutive trading limits [6][8] Key Stock Movements - A total of 41 stocks hit their daily limit, with a sealing rate of 62%, indicating strong market interest [1] - Notable stocks included Yingxin Development with five consecutive limits and Shikong Technology with three consecutive limits [1][12] Economic Indicators - The National Bureau of Statistics reported a 3.2% year-on-year increase in profits for large-scale industrial enterprises in the first nine months of 2025, totaling 53,732 billion yuan [26][27] - The Ministry of Commerce noted a steady expansion in inbound consumption, with a 22.3% increase in foreign visitors in the third quarter of 2025 [27]

存储芯片板块午后延续强势

Di Yi Cai Jing· 2025-10-27 06:06

Core Viewpoint - Jiangbolong's stock price increased by over 12%, reaching a new high, indicating strong market performance and investor interest [1] Company Performance - Jiangbolong's stock surge reflects positive market sentiment and potential growth opportunities within the company [1] - Daway Co., Shikong Technology, Demingli, Jingzhida, and Weidao Nano also experienced significant stock price increases, with some reaching their daily limit [1] Market Trends - The overall trend in the market shows a bullish sentiment, particularly in the sectors represented by the mentioned companies, suggesting a favorable investment climate [1]

存储芯片概念股涨幅进一步扩大,江波龙拉升涨13%,德明利逼近涨停

Ge Long Hui· 2025-10-27 05:30

Core Insights - The A-share market for storage chip concept stocks has seen significant gains, with companies like Jiangbolong rising by 13% and Demingli nearing a trading halt, indicating strong investor interest in this sector [1] Industry Summary - The storage chip market is currently experiencing an unprecedented shortage and price increase driven by AI demand, which began in the first half of the year and has intensified in the fourth quarter [1] - Industry insiders report that some storage manufacturers have adopted a strategy of pausing quotes for certain DRAM and Flash production lines, reflecting the ongoing supply constraints [1] Company Performance - Jiangbolong (301308) has seen a 13.65% increase in stock price, with a total market capitalization of 105.8 billion and a year-to-date increase of 193.37% [2] - Demingli (001309) has increased by 7.88%, with a market cap of 53.1 billion and a year-to-date increase of 276.61% [2] - Other notable performers include: - Guoao Technology (300551) up by 9.50% with a market cap of 4.547 billion and a year-to-date increase of 34.10% [2] - Yao Ke Technology (002409) up by 4.20% with a market cap of 39.7 billion and a year-to-date increase of 45.23% [2]