半导体芯片

Search documents

2.6万亿巨头,再创新高!

中国基金报· 2025-10-17 03:34

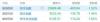

中国基金报记者 李智 一起来看下最新的市场情况及资讯。 10月17日开盘,A股三大指数集体低开,创业板指跌超2%。个股方面,4100只个股下跌。 | 上证指数 | 深证成指 | 北证50 | | --- | --- | --- | | 3882.20 | 12843.47 | 1473.92 | | -34.03 -0.87% | -242.94 -1.86% | -14.79 -0.99% | | 科创50 | 创业板指 | 万得全A | | 1377.15 | 2967.14 | 6186.80 | | -39.43 -2.78% | -70.30 -2.31% | -81.62 -1.30% | | 沪深300 | 中证500 | 中证A500 | | 4558.34 | 7121.84 | 5451.65 | | -60.09 -1.30% -109.70 -1.52% | | -80.13 -1.45% | | 中证1000 | 深证100 | 中证红利 | | 7301.79 | 5640.76 | 5644.13 | | -100.04 -1.35% | -117.90 -2.05% | +4. ...

A股成交跌破两万亿

Di Yi Cai Jing Zi Xun· 2025-10-16 09:33

Market Overview - A-shares continue to experience reduced trading volume, with the Shanghai Composite Index closing at 3916 points, up 0.1%, and the Sci-Tech Innovation 50 Index down 0.94% at 1416.58 points [2] - Trading volume in the Shanghai, Shenzhen, and Beijing markets fell below 1.95 trillion yuan, marking the first time since August 12 that it has dropped below 2 trillion yuan [2] Sector Performance - High dividend sectors such as insurance, banking, coal, and shipping have shown strong performance, while some previously strong tech stocks have experienced corrections [2] - The demand for adjustment in high-valuation sectors like artificial intelligence, solid-state batteries, and non-ferrous metals is noted, with traditional industries remaining undervalued and offering high dividend yields [2][3] Market Sentiment - Market participants are exhibiting cautious sentiment, leading to reduced trading activity as they await the emergence of new leading sectors [3] - The current market environment is characterized by a potential shift in market style, with high dividend sectors expected to perform strongly in the fourth quarter, contrasting with the stagnation seen in the third quarter [6] Future Outlook - Analysts suggest that the fourth quarter may see a style shift towards value sectors such as banking, coal, and liquor, which have shown strong performance, while technology and non-ferrous metals may continue to experience adjustments [6][7] - The focus on low-valuation, high-dividend sectors indicates a potential for valuation recovery, especially as the market's attention shifts towards policy expectations and valuation levels [6][7]

A股成交跌破两万亿,风格转换或贯穿第四季度|市场观察

Di Yi Cai Jing· 2025-10-16 08:36

Group 1 - The high dividend sector is expected to lead the market in the fourth quarter, contrasting with the stagnation observed in the third quarter, as valuations remain historically low and signs of capital inflow are evident [1][4] - The A-share market is experiencing a volume contraction, indicating a shift to a consolidation phase, with traditional industries still undervalued and high dividend yields [1][2] - The market is witnessing a style shift, with value sectors such as banking, coal, and liquor outperforming, while previously leading sectors like TMT and non-ferrous metals are undergoing adjustments [4][5] Group 2 - The recent market rally since April 7 has seen the Shanghai Composite Index rise approximately 800 points, primarily driven by artificial intelligence and "anti-involution" themes, but a need for a switch in market focus is emerging [2][3] - Analysts suggest that the current cautious sentiment among market participants is leading to reduced trading activity, with volume dropping below 2 trillion yuan for the first time since August 12 [2][3] - The fourth quarter is anticipated to see a continued focus on low-valuation sectors, with potential for valuation recovery as the market shifts from growth to value investing [5][6]

“我把自己的创业故事,做成了一款游戏”丨后窗

投中网· 2025-10-15 08:44

Core Viewpoint - The article discusses the concept of "sandbox simulation" as a decision-making tool in venture capital and entrepreneurship, drawing parallels between military strategy and business strategy [5][6][7]. Group 1: Sandbox Simulation in Investment - "Sandbox simulation" originated from military strategy, where it was used to predict outcomes in warfare, and has now been adapted for corporate strategic planning [5][6]. - Shell Oil successfully used sandbox simulation in 1965 to anticipate the 1973 oil crisis, allowing for strategic adjustments that minimized potential losses [6]. - The article highlights the popularity of simulation games among venture capitalists, as they enjoy validating ideas and exploring possibilities in a simulated environment [6][7]. Group 2: Entrepreneurial Journey and Game Development - A reader, inspired by the article, developed a board game that simulates the entrepreneurial financing process based on their experiences in the semiconductor industry [7][8]. - The entrepreneurial journey began in 2021, leading to the creation of a startup focused on the consumer electronics supply chain in the Yangtze River Delta [8][9]. - Initial months of the startup were characterized by chaotic growth, with the founder handling multiple roles while also engaging with investors [9][10]. Group 3: Challenges in Startup Growth - As the company grew, the nature of investor inquiries shifted from curiosity to urgent questioning, reflecting the company's progress and the market environment [12]. - Delays in product development led to increased pressure, with the CEO adopting different personas to manage internal and external expectations [12][13]. - The startup faced typical challenges in the Chinese venture capital landscape, including intense work hours and chaotic project management [13][14]. Group 4: Game Mechanics and Design - The game design incorporates various elements such as trade wars, capital winter, and IPO fluctuations, allowing players to experience the complexities of entrepreneurship [16][17]. - Different industries are represented in the game, each with unique sales logic and production mechanisms, reflecting real-world market dynamics [17][19]. - The game also emphasizes the importance of talent and research mechanisms, introducing randomness to simulate the unpredictability of startup success [21][22]. Group 5: Investment Mechanism in the Game - The game ties its victory conditions to venture capital milestones, mirroring real-life funding rounds and market expectations [24]. - Players aim to achieve specific project milestones to secure funding, with the game simulating the pressure of meeting investor demands [24]. - The final goal is to achieve a successful IPO, with players' wealth calculated based on their company's valuation at the end of the game [24][26].

A股指数持续走弱,创业板指跌逾4%,下跌个股近3600只

Feng Huang Wang Cai Jing· 2025-10-14 06:33

Group 1 - The semiconductor chips, consumer electronics, computing hardware, and non-ferrous metals sectors experienced significant declines, with nearly 3,500 stocks in the Shanghai, Shenzhen, and Beijing markets falling [1] - The A-share index continued to weaken, with the ChiNext index dropping over 4.00%, the Shanghai Composite Index falling by 0.68%, the Shenzhen Component Index decreasing by 2.48%, and the STAR 50 Index declining by nearly 4.3% [2]

A股指数分化,创业板指跌逾1%,芯片领跌市场

Feng Huang Wang Cai Jing· 2025-10-14 02:38

Core Viewpoint - The A-share market shows divergence with the ChiNext index dropping over 1%, while the Shanghai Composite Index rises by 0.43% [1] Market Performance - The Shanghai Composite Index is at 3905.76, up by 0.42% with a trading volume of approximately 567.8 billion [2] - The Shenzhen Component Index stands at 13199.70, down by 0.24%, with a trading volume of about 655.1 billion [2] - The ChiNext index is at 3047.56, down by 1.01%, with a trading volume of around 292.2 billion [2] - The North 50 index is at 1502.96, up by 1.05% [2] Sector Performance - Semiconductor chips, non-ferrous metals, and computing hardware sectors experienced significant declines [1] - Nearly 2100 stocks in the Shanghai, Shenzhen, and Beijing markets saw declines [1] Trading Volume - The trading volume in the Shanghai and Shenzhen markets has exceeded 1 trillion for the 94th consecutive trading day, with a decrease of over 70 billion compared to the previous day [2] - The estimated total trading amount for the day is approximately 2.45 trillion [2]

市场低开回升显韧性,有色、芯片股强者恒强,稀土板块或成短线关注焦点

Xin Lang Cai Jing· 2025-10-14 01:20

Group 1 - The market demonstrated resilience with the three major indices rebounding after a significant low opening, indicating a need for short-term consolidation while focusing on core stocks [1] - The rare earth permanent magnet sector experienced a comprehensive surge, with over ten stocks including Northern Rare Earth and China Rare Earth hitting the daily limit, driven by upgraded control measures and strategic attributes [1] - The non-ferrous metals sector is expected to remain active, supported by rising futures prices, with a focus on low-position rebound opportunities [2] Group 2 - The semiconductor chip sector showed renewed activity, with Huahong Semiconductor hitting a limit up, and several stocks in the new semiconductor concept continuing to perform strongly [2] - Multiple brokerages adjusted the margin financing rates for SMIC and BAW Storage, which may help to attract investor interest back into the sector [2] - Despite the positive momentum, caution is advised as the semiconductor sector is at a relatively high level, and without sufficient capital support, it may face further volatility [2]

每日收评沪指低开高走微跌0.19%,全市场逾百股涨超9%,稀土、芯片概念股双双爆发

Sou Hu Cai Jing· 2025-10-13 10:21

Market Overview - The market showed resilience with major indices recovering from initial declines, with the ChiNext 50 index rising over 1% in the afternoon session [1] - The total trading volume in the Shanghai and Shenzhen markets was 2.35 trillion yuan, a decrease of 160.9 billion yuan compared to the previous trading day [1] Sector Performance - The rare earth permanent magnet sector experienced a significant surge, with multiple stocks such as Galaxy Magnetic and Northern Rare Earth hitting the daily limit [2] - The semiconductor industry also saw a wave of limit-up stocks, including New Lai Materials and Kai Mei Teqi, with over ten stocks reaching the daily limit [1][3] - The non-ferrous metals sector was active again, with stocks like China Ruilin and Western Gold hitting the daily limit, driven by rising prices of gold and silver [3] Rare Earth Sector Insights - Northern Rare Earth announced an increase in the transaction price for rare earth concentrates for Q4 2025 to 26,205 yuan/ton (excluding tax), a 37% increase from the previous period [2] - The rare earth industry is positioned strategically due to supply-demand dynamics, with China's quota management and export controls enhancing its strategic position [2] Semiconductor Sector Insights - The upcoming Bay Area Semiconductor Industry Eco-Expo in Shenzhen is expected to showcase local semiconductor companies, indicating growth potential in the domestic semiconductor manufacturing and equipment sectors [3] - The semiconductor sector is anticipated to grow rapidly due to policy and demand drivers, although there are concerns about potential volatility in stock prices following recent adjustments [3] Individual Stock Highlights - Stocks like Bluefeng Biochemical and Tianji Co. have shown strong performance, with Bluefeng achieving a "limit-up" for eight consecutive days [5] - The controlled nuclear fusion concept has gained traction, with stocks like Hezhong Intelligent and Antai Technology showing significant upward trends [5] Future Market Analysis - The A-share market demonstrated strong resilience despite initial negative news, with a notable recovery in major indices [7] - However, trading volume decreased, raising concerns about whether this trend can be sustained in the short term [7]

港股收评:跌幅收窄恒指跌1.52%,半导体芯片股、黄金股转涨!小米跌5.7%,华虹半导体涨8%,中芯国际涨超3%,赤峰黄金、紫金黄金国际涨超9%

Ge Long Hui· 2025-10-13 08:59

Market Overview - The Hong Kong stock market experienced a decline, with the Hang Seng Index closing down 1.52% at 25,889 points, having previously dropped as much as 3.6% during the day [1] - The Hang Seng Tech Index and the China Enterprises Index fell by 1.82% and 1.45% respectively, with the tech index at one point down nearly 5% [1] Sector Performance - Large technology stocks showed a significant narrowing of losses in the afternoon, with Xiaomi down 5.7% (previously nearly 9%), JD.com down 3.6%, and Baidu down 2.14% [3] - Consumer electronics stocks faced notable declines, particularly due to potential escalations in trade tensions, with Apple-related stock Hongteng Precision dropping nearly 8% and Lens Technology down over 6% [3] - Other sectors such as new energy vehicles, gambling, education, insurance, home appliances, aviation, and Chinese brokerage stocks also saw declines [3] Positive Movements - In contrast, semiconductor stocks and gold stocks collectively turned positive in the afternoon, with Huahong Semiconductor rising by 8% and SMIC up over 3% [3] - Gold stocks like Chifeng Jilong Gold and Zijin Mining International surged over 9%, while rare earth concept stock Jilin Jien Nickel Industry saw a strong increase of 13% [3] - Software, wind power, military, and shipping stocks showed some active performance [3]

港股收评:恒指跌1.52%,贵金属、稀土概念全天强势

Ge Long Hui· 2025-10-13 08:36

Market Overview - The Hang Seng Index closed down 1.52% at 25,889 points, having previously dropped as much as 3.6% during the day [1] - The Hang Seng Tech Index and the China Enterprises Index fell by 1.82% and 1.45%, respectively, with the tech index experiencing a near 5% drop at one point [1][2] Sector Performance - Large tech stocks showed a significant narrowing of losses in the afternoon, with Xiaomi down 5.7% after a near 9% drop, and JD.com down 3.6% [2] - Consumer electronics stocks were among the hardest hit due to potential escalations in trade tensions, while sectors like new energy vehicles, gambling, education, insurance, and aviation also declined [2] - Semiconductor and gold stocks collectively turned positive in the afternoon, with rare earth stock Jinchuan Magnetics surging 13% [2][8] Specific Stock Movements - Apple-related stocks saw a collective decline, with Hongteng Precision down over 7%, Lens Technology down over 6%, and Sunny Optical down over 4% [4][5] - The pharmaceutical outsourcing sector experienced significant drops, with Kelaiying down over 7% and WuXi AppTec down over 6% [6][7] - Rare earth stocks, particularly Jinchuan Magnetics, saw a notable increase of over 13% due to improved supply-demand dynamics [8] - Gold and precious metals stocks performed strongly, with Chifeng Jilong Gold and Zijin Mining both rising over 9% [9] Banking Sector - Some banks, such as Guangzhou Rural Commercial Bank, saw gains of over 5%, while others like Guizhou Bank and Chongqing Bank rose over 2% [12] - Analysts noted that the banking sector has underperformed since July 10, with a cumulative decline of 14%, but there may be opportunities for recovery as dividend dates approach [12] Individual Stock Highlights - Yao Cai Securities surged over 19% after receiving approval from the Hong Kong Securities and Futures Commission for an acquisition by Ant Group [13] Future Outlook - Analysts expect the Hong Kong market to experience volatility due to escalating US-China trade tensions, but domestic growth policies may stabilize investor sentiment over time [16] - Suggested sectors for investment include precious metals as a hedge against market uncertainty, the AI industry due to expanding capital expenditures from global tech giants, and sectors highlighted in China's 14th Five-Year Plan [16]