摩托车及其他

Search documents

摩托车及其他板块11月7日跌0.91%,征和工业领跌,主力资金净流出5252.42万元

Zheng Xing Xing Ye Ri Bao· 2025-11-07 08:41

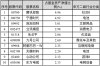

Market Overview - On November 7, the motorcycle and other sectors fell by 0.91%, with Zhenghe Industrial leading the decline [1] - The Shanghai Composite Index closed at 3997.56, down 0.25%, while the Shenzhen Component Index closed at 13404.06, down 0.36% [1] Stock Performance - Notable stock performances included: - Aima Technology (603529) closed at 32.18, up 0.97% with a trading volume of 112,700 shares and a turnover of 365 million yuan [1] - Zhenghe Industrial (003033) closed at 75.71, down 4.72% with a trading volume of 21,400 shares and a turnover of 165 million yuan [2] - Longxin General (603766) closed at 13.73, down 3.78% with a trading volume of 260,400 shares and a turnover of 362 million yuan [2] Capital Flow - The motorcycle and other sectors experienced a net outflow of 52.52 million yuan from main funds, while retail investors saw a net inflow of 56.14 million yuan [2] - The capital flow for specific stocks showed: - Aima Technology had a main fund net inflow of 31.71 million yuan, while retail investors had a net outflow of 18.69 million yuan [3] - Zhenghe Industrial had a main fund net outflow of 4.30 million yuan, with retail investors seeing a net inflow of 10.68 million yuan [3]

摩托车及其他板块11月6日涨1.43%,千里科技领涨,主力资金净流入2585.62万元

Zheng Xing Xing Ye Ri Bao· 2025-11-06 08:51

Group 1 - The motorcycle and other sectors increased by 1.43% on the previous trading day, with Qianli Technology leading the gains [1] - The Shanghai Composite Index closed at 4007.76, up 0.97%, while the Shenzhen Component Index closed at 13452.42, up 1.73% [1] Group 2 - The net inflow of main funds in the motorcycle and other sectors was 25.86 million yuan, while retail funds experienced a net outflow of 9.94 million yuan [2] - The net outflow of speculative funds was 15.91 million yuan [2]

九号公司(689009):25Q3收入保持高增长,多元布局深化

Hua Yuan Zheng Quan· 2025-11-05 09:15

Investment Rating - The investment rating for the company is "Accumulate" (maintained) [5] Core Views - The company has maintained high revenue growth in Q3 2025, with a diversified layout deepening [5] - The electric two-wheeler segment continues to drive revenue growth, with a significant increase in both sales volume and average selling price (ASP) [6] - The company is expected to capture more market share through product pricing strategies and channel expansion, with strong potential in overseas markets and software services [6] - The gross margin has improved, and the company is increasing its investment in research and development [6] - The company is positioned as a leader in smart short-distance transportation and service robots, with substantial growth potential across various business lines [6] Financial Summary - For 2023, the company is projected to achieve a revenue of 10,222 million RMB, with a year-on-year growth rate of 0.97% [5] - By 2025, the revenue is expected to reach 21,397 million RMB, reflecting a year-on-year growth rate of 50.73% [5] - The net profit attributable to the parent company is forecasted to be 2,005 million RMB in 2025, with a year-on-year growth rate of 84.90% [5] - The earnings per share (EPS) is projected to be 27.95 RMB in 2025, with a return on equity (ROE) of 26.93% [5] - The price-to-earnings (P/E) ratio is expected to be 20.85 in 2025 [5]

春风动力现7笔大宗交易 合计成交66.00万股

Zheng Quan Shi Bao Wang· 2025-11-04 16:22

Core Insights - Chuncheng Power conducted 7 block trades on November 4, totaling 660,000 shares and a transaction amount of 156 million yuan, with a transaction price of 236.96 yuan, reflecting a discount of 5.13% compared to the closing price of the day [2][3] - The closing price of Chuncheng Power on the same day was 249.78 yuan, down 1.97%, with a turnover rate of 0.68% and a total transaction amount of 263 million yuan, indicating a net outflow of 13.75 million yuan in main funds [2][3] Trading Details - The block trades included: - 30,000 shares for 71.09 million yuan at 236.96 yuan, with a discount of 5.13%, executed by institutional special seats [3] - 16,000 shares for 37.91 million yuan at the same price and discount, also by institutional special seats [3] - Additional trades included 8,000 shares, 5,000 shares, and smaller transactions, all at the same price and discount, indicating strong institutional participation [3] Financing Data - The latest financing balance for Chuncheng Power is 15.7 million yuan, showing a decrease of 8.87 million yuan over the past five days, representing a decline of 5.33% [3] - The company was established on December 9, 2003, with a registered capital of 1.52577663 billion yuan [3]

摩托车及其他板块11月3日跌0.61%,涛涛车业领跌,主力资金净流入3534.9万元

Zheng Xing Xing Ye Ri Bao· 2025-11-03 08:47

Market Overview - The motorcycle and other sectors experienced a decline of 0.61% on the trading day, with TaoTao Industry leading the drop [1] - The Shanghai Composite Index closed at 3976.52, up 0.55%, while the Shenzhen Component Index closed at 13404.06, up 0.19% [1] Stock Performance - Notable gainers included: - Longxin General (603766) with a closing price of 14.22, up 4.48% and a trading volume of 449,500 shares, totaling 632 million yuan [1] - Xinlong Health (002105) closed at 7.07, up 1.29% with a trading volume of 51,000 shares, totaling 35.92 million yuan [1] - Significant decliners included: - TaoTao Industry (301345) closed at 222.36, down 6.37% with a trading volume of 22,300 shares, totaling 493 million yuan [2] - New Day Co. (603787) closed at 13.97, down 2.78% with a trading volume of 140,900 shares, totaling 195 million yuan [2] Capital Flow - The motorcycle and other sectors saw a net inflow of 35.34 million yuan from main funds, while retail investors experienced a net outflow of 164 million yuan [2] - The main funds' net inflow for key stocks included: - Qianli Technology (601777) with a net inflow of 43.83 million yuan, accounting for 9.40% [3] - TaoTao Industry (301345) with a net inflow of 25.48 million yuan, accounting for 5.94% [3] - Retail investors showed significant outflows in several stocks, including: - Qianli Technology (601777) with a net outflow of 92.44 million yuan, accounting for -19.82% [3] - Spring Wind Power (603129) with a net outflow of 28.84 million yuan, accounting for -13.52% [3]

摩托车及其他板块10月31日涨1.5%,新日股份领涨,主力资金净流入8089.17万元

Zheng Xing Xing Ye Ri Bao· 2025-10-31 08:41

Market Overview - On October 31, the motorcycle and other sectors rose by 1.5%, with Xinri Co., Ltd. leading the gains [1] - The Shanghai Composite Index closed at 3954.79, down 0.81%, while the Shenzhen Component Index closed at 13378.21, down 1.14% [1] Key Stocks Performance - Xinri Co., Ltd. (603787) closed at 14.37, up 5.27% with a trading volume of 183,300 shares and a turnover of 260 million yuan [1] - Yong'an Xing (603776) closed at 20.05, up 5.14% with a trading volume of 68,200 shares [1] - Aima Technology (603529) closed at 32.67, up 2.93% with a trading volume of 127,200 shares [1] - Qianli Technology (601777) closed at 11.91, up 2.67% with a trading volume of 466,600 shares [1] - Other notable performances include XD Jiuhua (600689) up 1.83% and Huayang Saiche (920058) up 1.65% [1] Capital Flow Analysis - The motorcycle and other sectors saw a net inflow of 80.89 million yuan from main funds, while retail funds experienced a net outflow of 2.73 million yuan [2] - The main funds' net inflow and outflow for key stocks include: - Aima Technology: net outflow of 41.65 million yuan [3] - Qianli Technology: net inflow of 35.02 million yuan [3] - Yong'an Xing: net inflow of 2.15 million yuan [3] - Spring Wind Power (603129): net inflow of 9.48 million yuan [3]

大族激光目标价涨幅超60%,嘉益股份、太辰光评级被调低|券商评级观察

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-30 01:25

Group 1 - The core viewpoint of the article highlights significant target price increases for certain companies, with Dazhu Laser, Qianjiang Motorcycle, and Lihigh Food leading the rankings with target price increases of 62.27%, 54.74%, and 54.33% respectively, indicating strong market confidence in these sectors [1] Group 2 - On October 29, brokerages lowered ratings for two companies: Huazhong Securities downgraded Jiayi Co., from "Buy" to "Hold," while Qunyi Securities (Hong Kong) downgraded Taicheng Light from "Buy" to "Range Trading," reflecting a cautious outlook on these firms [1]

泉果基金孙伟:消费复苏需观察政策实施力度,三季度增配新消费与锂电

Sou Hu Cai Jing· 2025-10-29 09:20

Core Insights - The report from the "泉果消费机遇" fund indicates a significant growth in fund size, reaching 695 million yuan by the end of Q3 2025, up from 61.93 million yuan in Q2 2025, reflecting increasing recognition from investors, including institutions [1][2] - The fund's net value performance shows a 33.00% increase over the past year, outperforming the benchmark of 3.69% [1] Fund Performance and Market Context - The fund has gained favor among institutional investors, with 2.856 million shares held, accounting for 4.96% of total shares [2] - In Q3 2025, major stock indices performed well, with the Shanghai Composite Index rising by 12.73%, Shenzhen Component Index by 29.25%, CSI 300 by 17.90%, and Hang Seng Index by 11.56% [2] - Economic indicators showed steady growth, with industrial added value increasing by 5.7% and 5.2% in July and August respectively, and retail sales growing by 3.7% and 3.4% in the same months [2] Portfolio Adjustments - The fund manager, Sun Wei, indicated a slight increase in equity positions and adjustments in the portfolio structure, focusing on new consumption and lithium battery sectors [3] - The fund increased allocations in personal care, trendy toys, and gaming industries while reducing exposure in closely related sectors [3] - The top ten holdings account for 30.12% of the fund's net asset value, with Tencent Holdings, CATL, and Pop Mart among the largest positions [5] Investment Strategy - As of Q3 2025, the fund's stock position constituted 79.01% of its net assets, with a 24.77% allocation to Hong Kong stocks, showing stability compared to the previous quarter [4][3] - New entries in the top ten holdings include Pop Mart, Alibaba-W, and Tianqi Lithium, while previous holdings like Yanjing Beer and Li Auto have exited the list [3][5]

摩托车及其他板块10月28日涨0.12%,征和工业领涨,主力资金净流出1.51亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-28 08:33

Market Overview - On October 28, the motorcycle and other sectors rose by 0.12%, led by Zhenghe Industrial. The Shanghai Composite Index closed at 3988.22, down 0.22%, while the Shenzhen Component Index closed at 13430.1, down 0.44% [1]. Stock Performance - Zhenghe Industrial (003033) closed at 86.53, up 10.01% with a trading volume of 51,900 shares and a transaction value of 432 million yuan [1]. - Shanghai Phoenix (600679) closed at 13.53, up 3.28% with a trading volume of 202,500 shares and a transaction value of 275 million yuan [1]. - TaoTao Vehicle (301345) closed at 252.20, up 2.40% with a trading volume of 18,100 shares and a transaction value of 454 million yuan [1]. - Qianli Technology (601777) closed at 11.41, up 1.78% with a trading volume of 421,100 shares and a transaction value of 480 million yuan [1]. - Other notable performances include Xinlong Health (002105) up 1.58% and Chunfeng Power (603129) up 0.52% [1]. Capital Flow - The motorcycle and other sectors experienced a net outflow of 151 million yuan from main funds, while retail funds saw a net inflow of 62.61 million yuan [2]. - The main funds showed a net outflow in several stocks, including Zhenghe Industrial and Qianli Technology, while retail investors contributed positively to stocks like Green通科技 [3]. Detailed Stock Capital Flow - Zhenghe Industrial had a main fund net outflow of 33.16 million yuan, with retail inflow of 21.91 million yuan [3]. - Qianli Technology saw a main fund net inflow of 13.31 million yuan, but retail investors had a net outflow of 15.13 million yuan [3]. - Chunfeng Power had a main fund net inflow of 9.84 million yuan, while retail investors had a slight outflow [3].

永安行涨2.21%,成交额5119.87万元,主力资金净流入19.73万元

Xin Lang Cai Jing· 2025-10-27 05:56

Group 1 - The stock price of Yong'an Xing increased by 2.21% on October 27, reaching 19.90 CNY per share, with a total market capitalization of 5.587 billion CNY [1] - Year-to-date, Yong'an Xing's stock price has risen by 56.45%, but it has seen a decline of 8.13% over the past 20 days and 9.46% over the past 60 days [1] - The company has appeared on the trading leaderboard five times this year, with the most recent instance on June 26, where it recorded a net buy of -32.5976 million CNY [1] Group 2 - Yong'an Xing Technology Co., Ltd. was established on August 24, 2010, and went public on August 17, 2017, focusing on shared mobility systems based on IoT and big data analysis [2] - The company's revenue composition includes: system operation services (35.18%), shared mobility services (21.06%), hydrogen products and services (19.40%), smart living services (13.76%), and system sales (10.59%) [2] - As of June 30, the number of shareholders increased by 5.04% to 16,600, while the average circulating shares per person decreased by 4.58% to 14,549 shares [2] Group 3 - Yong'an Xing has distributed a total of 438 million CNY in dividends since its A-share listing, with 158 million CNY distributed over the past three years [3]