AI IaaS

Search documents

2025H1中国AI IaaS市场同增122.4%,2030年我国动力电池回收市场将破千亿:化工新材料产业周报-20251026

Guohai Securities· 2025-10-26 12:01

Investment Rating - The report maintains a "Recommended" rating for the new materials industry [1]. Core Insights - The new materials sector is positioned for accelerated growth due to rapid downstream demand, supported by policy backing and technological breakthroughs. It is identified as a foundational industry that underpins other sectors, including electronics, renewable energy, biotechnology, and environmental protection [4]. Summary by Sections 1. Electronic Information Sector - Focus areas include semiconductor materials, display materials, and 5G materials [5]. - The AI IaaS market in China is projected to grow by 122.4% year-on-year in the first half of 2025, reaching a market size of 19.87 billion yuan. The GenAI IaaS market is expected to grow by 219.3%, while OtherAI IaaS is projected to decline by 14.1% [6][23]. 2. Aerospace Sector - Key materials of interest are PI films, precision ceramics, and carbon fibers [8]. - A new assembly line for Airbus A320 aircraft in Tianjin is set to commence operations in early 2026 [9]. 3. New Energy Sector - Focus on photovoltaic materials, lithium-ion batteries, proton exchange membranes, and hydrogen storage materials [10]. - The domestic market for battery recycling is expected to exceed 100 billion yuan by 2030, with a projected recycling volume of over 300,000 tons in 2024 [10]. 4. Biotechnology Sector - Key areas include synthetic biology and scientific services [11]. - A development plan aims to enhance the quality of listed companies in Shenzhen, targeting a total market value exceeding 20 trillion yuan by 2027 [12]. 5. Energy Conservation and Environmental Protection Sector - Focus on adsorbent resins, membrane materials, and biodegradable plastics [13]. - A plan to establish an ecological environment rights trading platform in Hubei aims for completion by 2027 [14]. 6. Key Companies and Profit Forecasts - Notable companies include Ruihua Tai, Guangwei Composite, and others, with various EPS and PE ratios forecasted for 2024-2026 [15]. - For instance, Guangwei Composite is projected to have an EPS of 0.89 in 2024, with a PE ratio of 32.16 [15]. 7. Industry Dynamics - The new materials industry is expected to enter a prosperous cycle driven by downstream applications [14]. - The report emphasizes the importance of identifying companies with strong R&D capabilities and excellent management within the core supply chain [4].

通信行业双周报(2025、10、10-2025、10、23):主要基础电信运营商前三季度业绩披露-20251024

Dongguan Securities· 2025-10-24 08:41

Investment Rating - The report maintains an "Overweight" rating for the communication industry, expecting the industry index to outperform the market index by more than 10% in the next six months [2][46]. Core Viewpoints - The major telecommunications operators in China reported a slight decline in revenue growth for the first three quarters of 2025, but overall net profit continues to show good growth. As the basic market approaches saturation, digital and innovative businesses are becoming new growth engines for operators, with government and enterprise digitalization becoming key pillars of growth. The communication industry is expected to experience a period of technological iteration and policy dividends, with new growth drivers from AI, quantum communication, and low-altitude economy [3][41]. Summary by Sections 1. Communication Industry Market Review - The communication sector index fell by 1.88% over the past two weeks (10/10-10/23), outperforming the CSI 300 index by 0.31 percentage points. Year-to-date, the sector has risen by 60.32%, outperforming the CSI 300 index by 43.26 percentage points [4][11]. 2. Industry News - The International Telecommunication Union confirmed that the 2027 World Radiocommunication Conference will be held in Shanghai, China [16]. - Omdia predicts that the number of global 5G Fixed Wireless Access (FWA) users will reach 150 million by 2030, with a compound annual growth rate (CAGR) of 23% [19]. - IDC reported that the AI IaaS market in China grew by 122.4% year-on-year in the first half of 2025, reaching a market size of 19.87 billion yuan [20]. 3. Company Announcements - Yiyuan Communication reported a net profit growth of 105.65% year-on-year for the first three quarters of 2025, with revenue of 17.877 billion yuan [24]. - China Telecom's net profit for the first three quarters of 2025 grew by 5%, with total revenue of 394.3 billion yuan [27]. 4. Industry Data Updates - As of August 2025, the mobile phone user base reached approximately 1.819 billion, a year-on-year increase of 2.67% [28]. - The total number of 5G base stations reached 4.646 million by August 2025, accounting for 36.3% of all mobile base stations [37]. 5. Investment Recommendations - The report suggests focusing on companies that align with the themes of "technology commercialization, policy catalysis, and earnings certainty," highlighting companies such as China Mobile, China Telecom, and FiberHome Communication [41][42].

IDC:中国AI基础设施市场爆发式增长,阿里云第一

Cai Jing Wang· 2025-10-22 08:20

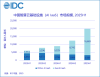

Core Insights - The Chinese AI Infrastructure as a Service (IaaS) market is projected to grow by 122.4% year-on-year, reaching 19.87 billion by the first half of 2025, driven by the demand for AI capabilities across various industries [1][2] - Alibaba Cloud leads the market with a 24.7% share, excelling in both Generative AI IaaS and Other AI IaaS segments [1] - The Generative AI IaaS segment is expected to account for over 80% of the AI IaaS market, with a staggering growth of 219.3% year-on-year [1] Market Dynamics - The demand for AI services is robust across multiple sectors, including internet, automotive, mobile manufacturing, finance, and government, with automotive companies intensifying competition for smart driving solutions [2] - Alibaba Cloud has established partnerships with major Chinese automotive manufacturers, such as FAW, BYD, Geely, NIO, and Xpeng, to enhance their smart capabilities [2] Future Projections - The importance of inference infrastructure, necessary for running AI agents, is expected to significantly increase, becoming a core component of AI cloud services [2] - The overall AI infrastructure market is anticipated to approach 150 billion by 2029 [2]

IDC:上半年中国AI IaaS市场规模达198.7亿元 整体市场同比增长122.4%

智通财经网· 2025-10-21 03:56

Core Insights - The overall AI IaaS market in China is expected to grow by 122.4% year-on-year, reaching a market size of 19.87 billion RMB by the first half of 2025 [1] - The GenAI IaaS market is projected to grow by 219.3%, with a market size of 16.68 billion RMB, while the Other AI IaaS market is expected to decline by 14.1%, reaching 3.19 billion RMB [1] Market Overview - The AI IaaS market is experiencing explosive growth, driven by strong demand across various sectors including internet, automotive, mobile manufacturing, finance, and government [5] - Cloud service providers have significantly increased capital investment in AI infrastructure, leading to stable resource supply and pricing in the computing market [5] - The demand for intelligent computing and AI applications is rising, particularly in the automotive sector, where competition for autonomous driving solutions is intensifying [5] GenAI IaaS Market Dynamics - The focus in the GenAI IaaS market is shifting from large-scale model training to inference, with inference scenarios accounting for 42% of the market share in the first half of the year [6] - The DeepSeek event has positively impacted the market, with significant deployments in state-owned enterprises and government sectors nearing completion [6] - Major enterprises are beginning to test generative AI applications within their business systems, indicating a shift towards more diverse AI applications [6] Supply Landscape - The supply landscape is evolving towards a diversified ecosystem, with cloud vendors and leading computing clients focusing on optimizing inference service cost structures [7] - Domestic and international cloud computing companies are increasingly investing in self-developed chips, signaling a new growth phase for domestic computing resources [7] Competitive Landscape - The GenAI IaaS market share has risen to 84%, while the Other AI IaaS market share has dropped to 16%, indicating a concentration of market power [9] - Alibaba Cloud maintains the largest market share by increasing capital expenditure on AI infrastructure and offering diverse AI IaaS services [9] - Other players like ByteDance's Volcano Engine and Baidu are also expanding their market presence through competitive pricing and technological advantages [9] Operator Developments - Major telecom operators are rapidly deploying intelligent computing resources, with significant growth in AI-related business [10] - China Telecom is building a distributed intelligent computing network, while China Mobile and China Unicom are enhancing their AI capabilities and service offerings [10] Future Projections - The AI IaaS market in China is expected to continue its rapid growth, potentially reaching nearly 150 billion RMB by 2029, with inference computing accounting for nearly 80% of the market [12] - Technological advancements in multi-modal models and video generation models are anticipated to drive new AI applications and further increase demand for AI computing resources [12]

每日市场观察-20250702

Caida Securities· 2025-07-02 07:02

Market Performance - On July 1, the Shanghai Composite Index rose by 0.39%, the Shenzhen Component increased by 0.11%, while the ChiNext Index fell by 0.24%[3] - The total trading volume in the Shanghai and Shenzhen markets approached 1.5 trillion yuan, slightly down from the previous trading day[1] - Over 2,600 stocks rose in the two markets, indicating a structural rotation of market hotspots[1] Sector Highlights - The pharmaceutical sector, particularly innovative drugs, immunotherapy, weight loss drugs, and vitamins, showed strong performance[1] - The semiconductor equipment industry within the technology sector also attracted significant market attention[2] Fund Flows - On July 1, net inflows into the Shanghai Stock Exchange were 5.69 billion yuan, while the Shenzhen Stock Exchange saw net inflows of 290 million yuan[4] - The top three sectors for capital inflow were chemical pharmaceuticals, chemical products, and electricity[4] Policy Developments - The National Healthcare Security Administration and the National Health Commission issued measures to support the high-quality development of innovative drugs, enhancing information sharing among healthcare, insurance, and pharmaceuticals[5] - The measures aim to expedite the entry of innovative drugs into designated medical institutions and ensure timely adjustments to drug supplies[5] Economic Indicators - The Caixin China Manufacturing PMI for June rose to 50.4, indicating a return to the expansion zone, up by 2.1 percentage points from May[6] - The State-owned Assets Supervision and Administration Commission emphasized the development of the new energy vehicle industry and enhancing talent capabilities[7] Industry Trends - The GenAI IaaS market in China is projected to reach 8.74 billion yuan in the second half of 2024, marking a year-on-year increase of 165%[8] - The film box office for the first half of 2025 reached 29.231 billion yuan, with a year-on-year growth of 22.91%[9] - Heavy truck wholesale sales in June increased by approximately 29% year-on-year, with total sales around 92,000 units[11] Fund Management - Public REITs have surpassed a total market value of 200 billion yuan since their inception in 2020, following the implementation of new guidelines for registration and settlement[12] - Twelve public funds with over 100 billion yuan in management collectively manage 3.59 trillion yuan, accounting for 80% of the total ETF market[13]

阿里云霸榜中国 AI IaaS 市场!科创人工智能ETF华夏(589010)盘中交投活跃

Mei Ri Jing Ji Xin Wen· 2025-07-02 05:46

Group 1 - The core viewpoint of the news highlights the performance of the AI-focused ETF and the significant growth in the AI IaaS market, particularly in the context of generative AI [1][2] - As of 11 AM today, the Huaxia Sci-Tech AI ETF (589010) is down 1.28%, with component stocks showing mixed performance, including Shitou Technology leading with a 1.64% increase and Hengxuan Technology declining by 3.32% [1] - According to IDC's latest report, Alibaba Cloud is projected to capture a 23% market share in the AI IaaS sector for 2024, while Huawei Cloud and Volcano Engine are expected to hold 10% and 9% respectively [1] Group 2 - The report indicates that the generative AI IaaS market in China is expected to surge by 165% year-on-year in the second half of 2024, reaching 8.74 billion yuan, marking a significant milestone where it will account for over 70% of the overall AI IaaS market [1] - Huatai Securities expresses optimism regarding the AI training and inference demand, suggesting that global tech firms are likely to increase their AI investments [2] - The outlook for the second half of 2025 includes expectations for continued iteration of large model architectures and advancements in domestic manufacturing capabilities, which may enhance the localization rate for domestic equipment manufacturers [2]

影响市场重大事件:中央财经委会议研究纵深推进全国统一大市场建设、推动海洋经济高质量发展

Mei Ri Jing Ji Xin Wen· 2025-07-01 23:59

Group 1 - The Central Financial Committee emphasizes the need to deepen the construction of a unified national market and promote high-quality development of the marine economy, focusing on innovation, efficient collaboration, and industrial upgrades [1] - The National Healthcare Security Administration and the National Health Commission have introduced 16 measures to support the high-quality development of innovative drugs, covering the entire chain from research and development to payment systems [2] - Shanghai has established a second phase fund for industrial transformation and upgrading with a total scale of 50 billion yuan, aimed at enhancing financial support for strategic emerging industries [3] Group 2 - Shanghai is implementing joint support policies for key industrial chains such as integrated circuits, large aircraft, and marine vessels, encouraging strong collaboration among quality enterprises [4] - The third China International Supply Chain Promotion Expo will take place from July 16 to 20, showcasing products that have successfully cleared customs, including high-performance industrial switches and integrated circuit modules [5] - The latest survey on the digital transformation of brokerage firms focuses on the internet brokerage business and sales amounts, indicating a shift in regulatory oversight [6][7] Group 3 - IDC reports that the GenAI IaaS market in China is expected to reach 8.74 billion yuan in the second half of 2024, with a year-on-year increase of 165%, highlighting the growth of AI infrastructure [8] - The total scale of ETFs in China reached a historic high of 4.3 trillion yuan in the first half of the year, with stock ETFs accounting for over 70% of this total [9] - The National Healthcare Security Administration is working on collaboration between basic medical insurance and commercial health insurance, focusing on data sharing and synchronized settlements [10] Group 4 - Bond ETFs have reached a new high of 383.98 billion yuan, with a net inflow of 175.78 billion yuan in the first half of the year, indicating strong investor interest in this asset class [11]

IDC:2024年下半年中国GenAI IaaS市场达87.4亿元 同比激增165%

news flash· 2025-07-01 03:04

Core Insights - The report by IDC indicates that the Chinese GenAI IaaS market is expected to reach 8.74 billion yuan in the second half of 2024, marking a year-on-year increase of 165% [1] - Generative AI IaaS is becoming the dominant segment within the overall AI IaaS market, accounting for over 70% of the market share for the first time [1] Market Share Distribution - Alibaba Cloud holds a 23% market share in the AI IaaS sector for 2024 [1] - Huawei Cloud accounts for 10% of the market share [1] - Volcano Engine has a 9% market share [1]

IDC:中国2024年AI IaaS市场份额,阿里云占比第一,超过二三名总和

news flash· 2025-07-01 02:30

Group 1 - The core viewpoint of the article highlights that Alibaba Cloud holds a 23% market share in China's AI infrastructure (AI IaaS) market for 2024, making it the leader in the market, surpassing the combined share of the second and third players [1] - In the generative AI infrastructure sector, Alibaba Cloud has achieved dual championships in both model training and model inference markets [1]