PSBC(01658)

Search documents

等业务也能读好书!邮储银行资中县支行把“图书馆”搬进营业厅

Xin Lang Cai Jing· 2025-10-22 10:00

转自:推广 邮储银行资中县支行打造"悦读驿站"客户图书角 "原来办业务还能顺便'充电',孩子看绘本也不闹了,我也能安心办业务了。"一位带孩子办业务的钱女士表示。数据显示,图书角日均接待量稳定在10户左 右,九成受访者给出"非常满意"评价。 等候业务办理的客户在翻阅书籍 邮储银行资中县支行营业部负责人表示,下一步将持续开展"金融知识微课堂""亲子阅读日"等主题活动,持续深化"书香银行"建设,让金融服务更具人文温 度。 来源:推广 为深入践行"金融为民"服务理念,积极响应全民阅读号召,中国邮政储蓄银行资中县支行营业部于2025年10月13日正式启用"悦读驿站"客户图书角,将金融 服务与文化惠民深度融合。截至目前,图书角已累计服务客户超70户,成为网点内广受好评的"文化会客厅",有效提升了客户等候体验与满意度。 图书角选址于银行营业大厅智能服务区与等候区交界处,与网点原有的"邮爱驿站"便民服务区形成功能互补。空间设计以"温暖、开放、共享"为核心理念, 原木色阶梯式书架搭配绿植与暖光照明,辅以布艺沙发和圆形阅读桌,营造出兼具现代感与书香气息的休闲环境。 在书籍配置上,邮储银行资中县支行营业部充分调研客户需求,推出了" ...

邮储银行10月21日获融资买入1.09亿元,融资余额8.64亿元

Xin Lang Cai Jing· 2025-10-22 06:32

Core Viewpoint - Postal Savings Bank of China (PSBC) shows a mixed performance in trading and financing activities, with low financing balance and high short-selling volume, indicating potential investor caution and market dynamics [1][2]. Financing Activities - On October 21, PSBC recorded a financing buy-in of 1.09 billion yuan, with a net financing purchase of 1470.94 million yuan, while the total financing and securities lending balance reached 8.69 billion yuan [1]. - The current financing balance of 8.64 billion yuan accounts for 0.23% of the circulating market value, which is below the 20th percentile level over the past year, indicating a low financing level [1]. Short-selling Activities - On the same day, PSBC saw a short-selling repayment of 150,800 shares and a short-selling amount of 76,000 shares, amounting to 43,100 yuan at the closing price [1]. - The remaining short-selling volume stands at 936,100 shares, with a short-selling balance of 5.31 million yuan, which exceeds the 70th percentile level over the past year, indicating a relatively high short-selling position [1]. Company Overview - PSBC, established on March 6, 2007, and listed on December 10, 2019, primarily provides banking and related financial services in China, with a business structure comprising personal banking (65.15%), corporate banking (22.71%), and funding operations (12.10%) [2]. - As of June 30, 2025, PSBC reported a net profit of 49.23 billion yuan, reflecting a year-on-year growth of 0.85% [2]. Shareholder Information - Since its A-share listing, PSBC has distributed a total of 137.80 billion yuan in dividends, with 77.40 billion yuan distributed over the past three years [3]. - As of June 30, 2025, the top ten circulating shareholders include Hong Kong Central Clearing Limited, which holds 942 million shares, an increase of 60.83 million shares from the previous period [3].

险资再度增持银行股 热情或将持续

Jin Rong Shi Bao· 2025-10-22 06:04

Core Viewpoint - Insurance capital is actively increasing its holdings in bank stocks, driven by high dividend yields and stable returns, particularly in a low-interest-rate environment [1][3][4]. Group 1: Recent Activities of Insurance Capital - On October 10, Ping An Life increased its holdings in China Merchants Bank H-shares by 2.989 million shares, raising its total to 781 million shares, which accounts for 17% of the bank's H-shares [1]. - On the same day, Ping An purchased 6.416 million shares of Postal Savings Bank, bringing its total holdings to 17.01% [1]. - As of September 30, Ping An Life had acquired 39.634 million shares of Agricultural Bank H-shares, increasing its stake to 17.03%, with total holdings across its subsidiaries exceeding 19% [2]. Group 2: Reasons for Increased Investment in Bank Stocks - The high dividend yields and stable returns of bank stocks make them an ideal choice for insurance capital, especially in a declining interest rate environment [3]. - Regulatory encouragement for insurance capital to enter the market and new accounting standards promoting high-dividend asset allocation are also driving this trend [3]. - Current valuations of bank stocks are at historical lows, providing a favorable investment opportunity with cyclical resilience and policy support [3]. Group 3: Growth in Equity Allocation by Insurance Capital - A joint initiative by six departments aims to guide long-term funds, including insurance capital, to increase their market participation [4]. - As of the second quarter of 2025, the total investment balance of insurance companies exceeded 36 trillion yuan, with stock investments rising by 26.38% year-on-year [4]. - The five major listed insurance companies reported a total stock investment balance of 1.8 trillion yuan by mid-2025, reflecting an increase of over 400 billion yuan from the previous year [4]. Group 4: Market Outlook and Challenges - Insurance capital is expected to benefit from equity investments, enhancing investment returns and optimizing portfolio performance [5]. - However, challenges include the inherent volatility of the stock market, necessitating improved risk management and investment proportion control [5]. - Increased instances of insurance capital acquiring stakes may lead to market discussions regarding their impact [5].

天津 扬帆“渔船贷” 开海鱼满仓

Jin Rong Shi Bao· 2025-10-22 02:32

Core Insights - The introduction of the "Fishing Boat Loan" by Postal Savings Bank in Tianjin has significantly improved the financial situation of local fishermen, enabling them to purchase new boats and equipment, thus enhancing their operational capacity [1][2][3]. Group 1: Financial Needs of Fishermen - Fishermen in Tianjin's Binhai New Area primarily require funds for three main purposes: purchasing new boats, acquiring fishing nets, and repairing existing boats [2]. - The cost of small wooden boats is approximately 600,000 yuan, while larger boats can cost nearly 4 million yuan [2]. - Many fishermen face challenges in obtaining bank credit due to insufficient cash flow records, as fishing transactions are often conducted in cash [2]. Group 2: "Fishing Boat Loan" Product Features - The "Fishing Boat Loan" allows fishermen to apply for credit loans under 1 million yuan for operational expenses, while larger loans for boat purchases can reach up to 10 million yuan [3]. - The loan application process has been simplified, requiring only four certificates (inspection certificate, ownership certificate, fishing license, and ship registration certificate) and allowing applications even during the fishing moratorium [3]. - The bank has implemented an online pre-approval and assessment process, enabling fishermen to submit applications via mobile devices, with approvals completed in as little as one week [3]. Group 3: Impact on Fishermen's Operations - Fishermen like Xue Shulai have reported significant increases in daily earnings, with potential sales exceeding 30,000 yuan per day from their fishing activities [3]. - The financial support from the "Fishing Boat Loan" has allowed fishermen to operate with greater confidence, reducing concerns about maintenance and new purchases [4][5]. - The bank is also working to enhance financial literacy among fishermen and facilitate connections with local businesses to expand their market reach [3].

港股异动丨内银股普涨,农业银行涨超1%再创新高,录得10连阳

Ge Long Hui· 2025-10-22 01:56

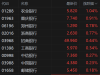

Group 1 - The core viewpoint is that Hong Kong bank stocks are experiencing a bullish trend, with Agricultural Bank of China reaching a new historical high and achieving a 10-day consecutive rise [1] - Morgan Stanley anticipates that after a seasonal adjustment in Q3, there will be good investment opportunities in Q4 and Q1 of the following year for domestic bank stocks [1] - Factors supporting the revaluation of Chinese banking stocks include upcoming dividend distributions, stabilized interest rates, a 500 billion RMB structural financial policy tool, and a more sustainable policy path [1] Group 2 - Agricultural Bank of China saw an increase of 1.04%, reaching a latest price of 5.820 [2] - Other banks also recorded gains, including Chongqing Bank (+0.91%), Zhengzhou Bank (+0.78%), and Zhejiang Bank (+0.77%) [2] - The overall trend indicates a positive performance across various banks, with notable increases in share prices for several institutions [2]

长安基金管理有限公司关于增加中国邮政储蓄银行股份有限公司邮你同赢平台为旗下部分基金销售机构的公告

Shang Hai Zheng Quan Bao· 2025-10-21 18:45

Group 1 - Chang'an Fund Management Co., Ltd. has signed a sales agreement with Postal Savings Bank of China, allowing the bank to sell certain funds starting from October 22, 2025 [1] - Investors can open accounts and conduct transactions related to the specified funds through the Postal Savings Bank's "You Ni Tong Ying" platform [1] - Detailed information regarding the funds, including business rules, fees, and important matters, can be found in the fund contracts, prospectuses, and product summaries published by the company [1] Group 2 - The announcement was made by Chang'an Fund Management Co., Ltd. on October 22, 2025 [3]

存6万一年利息588元,邮储银行定期存款还值得存吗?

Sou Hu Cai Jing· 2025-10-21 12:28

Core Viewpoint - Despite low interest rates, bank deposits remain a reliable investment option, especially for those seeking stable returns without market risks [1][10]. Interest Calculation - The formula for calculating interest on fixed deposits is straightforward: Interest = Principal × Annual Interest Rate × Time (in years) [1]. - For example, a deposit of 60,000 yuan for one year at an interest rate of 0.98% yields 588 yuan [1][4]. Interest Differences Based on Amount and Duration - The longer the deposit duration, the more significant the returns due to the compounding effect, particularly noticeable in five-year terms [3]. - Specific interest amounts for different durations include: - 60,000 yuan for one year: 588 yuan - 60,000 yuan for two years: 1,260 yuan - 60,000 yuan for three years: 2,250 yuan - 60,000 yuan for five years: 4,550 yuan [4]. Stability of Low Interest Rates - While current interest rates may seem low compared to other investment vehicles like stocks or funds, the safety of deposits is a major advantage [3]. - Deposits are insured up to 500,000 yuan, providing security even if the bank faces issues [3]. Duration Selection for Deposits - The choice between one, two, or three-year deposits should align with personal financial plans [6]. - For short-term needs, a one-year deposit is more flexible, while two to three-year deposits offer slightly higher rates [6]. Postal Savings Bank's Interest Rates - The interest rates offered by Postal Savings Bank are considered above average among state-owned banks, particularly for three and five-year terms [6]. - Although local banks may offer higher rates, they come with increased risks, making Postal Savings Bank a safer choice for conservative investors [6]. Importance of Interest in Daily Life - Even modest interest amounts can contribute to everyday expenses, highlighting the importance of saving [8]. - Regular deposits can provide a sense of financial security, especially for retirees [8]. Relevance of Savings in Modern Finance - Savings remain a foundational aspect of financial management, providing stability amid economic uncertainties [8]. - A solid savings base allows for greater freedom in times of need, such as medical emergencies or job changes [8]. Conclusion - Low interest rates do not diminish the value of savings; rather, they emphasize the need for prudent financial management [10]. - Building a habit of saving and understanding the value of each yuan can empower households financially [10].

“土特产”新气象︱从土特产到金招牌,邮储银行金融赋能常山胡柚产业升级

Xin Lang Cai Jing· 2025-10-21 10:33

Core Insights - The article highlights the successful development of the Changshan pomelo industry in Zhejiang Province, which has reached a scale of over 1.18 million mu and is now part of the 10 billion yuan local specialty product industry chain in Zhejiang [1][2] - The growth of the pomelo industry is significantly supported by innovative financial services from Postal Savings Bank, which has introduced products like "Youyou Loan" to alleviate financing difficulties for agricultural operators [1][2] Financial Support and Innovation - Postal Savings Bank has provided credit support to 318 new agricultural operators in Changshan County, with a total loan balance of 77.7045 million yuan for the "Youyou Loan" program, effectively facilitating financial access for farmers [2] - The bank has also tailored financial service solutions for specific projects, such as a 10 million yuan science and technology credit loan for the construction of the Pomelo Cultural and Tourism Integration Industrial Park [2][3] Industry Growth and Diversification - The Changshan pomelo is evolving from a fresh fruit into various products, including beverages, food ingredients, and cosmetics, aiming for a target of becoming a 10 billion yuan industry [2][3] - The article emphasizes the collaboration between Postal Savings Bank, local government, and agricultural entities in driving the transformation of local specialties into a thriving industry, showcasing the practical implementation of rural revitalization strategies [3]

寓教于乐 邮储银行郑州分行金融暖流润乡村

Huan Qiu Wang· 2025-10-21 06:01

Core Viewpoint - Postal Savings Bank of China Zhengzhou Branch is actively promoting financial literacy in rural areas, aiming to enhance financial awareness and support rural revitalization through engaging activities [1] Group 1: Financial Education Activities - The bank organized a financial knowledge promotion event in Xihuangli Village, Zhengzhou, under the slogan "Protecting Financial Rights, Supporting a Better Life" [1] - The event featured interactive games to make financial education enjoyable, particularly targeting the elderly with a dedicated area for learning about digital payment tools [1] - A photo booth was set up to capture villagers' smiles, with frames printed with financial tips, combining memorable moments with practical knowledge [1] Group 2: Community Engagement and Support - The "Huinong Lino Financial Classroom" attracted significant interest, where staff provided one-on-one consultations on savings, personal credit, and electronic payment security [1] - Financial knowledge brochures were distributed to villagers, and experts from the Henan Provincial Department of Agriculture and Rural Affairs explained the latest agricultural policies [1] - Local police from the Zhengzhou Anti-Fraud Center shared real-life scam cases in a friendly dialect to educate villagers about common fraud techniques [1] Group 3: Future Initiatives - The Postal Savings Bank of China Zhengzhou Branch plans to continue innovating in financial literacy initiatives to ensure ongoing support for rural communities and safeguard villagers' financial security [1]

邮储银行10月20日获融资买入1.13亿元,融资余额8.49亿元

Xin Lang Cai Jing· 2025-10-21 03:17

Core Insights - Postal Savings Bank of China (PSBC) experienced a decline of 0.70% in stock price on October 20, with a trading volume of 1.04 billion yuan [1] - The bank's financing activities showed a net buy of -34.86 million yuan, indicating a higher level of financing repayment compared to new purchases [1] - As of October 20, the total margin balance for PSBC was 855 million yuan, with a financing balance of 849 million yuan, representing only 0.22% of the circulating market value, which is below the 20th percentile of the past year [1] Financing and Margin Trading - On October 20, PSBC had a financing buy of 113 million yuan and a repayment of 147 million yuan, leading to a net financing outflow [1] - The bank's margin trading showed a high level of short selling, with 139,900 shares sold and a remaining short balance of 613,040 yuan, which is above the 80th percentile of the past year [1] Company Overview - PSBC, established on March 6, 2007, and listed on December 10, 2019, provides a range of banking and financial services in China [2] - The bank's main business segments include personal banking (65.15% of revenue), corporate banking (22.71%), and funding operations (12.10%) [2] - As of June 30, 2025, PSBC reported a net profit of 49.23 billion yuan, reflecting a year-on-year growth of 0.85% [2] Shareholder and Dividend Information - Since its A-share listing, PSBC has distributed a total of 137.80 billion yuan in dividends, with 77.40 billion yuan in the last three years [3] - As of June 30, 2025, the top ten shareholders included Hong Kong Central Clearing Limited, which increased its holdings by 60.83 million shares [3] - Other significant shareholders include various ETFs, which have also increased their holdings in PSBC [3]