INTEL(04335)

Search documents

英特尔三季度营收137亿美元 实现扭亏为盈

Huan Qiu Wang Zi Xun· 2025-10-24 07:31

Core Insights - Intel reported better-than-expected revenue for Q3 2025, with revenue of $13.7 billion, a 3% year-over-year increase, and an EPS of $0.90 [1] - The company anticipates Q4 2025 revenue between $12.8 billion and $13.8 billion, with an expected EPS loss of $0.14 [1] - The stock price has risen approximately 85% over the past six months, supported by U.S. government policies and significant investments from SoftBank and Nvidia [2] Financial Performance - Intel achieved a net income of $4.1 billion for the three months ending September, marking its first quarterly profit of 2023, compared to a net loss of $16.6 billion a year earlier [2] - The gross margin improved from 15% in the same quarter last year to 38% [3] - The company has reduced its workforce by nearly 30% over the past year, focusing on cutting middle management while hiring top engineers [2] Market Dynamics - Sales of personal computer chips exceeded expectations due to upgrades in Microsoft's operating system, and AI-related products also showed growth [3] - Intel is attempting to regain clients like Apple, Qualcomm, and Nvidia from TSMC, with increased engagement with multiple potential customers [3] - Despite recent investments and asset sales, long-term challenges remain, with analysts warning that the company's situation is still precarious [4]

英特尔第三季度业绩反弹 代工业务仍面临挑战

Zhong Guo Jing Ying Bao· 2025-10-24 06:40

Core Insights - Intel reported its Q3 2025 earnings with revenue of $13.7 billion, a 3% year-over-year increase, surpassing market expectations of $13.2 billion. The net profit reached $4.1 billion, marking a significant turnaround from a net loss of $16.6 billion in the same quarter last year, ending a streak of consecutive losses. This is the first profitable report following investments from the U.S. government, Nvidia, and SoftBank, leading to a post-market stock price surge of up to 7% [2] Group 1: Financial Performance - The Client Computing Group generated $8.5 billion in revenue, a 5% year-over-year increase, benefiting from a recovery in the PC market, accounting for over 60% of total revenue [2] - The Data Center and AI segment reported revenue of $4.1 billion, a slight decline of 1%, while the foundry business generated $4.2 billion, down 2% year-over-year [2] Group 2: Strategic Investments and Future Outlook - Intel has received significant investments from the U.S. government, Nvidia, and SoftBank, which have strengthened its balance sheet and boosted market confidence in its ability to return to profitability and regain its leadership in chip manufacturing [2][3] - The company announced the official production launch of its Fab52 facility in Arizona, initiating mass production of 18A process chips, along with the introduction of the Panther Lake mobile processor and the ClearWater Forest platform, with plans for a 2026 release [2] Group 3: Challenges Ahead - Despite the positive financial results, Intel's foundry services division faces challenges, reporting $4.2 billion in revenue for Q3, a 2% year-over-year decline, and an operating loss of $2.3 billion, exceeding market expectations. Although this loss is significantly reduced from $5.8 billion in the previous year, the profitability of the foundry business remains a key focus for investors and the market [3]

英特尔第四财季营收展望乐观 股价盘后大涨

Xin Lang Cai Jing· 2025-10-24 05:04

Core Viewpoint - Intel has provided an optimistic revenue outlook driven by a recovery in personal computer demand, boosting confidence in the company's turnaround efforts [1][2] Group 1: Revenue Outlook - Intel expects fourth-quarter revenue to be between $12.8 billion and $13.8 billion, with a midpoint of $13.3 billion, slightly below analysts' average estimate of $13.4 billion [1] - The revenue forecast does not include income from Intel's recently spun-off business unit, which may have influenced some analysts' predictions [1][2] Group 2: Stock Performance - Intel's stock price closed at $38.16 on October 23, with a nearly 7% increase in after-hours trading following the earnings outlook [1] - The stock has surged approximately 90% year-to-date, ranking among the top performers in the Philadelphia Semiconductor Index [1] Group 3: Financial Performance - Intel achieved quarterly profitability for the first time since the end of 2023, reporting a third-quarter earnings per share of $0.23, significantly above the analysts' average estimate of $0.01 [2] - Revenue for the third quarter grew by 3% to $13.7 billion, exceeding expectations [2] Group 4: Business Developments - The recent spin-off of Intel's programmable chip division, Altera, has reduced the fourth-quarter revenue forecast by approximately $400 million to $500 million [2] - Intel's CFO, Dave Zinsner, indicated that excluding Altera's revenue, the company's outlook would appear more favorable compared to market estimates [2]

英特尔:止亏回血,“美式中芯”能挖角台积电吗?

3 6 Ke· 2025-10-24 03:31

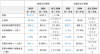

Core Insights - Intel reported Q3 2025 revenue of $13.65 billion, a year-on-year increase of 2.8%, slightly exceeding guidance, driven by a recovery in client business [1][19] - The gross margin significantly rebounded to 38.2%, outperforming the guidance of 34.1%, following a previous quarter's decline due to non-operating expenses [1][21] - The company continues to implement cost-cutting measures, with operating expenses at $4.54 billion, and R&D expenses down to $3.23 billion, reflecting a focus on efficiency [1][23] Financial Performance - Revenue: Q3 2025 revenue was $13.65 billion, up 2.8% year-on-year, primarily from client business recovery [1][19] - Gross Margin: Achieved a gross margin of 38.2%, significantly above market expectations [1][21] - Operating Expenses: Operating expenses were $4.54 billion, down 59% year-on-year, with R&D expenses at $3.23 billion [1][23] Workforce and Cost Management - Employee Count: Total employees reduced to 88,400, with plans to further decrease to approximately 75,000 by year-end [2] - Cost-Cutting Strategy: The company is actively reducing costs, with a focus on R&D and operational efficiency [1][23] Business Segments - Client Computing: Revenue from client computing was $8.54 billion, a 4.6% increase year-on-year, driven by a recovery in the PC market [3][29] - Data Center and AI: Revenue from data center and AI was $4.12 billion, down 0.6% year-on-year, indicating a stable but challenging environment [3][35] - Foundry Business: Foundry revenue was $4.24 billion, down 2.4% year-on-year, with a focus on internal production rather than external orders [4][39] Future Outlook - Q4 Guidance: Intel expects Q4 2025 revenue between $12.8 billion and $13.8 billion, with a gross margin forecast of 34.5% [4][6] - Strategic Partnerships: Recent collaborations with Nvidia and investments from the U.S. government and SoftBank are expected to bolster market confidence and operational capabilities [6][10] Market Position and Strategy - Competitive Landscape: Intel is facing challenges in maintaining market share in the PC segment against competitors like AMD, despite recent partnerships aimed at enhancing competitiveness [10][34] - Manufacturing Advancements: The company is progressing with its 18A process technology, which is expected to enhance its manufacturing capabilities and attract external orders [14][42]

英特尔:2025年Q3营收137亿美元,同比增长3%

Xin Lang Ke Ji· 2025-10-24 03:23

Core Insights - Intel reported Q3 2025 revenue of $13.7 billion, a 3% increase year-over-year, with earnings per share (EPS) of $0.90 and non-GAAP EPS of $0.23 [1] Financial Performance - Revenue: $13.7 billion in Q3 2025, up 3% from $13.3 billion in Q3 2024 [1] - Gross Margin: 38.2%, an increase of 23.2 percentage points compared to 15.0% in Q3 2024 [1] - R&D and Marketing Expenses: $4.4 billion to $5.4 billion, a decrease of 20% from $3.9 billion to $4.8 billion in Q3 2024 [1] - Operating Profit Margin: 5.0%, up 73.2 percentage points from (68.2)% in Q3 2024 [1] - Net Income: $4.1 billion, a 124% increase from a net loss of $16.6 billion in Q3 2024 [1] - Diluted EPS: $0.90, up 123% from a loss of $3.88 in Q3 2024 [1] Future Outlook - Intel expects Q4 2025 revenue to be between $12.8 billion and $13.8 billion, with an anticipated EPS loss of ($0.14) and non-GAAP EPS of $0.08 [1]

英特尔交出“翻身答卷”!Q3净利润猛增124%,大幅扭亏

Ge Long Hui· 2025-10-24 03:20

Core Insights - Intel reported a significant rebound in its financial performance for Q3 2025, with revenue and profit exceeding market expectations, indicating initial success in its transformation strategy [1][2]. Financial Performance - Revenue for Q3 2025 reached $13.7 billion, a year-over-year increase of approximately 3%, surpassing analyst expectations of $13.2 billion [2][3]. - The company achieved a net profit of $4.1 billion, a turnaround from a net loss of $16.6 billion in the same quarter last year, marking a 124% improvement [2][3]. - Gross margin improved significantly from about 15% in Q3 2024 to 38.2% in Q3 2025 [2][3]. - Diluted earnings per share were $0.90, compared to a loss of $3.88 per share in the previous year [2][3]. Business Segments - The Client Computing Group (CCG) generated $8.5 billion in revenue, up 5% year-over-year, reflecting a recovery in the consumer electronics and enterprise PC markets [5]. - The Data Center and AI (DCAI) segment reported $4.1 billion in revenue, a slight decline of 1% compared to the previous year [5]. - Total revenue from Intel's core product business, which includes CCG and DCAI, was $12.7 billion, also up 3% year-over-year [4][5]. Strategic Developments - Intel's improved profitability is attributed to effective cost control, enhanced manufacturing efficiency, and a recovering PC market [4]. - The company is making strides in its strategic transformation, with the Chandler, Arizona Fab52 facility now operational, set to produce 18A process chips [6]. - Intel received approximately $89 billion in investments from the U.S. government to bolster its technology and manufacturing capabilities, including $5.7 billion in the current quarter [6]. Collaborations and Future Outlook - Intel announced a strategic partnership with NVIDIA to co-develop custom data center and PC products, with NVIDIA investing $5 billion in Intel [7]. - For Q4 2025, Intel expects revenue between $12.8 billion and $13.8 billion, with a projected Non-GAAP earnings per share of approximately $0.08 [8]. - Analysts express cautious optimism regarding Intel's performance, noting the need for continued focus on the data center and foundry business segments [8][9].

英特尔CEO确认:18A工艺已进入大规模量产,为三代产品奠定基础

Sou Hu Cai Jing· 2025-10-24 03:01

Core Insights - Intel's CEO Lip-Bu Tan outlined the company's future strategies for client, server, and foundry businesses during the Q3 2025 earnings call [1][3]. Client Processors - Intel confirmed that the first high-end model of the Panther Lake processor, based on the 18A process, will be launched by the end of 2025, with a full reveal at CES 2026 [4]. - Following Panther Lake, the next-generation Nova Lake is set to debut in the second half of 2026, featuring significant architectural and software innovations, including up to 52 cores and a new Xe3P Arc integrated graphics [6]. Server Products - Demand for the Granite Rapids (Xeon 6 P cores) processors remains strong, with Clearwater Forest (Xeon 6+) and Diamond Rapids (Xeon 7) based on the 18A process expected to launch in mid-2026 and beyond, respectively [7]. - The upcoming Coral Rapids processor will reintroduce simultaneous multithreading (SMT) technology to enhance multitasking performance, currently in the definition stage [9]. Process Technology - The 18A process has entered high-volume manufacturing at Fab 52 in Arizona, with yield progress meeting expectations, supporting at least three generations of client and server products [10]. - Performance-optimized 18A-P and the more advanced 14A nodes are also in steady development, while Intel emphasizes a rigorous investment strategy in its foundry services, leveraging advanced packaging technologies like EMIB for differentiation [10]. - Intel plans to release AI-optimized GPU products annually, with the first product, Crescent Island, utilizing the Xe3P architecture [10].

中国资产昨夜上涨英特尔盘后大涨超7%

Xin Lang Cai Jing· 2025-10-24 02:47

【#中国资产昨夜上涨##英特尔盘后大涨超7%#】美东时间10月23日(周四),美股三大指数集体收 涨,纳指涨0.89%,标普500指数涨0.58%,道指涨0.31%。美国大型科技股普遍上涨,万得美国科技七 巨头指数上涨0.70%。个股方面,特斯拉涨超2%,亚马逊、英伟达涨超1%,谷歌涨0.55%,苹果涨 0.44%,脸书涨0.08%,微软持平。英特尔股价收涨逾3%,总市值回升至1670亿美元,公司盘后股价继 续上攻,截至北京时间10月24日6:27,大涨逾7%。英特尔三季报显示,其在2025年第三季度实现营收 136.5亿美元,同比增长2.8%,预计第四季度营收在128亿美元至138亿美元之间。中概股多数上涨,纳 斯达克中国金龙指数涨1.66%,万得中概科技龙头指数涨2.65%。#英特尔第三季度调整后每股收益0.23 美元# 来源:@中新经纬微博 ...

获得政府投资后,英特尔交出首个盈利财报

Di Yi Cai Jing Zi Xun· 2025-10-24 02:36

Group 1 - Intel has received a total of over $10 billion in strategic financing from the U.S. government, Nvidia, and SoftBank, marking a turnaround for the company after previous losses [1][2] - In Q3, Intel reported revenue of $13.7 billion, a 3% year-over-year increase, and a net profit of $4.1 billion, compared to a loss of $17 billion in the same period last year, ending a six-quarter decline [1] - The CFO of Intel indicated strong chip demand leading to supply constraints, with expectations for this trend to continue until 2026, driven by upgrades in data centers and operators' CPU needs [1] Group 2 - Intel is undergoing significant organizational changes, including a plan to reduce its workforce by approximately 15%, bringing the total number of employees down to around 75,000 by year-end [2] - In addition to the financing from SoftBank and the U.S. government, Intel has secured $5.7 billion in government investments in Q3, which will support the expansion of U.S. technology and manufacturing [2] - Intel is collaborating with Nvidia to develop custom data center and PC products, with Nvidia agreeing to invest $5 billion in Intel's common stock, expected to be completed by the end of Q4 [2] Group 3 - Intel's foundry business is progressing as planned, with the 18A process node, its first 2-nanometer technology, on track for release [3] - The future success of Intel is seen as dependent on securing real orders in Q4 and realizing growth potential in AI and foundry services over the next 1-2 years [3] - Despite significant investments in chip foundries, Intel has struggled to attract major external clients, making the revitalization of its foundry business crucial for its resurgence [3]

英特尔:Intel 10 / 7 制程产能紧张,AI PC 出货预期不变

Sou Hu Cai Jing· 2025-10-24 01:45

Core Insights - Intel is facing supply constraints for its mature process nodes, specifically Intel 10 and Intel 7, despite exceeding wafer delivery expectations in Q3 2025 [1] - The company does not plan to increase production capacity for these nodes and will focus on utilizing inventory while guiding customers towards alternative products, with supply expected to be tighter in Q1 2026 [1] - The adoption rate of AI PCs in the commercial sector is increasing, and Intel maintains its expectation to ship approximately 100 million AI PC devices by the end of this year [1] Group 1 - Intel's foundry division delivered more wafers than expected in Q3, but this was still insufficient to meet demand from data center and client customers [1] - The company is not planning to increase production capacity for Intel 10 and Intel 7 nodes, opting instead to manage inventory and direct customers to other products [1] - Supply for Q1 2026 is anticipated to be even tighter than current levels [1] Group 2 - For Intel 18A and Panther Lake, current process yields are sufficient to meet capacity needs but do not achieve acceptable profit margins [3] - Intel expects that by the end of 2026, Intel 18A will meet internal profit margin targets, with industry-acceptable yields projected for 2027 [3] - Intel has strengthened collaboration with customers on the cutting-edge Intel 14A process in Q3, enhancing confidence and successfully attracting key talent in process technology [3]