PING AN OF CHINA(601318)

Search documents

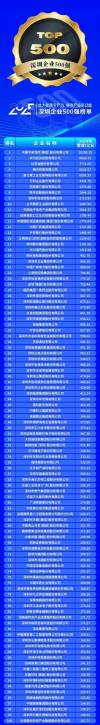

2025深圳企业500强榜单发布:平安、华为、比亚迪位列前三

Sou Hu Cai Jing· 2025-10-28 17:42

Core Insights - The "2025 Shenzhen Top 500 Enterprises List" was officially released, with Ping An Insurance, Huawei Investment, and BYD ranking as the top three, maintaining their leading positions [1][16] - The list is based on the companies' revenue for the fiscal year 2024, and the accompanying report analyzes various dimensions of enterprise development, including scale, operational efficiency, innovation capability, social contribution, and internationalization [1][16] Group 1: Key Characteristics of the Top 500 Enterprises - Overall revenue growth is observed, with 18 companies exceeding 100 billion yuan in revenue, but the average sales profit margin has decreased to 4.86%, down from 5.10% in 2023 [1][2] - The number of companies in the 1-10 billion yuan revenue range has increased to 331, a year-on-year growth of 5.41%, with total revenue in this segment rising by 9.76% [1][2] Group 2: Competitive Landscape - The competition among top enterprises is intensifying, with 97 new entrants making up 19% of the list, and only 22 companies maintaining their previous rankings [2] - The revenue threshold for entering the list has been consistently rising over the past five years, indicating a rapidly evolving competitive landscape [2] Group 3: Private Sector Dynamics - Private enterprises account for 70% of the list, contributing over 45% of total revenue, particularly excelling in high-end medical devices and robotics sectors [2] - The manufacturing sector remains robust, with 207 manufacturing companies on the list showing a revenue growth of 13.82%, although traditional manufacturing faces transformation pressures [2] Group 4: Regional Development - The regional development is categorized into three tiers: Nanshan and Futian as the "core leading tier," Longgang and four other districts as the "growth and challenge tier," and Luohu and three other districts as the "transformation and adjustment tier," highlighting distinct industrial characteristics and collaboration opportunities [2] Group 5: Future Directions - Shenzhen's top 500 enterprises need to focus on enhancing value addition, optimizing innovation workforce allocation, balancing industrial development, and improving overseas business layouts to drive sustainable growth and support the city's economic high-quality development [16]

中国平安10月28日大宗交易成交250.10万元

Zheng Quan Shi Bao Wang· 2025-10-28 15:56

Core Insights - China Ping An executed a block trade on October 28, with a volume of 43,300 shares and a transaction value of 2.501 million yuan, at a price of 57.76 yuan per share [2][3] - The stock has seen a total of 8 block trades in the past three months, amounting to a cumulative transaction value of 181 million yuan [2] - The closing price for China Ping An on the same day was 57.76 yuan, reflecting a slight increase of 0.02%, with a turnover rate of 0.46% and a total trading volume of 2.843 billion yuan [2] Trading Activity - The buyer of the block trade was Guangfa Securities Co., Ltd. Guangzhou Kangwang Middle Road Securities Business Department, while the seller was Guotai Junan Securities Co., Ltd. Headquarters [2][3] - The latest margin financing balance for the stock is 23.921 billion yuan, showing a decrease of 313 million yuan over the past five days, which is a decline of 1.29% [3] - Over the last five days, the stock has increased by 1.08%, with a total net inflow of funds amounting to 443 million yuan [2]

中国平安 业绩大增

Zhong Guo Ji Jin Bao· 2025-10-28 15:48

Core Insights - China Ping An reported a significant increase in net profit for the third quarter, with a year-on-year growth of 45.4% [2][4]. Financial Performance - For the first three quarters of 2025, the company achieved an operating profit attributable to shareholders of 116.26 billion yuan, representing a year-on-year increase of 7.2%, with a 15.2% growth in the third quarter [4]. - The net profit attributable to shareholders for the first three quarters reached 132.86 billion yuan, up 11.5% year-on-year, with a notable 45.4% increase in the third quarter [4]. - As of September 30, 2025, the company's net assets attributable to shareholders stood at 986.41 billion yuan, reflecting a 6.2% growth after dividends [4]. Insurance Business Growth - The new business value for life and health insurance saw a robust increase of 46.2% in the first three quarters of 2025, with agents' average new business value rising by 29.9% and bank insurance channel new business value soaring by 170.9% [5]. - The property insurance segment reported a premium income of 256.25 billion yuan, marking a 7.1% year-on-year growth, with a combined cost ratio of 97.0%, an improvement of 0.8 percentage points [5]. Investment Performance - The investment portfolio of the insurance funds achieved a non-annualized comprehensive investment return of 5.4%, up by 1.0 percentage point year-on-year, with a non-annualized net investment return of 2.8% [5]. - The scale of the insurance funds investment portfolio exceeded 6.41 trillion yuan, reflecting an 11.9% increase since the beginning of the year [5]. AI and Ecosystem Development - The company has leveraged AI to enhance its ecosystem, with a database containing 30 trillion bytes of data covering nearly 250 million individual customers [6]. - AI technologies have improved customer experience, risk control, cost reduction, and sales promotion, with 89% of auto insurance policies being issued in an average of one minute through intelligent systems [6][7]. - AI-driven fraud detection in property insurance has intercepted losses amounting to 9.15 billion yuan in the first three quarters of 2025 [7].

中国平安收获强势三季报,第三季度净利润同比大增45.4%

第一财经· 2025-10-28 15:46

Core Viewpoint - China Ping An reported strong financial performance for the first three quarters of 2025, with significant growth in both revenue and profit metrics, indicating robust operational efficiency and strategic channel transformations [3][4]. Financial Performance - For the first three quarters, China Ping An achieved operating revenue of 901.67 billion yuan, a year-on-year increase of 4.6% [3]. - The operating profit attributable to shareholders reached 116.26 billion yuan, up 7.2%, with a notable 15.2% growth in the third quarter [3]. - Net profit attributable to shareholders for the first three quarters was 132.86 billion yuan, reflecting an 11.5% year-on-year increase, with a substantial 45.4% growth in the third quarter alone [3]. Life and Health Insurance - The new business value for life and health insurance was 35.72 billion yuan, marking a 46.2% increase year-on-year, with the new business value rate rising by 9.0 percentage points [3]. - The agent channel saw a 23.3% increase in new business value, while the average new business value per agent grew by 29.9% [3]. - The bancassurance channel experienced a remarkable 170.9% increase in new business value, contributing 35.1% to the new business value of life insurance [3]. Property Insurance - In property insurance, the original insurance premium income reached 256.25 billion yuan, a 7.1% increase year-on-year [4]. - The overall combined cost ratio improved by 0.8 percentage points to 97.0% [4]. - The auto insurance segment generated 166.12 billion yuan in premium income, up 3.5%, while non-auto insurance premiums increased by 14.3% to 90.13 billion yuan [4]. Investment Performance - The investment portfolio achieved a non-annualized comprehensive investment return of 5.4%, up 1.0 percentage points year-on-year, with a non-annualized net investment return of 2.8% [5]. - As of September 30, 2025, the investment portfolio size exceeded 6.41 trillion yuan, reflecting an 11.9% growth since the beginning of the year [5]. - The company increased equity allocations and diversified into quality alternative assets to enhance long-term investment returns [5]. Banking Operations - Ping An Bank reported operating revenue of 100.67 billion yuan and a net profit of 38.34 billion yuan for the first three quarters [5]. - The non-performing loan ratio stood at 1.05%, a slight decrease of 0.01 percentage points from the beginning of the year [5]. - The provision coverage ratio was 229.60%, with a 60-day overdue loan deviation of 0.77 [5]. Customer Metrics - As of September 30, 2025, the number of individual customers reached nearly 250 million, a 2.9% increase since the beginning of the year [5]. - The average number of contracts held per customer rose to 2.94, up 0.7% [5]. - The retention rate for customers holding four or more contracts was 97.5%, significantly higher than the 12.8 percentage points retention rate for those with only one contract [5].

中国平安前三季度净利增11.5%,寿险多渠道发力

券商中国· 2025-10-28 15:27

Core Viewpoint - China Ping An's Q3 financial report shows a significant net profit growth of 45.4% year-on-year, despite a lower growth rate compared to other leading insurance companies. The company achieved a net profit of 132.86 billion yuan in the first three quarters, representing an 11.5% increase year-on-year, indicating resilience in its financial performance [1][3]. Business Performance - In the first three quarters, the new business value of life and health insurance grew by 46.2%, with the agent channel's new business value increasing by 29.9% and the bancassurance channel's new business value soaring by 170.9% [2][4]. - The total operating revenue for the first three quarters reached 832.94 billion yuan, a 7.4% increase year-on-year, while the operating profit attributable to shareholders was 116.26 billion yuan, up 7.2% [3]. - The company reported a net asset value of 986.41 billion yuan as of September 30, 2025, reflecting a 6.2% growth after dividends [3]. Investment Performance - The investment performance of insurance funds significantly improved, achieving a non-annualized comprehensive investment return of 5.4%, an increase of 1.0 percentage points year-on-year. The non-annualized net investment return was 2.8% [5][6]. - As of September 30, 2025, the scale of the insurance fund investment portfolio exceeded 6.41 trillion yuan, growing by 11.9% since the beginning of the year [6]. Service Expansion - The "insurance + service" strategy has deepened, focusing on healthcare, home care, and high-quality elderly care services. The company has launched high-quality elderly care community projects in five cities, with ongoing operations in Shanghai and a planned trial operation in Shenzhen by year-end [7]. - In the first three quarters, the health insurance premium income reached nearly 127 billion yuan, with medical insurance premium income close to 58.8 billion yuan, reflecting a 2.6% year-on-year growth [7]. Customer Growth - Ping An Bank reported an operating income of 100.67 billion yuan and a net profit of 38.34 billion yuan in the first three quarters. The total number of personal customers reached nearly 250 million, a 2.9% increase since the beginning of the year [8].

中国平安,业绩大增

Zhong Guo Ji Jin Bao· 2025-10-28 14:09

Core Insights - China Ping An reported a significant increase in net profit for the third quarter, with a year-on-year growth of 45.4% [1][3] Financial Performance - For the first three quarters of 2025, the company achieved an operating profit attributable to shareholders of 116.26 billion yuan, representing a year-on-year increase of 7.2% [3] - The net profit attributable to shareholders for the first three quarters reached 132.86 billion yuan, up 11.5% year-on-year, with a 45.4% increase in the third quarter alone [3] - As of September 30, 2025, the company's net assets attributable to shareholders stood at 986.41 billion yuan, reflecting a 6.2% growth after dividends [3] Insurance Business Growth - The new business value of life and health insurance saw a robust growth of 46.2% in the first three quarters of 2025 [4] - The average new business value per agent increased by 29.9%, while the new business value from the bancassurance channel surged by 170.9% [4] - Property insurance premium income reached 256.25 billion yuan, marking a 7.1% year-on-year growth, with a combined cost ratio of 97.0%, improving by 0.8 percentage points [4] Investment Performance - The investment portfolio of the insurance funds achieved a non-annualized comprehensive investment return of 5.4%, up by 1.0 percentage point year-on-year [4] - The scale of the investment portfolio exceeded 6.41 trillion yuan, growing by 11.9% since the beginning of the year [4] AI and Technology Integration - The company has accumulated 30 trillion bytes of data covering nearly 250 million individual customers, enhancing its AI capabilities [6] - AI technologies have enabled significant improvements in customer experience, risk control, cost reduction, and sales promotion [6][7] - In the first three quarters of 2025, AI-driven claims processing intercepted fraud losses amounting to 9.15 billion yuan [7] - AI service interactions exceeded 1.292 billion, covering 80% of total customer service volume [7]

中国平安,业绩大增

中国基金报· 2025-10-28 14:02

Core Viewpoint - China Ping An reported a significant increase in net profit for the third quarter, with a year-on-year growth of 45.4% and a strong performance in life and health insurance new business value, which grew by 46.2% [2][5][6]. Financial Performance - For the first three quarters of 2025, the group achieved an operating profit attributable to shareholders of 116.264 billion yuan, a year-on-year increase of 7.2%, with a 15.2% growth in the third quarter [5]. - The net profit attributable to shareholders for the first three quarters was 132.856 billion yuan, reflecting an 11.5% year-on-year increase, with a notable 45.4% growth in the third quarter [5]. - As of September 30, 2025, the net assets attributable to shareholders were 986.406 billion yuan, showing a 6.2% increase after dividends, indicating resilience in the balance sheet and sustainable profitability [5]. Insurance Business Growth - The new business value for life and health insurance saw a robust increase of 46.2% in the first three quarters of 2025, with agents' average new business value rising by 29.9% and bank insurance channel new business value soaring by 170.9% [6][7]. - Property insurance performance remained stable, with original insurance premium income reaching 256.247 billion yuan, a 7.1% year-on-year increase, and a comprehensive cost ratio of 97.0%, improving by 0.8 percentage points [7]. Investment Performance - The investment portfolio of insurance funds achieved a non-annualized comprehensive investment return rate of 5.4%, up by 1.0 percentage point year-on-year, with a non-annualized net investment return rate of 2.8% [7]. - The scale of the insurance funds investment portfolio exceeded 6.41 trillion yuan, reflecting an 11.9% growth since the beginning of the year [7]. AI and Ecosystem Development - China Ping An has accumulated a vast database of 30 trillion bytes of data covering nearly 250 million individual customers, leveraging this data to enhance financial services and operational efficiency [8][9]. - The company has implemented AI technologies to improve customer experience, risk control, cost reduction, and sales enhancement, achieving significant automation in claims processing and customer service [9][10]. - AI-driven initiatives have led to a 91.5 billion yuan reduction in losses through fraud prevention and a 23% increase in policy renewal rates [10].

睿远基金旗下明星经理持仓出炉!看好人工智能浪潮 增持阿里巴巴等

Zhi Tong Cai Jing· 2025-10-28 13:45

Core Viewpoint - The report highlights that prominent fund managers from Ruifeng Fund have increased their holdings in leading technology companies like Alibaba, indicating a strong belief in the potential of artificial intelligence as a major technological transformation following the internet era [1]. Fund Performance - The Ruifeng Growth Value Mixed Fund, managed by Fu Pengbo and Zhu Lin, saw a net value increase of over 50% in Q3, with A-class shares rising by 51.09%, outperforming the benchmark by 14.82%, marking the highest quarterly record since its inception in 2019 [1]. - The Ruifeng Balanced Value Three-Year Holding Mixed A Fund, managed by Zhao Feng, reported a net value growth rate of 19.29%, exceeding the benchmark return of 13.70% during the same period [3][4]. Portfolio Adjustments - The top ten holdings of the Ruifeng Growth Value Mixed Fund included stocks that doubled in price during Q3, such as Xinyi Technology, Shenghong Technology, and Cambricon, although these were reduced in the portfolio [1]. - The fund maintained a high stock asset allocation with over 90% in equities, and the top ten holdings accounted for 66% of the net value, showing a significant increase from the previous quarter [2][3]. Sector Focus - The fund managers expressed a continued positive outlook on artificial intelligence, focusing on sectors such as internet technology, optical modules, PCB, chips, and innovative pharmaceuticals [2][3]. - The report indicates that the concentration of holdings increased due to significant price rises in key stocks, particularly in the new energy and Apple supply chain sectors [3]. Investment Strategy - Zhao Feng emphasized that AI is becoming the largest technological transformation after the internet, with rapid adoption across various industries [5]. - The report notes that while there are uncertainties regarding the future returns from substantial investments in foundational models and data centers, leading internet companies are well-positioned financially to support these capital expenditures [6].

中国平安(601318) - 中国平安第十三届董事会第十一次会议决议公告

2025-10-28 13:14

证券代码:601318 证券简称:中国平安 公告编号:临 2025-044 具体内容请见本公司于同日在上海证券交易所网站(www.sse.com.cn)披露 的《中国平安保险(集团)股份有限公司 2025 年第三季度报告》。 表决结果:赞成 15 票、反对 0 票、弃权 0 票 二、审议通过了《关于审议公司资金运用相关制度的议案》 表决结果:赞成 15 票、反对 0 票、弃权 0 票 中国平安保险(集团)股份有限公司 第十三届董事会第十一次会议决议公告 中国平安保险(集团)股份有限公司(以下简称"本公司")董事会及全体董事 保证本公告内容不存在任何虚假记载、误导性陈述或者重大遗漏,并对其内容的 真实性、准确性和完整性承担法律责任。 本公司第十三届董事会第十一次会议(以下简称"会议")书面通知于 2025 年 10 月 14 日发出,会议于 2025 年 10 月 28 日在深圳市召开。会议应出席董事 15 人,实到董事 15 人,会议有效行使表决权票数 15 票。本公司全体监事和高 级管理人员列席了会议。会议的召集、召开程序符合《中华人民共和国公司法》 和《中国平安保险(集团)股份有限公司章程》的相关规定,会 ...

中国平安2025年前三季度归母营运利润同比增7.2%

Zhong Guo Jing Ying Bao· 2025-10-28 12:37

Core Insights - China Ping An reported a revenue of 832.94 billion yuan for the first three quarters of 2025, marking a year-on-year growth of 7.4% [1] - The net profit attributable to shareholders reached 132.86 billion yuan, reflecting an 11.5% increase year-on-year [1] Business Performance - The new business value for life and health insurance reached 35.72 billion yuan, up 46.2% year-on-year, with a new business value rate increasing by 9.0 percentage points [2] - The property and casualty insurance segment generated service revenue of 253.44 billion yuan, a 3.0% increase, while original premium income rose by 7.1% to 256.25 billion yuan [2] - The investment portfolio achieved a non-annualized comprehensive investment return of 5.4%, up 1.0 percentage point year-on-year [2][3] Investment Strategy - The investment portfolio size exceeded 6.41 trillion yuan, growing by 11.9% since the beginning of the year [3] - The company is actively managing interest rate fluctuations and increasing equity allocations to ensure stable long-term investment returns [3]