PING AN OF CHINA(601318)

Search documents

中国平安保险(集团)股份有限公司2025年第三季度报告

Shang Hai Zheng Quan Bao· 2025-10-28 22:55

Core Viewpoint - The company reported a solid performance in the third quarter of 2025, with significant growth in net profit and operating profit, driven by its core financial services and insurance businesses. Financial Performance - The company achieved an operating profit of 116.26 billion yuan, a year-on-year increase of 7.2% [10] - Net profit attributable to shareholders reached 132.86 billion yuan, up 11.5% year-on-year, with a substantial quarterly growth of 45.4% [10] - Total revenue for the period was 832.94 billion yuan, reflecting a 7.4% increase compared to the previous year [10] Business Segments Life and Health Insurance - New business value for life and health insurance reached 35.72 billion yuan, a 46.2% increase year-on-year [10] - The new business value rate (based on standard premium) rose by 9.0 percentage points to 30.6% [23] - The agent channel saw a 23.3% increase in new business value, while the bancassurance channel surged by 170.9% [10][23] Property Insurance - The company reported a premium income of 256.25 billion yuan from property insurance, marking a 7.1% increase [11] - The overall combined cost ratio improved by 0.8 percentage points to 97.0% [11] Banking Operations - The bank's net profit was 38.34 billion yuan, a decrease of 3.5% year-on-year [34] - The non-performing loan ratio stood at 1.05%, a slight decrease from the beginning of the year [34] - Core Tier 1 capital adequacy ratio improved to 9.52%, up 0.40 percentage points [34] Investment Performance - The investment portfolio achieved a non-annualized comprehensive investment return of 5.4%, an increase of 1.0 percentage points year-on-year [32] - The total scale of the investment portfolio exceeded 6.41 trillion yuan, growing by 11.9% since the beginning of the year [32] Customer Base and Retention - The company served nearly 250 million individual customers, a 2.9% increase from the start of the year [13] - The retention rate for customers holding four or more contracts reached 97.5% [13] Strategic Initiatives - The company continues to enhance its "financial + healthcare" strategy, with a focus on digital transformation and customer-centric services [43] - The healthcare and elderly care services have expanded, covering 85 cities and serving nearly 240,000 customers [19]

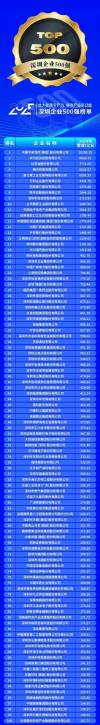

平安华为比亚迪稳居前三

Shen Zhen Shang Bao· 2025-10-28 22:21

Core Insights - The "2025 Shenzhen Top 500 Enterprises List" was released, with China Ping An Insurance, Huawei Investment Holdings, and BYD Company ranking in the top three [1] - The list ranks companies based on their 2024 annual revenue, while the accompanying report evaluates companies on multiple dimensions including scale, operational efficiency, innovation capability, social contribution, and international development [1] Group 1: Performance Trends - Operating performance shows a moderate recovery, with overall revenue growth reversing the previous year's decline; the number of companies with revenue exceeding 100 billion remains at 18 [1] - The average sales profit margin for these companies is 4.86%, slightly down from 5.10% in 2023, indicating a small decline in overall profitability [1] Group 2: Company Dynamics - The number of companies in the revenue range of 1 billion to 10 billion increased to 331, a year-on-year rise of 5.41%; these companies achieved a total revenue of 11,138 billion, with a year-on-year growth of 9.76% [2] - The competitive landscape among leading companies is intense, with 97 new entrants making up 19% of the list; 22 companies maintained their rankings, indicating frequent changes in competitive positions [2] Group 3: Sector Contributions - Private enterprises constitute 70% of the top 500, accounting for over 45% of total revenue; they are particularly strong in high-end medical devices and robotics, driving innovation and market expansion [2] - The manufacturing sector remains robust with 207 companies (41% of the list) and a revenue growth of 13.82%, although competition within the sector is increasingly polarized [2] Group 4: Regional Development - Regional development is characterized by a "three-tier" structure: Nanshan and Futian as the "core leading layer," Longgang, Baoan, Longhua, and Pingshan as the "growth attack layer," and Luohu, Yantian, and Guangming in the "transformation adjustment layer" [3] - Each district's industrial characteristics are becoming more pronounced, but there is still significant room for improvement in collaborative development [3]

中国平安(601318.SH)发布前三季度业绩,归母净利增长11.5%至1328.56亿元

智通财经网· 2025-10-28 18:13

Core Insights - China Ping An reported a 7.2% year-on-year increase in operating profit to CNY 116.26 billion for the first three quarters of 2025, with net profit rising by 11.5% to CNY 132.86 billion, and a significant 45.4% increase in the third quarter alone [1] - The group's total revenue reached CNY 832.94 billion, reflecting a 7.4% year-on-year growth [1] Insurance Business Performance - The life and health insurance segment showed continuous growth, with new business value reaching CNY 35.72 billion, a 46.2% increase year-on-year, and the new business value rate (based on standard premium) rising by 9.0 percentage points [1] - The agent channel's new business value grew by 23.3%, while per capita new business value increased by 29.9%; the bank insurance channel saw a remarkable 170.9% growth, contributing 35.1% to the new business value of Ping An's life insurance [1] Property Insurance Performance - The property insurance segment reported a stable growth in performance, with original insurance premium income of CNY 256.25 billion, up 7.1% year-on-year, and an overall combined cost ratio of 97.0%, improving by 0.8 percentage points [1] Investment Performance - The investment performance of insurance funds significantly improved, achieving a non-annualized comprehensive investment return rate of 5.4%, an increase of 1.0 percentage point year-on-year [2] Banking Business Performance - Ping An Bank maintained steady operations with a net profit of CNY 38.34 billion for the first three quarters of 2025; the non-performing loan ratio stood at 1.05%, down by 0.01 percentage points since the beginning of the year, and the provision coverage ratio was 229.60% [2] - The core Tier 1 capital adequacy ratio improved to 9.52%, an increase of 0.40 percentage points from the start of the year [2]

中国平安发布前三季度业绩,归母净利增长11.5%至1328.56亿元

Zhi Tong Cai Jing· 2025-10-28 18:11

Core Insights - China Ping An (601318.SH) reported a significant increase in operational profit and net profit for the first three quarters of 2025, with operational profit reaching 116.26 billion yuan, up 7.2% year-on-year, and net profit at 132.86 billion yuan, up 11.5% [1][2] - The company achieved a substantial growth in its life and health insurance business, with new business value increasing by 46.2% to 35.72 billion yuan [1] - Investment performance of insurance funds improved significantly, with a non-annualized comprehensive investment return of 5.4%, up 1.0 percentage points year-on-year [2] Financial Performance - For the first three quarters of 2025, the total operating revenue was 832.94 billion yuan, reflecting a year-on-year growth of 7.4% [1] - As of September 30, 2025, the equity attributable to shareholders of the parent company was 986.41 billion yuan, an increase of 6.2% from the beginning of the year [1] Business Segments - The life and health insurance segment showed robust growth, with the agent channel's new business value increasing by 23.3% and the bank insurance channel's new business value soaring by 170.9% [1] - Property insurance maintained stable growth, with original insurance premium income reaching 256.25 billion yuan, up 7.1% year-on-year, and an overall combined cost ratio of 97.0%, improving by 0.8 percentage points [1] Banking Operations - Ping An Bank reported a net profit of 38.34 billion yuan for the first three quarters of 2025, with a non-performing loan ratio of 1.05%, a decrease of 0.01 percentage points from the beginning of the year [2] - The core Tier 1 capital adequacy ratio improved to 9.52%, up 0.40 percentage points from the beginning of the year [2]

2025深圳企业500强榜单发布:平安、华为、比亚迪位列前三

Sou Hu Cai Jing· 2025-10-28 17:42

Core Insights - The "2025 Shenzhen Top 500 Enterprises List" was officially released, with Ping An Insurance, Huawei Investment, and BYD ranking as the top three, maintaining their leading positions [1][16] - The list is based on the companies' revenue for the fiscal year 2024, and the accompanying report analyzes various dimensions of enterprise development, including scale, operational efficiency, innovation capability, social contribution, and internationalization [1][16] Group 1: Key Characteristics of the Top 500 Enterprises - Overall revenue growth is observed, with 18 companies exceeding 100 billion yuan in revenue, but the average sales profit margin has decreased to 4.86%, down from 5.10% in 2023 [1][2] - The number of companies in the 1-10 billion yuan revenue range has increased to 331, a year-on-year growth of 5.41%, with total revenue in this segment rising by 9.76% [1][2] Group 2: Competitive Landscape - The competition among top enterprises is intensifying, with 97 new entrants making up 19% of the list, and only 22 companies maintaining their previous rankings [2] - The revenue threshold for entering the list has been consistently rising over the past five years, indicating a rapidly evolving competitive landscape [2] Group 3: Private Sector Dynamics - Private enterprises account for 70% of the list, contributing over 45% of total revenue, particularly excelling in high-end medical devices and robotics sectors [2] - The manufacturing sector remains robust, with 207 manufacturing companies on the list showing a revenue growth of 13.82%, although traditional manufacturing faces transformation pressures [2] Group 4: Regional Development - The regional development is categorized into three tiers: Nanshan and Futian as the "core leading tier," Longgang and four other districts as the "growth and challenge tier," and Luohu and three other districts as the "transformation and adjustment tier," highlighting distinct industrial characteristics and collaboration opportunities [2] Group 5: Future Directions - Shenzhen's top 500 enterprises need to focus on enhancing value addition, optimizing innovation workforce allocation, balancing industrial development, and improving overseas business layouts to drive sustainable growth and support the city's economic high-quality development [16]

中国平安10月28日大宗交易成交250.10万元

Zheng Quan Shi Bao Wang· 2025-10-28 15:56

Core Insights - China Ping An executed a block trade on October 28, with a volume of 43,300 shares and a transaction value of 2.501 million yuan, at a price of 57.76 yuan per share [2][3] - The stock has seen a total of 8 block trades in the past three months, amounting to a cumulative transaction value of 181 million yuan [2] - The closing price for China Ping An on the same day was 57.76 yuan, reflecting a slight increase of 0.02%, with a turnover rate of 0.46% and a total trading volume of 2.843 billion yuan [2] Trading Activity - The buyer of the block trade was Guangfa Securities Co., Ltd. Guangzhou Kangwang Middle Road Securities Business Department, while the seller was Guotai Junan Securities Co., Ltd. Headquarters [2][3] - The latest margin financing balance for the stock is 23.921 billion yuan, showing a decrease of 313 million yuan over the past five days, which is a decline of 1.29% [3] - Over the last five days, the stock has increased by 1.08%, with a total net inflow of funds amounting to 443 million yuan [2]

中国平安 业绩大增

Zhong Guo Ji Jin Bao· 2025-10-28 15:48

Core Insights - China Ping An reported a significant increase in net profit for the third quarter, with a year-on-year growth of 45.4% [2][4]. Financial Performance - For the first three quarters of 2025, the company achieved an operating profit attributable to shareholders of 116.26 billion yuan, representing a year-on-year increase of 7.2%, with a 15.2% growth in the third quarter [4]. - The net profit attributable to shareholders for the first three quarters reached 132.86 billion yuan, up 11.5% year-on-year, with a notable 45.4% increase in the third quarter [4]. - As of September 30, 2025, the company's net assets attributable to shareholders stood at 986.41 billion yuan, reflecting a 6.2% growth after dividends [4]. Insurance Business Growth - The new business value for life and health insurance saw a robust increase of 46.2% in the first three quarters of 2025, with agents' average new business value rising by 29.9% and bank insurance channel new business value soaring by 170.9% [5]. - The property insurance segment reported a premium income of 256.25 billion yuan, marking a 7.1% year-on-year growth, with a combined cost ratio of 97.0%, an improvement of 0.8 percentage points [5]. Investment Performance - The investment portfolio of the insurance funds achieved a non-annualized comprehensive investment return of 5.4%, up by 1.0 percentage point year-on-year, with a non-annualized net investment return of 2.8% [5]. - The scale of the insurance funds investment portfolio exceeded 6.41 trillion yuan, reflecting an 11.9% increase since the beginning of the year [5]. AI and Ecosystem Development - The company has leveraged AI to enhance its ecosystem, with a database containing 30 trillion bytes of data covering nearly 250 million individual customers [6]. - AI technologies have improved customer experience, risk control, cost reduction, and sales promotion, with 89% of auto insurance policies being issued in an average of one minute through intelligent systems [6][7]. - AI-driven fraud detection in property insurance has intercepted losses amounting to 9.15 billion yuan in the first three quarters of 2025 [7].

中国平安收获强势三季报,第三季度净利润同比大增45.4%

第一财经· 2025-10-28 15:46

Core Viewpoint - China Ping An reported strong financial performance for the first three quarters of 2025, with significant growth in both revenue and profit metrics, indicating robust operational efficiency and strategic channel transformations [3][4]. Financial Performance - For the first three quarters, China Ping An achieved operating revenue of 901.67 billion yuan, a year-on-year increase of 4.6% [3]. - The operating profit attributable to shareholders reached 116.26 billion yuan, up 7.2%, with a notable 15.2% growth in the third quarter [3]. - Net profit attributable to shareholders for the first three quarters was 132.86 billion yuan, reflecting an 11.5% year-on-year increase, with a substantial 45.4% growth in the third quarter alone [3]. Life and Health Insurance - The new business value for life and health insurance was 35.72 billion yuan, marking a 46.2% increase year-on-year, with the new business value rate rising by 9.0 percentage points [3]. - The agent channel saw a 23.3% increase in new business value, while the average new business value per agent grew by 29.9% [3]. - The bancassurance channel experienced a remarkable 170.9% increase in new business value, contributing 35.1% to the new business value of life insurance [3]. Property Insurance - In property insurance, the original insurance premium income reached 256.25 billion yuan, a 7.1% increase year-on-year [4]. - The overall combined cost ratio improved by 0.8 percentage points to 97.0% [4]. - The auto insurance segment generated 166.12 billion yuan in premium income, up 3.5%, while non-auto insurance premiums increased by 14.3% to 90.13 billion yuan [4]. Investment Performance - The investment portfolio achieved a non-annualized comprehensive investment return of 5.4%, up 1.0 percentage points year-on-year, with a non-annualized net investment return of 2.8% [5]. - As of September 30, 2025, the investment portfolio size exceeded 6.41 trillion yuan, reflecting an 11.9% growth since the beginning of the year [5]. - The company increased equity allocations and diversified into quality alternative assets to enhance long-term investment returns [5]. Banking Operations - Ping An Bank reported operating revenue of 100.67 billion yuan and a net profit of 38.34 billion yuan for the first three quarters [5]. - The non-performing loan ratio stood at 1.05%, a slight decrease of 0.01 percentage points from the beginning of the year [5]. - The provision coverage ratio was 229.60%, with a 60-day overdue loan deviation of 0.77 [5]. Customer Metrics - As of September 30, 2025, the number of individual customers reached nearly 250 million, a 2.9% increase since the beginning of the year [5]. - The average number of contracts held per customer rose to 2.94, up 0.7% [5]. - The retention rate for customers holding four or more contracts was 97.5%, significantly higher than the 12.8 percentage points retention rate for those with only one contract [5].

中国平安前三季度净利增11.5%,寿险多渠道发力

券商中国· 2025-10-28 15:27

Core Viewpoint - China Ping An's Q3 financial report shows a significant net profit growth of 45.4% year-on-year, despite a lower growth rate compared to other leading insurance companies. The company achieved a net profit of 132.86 billion yuan in the first three quarters, representing an 11.5% increase year-on-year, indicating resilience in its financial performance [1][3]. Business Performance - In the first three quarters, the new business value of life and health insurance grew by 46.2%, with the agent channel's new business value increasing by 29.9% and the bancassurance channel's new business value soaring by 170.9% [2][4]. - The total operating revenue for the first three quarters reached 832.94 billion yuan, a 7.4% increase year-on-year, while the operating profit attributable to shareholders was 116.26 billion yuan, up 7.2% [3]. - The company reported a net asset value of 986.41 billion yuan as of September 30, 2025, reflecting a 6.2% growth after dividends [3]. Investment Performance - The investment performance of insurance funds significantly improved, achieving a non-annualized comprehensive investment return of 5.4%, an increase of 1.0 percentage points year-on-year. The non-annualized net investment return was 2.8% [5][6]. - As of September 30, 2025, the scale of the insurance fund investment portfolio exceeded 6.41 trillion yuan, growing by 11.9% since the beginning of the year [6]. Service Expansion - The "insurance + service" strategy has deepened, focusing on healthcare, home care, and high-quality elderly care services. The company has launched high-quality elderly care community projects in five cities, with ongoing operations in Shanghai and a planned trial operation in Shenzhen by year-end [7]. - In the first three quarters, the health insurance premium income reached nearly 127 billion yuan, with medical insurance premium income close to 58.8 billion yuan, reflecting a 2.6% year-on-year growth [7]. Customer Growth - Ping An Bank reported an operating income of 100.67 billion yuan and a net profit of 38.34 billion yuan in the first three quarters. The total number of personal customers reached nearly 250 million, a 2.9% increase since the beginning of the year [8].

中国平安,业绩大增

Zhong Guo Ji Jin Bao· 2025-10-28 14:09

Core Insights - China Ping An reported a significant increase in net profit for the third quarter, with a year-on-year growth of 45.4% [1][3] Financial Performance - For the first three quarters of 2025, the company achieved an operating profit attributable to shareholders of 116.26 billion yuan, representing a year-on-year increase of 7.2% [3] - The net profit attributable to shareholders for the first three quarters reached 132.86 billion yuan, up 11.5% year-on-year, with a 45.4% increase in the third quarter alone [3] - As of September 30, 2025, the company's net assets attributable to shareholders stood at 986.41 billion yuan, reflecting a 6.2% growth after dividends [3] Insurance Business Growth - The new business value of life and health insurance saw a robust growth of 46.2% in the first three quarters of 2025 [4] - The average new business value per agent increased by 29.9%, while the new business value from the bancassurance channel surged by 170.9% [4] - Property insurance premium income reached 256.25 billion yuan, marking a 7.1% year-on-year growth, with a combined cost ratio of 97.0%, improving by 0.8 percentage points [4] Investment Performance - The investment portfolio of the insurance funds achieved a non-annualized comprehensive investment return of 5.4%, up by 1.0 percentage point year-on-year [4] - The scale of the investment portfolio exceeded 6.41 trillion yuan, growing by 11.9% since the beginning of the year [4] AI and Technology Integration - The company has accumulated 30 trillion bytes of data covering nearly 250 million individual customers, enhancing its AI capabilities [6] - AI technologies have enabled significant improvements in customer experience, risk control, cost reduction, and sales promotion [6][7] - In the first three quarters of 2025, AI-driven claims processing intercepted fraud losses amounting to 9.15 billion yuan [7] - AI service interactions exceeded 1.292 billion, covering 80% of total customer service volume [7]