Ninebot(689009)

Search documents

泉果基金孙伟:消费复苏需观察政策实施力度,三季度增配新消费与锂电

Sou Hu Cai Jing· 2025-10-29 09:20

Core Insights - The report from the "泉果消费机遇" fund indicates a significant growth in fund size, reaching 695 million yuan by the end of Q3 2025, up from 61.93 million yuan in Q2 2025, reflecting increasing recognition from investors, including institutions [1][2] - The fund's net value performance shows a 33.00% increase over the past year, outperforming the benchmark of 3.69% [1] Fund Performance and Market Context - The fund has gained favor among institutional investors, with 2.856 million shares held, accounting for 4.96% of total shares [2] - In Q3 2025, major stock indices performed well, with the Shanghai Composite Index rising by 12.73%, Shenzhen Component Index by 29.25%, CSI 300 by 17.90%, and Hang Seng Index by 11.56% [2] - Economic indicators showed steady growth, with industrial added value increasing by 5.7% and 5.2% in July and August respectively, and retail sales growing by 3.7% and 3.4% in the same months [2] Portfolio Adjustments - The fund manager, Sun Wei, indicated a slight increase in equity positions and adjustments in the portfolio structure, focusing on new consumption and lithium battery sectors [3] - The fund increased allocations in personal care, trendy toys, and gaming industries while reducing exposure in closely related sectors [3] - The top ten holdings account for 30.12% of the fund's net asset value, with Tencent Holdings, CATL, and Pop Mart among the largest positions [5] Investment Strategy - As of Q3 2025, the fund's stock position constituted 79.01% of its net assets, with a 24.77% allocation to Hong Kong stocks, showing stability compared to the previous quarter [4][3] - New entries in the top ten holdings include Pop Mart, Alibaba-W, and Tianqi Lithium, while previous holdings like Yanjing Beer and Li Auto have exited the list [3][5]

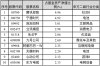

九号公司:截至2025年10月20日股东总户数为21,399户

Xin Lang Cai Jing· 2025-10-29 08:54

Summary - As of October 20, 2025, the total number of shareholders for the company (九号公司, SH689009) is 21,399 [1]

摩托车及其他板块10月29日涨0.55%,新日股份领涨,主力资金净流出121.44万元

Zheng Xing Xing Ye Ri Bao· 2025-10-29 08:34

Market Overview - On October 29, the motorcycle and other sectors rose by 0.55% compared to the previous trading day, with Xinri Co., Ltd. leading the gains [1] - The Shanghai Composite Index closed at 4016.33, up 0.7%, while the Shenzhen Component Index closed at 13691.38, up 1.95% [1] Stock Performance - Xinri Co., Ltd. (603787) closed at 14.00, with a gain of 2.94% and a trading volume of 202,800 shares, amounting to a transaction value of 282 million yuan [1] - Other notable performers included Huayang Racing (920058) with a 2.21% increase, Qianli Technology (601777) up by 2.10%, and Jiangui General (603766) rising by 1.91% [1] - Conversely, companies like Zhenghe Industrial (003033) and Taotao Vehicle (301345) experienced declines of 6.59% and 4.96%, respectively [2] Capital Flow Analysis - The motorcycle and other sectors saw a net outflow of 1.2144 million yuan from institutional investors, while retail investors contributed a net inflow of 1.36 billion yuan [2] - The capital flow data indicates that retail investors were more active in purchasing shares compared to institutional and speculative investors [2] Individual Stock Capital Flow - Spring Power (603129) experienced a significant net outflow from institutional investors of 48.8487 million yuan, while retail investors had a net inflow of 34.6531 million yuan [3] - Taotao Vehicle (301345) had a net inflow of 35.9585 million yuan from institutional investors, but a net outflow from speculative investors of 40.4043 million yuan [3] - Qianli Technology (601777) saw a net inflow of 24.3377 million yuan from institutional investors, while retail investors contributed a smaller net inflow of 698.17 thousand yuan [3]

九号公司(689009):营收高增,持续看好公司成长

CMS· 2025-10-28 10:23

Investment Rating - The report maintains a "Strong Buy" investment rating for the company [3][5]. Core Views - The company reported a revenue of 6.7 billion yuan in Q3, representing a year-on-year growth of 57%, and a net profit attributable to shareholders of 550 million yuan, up 46% year-on-year [1][5]. - The company is expected to continue its strong growth trajectory, with projected net profits of 2.1 billion yuan, 2.8 billion yuan, and 3.7 billion yuan for the years 2025, 2026, and 2027, respectively [5]. - The report highlights significant growth in various product segments, including a 59% increase in two-wheeler sales and a doubling of revenue from lawnmowers [5]. Financial Data and Valuation - The total revenue for 2023 is projected at 10.22 billion yuan, with a year-on-year growth of 1%, and is expected to reach 35.24 billion yuan by 2027, with a growth rate of 31% [2][12]. - The company's earnings per share (EPS) are forecasted to increase from 0.83 yuan in 2023 to 5.18 yuan in 2027, reflecting a strong growth outlook [2][13]. - The price-to-earnings (PE) ratio is expected to decrease from 78.5 in 2023 to 12.6 in 2027, indicating improving valuation metrics as earnings grow [2][13]. Product Performance - The two-wheeler segment achieved sales of 1.49 million units in Q3, with revenue of 4.5 billion yuan, marking a 72% increase year-on-year [5]. - The lawnmower business continues to show strong growth, contributing 660 million yuan in revenue, up 36% year-on-year, with flagship products achieving double the average industry efficiency [5]. - The company is enhancing its brand presence through marketing initiatives, including a sci-fi short film that garnered over 74 million views on social media [5].

14只科创板股获融资净买入额超1亿元

Zheng Quan Shi Bao Wang· 2025-10-28 03:09

Core Insights - The total margin balance of the STAR Market reached 258.603 billion yuan on October 27, an increase of 4.599 billion yuan from the previous trading day [1] - The financing balance amounted to 257.688 billion yuan, up by 4.573 billion yuan, while the margin short balance was 0.915 billion yuan, increasing by 0.026 billion yuan [1] Individual Stock Performance - On October 27, 371 stocks on the STAR Market experienced net financing inflows, with 14 stocks having net inflows exceeding 100 million yuan [1] - Lanke Technology topped the list with a net financing inflow of 675 million yuan, followed by Huahong Semiconductor, SMIC, Shengyi Technology, Juchen Technology, Ninebot, and Tuojing Technology [1]

科创ETF(588050)开盘跌0.85%,重仓股中芯国际跌1.12%,海光信息跌1.21%

Xin Lang Cai Jing· 2025-10-28 02:48

Group 1 - The core point of the article highlights the performance of the Sci-Tech Innovation ETF (588050), which opened down 0.85% at 1.510 yuan on October 28 [1] - Major holdings in the ETF include companies like SMIC, which fell by 1.12%, and Cambrian, which dropped by 1.68%, while Kingsoft Office saw an increase of 4.42% [1] - The ETF's performance benchmark is the Shanghai Stock Exchange Sci-Tech Innovation Board 50 Index, managed by ICBC Credit Suisse Asset Management Company, with a return of 6.10% since its inception on September 28, 2020, and a return of 2.28% over the past month [1]

交银国际每日晨报-20251028

BOCOM International· 2025-10-28 01:33

Group 1: Company Insights - 九号公司 - The company continues to see growth in two-wheeled vehicle sales, achieving a revenue of RMB 183.9 billion in the first three quarters of 2025, representing a year-on-year increase of 68.6% [1] - In Q3 2025, the company reported a revenue of RMB 66.5 billion, up 56.8% year-on-year, with two-wheeled vehicle revenue at RMB 44.54 billion, reflecting a year-on-year increase of approximately 72% [1][2] - The average selling price of two-wheeled vehicles was RMB 2,996, showing a year-on-year increase of about 8% [1][2] - The company maintains a positive outlook on product synergy and has raised its store target, indicating optimistic growth prospects [2] Group 2: Company Insights - 亿纬锂能 - The company reported a revenue of RMB 168.3 billion in Q3 2025, a year-on-year increase of 35.8%, with energy storage and power battery shipments at 19.7 GWh and 13.1 GWh respectively [3][4] - The company maintains its annual shipment target of 130 GWh, with energy storage and power battery shipments expected to be approximately 80 GWh and 50 GWh respectively [3] Group 3: Financial Performance - In Q3 2025, the gross profit margin for the company was 29.0%, with a year-on-year increase of 0.5 percentage points but a quarter-on-quarter decline of 1.9 percentage points due to seasonal factors [2] - The net profit attributable to shareholders for Q3 2025 was RMB 5.5 billion, a year-on-year increase of 46%, while the net profit margin was 8.2%, down 0.6 percentage points year-on-year [2][4] - The company expects an improvement in profitability in Q4 2025 due to price increases for batteries [4][7] Group 4: Industry Insights - Technology Sector - The technology sector is expected to receive increased policy support during the "15th Five-Year Plan" period, with a focus on high-level technological self-reliance and innovation [10][11] - Investment opportunities are anticipated in key areas such as artificial intelligence, semiconductor manufacturing, and new communication technologies [11][12]

九号公司(689009):2025年三季报点评:Q3归母净利润同比+45.86%,两轮车、滑板车延续高增长趋势

Soochow Securities· 2025-10-27 10:08

Investment Rating - The report maintains a "Buy" rating for the company [4] Core Insights - In Q3 2025, the company's net profit attributable to shareholders increased by 45.86% year-on-year, with strong growth trends continuing in electric two-wheelers and electric scooters [2] - For the first three quarters of 2025, the company achieved revenue of 18.39 billion yuan, a year-on-year increase of 68.63%, and a net profit of 1.787 billion yuan, up 84.31% year-on-year [2] - The company is expected to continue its revenue growth trajectory due to expanding channels and strong demand for new products [2] Financial Performance - The company's total revenue for 2023 is projected at 10.222 billion yuan, with a year-on-year growth of 0.97%, and is expected to reach 33.612 billion yuan by 2027, with a growth rate of 23.85% [1] - The net profit attributable to shareholders is forecasted to be 597.99 million yuan in 2023, increasing to 3.285 billion yuan by 2027, reflecting a growth rate of 26.41% [1] - The latest diluted EPS is projected to be 8.34 yuan in 2023, rising to 45.79 yuan by 2027 [1] Profitability and Cost Control - The company's gross profit margin for the first three quarters of 2025 was 29.89%, an increase of 0.21 percentage points year-on-year [3] - The selling, general, and administrative expense ratio decreased by 2.43 percentage points year-on-year to 16.59% for the first three quarters of 2025, indicating strong cost control [3] Business Growth Drivers - The electric two-wheeler market is expected to benefit from the old-for-new policy starting in 2024, which will stimulate replacement demand [4] - The company is positioned in the mid-to-high-end market with leading smart technology, which is anticipated to enhance brand competitiveness and drive revenue growth [4] - New business segments, such as the Navimow smart lawn mower, are expected to contribute significantly to revenue growth, with a target of reaching 100,000 households in Europe by 2024 [4]

九号公司第三季度营收66.5亿元 连续9个季度增长

Zhong Zheng Wang· 2025-10-27 07:39

Core Insights - Ninebot Company reported a strong financial performance in Q3, with revenue of 6.65 billion yuan, a year-on-year increase of 56.82%, marking nine consecutive quarters of growth [1] - The net profit attributable to shareholders reached 550 million yuan, up 45.86% year-on-year, with a gross margin improvement of 1.7 percentage points to 29.9% [1] Business Performance - The electric two-wheeler segment remains the standout performer, with sales of 1.4867 million units in Q3, generating revenue of 4.454 billion yuan, a year-on-year growth of approximately 72% [2] - The company announced that its cumulative sales of smart electric two-wheelers in the Chinese market have surpassed 9 million units, entering a new phase towards reaching 10 million units [2] - The launch of the new flagship smart electric motorcycle M5 series saw sales exceed 11,292 units within four hours, generating over 100 million yuan in sales [2] - The electric scooter business also showed strong performance, with retail revenue increasing by 38.14% year-on-year to 957 million yuan in Q3 [2] R&D and Innovation - Ninebot Company has significantly invested in R&D, with expenditures reaching 872 million yuan in the first three quarters of 2025, a 59% increase year-on-year [3] - The company has developed a proprietary operating system, NimbleOS, enhancing the overall performance of its vehicles by integrating various hardware capabilities [3] - As of mid-2023, Ninebot has secured 5,982 global intellectual property rights and has been involved in over 110 domestic and international technical standards across various technology fields [3] Strategic Vision - The founders of Ninebot emphasize that R&D investments are aimed at meeting user needs and anticipating unrecognized demands, focusing on transforming technology from a "toy" into a "life partner" for users [4]

九号公司第三季度净利增46%至5亿元,电动两轮车贡献超六成收入

Sou Hu Cai Jing· 2025-10-27 02:47

Core Insights - Ninebot Company (WD) reported significant growth in revenue and net profit for the first three quarters of 2025, with revenue reaching 18.39 billion yuan, a year-on-year increase of 68.63%, and net profit of 1.79 billion yuan, up 84.31% [1][2] Financial Performance - For Q3 2025, Ninebot Company achieved revenue of 6.65 billion yuan, reflecting a 56.82% increase compared to the same period last year [2] - The net profit attributable to shareholders for Q3 2025 was 545.53 million yuan, marking a 45.86% year-on-year growth [2] - The basic earnings per share for Q3 2025 was 7.61 yuan, up 45.30% from the previous year [2] Business Segments - Electric two-wheelers remain the core revenue source for Ninebot Company, with Q3 sales reaching 1.49 million units and generating 4.45 billion yuan, accounting for 67% of total revenue [3] - Sales of self-branded retail scooters reached 418,300 units, generating 957 million yuan, a 38% increase from the previous year [3] - All-terrain vehicle sales totaled 7,500 units, with revenue of 330 million yuan, up 27% year-on-year [3] Market Expansion - As of September 30, Ninebot Company has over 9,700 electric two-wheeler specialty stores in China [7] - The company announced that its smart two-wheeled electric vehicle shipments in the Chinese market surpassed 9 million units, achieving this milestone in just 52 days [6] Product Launch Success - The flagship smart electric motorcycle M5 series launched on August 26, 2025, sold over 11,292 units within the first four hours, generating over 100 million yuan in sales [6] - By October 20, 2025, the M5 series had sold over 35,000 units, with total sales reaching 351 million yuan [6]