Yunnan Botanee Bio-Technology (300957)

Search documents

格局生变,优选成长

Haitong Securities International· 2025-11-04 09:08

Group 1: Industry Overview - The cosmetics retail sales in China grew by 3.9% year-on-year from January to September 2025, slightly underperforming the overall retail market by 0.6 percentage points, indicating a stable demand environment [4][14]. - Online platforms like Tmall and Douyin are experiencing a shift, with Tmall showing signs of recovery due to flash sales and member subsidies, while Douyin's growth has slightly slowed down [17][20]. - The demand for high-end and cost-effective products is increasing, while the mid-range segment is facing pressure due to a more conservative consumer environment [5][41]. Group 2: Competitive Landscape - The trend of domestic brands replacing foreign ones is slowing down, with leading foreign brands like L'Oréal and Estée Lauder showing signs of recovery in the Chinese market [23][24]. - The growth of domestic brands is becoming more differentiated, with some brands like Proya and Shiseido experiencing declines, while others like Youngor and Shanghai Jahwa continue to grow [23][24]. - The industry is witnessing an acceleration in the multi-brand matrix among leading companies, which is expected to increase market concentration [27][28]. Group 3: Key Companies - The report highlights several companies with strong growth potential, including Ruya Chen, Shumei Co., and Maogeping, which are expected to benefit from their brand strength and market positioning [3][54]. - Companies like Dekang Oral Care and Shanghai Jahwa are noted for their stable fundamentals and potential for marginal improvement, while others like Jinbo Biological and Huaxi Biological are anticipated to reach turning points [54]. - Ruya Chen's self-owned brand, Zhenjia, has shown significant growth, with a revenue increase of 345% year-on-year in Q3 2025, indicating strong brand development capabilities [60].

化妆品板块11月4日跌1.75%,丸美生物领跌,主力资金净流出2.08亿元

Zheng Xing Xing Ye Ri Bao· 2025-11-04 08:51

Core Viewpoint - The cosmetics sector experienced a decline of 1.75% on November 4, with Marubi Biotechnology leading the drop [1][2] Group 1: Market Performance - The Shanghai Composite Index closed at 3960.19, down 0.41%, while the Shenzhen Component Index closed at 13175.22, down 1.71% [1] - Major stocks in the cosmetics sector showed varied performance, with Qing Song Co. slightly up by 0.28% and Marubi Biotechnology down by 3.92% [1][2] Group 2: Trading Volume and Value - The trading volume and value for key stocks in the cosmetics sector were significant, with Qingdao Kingway recording a trading volume of 576,600 shares and a transaction value of 470 million yuan [2] - The total net outflow of main funds in the cosmetics sector was 208 million yuan, while retail investors saw a net inflow of 155 million yuan [2] Group 3: Fund Flow Analysis - The main funds showed a net outflow in several companies, including Marubi Biotechnology with a net outflow of 7.54 million yuan, while retail investors had a net inflow of 17.24 million yuan [3] - LaFang Co. had a net inflow of 8.17 million yuan from retail investors, despite a net outflow from main funds [3]

贝泰妮(300957) - 2025年10月投资者关系活动记录表

2025-11-03 15:00

Group 1: Strategic Adjustments - The company has introduced new talent in key online and mid-platform positions, focusing on core products and optimizing business structure to enhance product competitiveness and channel penetration [1] - Systematic improvements in profitability, technological accumulation, and brand layout have been achieved through ongoing strategic adjustments [1] Group 2: Research and Development - R&D expenses decreased by 14.17% year-on-year, attributed to normal fluctuations in project progress, with a commitment to maintaining high levels of R&D investment [1] - The company is leveraging its Yunnan Province plant extraction laboratory and global R&D centers to conduct comprehensive research projects from basic research to product development [2] Group 3: Financial Performance - Operating cash flow reached 442 million yuan in the first three quarters, a remarkable increase of 6772.14%, indicating strong cash generation capability and operational efficiency [2] - The company has implemented proactive inventory and channel management strategies, laying a solid foundation for long-term value growth [2] Group 4: Intangible Assets - Intangible assets increased significantly by 116%, primarily due to the acquisition of trademarks, patents, and non-patent technologies related to the TriPollar brand [2] - The acquisition strengthens the company's R&D and technological moat, marking its entry into the billion-level beauty instrument market and opening a second growth line [2]

2025年三季度新消费财报:IP、宠物、颜值经济分化,增长逻辑深度重构

Zheng Quan Shi Bao· 2025-11-03 12:17

Core Insights - The performance of the new consumption sector shows significant divergence, with companies like Pop Mart achieving impressive growth, while the capital market reacts with valuation adjustments [1] - The pet economy continues to attract capital attention, with companies like Zhongchong and Guai Bao Pet reporting steady growth, yet facing valuation declines [1] - The beauty economy, represented by companies like Aimeike and Huaxi Biological, is experiencing notable declines in performance [1] IP Economy Performance - Pop Mart reported a substantial revenue increase of 245%-250% year-on-year for Q3 2025, continuing its high growth trend from the first half of the year [2] - In the Chinese market, revenue grew by 185%-190%, with online channels surging by 300%-305% and offline channels by 130%-135% [2] - Overseas revenue skyrocketed by 365%-370%, with the Americas showing an extraordinary growth of 1265%-1270% [2] - Light Media also saw significant growth, with Q3 revenue reaching 3.616 billion yuan, a 150.81% increase, and net profit soaring by 406.78% [2][3] Pet Economy Trends - Zhongchong reported Q3 revenue of 3.860 billion yuan, up 21.05%, and net profit of 333 million yuan, up 18.21% [4] - Guai Bao Pet achieved Q3 revenue of 4.737 billion yuan, a 29.03% increase, with net profit growing by 9.05% [4] - Despite high market demand, the pet economy faces challenges from homogenization and increased competition [5] Beauty Economy Challenges - Aimeike's Q3 revenue fell by 21.49% to 1.865 billion yuan, with net profit down 31.05% [6] - Huaxi Biological reported a revenue decline of 18.36% to 3.163 billion yuan, with net profit decreasing by 30.29% [6] - Beitaini's revenue dropped by 13.78% to 3.464 billion yuan, with net profit down 34.45% [6] - The medical beauty industry is undergoing a strategic transformation, with a focus on high-end markets and new materials gaining attention [6][7]

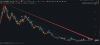

贝泰妮业绩陷颓势:前三季度业绩双降、销售费用率破新高达53% 上半年全渠道承压且薇诺娜销售额下滑

Xin Lang Zheng Quan· 2025-10-31 09:47

Core Viewpoint - Beitaini is experiencing significant operational challenges, reflected in its declining revenue and net profit for the first three quarters, despite a slight recovery in the third quarter [1][4][10] Financial Performance - For the first three quarters, Beitaini reported revenue of 3.464 billion yuan, a year-on-year decrease of 13.78%, and a net profit of 272 million yuan, down 34.45% year-on-year [1][4] - In the third quarter alone, the company achieved a net profit of 25.22 million yuan, marking a return to profitability, but this does not offset the overall performance decline [1][4] Market Position and Valuation - Beitaini's market capitalization has dropped significantly from over 120 billion yuan at its peak to approximately 19 billion yuan, indicating a loss of over 100 billion yuan in market value since its IPO [2][4] - The stock price has fallen below its initial offering price, reflecting investor concerns about the company's growth prospects [2] Revenue Channels - All three major revenue channels (online, OMO, and offline) have shown declines, with offline sales plummeting by 41.6% [6] - Specific declines in major e-commerce platforms include a 10.5% drop in Alibaba, 22.1% in JD.com, and 18.9% in Vipshop, while Douyin was the only platform to show a 7.4% increase [6] Product Performance - The core product categories, skincare and cosmetics, saw revenue declines of 12.0% and 7.1%, respectively, with skincare accounting for 85% of total revenue [6][7] - The primary brand, Winona, generated 1.95 billion yuan in revenue for the first half of 2025, representing 82.17% of total revenue, but its growth has slowed significantly [7] Strategic Initiatives - To mitigate reliance on its main brand, Beitaini is diversifying its product offerings, including launching new brands and acquiring existing ones [7] - However, the development of new brands requires substantial investment and may take time to yield results, leading to revised profit forecasts for 2025-2027 [7][9] Profitability Challenges - Despite a slight increase in gross margin to 74.3%, the company's expense ratio has risen to 67.7%, with sales expenses reaching a record high of 53.1%, squeezing profit margins [10][12] - The sales expense ratio has increased significantly over the years, indicating that a large portion of revenue is being consumed by marketing without driving growth [12]

贝泰妮三季度业绩持续低迷,出海与线下战略何时见效?

Guan Cha Zhe Wang· 2025-10-31 09:28

Core Viewpoint - After returning to profitability in the third quarter, Betaini announced a share reduction by its second-largest shareholder, Sequoia Capital, which sold 8.43 million shares, accounting for 2% of the total share capital, raising 368 million yuan [1][2][3] Shareholder Actions - Sequoia Capital's share reduction was executed through a block trade, reducing its holding to 7.66% [2] - Since the lifting of the share lock-up in 2022, Sequoia has completed five rounds of reductions, cashing out nearly 6 billion yuan [2][4] - Other shareholders, including the controlling family of the actual controller, have also been reducing their stakes, indicating a broader trend of capital exit [4][5] Financial Performance - In Q3, Betaini reported a net profit of 252 million yuan, a year-on-year increase of 136.55%, but this was largely driven by investment income rather than core business improvement [3][8] - For the first three quarters, the company experienced a revenue decline of 13.78% to 3.464 billion yuan and a net profit drop of 34.45% to 272 million yuan, marking the first time in six years that both revenue and net profit declined [8][6] Market Challenges - The company's reliance on e-commerce and key opinion leaders (KOLs) for sales has become unsustainable, leading to a decline in profitability [3][11] - Betaini's core brand, Winona, contributed 82.17% of revenue in the first half of 2025, facing increasing competition and declining growth rates [17][18] Strategic Adjustments - The company is focusing on optimizing its multi-channel strategy and expanding its overseas business, particularly in Thailand and other international markets [12][16] - Betaini has implemented cost-cutting measures, reducing sales and management expenses while maintaining a stable R&D investment rate [13][15] Future Outlook - Investors are closely monitoring Betaini's ability to diversify its brand portfolio and reduce dependence on Winona to establish sustainable growth [18]

化妆品板块10月31日跌0.58%,嘉亨家化领跌,主力资金净流出1.31亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-31 08:48

Market Overview - The cosmetics sector experienced a decline of 0.58% on October 31, with Jiaheng Jiahua leading the drop [1] - The Shanghai Composite Index closed at 3954.79, down 0.81%, while the Shenzhen Component Index closed at 13378.21, down 1.14% [1] Individual Stock Performance - Notable gainers included: - Qingsong Co., Ltd. (300132) with a closing price of 7.23, up 5.39% [1] - Lafang Jiahua (603630) at 22.74, up 3.04% [1] - Shuiyang Co., Ltd. (300740) at 20.43, up 2.82% [1] - Jiaheng Jiahua (300955) saw a significant decline, closing at 35.66, down 5.01% [2] - Marubi Biotechnology (603983) also fell, closing at 34.53, down 4.16% [2] Trading Volume and Capital Flow - The cosmetics sector had a net outflow of 131 million yuan from main funds, while retail investors saw a net inflow of 214 million yuan [2] - The trading volume for Qingsong Co., Ltd. was 329,200 shares, with a transaction value of 23.5 million yuan [1] - Jiaheng Jiahua had a trading volume of 50,300 shares, with a transaction value of 183 million yuan [2] Capital Flow Analysis - Shanghai Jahwa (600315) had a net inflow of 11.76 million yuan from main funds, but a net outflow of 23.52 million yuan from retail investors [3] - Other companies like Lafang Jiahua and Qingsong Co., Ltd. also experienced mixed capital flows, with retail investors showing some interest despite overall outflows from main and speculative funds [3]

梓渝引爆2亿GMV、杨幂穿背背佳上热搜,杨颖代言企鹅引争议,谁是双十一有效代言?

Xin Lang Cai Jing· 2025-10-31 05:49

Core Insights - The difficulty in selecting female celebrities as brand ambassadors is highlighted, with brands finding it easier to choose male stars who can deliver strong sales and high cost-effectiveness [1][12] - The marketing landscape for apparel and beauty brands has intensified as they prepare for the Double Eleven shopping festival, with a significant increase in the number of celebrity endorsements [3][29] - The emergence of new celebrities, including athletes and actors from popular dramas, is reshaping the endorsement market, leading to a focus on short-term collaborations aimed at immediate sales conversion [7][12] Group 1 - The number of announced celebrity endorsements reached 290 in the last 30 days leading up to October 26, averaging nearly 10 new endorsements per day [3] - Brands are increasingly prioritizing endorsements that can drive direct sales and enhance visibility during the critical Double Eleven period [7][12] - The trend of short-term collaborations emphasizes the need for brands to create buzz and drive traffic quickly, with a focus on event-driven marketing [7][12] Group 2 - The endorsement strategies for Double Eleven differ from regular campaigns, with brands seeking to maximize sales conversion and brand visibility through targeted celebrity partnerships [11][12] - Successful case studies, such as the collaboration between Duck Duck and celebrity Ziyu, demonstrate the effectiveness of quick and strategic partnerships in achieving high sales volumes [8][40] - Brands are increasingly looking for ambassadors who not only have strong fan engagement but also align with the brand's image and values, as seen in the partnerships with high-profile celebrities like Yang Mi and Di Li Re Ba [14][48] Group 3 - The apparel and beauty sectors dominate the endorsement market, accounting for over half of the total endorsements, driven by the high consumer demand during Double Eleven [29][31] - Brands are leveraging the popularity of emerging celebrities to enhance brand recognition and drive sales, particularly in the competitive apparel market [31][42] - The integration of celebrity endorsements with platform-specific marketing strategies is becoming essential, as brands seek to optimize their reach and engagement during major sales events [34][36]

贝泰妮(300957):2025年三季报点评:扭亏为盈,仍在调整

Huachuang Securities· 2025-10-31 04:53

Investment Rating - The report upgrades the investment rating of the company to "Recommended" with a target price of 48.92 CNY [2][8]. Core Insights - The company has turned profitable, showing signs of operational improvement with a focus on cash flow enhancement. For the first three quarters of 2025, total revenue was 3.464 billion CNY, down 14% year-on-year, while net profit attributable to shareholders was 272 million CNY, a decrease of 34% year-on-year. The gross margin improved to 74.3% [2][8]. - The company is actively adjusting its product and channel strategies to enhance profitability, focusing on core products and optimizing channel operations [2][8]. - The sub-brand Aikeman is expanding through multiple channels, targeting high-end consumers and leveraging the company's R&D capabilities to strengthen its market position [2][8]. Financial Performance Summary - For 2025, the company is projected to have total revenue of 5.406 billion CNY, a decrease of 5.8% year-on-year, with a net profit of 412 million CNY, down 18% year-on-year. The earnings per share (EPS) is expected to be 0.97 CNY [4][5]. - The company’s gross margin is expected to improve slightly to 74.9% in 2025, with a net margin of 7.6% [4][5]. - The company’s cash flow from operating activities is projected to be 416 million CNY in 2025, indicating a significant improvement in cash flow management [9].

QFII选股“各有所好”,第三季度超120只A股获增持

Zheng Quan Shi Bao· 2025-10-30 23:16

Group 1 - The QFII system has become a significant channel for foreign capital to enter the A-share market since its introduction in 2002, with distinct stock selection preferences and investment styles compared to domestic funds [1][8] - In the third quarter, at least 121 stocks were increased in holdings by QFII, with the most significant increases not in the semiconductor sector but in electrical equipment, machinery, hardware, and chemicals [2][3] - Major QFII institutions like Morgan Stanley and Abu Dhabi Investment Authority have continued to increase their positions in A-shares, with a focus on a diversified portfolio of stocks [1][2] Group 2 - The top five industries with the most significant QFII increases in holdings in the third quarter were machinery, hardware equipment, electrical equipment, semiconductors, and chemicals [2] - Notably, only one stock from the banking sector, Nanjing Bank, was among the top 20 stocks increased by QFII, with a significant increase of 124 million shares by BNP Paribas [4] - Abu Dhabi Investment Authority has a concentrated investment style, holding only 22 stocks, and has made selective increases and decreases in its holdings, including a notable reduction in its stake in Zijin Mining [5][6] Group 3 - The GATES FOUNDATION TRUST has a concentrated portfolio with a preference for small-cap stocks, holding only two stocks at the end of the third quarter [6] - The Macau Monetary Authority has been active in increasing its holdings, particularly in the non-ferrous metals, food and beverage, and automotive sectors [7] - The QFII system is expected to expand further, with over 900 qualified foreign investors and ongoing reforms aimed at making it easier for foreign investors to participate in the Chinese market [8]