可控核聚变

Search documents

大幅拉升!刚刚,A股刷屏!

券商中国· 2025-10-28 04:45

Core Viewpoint - The A-share market has shown significant movements across multiple sectors, with the Shanghai Composite Index surpassing 4000 points for the first time since August 2015, driven by strong performances in sectors such as controllable nuclear fusion, domestic software, PCB, and commercial aerospace [1][3]. Sector Summaries Controllable Nuclear Fusion - Controllable nuclear fusion stocks have been on a continuous rise, with companies like Dongfang Tantalum and Antai Technology experiencing multiple trading halts due to price increases. Recent reports indicate that key materials for "artificial sun" technology have achieved domestic industrialization [1][7]. - The research team led by Rong Lijian has successfully developed high-purity ton-level Hastelloy C276 metal substrates for superconducting materials, overcoming previous technological bottlenecks [7][8]. - The second-generation high-temperature superconducting tape is crucial for creating strong magnetic fields necessary for plasma confinement, marking a significant advancement in clean energy exploration [8][9]. PCB Sector - PCB concept stocks have collectively strengthened, with companies like Aisen Co. and Meilian New Materials seeing gains exceeding 11%. Shengyi Technology has also reported a significant increase in revenue and profit forecasts, with expected revenue growth of 108% to 121% year-on-year [4]. Domestic Software - Domestic software stocks have shown active performance, with several companies reaching their daily price limits. The 20th National Congress has emphasized the importance of new productivity and technological self-reliance, suggesting a favorable policy environment for domestic software and hardware companies [4]. Commercial Aerospace - The commercial aerospace sector has rebounded, with companies like Aerospace Development and Aerospace Technology seeing strong stock performance. Recent successful tests of the Tianlong-3 rocket have set new records for satellite deployment in China, indicating advancements in the commercial aerospace industry [4][9]. Financial Sector - The financial sector has also shown notable movements, with companies like Ruida Futures and Huijin Co. experiencing significant price increases, reflecting a broader positive sentiment in the market [5]. Currency and Policy Impact - The onshore RMB has appreciated against the USD, reaching its highest level since November 2024, which may enhance foreign investment in RMB-denominated assets. Additionally, the China Securities Regulatory Commission has introduced measures to optimize the Qualified Foreign Institutional Investor (QFII) system, aiming to create a more transparent and efficient investment environment [3].

吨级工业化制备!我国可控核聚变关键材料取得重要进展

Ke Ji Ri Bao· 2025-10-28 03:44

Core Insights - Significant progress has been made in the field of key materials for controllable nuclear fusion in China, with the successful development of the second-generation high-temperature superconducting tape core material, Hastelloy C276, marking a shift from reliance on imports [1][3] - The second-generation high-temperature superconducting tape is essential for constructing controllable nuclear fusion devices, often referred to as "artificial suns," as it generates the strong magnetic fields necessary to confine plasma at temperatures exceeding one hundred million degrees Celsius [3] Material Development - Researchers at the Institute of Metal Research, Chinese Academy of Sciences, achieved industrial-scale production of high-purity C276 alloy using a self-developed purification technology, producing it in ton-level quantities [3] - The team overcame technical challenges in processing ultra-thin and ultra-long tapes, successfully rolling the alloy into a tape with a thickness of only 0.046 mm, a width of 12 mm, and a length exceeding 2000 meters, with a surface smoothness of less than 20 nanometers [3] - The C276 material exhibits exceptional strength at liquid nitrogen temperatures, capable of supporting approximately 19 tons of weight over an area the size of a fingernail, and retains excellent performance even after high-temperature treatment [3] Application and Validation - The domestically produced C276 has been validated by multiple enterprises and has successfully been used to create high-temperature superconducting tapes that meet international performance standards, contributing to relevant domestic technology projects [3]

A股午评 | 沪指时隔十年再度站上4000点 福建板块延续强势 贵金属概念等跌幅居前

智通财经网· 2025-10-28 03:43

Core Viewpoint - The A-share market has seen the Shanghai Composite Index rise above 4000 points for the first time in ten years, marking a significant milestone since August 19, 2015, with a half-day trading volume of 1.35 trillion yuan, down 215.6 billion yuan from the previous trading day [1][2]. Historical Context - The Shanghai Composite Index has previously crossed the 4000-point mark twice: in May 2007 and April 2015. In both instances, the index experienced short-term selling pressure but continued to rise significantly within six months, reaching 6124 points (up 53%) in October 2007 and 5178 points (up nearly 30%) in June 2015 [2][3]. Current Market Dynamics - The current market is characterized by rapid rotation of hot sectors, with significant movements in the financial sector and strong performances in the Fujian and controlled nuclear fusion sectors. Notable stocks include Pingtan Development and Antai Technology, which have shown substantial gains [1][4][6]. Sector Highlights 1. **Fujian Sector**: The Fujian sector continues to perform strongly, with Pingtan Development achieving six consecutive trading limits. The opening of a new international flight route is expected to benefit local stocks [4]. 2. **Controlled Nuclear Fusion**: Stocks related to controlled nuclear fusion have gained traction, with Antai Technology and others showing strong performance following announcements about China's "artificial sun" project [6]. 3. **Technology and Innovation**: The emergence of AI models like DeepSeek-R1 is driving innovation across various sectors, positioning China at the forefront of technological advancements [3]. Future Market Outlook - Analysts suggest that the Chinese stock market is entering a "transformation bull market," driven by new financial policies and capital market reforms. Key sectors to watch include technology, new materials, and financial stability [7][8][9]. - The market is expected to maintain a strong performance in the short term, supported by favorable policy signals and improving corporate earnings [8][10]. Industry Focus Areas - Key industries to monitor include AI, chips, robotics, batteries, innovative pharmaceuticals, non-ferrous metals, machinery, military, social services, and large financial institutions [11].

沪指十年磨一剑再破4000点,科技股成领涨引擎,迎来新纪元!

Sou Hu Cai Jing· 2025-10-28 03:42

Group 1 - The overall market sentiment is positive, with external markets experiencing significant gains while A-shares show modest increases, indicating a potential breakthrough of the 4000-point mark soon [1] - The technology sector is expected to see unprecedented development opportunities during the "14th Five-Year Plan" period, with a focus on high-value-added areas of the industrial chain, driven by product innovation and policy support [1] - The domestic software sector is transitioning from an optional choice to a necessity, with the market size driven by government procurement expected to reach 1.2 trillion yuan by 2027, reflecting a compound annual growth rate of approximately 18% [3] Group 2 - The Shanghai Composite Index has shown resilience, attempting to break through the 4000-point level, influenced by easing global trade tensions and anticipated interest rate cuts by the Federal Reserve [5] - The market is witnessing a shift towards small and mid-cap stocks, with the ChiNext Index also recovering quickly from declines, indicating a broader market trend [5] - The nuclear fusion sector continues to gain momentum, with projections indicating that the global nuclear fusion market could exceed 40 trillion dollars by 2050, highlighting significant growth potential [3]

A股可控核聚变概念股强势,为中央定调6大未来产业,机构称看好产业趋势向上!安泰科技、东方钽业涨停,西部超导涨9%,爱科赛博涨8%

Ge Long Hui· 2025-10-28 03:36

Core Viewpoint - The A-share market is experiencing a collective rise in controllable nuclear fusion concept stocks, driven by recent policy announcements that highlight the importance of quantum technology and nuclear fusion as new economic growth points [1][2]. Group 1: Stock Performance - An Tai Technology (000969) and Dongfang Tantalum (000962) both reached the daily limit up of 10% [1]. - Western Superconducting (688122) increased by 9.09%, while Aikosebo rose by 8.47% [1][2]. - Yongding Co. (600105) saw a rise of 7.26%, and Jinbei Electric (002533) increased by 5.20% [1][2]. - Other notable performers include Jingda Co. (600577) with a 5.10% increase and Xuguang Electronics (600353) with a 4.66% rise [1][2]. Group 2: Market Context - On October 24, the Central Committee proposed the 15th Five-Year Plan, emphasizing the development of future industries, including quantum technology and nuclear fusion [2]. - The report from Guojin Securities indicates that these sectors are expected to receive top-level policy support and funding, enhancing their growth potential [2].

沪指上探4000点

Zheng Quan Shi Bao· 2025-10-28 03:23

Market Overview - On October 28, the A-share market saw all three major indices open lower but then rise, with the Shanghai Composite Index surpassing the 4000-point mark for the first time in 10 years, closing at 4000.22, up 0.08% [1][2]. Sector Performance - The Shenzhen Component Index reached 13506.13, with a slight increase of 0.12%, while the ChiNext Index surged by 40.55% to 3252.37 [2]. - Sectors that performed well included mineral products, transportation services, and trade agency, while coal, communication equipment, semiconductors, components, internet, and non-ferrous metals sectors faced declines [2]. Fujian Sector Strength - The Fujian sector continued its strong performance, with Pingtan Development (000592) achieving six consecutive trading limits in eight days, and Fujian Cement securing two consecutive trading limits [4]. - The opening of the first fifth freedom passenger route from Cambodia to Fuzhou and Tokyo is seen as a significant milestone for Fujian's openness and business environment [5]. New Listings - Eight Horse Tea's stock surged over 70% on its debut, trading at 85.9 HKD per share, with a global offering of 9 million shares and a net fundraising of approximately 390 million HKD [12][13]. - Cambridge Technology also saw a strong debut, with its stock rising over 50% initially and closing with a 44% increase, focusing on connection and data transmission devices [14][15]. Emerging Concepts - The controllable nuclear fusion concept saw initial gains, with companies like Antai Technology and Dongfang Tantalum Industries experiencing price increases [6][8]. - The domestic software sector also showed upward movement, with stocks like Rongji Software hitting the daily limit [10].

可控核聚变板块盘初冲高

Di Yi Cai Jing· 2025-10-28 03:10

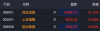

Core Insights - Nuwei Co., Dongfang Tantalum Industry reached new highs, while Antai Technology hit the daily limit up, indicating strong market performance in these companies [1] - Other companies such as Haheng Huaton, Changfu Co., Hezhuan Intelligent, and Western Superconducting also experienced upward movement, reflecting a positive trend in the sector [1] Company Performance - Nuwei Co. and Dongfang Tantalum Industry achieved record highs, showcasing their strong market position and investor confidence [1] - Antai Technology's stock reached the daily limit up, indicating significant investor interest and potential growth prospects [1] - Haheng Huaton, Changfu Co., Hezhuan Intelligent, and Western Superconducting followed suit with notable increases, suggesting a broader positive sentiment in the industry [1]

300300,20cm涨停!

Zhong Guo Ji Jin Bao· 2025-10-28 02:56

Market Overview - The A-share market opened lower on October 28, with the ChiNext index initially down by 0.9% but later rebounding to positive territory [2] - The Hong Kong stock market opened high but fell, with all three major indices in the red, and Li Ning leading the decline with a drop of over 4% [3] Sector Performance - Defense, telecommunications, transportation, and power equipment sectors showed strong gains, while beauty care, banking, and coal sectors remained sluggish [3] - Fujian local stocks and concepts related to controllable nuclear fusion were particularly active, with several stocks hitting their daily limit up [5][8] Fujian Local Stocks - Fujian local stocks saw significant strength, with Haixia Innovation (300300) hitting a 20% limit up for two consecutive days, and Pingtan Development (000592) achieving its sixth consecutive limit up [5] - Other notable performers included Fujian Cement (600802) with a 10.08% increase, and Xiamen Port (000905) and Xiamen Airport (600897) both hitting their daily limit up [6] Controllable Nuclear Fusion Sector - The controllable nuclear fusion sector remained active, with stocks like Antai Technology (000969) and Dongfang Tantalum (000962) hitting their daily limit up [8] - The global nuclear fusion market is projected to exceed $40 trillion by 2050, with significant investment opportunities anticipated if commercial nuclear fusion power plants are realized [10] Banking Sector - The banking sector experienced a sharp decline, with Shanghai Pudong Development Bank (600000) dropping over 5% during the session [11] - Other banks also saw declines, including Jiangyin Bank (002807) and China Everbright Bank (601818), with most major banks reporting losses [12]

可控核聚变概念拉升 安泰科技、东方钽业斩获两连板

Zheng Quan Shi Bao Wang· 2025-10-28 02:40

Core Viewpoint - The concept of controllable nuclear fusion is gaining momentum in the market, with significant stock price increases for companies involved in this sector, indicating strong investor interest and potential growth opportunities [1]. Group 1: Market Performance - Companies such as Antai Technology and Dongfang Tantalum have reached their daily price limits, while Western Superconducting has increased by over 9%, and Yongding shares have risen nearly 8% [1]. - Other companies like Hezhu Intelligent have also seen stock price increases of over 5% [1]. Group 2: Technological Breakthroughs - A research team led by researcher Rong Lijian from the Institute of Metal Research, Chinese Academy of Sciences, has achieved a breakthrough in the metal-based technology for second-generation high-temperature superconducting tapes, successfully industrializing high-purity ton-level Hastelloy (C276) metal substrates [1]. - The Chinese "artificial sun" project is expected to be completed by 2027, potentially becoming the first device in human history to achieve fusion power generation [1]. Group 3: Industry Development - According to Everbright Securities, since 2025, China's nuclear fusion sector has entered a rapid development phase characterized by technological breakthroughs and industrial layout [1]. - Key milestones include the transition of "China Circulation No. 3" into a new phase of combustion testing in March, the establishment of China Fusion Energy Co., Ltd. in July, and the successful installation of critical components for the BEST device in October [1]. - The industry is expected to accelerate with multiple technological routes being pursued, including the Circulation No. 4, Spark No. 1, and laser fusion power station projects led by academic teams, indicating a promising long-term outlook for controllable nuclear fusion projects [1].

顶层部署+业绩修复,国防军工逆市领涨!西部超导盘中暴拉10%,512810强势突破60日均线!

Xin Lang Ji Jin· 2025-10-28 02:27

Core Insights - The defense and military sector is showing strong performance in the market, leading with a 1.14% increase and a trading volume of 22.5 billion [1] - Recent policy developments, particularly the "15th Five-Year Plan," emphasize the importance of national defense, which is expected to create significant market opportunities [3] - The third-quarter financial reports indicate a robust recovery in the defense and military sector, with 27 out of 32 ETF component stocks reporting profits, and many showing substantial year-on-year growth [3] Group 1: Market Performance - The defense and military sector is outperforming other sectors, with a trading volume of 225 billion and a 1.14% increase [1] - The popular defense military ETF (512810) has seen a rapid increase of over 1%, breaking through key moving averages [1] - Key stocks such as Western Superconducting and Tianhai Defense have shown significant price increases, with Western Superconducting rising over 10% [1] Group 2: Policy Developments - The "15th Five-Year Plan" highlights the enhancement of national defense capabilities, positioning it alongside economic and technological advancements [3] - The plan aims to foster emerging industries, particularly in low-altitude economy, commercial aerospace, and deep-sea technology, which are closely aligned with the defense sector [3] - Analysts believe these developments could lead to the emergence of several trillion-dollar markets, benefiting companies within the defense and military ecosystem [3] Group 3: Financial Performance - Among the 32 component stocks of the defense military ETF that have reported third-quarter results, 27 have achieved profitability, with half of them showing double-digit growth year-on-year [3] - Notable financial performances include Chujiang New Materials with a 20-fold increase in net profit, and other companies like Gaode Infrared and Huafeng Technology also reporting significant profit growth [3][4] - The overall positive financial trends reinforce the expectation of strong demand recovery in the defense sector for 2025-2026 [4]