数据中心电源

Search documents

调研速递|伊戈尔接受高毅资产等40余家机构调研 海外工厂新能源变压器月产能合计1200台

Xin Lang Zheng Quan· 2025-11-30 15:39

Core Viewpoint - Igor Electric Co., Ltd. held a targeted on-site research event with over 40 institutional representatives, discussing key topics such as overseas factory capacity layout, new energy customer expansion, data center power business trends, and future strategic planning [1] Group 1: Research Event Overview - The investor relations activity was categorized as a targeted research event, conducted on-site in Jijiang District, Ji'an City, Jiangxi Province [2] - Participating institutions included a diverse range of entities such as securities firms, funds, private equity, and proprietary trading, with notable representatives from firms like Ping An Fund, Huaxia Fund, and CICC [3] Group 2: Key Research Insights - **Overseas Factory Capacity**: The company has established production facilities in Thailand and Mexico, with Thailand's factory fully operational at a monthly capacity of 700 new energy transformers. The Mexican factory is in the testing phase and is expected to reach a monthly capacity of 500 transformers by mid-2026. The U.S. factory focuses on distribution transformers with an annual capacity of 21,000 units [4] - **Overseas Customer Expansion**: The company has formed partnerships with leading EPC clients in North America and is gradually establishing collaborations with energy storage customers in Europe and the U.S. This expansion is driven by the gradual release of overseas capacity and increasing global demand for transformers, particularly in new energy applications [5] - **Data Center Power Solutions**: The company noted that current global data center power solutions primarily use UPS, with some adopting HVDC solutions. The release of NVIDIA's 800V architecture is expected to enhance the penetration of HVDC solutions. The company has focused on developing phase-shifting transformers and dry-type transformers for data centers, with production capacity expected to be released by mid-2025, expanding sales to markets in Japan, the U.S., and Malaysia [6] Group 3: Strategic Goals and H-Share Issuance - The management highlighted the strategic significance of issuing H-shares to enhance brand recognition and support overseas business expansion. The raised funds will be allocated for R&D, production facility construction, global manufacturing system layout, and operational capital [7] - The current operational goals focus on building and releasing domestic and overseas capacity, enriching the product matrix, and enhancing core competitiveness, with specific performance targets referenced in the 2024 stock option and restricted stock incentive plan [7]

麦格米特(002851) - 2025年10月30日投资者关系活动记录表

2025-10-30 15:10

Financial Performance - The company's net profit for the first three quarters has declined, primarily due to a decrease in gross margin and an increase in expense ratio [3] - Gross margin has been affected by intensified price competition in the consumer appliance sector, with a notable impact on the third quarter [4] - Excluding the variable frequency appliance division, other divisions saw a revenue increase of approximately 29% year-on-year [4][9] R&D and Strategic Focus - The company is heavily investing in R&D, particularly in AI, new energy, and smart home sectors, with a focus on long-term growth [5][10] - A significant increase in R&D and management expenses is attributed to the establishment of overseas bases and ongoing projects [3][4] - The company aims to integrate its energy storage and AI power supply teams to provide comprehensive power solutions for AI data centers [8][10] Market Opportunities and Growth Potential - The company identifies strong growth opportunities in data center power, new energy vehicles, energy storage, and smart appliances [4][10] - The AI industry is viewed as a critical growth area for the next decade, with substantial resources allocated for development [5][11] - The company has established partnerships with major energy storage firms and system solution providers, indicating positive progress in this sector [8] Challenges and Competitive Landscape - The company faces challenges in balancing high R&D costs with market demand and growth speed, particularly in the variable frequency appliance sector due to external factors like weather [9] - The AI server power market is complex, requiring significant effort to navigate customer needs and certification processes [7] - Despite competition from established players, the company is confident in its ability to grow within the AI sector by leveraging its technological advantages and customer relationships [11]

【午报】三大指数均跌超1%,防御性板块逆势走强,农业银行再创新高

Xin Lang Cai Jing· 2025-10-17 04:25

Market Overview - The market experienced a downward trend with the ChiNext Index falling over 2% and the Shanghai Composite Index down 1% [1] - The total trading volume in the Shanghai and Shenzhen markets was 1.18 trillion yuan, a decrease of 32.6 billion yuan compared to the previous trading day [1] - Defensive sectors such as coal and gas stocks showed strong performance, while data center power concepts faced significant declines [1][7] Coal Sector - The coal sector continued to perform well, with companies like Dayou Energy achieving a six-day streak of gains [1] - National Energy Administration's strict production checks have led to a continuous contraction in domestic coal output, which is expected to drive coal prices higher [3][27] - Analysts predict that coal prices will rebound in the fourth quarter, improving profitability for coal companies [27] Natural Gas Sector - The natural gas sector saw significant activity, with companies like Changchun Gas and Guo Xin Energy hitting their daily price limits [3][18] - The onset of winter heating demand has led to increased natural gas consumption, particularly in regions like Gansu [3][18] Banking Sector - The banking sector showed resilience, with Agricultural Bank of China reaching a historical high, and several other banks also experiencing gains [6] - China Construction Bank announced plans to increase support for new industrialization, aiming to provide over 5 trillion yuan in financing to various manufacturing entities over the next three years [6] Individual Stocks - A total of 33 stocks hit their daily limit up, with a sealing rate of 66%, indicating strong investor interest in certain stocks [1] - Notable performers included Dayou Energy, which achieved a 10% increase, and Antai Group, which also saw significant gains [2][28]

午评:创业板指跌2.37% 农业银行创历史新高

Zhong Guo Jin Rong Xin Xi Wang· 2025-10-17 04:09

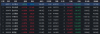

Market Overview - The market experienced a downward trend with the Shenzhen Component Index and ChiNext Index both falling over 2% [1] - As of the midday close, the Shanghai Composite Index reported 3877.20 points, down 1%, with a trading volume of 529.9 billion yuan; the Shenzhen Component Index was at 12825.85 points, down 1.99%, with a trading volume of 649.7 billion yuan; the ChiNext Index was at 2965.47 points, down 2.37%, with a trading volume of 279.4 billion yuan [1] - The total trading volume for both markets was 1.21 trillion yuan, a decrease of 57.8 billion yuan compared to the previous trading day [1] Sector Performance - The gas, precious metals, port shipping, and coal sectors showed strong performance, while wind power and photovoltaic sectors faced declines [1][2] - The port shipping sector continued its strong momentum, with Haitong Development achieving two consecutive trading limits [2] - Defensive sectors such as coal and gas stocks collectively strengthened, with Dayou Energy achieving five trading limits in six days [2] Institutional Insights - Honghan Investment noted a continuous decline in market trading volume, falling below 2 trillion yuan, indicating a shift of existing funds towards undervalued stocks [3] - Citic Securities highlighted a new action plan by the National Development and Reform Commission and the National Energy Administration to double the service capacity of electric vehicle charging facilities by 2027, which is expected to accelerate the construction of charging infrastructure [3] - The plan aims to establish 28 million charging facilities nationwide, providing over 300 million kilowatts of public charging capacity to meet the needs of over 80 million electric vehicles [3] Industry Developments - The photovoltaic industry is currently facing a supply-demand imbalance, with ongoing efforts to eliminate low-cost sales and consolidate production capacity [4] - The National Market Supervision Administration announced the establishment of a reporting system for fire incidents involving new energy vehicles, aiming to enhance regulatory oversight [5] - Huawei's Zhijie models are switching to CATL batteries due to insufficient production capacity from Zhongchuang Innovation, while maintaining the same vehicle pricing despite higher battery costs [6][7]

午评:创业板指半日跌2.37% 农业银行创历史新高

Xin Lang Cai Jing· 2025-10-17 03:42

Core Viewpoint - The market experienced a downward trend with the ChiNext Index falling by 2.37%, while Agricultural Bank reached a historical high [1] Market Performance - The market saw a decline in early trading, with the Shenzhen Component and ChiNext Index both dropping over 2% - The total trading volume in the Shanghai and Shenzhen markets was 1.18 trillion, a decrease of 32.6 billion compared to the previous trading day [1] Sector Performance - Defensive sectors showed strong performance, with coal and gas stocks rising collectively - Notable stocks included Daya Energy, which achieved five consecutive trading limits, and Guo Xin Energy, which had three limits in four days [1] - The banking sector experienced fluctuations, with Agricultural Bank rising over 2% to reach a historical high [1] Declining Stocks - The data center power concept faced significant losses, with stocks like Igor and Zhongheng Electric hitting the daily limit down - Major weight stocks such as Sungrow Power Supply, ZTE Corporation, and Luxshare Precision fell sharply [1] Overall Index Movement - By the end of the trading session, the Shanghai Composite Index fell by 1%, the Shenzhen Component dropped by 1.99%, and the ChiNext Index decreased by 2.37% [1]

看涨回升

第一财经· 2025-10-15 10:44

Market Overview - The A-share market shows a broad upward trend, with the Shanghai Composite Index recovering above the 3900-point mark, driven by emerging industries such as robotics, innovative pharmaceuticals, and data center power supply [4][10] - The ChiNext Index leads the gains among the three major indices, supported by the automotive, consumer electronics, and biopharmaceutical sectors [4] Market Performance - Over 4300 stocks rose today, indicating significant market profitability [5] - Emerging industries and traditional sectors are resonating, with a notable surge in the robotics concept and a collective rebound in innovative pharmaceuticals [5] - The automotive industry chain continues to strengthen, with both complete vehicles and components rising simultaneously [5] Trading Volume - The total trading volume in the two markets decreased by 19.5%, reflecting a "volume contraction rebound" characteristic, while maintaining high market activity [6] - Growth-oriented and cyclical sectors contributed significantly to the trading volume, while previously popular high-valuation sectors showed weaker performance [6] Fund Flow - Institutional investors are actively reallocating, with significant increases in sectors such as chemical pharmaceuticals, consumer electronics, and automotive [8] - Conversely, previously strong sectors like semiconductors and specialized equipment are experiencing sell-offs by major funds [8] - Retail investors remain active, with funds flowing into short-term gain sectors like robotics, innovative pharmaceuticals, and automotive [8] Investor Sentiment - Retail investor sentiment shows a high level of engagement, with a 75.85% participation rate [9] - The sentiment indicates a mix of strategies, with 25.59% of investors increasing their positions and 17.63% reducing them, while 56.78% remain unchanged [14]

10月15日连板股分析:连板股晋级率不足一成 午后机器人板块爆发

Xin Lang Cai Jing· 2025-10-15 07:54

Group 1 - The core viewpoint of the article highlights the underperformance of consecutive limit-up stocks, with a promotion rate of less than 10% for these stocks [1] - A total of 65 stocks reached the daily limit, with only 7 consecutive limit-up stocks, and only 1 stock achieved three consecutive limit-ups [1] - The overall market saw over 4,300 stocks rise, with more than 100 stocks hitting the daily limit or increasing over 10%, indicating a broader market strength despite the weak performance of consecutive limit-up stocks [1] Group 2 - The robotics sector experienced a significant surge in the afternoon, with over 20 stocks hitting the daily limit or increasing by more than 10%, including companies like Heshun Electric and Meili Technology [1] - The data center power supply concept became active again, with stocks like Jingquanhua and Sifang Co. showing strong performance, and Goldman Sachs revised its forecast for global data center electricity demand in 2030, projecting a substantial increase of 175% compared to 2023 [1]

A股收评:沪指重回3900点 全市场超4300只个股上涨

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-15 07:49

Market Overview - The Shanghai Composite Index rose over 1%, reclaiming the 3900-point mark, while the ChiNext Index increased by over 2% [1] - The Shanghai and Shenzhen markets recorded a total trading volume of 2.07 trillion yuan, a decrease of 503.4 billion yuan compared to the previous trading day [1][7] Sector Performance - The robotics sector saw significant activity, with stocks like Wuzhou New Spring and Sanhua Intelligent Control hitting the daily limit [2] - The airport and shipping sector experienced a rebound, with Huaxia Airlines reaching the daily limit [3] - The pharmaceutical sector remained strong throughout the day, with stocks such as Anglikang also hitting the daily limit [4] - The data center power supply concept showed active performance, with Sifang Co. and Jingquanhua achieving two consecutive limits in four days [5] - Conversely, the port and shipping stocks collectively declined, with Nanjing Port and Lianyungang experiencing significant drops [6] Individual Stock Highlights - Northern Rare Earth led in trading volume with 16.62 billion yuan, while other notable stocks included Sunshine Power, Shenghong Technology, Luxshare Precision, and CATL, which also had high trading volumes [8]

20cm涨停!新雷能抛出5折股权激励计划,公司回应

2 1 Shi Ji Jing Ji Bao Dao· 2025-09-30 10:53

Core Viewpoint - The company has announced a restricted stock incentive plan to attract and retain talent, aligning the interests of shareholders, the company, and core team members, while also planning an employee stock ownership plan for 2025 [2][3] Incentive Plan Details - The company plans to grant up to 7.05 million restricted stocks, accounting for approximately 1.30% of the total share capital, with an initial grant of 6.05 million shares to 283 core employees at a price of 9.15 yuan per share, which is about 50% of the closing price on September 29 of 18.70 yuan [2] - The restricted stocks will be sourced from a directed issuance or secondary market repurchase, and the company has confirmed that the stock repurchase will not affect future cash flow [3] Financial Performance - The company reported a net cash flow from operating activities of -69.17 million yuan for the first half of 2025, a decrease of 37.80% year-on-year, primarily due to slow customer payment collections, a common issue in the industry [3] - For the first half of 2025, the company achieved total operating revenue of 552 million yuan, a year-on-year increase of 12.93%, but reported a total profit of -9.4 million yuan, a decrease of 28.34%, and a net profit attributable to shareholders of -9.5 million yuan, down 39.82% year-on-year [3][4] Profit Decline Reasons - The decline in profit is attributed to increased expenses across sales, R&D, management, and finance, as well as a reduction in gross margin due to product price cuts and the need for scale efficiency, which is a challenge faced by the entire industry [4] - The revenue from power supply and motor drive products was 501 million yuan, accounting for 90.71% of total revenue, with a gross margin of 37.42%, marking a historical low for the same period [4] New Business Development - The company is focusing on expanding into the data center power supply sector, which has garnered significant market attention, with a 20% increase in stock price on September 30 within the data center power supply concept sector [4][5] - The company has indicated that data center power supply is a strategic direction for future development, although it is still in the market promotion phase and represents a relatively small portion of overall business [5] Industry Outlook - The industry is expected to have substantial growth potential, with major players like Alibaba driving demand for AI data center infrastructure, which could benefit the company as it expands its presence in the data center power supply market [5]

存储芯片涨价潮下,A股投资机会几何?三大指数拉升揭示答案

Sou Hu Cai Jing· 2025-09-30 03:55

Market Overview - The financial markets have reached new highs, influenced by a 25 basis point rate cut by the Federal Reserve in September, leading to a reduction in positions by institutions ahead of the National Day holiday [1] - The A-share market has struggled to break through the 3900-point level, prompting some large funds to shift their focus to overseas markets [1] - October is expected to see a surge in Q3 earnings reports, alongside the gradual emergence of favorable policies, suggesting a need for strategic positioning in the A-share market [1] Semiconductor Industry - The trend of domestic chip replacement in China is becoming increasingly clear, regardless of the future trajectory of China-U.S. relations [1] - Domestic AI chip companies such as Huawei, Haiguang, and Kunlun have made significant breakthroughs in technology and commercialization, enhancing product performance and cost-effectiveness [1] - The domestic AI chip industry is experiencing a comprehensive integration from upstream advanced processes to downstream model acceleration, indicating a robust growth trajectory [1] Storage Chip Sector - The storage chip sector has shown strong performance, with stocks like Jiangbolong and Xiangnong Chip rising over 6% to reach new highs [3] - The CFM flash memory market has released a report projecting a price increase of over 10% for server eSSD in Q4 2025, and a price rise of approximately 10% to 15% for DDR5 RDIMM [3] Metals Sector - The non-ferrous metals sector opened significantly higher, with companies like Xiyes and Huaxi Nonferrous rising over 5% and reaching historical highs [4] - LME metal futures closed higher, with copper rising by $232 to $10,414 per ton, aluminum up by $24 to $2,679 per ton, and zinc increasing by $52 to $2,940 per ton [4] Market Sentiment - The Shanghai Composite Index opened higher but showed signs of consolidation, with a noticeable decrease in the number of rising stocks compared to the previous day [6] - The technology sector has not yet reached peak concentration, and continued inflow of incremental capital may lead to a short-term adjustment before potential upward movement [6] - The ChiNext Index experienced fluctuations but remained in positive territory, with active capital flow but fewer stocks showing significant gains [6] Sector Performance - In the latest trading session, sectors such as storage chips, small metals, lithium mining, and military industry led the gains, while banking, insurance, and wind power equipment sectors lagged [10] - A total of 2,810 stocks rose, with 47 hitting the daily limit, while 2,123 stocks fell, with 9 hitting the lower limit [10]