创新药产业链

Search documents

百普赛斯(301080):海外业务持续拓展驱动业绩高增长

HTSC· 2025-10-29 08:47

Investment Rating - The report maintains a "Buy" rating for the company [5][9]. Core Insights - The company has achieved significant revenue growth driven by the expansion of its overseas business, with 9M25 revenue reaching 613 million RMB, a year-on-year increase of 32.3% [1][5]. - The net profit attributable to the parent company for 9M25 was 132 million RMB, reflecting a year-on-year growth of 58.6% [1][5]. - The company is focusing on enhancing its sales and marketing efforts, particularly in international markets, which is expected to sustain its revenue growth [1][9]. Financial Performance - For 9M25, the company's sales, management, and R&D expense ratios decreased year-on-year, indicating effective cost control [2]. - The gross profit margin for 9M25 was 91.23%, showing a slight decline of 0.09 percentage points compared to the previous year [2]. - The report forecasts net profits for the years 2025 to 2027 to be 181 million, 234 million, and 297 million RMB, respectively, with growth rates of 46.1%, 29.2%, and 26.9% [3]. Valuation - The target price for the company's stock is set at 77.99 RMB, based on a 56x PE valuation for 2026, compared to the industry average of 38x [3][5]. - The report highlights the company's strong performance in both domestic and international markets, which supports the optimistic valuation [3][9].

大涨!“硬科技”爆发

Zhong Guo Zheng Quan Bao· 2025-10-27 14:44

Group 1: Market Performance - On October 27, the Shanghai Composite Index approached 4000 points, with the "hard technology" sector, including storage chips and optical modules, leading the gains [1][4] - The three major A-share indices collectively rose, with the ChiNext Index and the Sci-Tech Innovation 50 Index increasing by 1.98% and 1.50%, respectively [4] - Several ETFs related to communication and semiconductors saw gains exceeding 3%, with some 5G communication-themed ETFs rising over 5% [4] Group 2: ETF Trends - The semiconductor ETF (159801) tracking the National Securities Semiconductor Index has seen a net inflow of over 480 million yuan in October, bringing its total size to over 5.1 billion yuan [4] - The Hong Kong Stock Connect Technology ETF (159262) has continuously attracted net inflows for 11 weeks, with its latest size surpassing 5.7 billion yuan [5] - The chip equipment ETF (560780) has gained over 55% this year, with a net inflow of over 300 million yuan in October, bringing its size to over 1.6 billion yuan [5] Group 3: Gold ETFs - Gold ETFs and Shanghai Gold ETFs experienced a net inflow of over 15.5 billion yuan from October 20 to October 23, but saw a net outflow of nearly 2 billion yuan on October 24 [2][11] - The recent decline in gold prices is attributed to high short-term congestion and reduced geopolitical risks, according to Huazhang Fund [7] Group 4: Cross-Border ETF Premium Risks - Several fund managers have issued warnings regarding premium risks associated with cross-border ETFs, with many tracking indices like the Nasdaq 100 and Nikkei 225 showing premium rates above 5% as of October 27 [3][15]

药明康德业绩后高开逾7%,港股医药ETF(159718.SZ)涨逾1%

Xin Lang Cai Jing· 2025-10-27 02:09

Group 1 - The pharmaceutical sector opened high on October 27, with the Hong Kong pharmaceutical ETF (159718.SZ) rising by 1.02% [1] - Notable stocks such as WuXi AppTec (药明康德) reported a revenue of RMB 32.86 billion for the first three quarters of 2025, marking an 18.6% year-on-year increase, and a net profit of RMB 12.076 billion, up 84.84% [1] - WuXi AppTec expects its revenue for the full year to be adjusted from RMB 42.5-43.5 billion to RMB 43.5-44 billion, with a focus on its CRDMO core business [1] Group 2 - The CXO sector continues to show strong performance, with companies like WuXi AppTec, Boteng Co., and MEDPACE exceeding expectations [2] - The innovative drug industry chain fundamentals remain positive, supported by recent financing data and the sustainable trend of innovative drugs going global [2] - The Hong Kong pharmaceutical ETF (159718.SZ) offers a balanced composition, including innovative drugs, CXO, internet healthcare, and innovative medical devices, making it a convenient investment tool for the sector [2]

海外CXO业绩分析:看好外需型CXO

Huafu Securities· 2025-10-26 08:12

Investment Rating - The report maintains a rating of "Outperform" for the pharmaceutical and biotechnology sector, indicating a positive outlook compared to the broader market [7]. Core Insights - The overseas CXO industry is entering a phase of accelerated recovery, with significant investment opportunities in domestic and foreign demand-driven CXO companies. Key companies to focus on include WuXi AppTec, WuXi Biologics, and others [4][17]. - The macro-level investment trends show a recovery in BD transactions and mergers, while PE/VC financing is still lagging behind. The global biopharmaceutical financing amount for Q1-Q3 2025 was $19.26 billion, down 13.8% year-on-year, but close to the $20.71 billion level of the same period in 2023 [17][21]. - The micro-level performance of major overseas CXO companies indicates a positive trend, with new molecular businesses maintaining high growth rates. Companies are generally optimistic about their annual performance guidance [21][25]. Summary by Sections Weekly Market Review - The CITIC Pharmaceutical Index increased by 0.6% from October 20 to October 24, 2025, underperforming the CSI 300 Index by 2.7 percentage points. Year-to-date, the CITIC Pharmaceutical Biotech Index has risen by 20.5%, outperforming the CSI 300 Index by 2.1 percentage points [3][32]. - The top-performing stocks this week included Teva Pharmaceutical (+22.3%), Bid Pharma (+18.9%), and others, indicating a strong performance in the CXO sector [3][47]. Investment Opportunities in CXO - The report emphasizes the importance of strategic allocation in the overseas CXO sector, highlighting the recovery in demand and performance of companies involved in new molecular businesses. The report suggests focusing on companies like WuXi AppTec and others [4][17]. - The performance of major overseas CXO companies in Q2 2025 showed that peptide CDMO outperformed other segments, with companies adjusting their annual performance guidance upwards [21][25]. Short-term Investment Thoughts - The report suggests that the innovative drug sector has undergone sufficient adjustment and is expected to rebound post-Q3 reports. The focus should be on high-performing sectors and companies with strong earnings capabilities [5][6]. - The report recommends a combination of innovative drugs, CXO, and medical devices for medium to long-term investment strategies, emphasizing the need for strategic allocation in high-growth areas [5][6].

公募基金,四季度投资策略来了

Zhong Guo Ji Jin Bao· 2025-10-17 08:37

Group 1 - The core viewpoint is that the A-share market has started strong in Q4, with the Shanghai Composite Index surpassing 3900 points, indicating potential opportunities for investment, particularly in technology growth sectors and high-dividend blue-chip stocks [1] Group 2 - The public fund industry believes that the attractiveness of stock assets has significantly increased, but a sustainable "slow bull" market requires fundamental support [2] - There is a consensus among public funds that despite the need for fundamental backing, there are still opportunities to go long in the market [3] Group 3 - The current environment shows that the A-share and Hong Kong stock markets are becoming increasingly valuable in global asset allocation, likely attracting more long-term capital [4] Group 4 - Investment strategies for Q4 should focus on technology growth and high-dividend blue-chip stocks, with an emphasis on sectors like banking, public utilities, and transportation, which offer stable earnings and low valuations [5][6] - The pharmaceutical sector is expected to see structural investment opportunities due to liquidity release from the Federal Reserve's rate cuts, benefiting innovative drugs and their supply chains [6] Group 5 - The gold and precious metals sector is viewed positively, with macroeconomic factors providing solid support for gold prices, driven by global fiscal expansion and central banks diversifying their reserve assets [7]

港股创新药50ETF(513780)早盘冲高一度涨超3%,机构:坚定看好创新产业链长牛行情

Xin Lang Cai Jing· 2025-10-16 05:10

Group 1 - The core viewpoint highlights a strong performance in the Hong Kong innovative drug sector, with the CSI Hong Kong Stock Connect Innovative Drug Index rising by 2.29% and significant gains in constituent stocks such as 3SBio, CanSino Biologics, and Rongchang Biologics [1] - The Hong Kong Innovative Drug 50 ETF has seen a half-day increase of 1.61%, with a notable trading volume of 4.73 billion yuan and a turnover rate of 14.12%, indicating active market participation [1] - In the first nine months of the year, the total value of Chinese innovative drug patent overseas contracts exceeded 100 billion USD, marking a 170% year-on-year increase, suggesting a robust growth trend in the sector [1] Group 2 - Recent reports indicate a slight pullback in the pharmaceutical sector, presenting potential investment opportunities, driven by a recovery in capital market financing and an increase in innovative drug overseas transaction volumes [2] - The CXO industry is expected to see performance recovery in the second half of 2025, supported by the anticipated effects of U.S. interest rate cuts [2] - The Hong Kong Innovative Drug 50 ETF tracks the CSI Hong Kong Stock Connect Innovative Drug Index, which includes leading companies in the sector, and is positioned for efficient investment in the high-volatility Hong Kong innovative drug market [2]

港股医药拉升,港股通医药ETF、港股创新药50ETF、香港医药ETF涨超3%

Ge Long Hui· 2025-10-15 08:27

Group 1 - The core viewpoint of the articles highlights a significant upward trend in the Hong Kong pharmaceutical sector, with various ETFs experiencing gains of over 3% amid a broader market recovery in A-shares [1] - The upcoming European Society for Medical Oncology (ESMO) conference in October 2025 is expected to be a key event, with new research abstracts to be presented, which may influence market sentiment [1] - In the first half of 2025, China has seen a total of 72 License-out transactions, surpassing half of the total transactions for 2024, with a 16% increase in total transaction value compared to the previous year [2] Group 2 - The trend of Chinese innovative drugs going global is driven by continuous innovation and efficiency improvements, despite concerns over potential trade conflicts [2] - The pharmaceutical sector is expected to experience a reversal in 2025, with a focus on innovative drugs and addressing unmet clinical needs, particularly in the dual/multi-antibody and ADC sectors [3] - The upcoming ESMO conference is anticipated to showcase clinical data from Chinese innovative drugs, which could be a major market catalyst, alongside the release of Q3 earnings reports and national healthcare negotiations in November [3]

10月月度组合电话会议:继续推荐创新药械产业链

2025-10-13 14:56

Summary of Conference Call Records Industry Overview - The A-share pharmaceutical sector underperformed the market in September 2025, declining by 1.7%, while the Hong Kong Hang Seng Healthcare Index rose by 5.2%, lagging behind the Hang Seng Index's 7.1% increase. The S&P 500 healthcare index increased by 1.6%, lower than the S&P 500's 3.5% rise [1][3][4]. Key Companies and Insights Changchun High-tech - Significant investment in R&D, focusing on pediatrics, oncology, and women's health. New products such as Meishiya and Jinbeixing are expected to ramp up quickly. Early-stage products like 047 and PD-1 agonist 120 have differentiated advantages, indicating substantial long-term growth potential [1][5]. Enhua Pharmaceutical - As a leader in the precision medicine sector, Enhua's main business is immune to centralized procurement risks. New product 60,001 is expected to mitigate risks associated with the procurement of etomidate. The company has a multi-pipeline layout in the CNS field, with a low current valuation [1][6]. Lepu Medical - Traditional business has stabilized, with strategic focus on innovative cardiovascular and metabolic drugs. Products like Mingweisheng's 109 injection and 105 injection are in clinical trials for obesity-related conditions. The company is also expanding into non-reimbursed areas [1][7]. Terbium Biologics - Recent approval for Pegbivac's use in chronic hepatitis B patients marks a significant clinical milestone. The growth hormone Tigebin is expected to drive performance in 2026 [1][8]. CRO Sector - Despite short-term impacts from safety legislation, the CRO industry is expected to recover. Companies like WuXi AppTec and Tigermed are recommended due to their strong market positions [2][9][22]. Market Trends and Predictions - The overall performance of the pharmaceutical sector in October 2025 is expected to be volatile, influenced by U.S.-China relations and tariff wars. However, the innovative drug supply chain remains promising. New recommendations include Changchun High-tech, Enhua Pharmaceutical, and Lepu Medical, while maintaining recommendations for Hengrui Medicine and Kelun Pharmaceutical [2][10]. Long-term Industry Outlook - The structural trends in the innovative drug industry and the advantages of China's engineering talent remain intact despite macro uncertainties. The external licensing model is considered safe under geopolitical conditions, with clear property rights [3][12]. Notable Companies to Watch - In October, companies such as Hengrui, Kangfang, and Rongchang Biologics are highlighted for their potential catalysts due to core asset data disclosures [2][13]. Additional Insights - The CRO sector is expected to see valuation recovery, with companies like WuXi AppTec projected to achieve double-digit revenue growth in Q3 2025 [22]. - JD Health is noted for its strong growth potential in the consumer healthcare sector, with revenue growth expected to exceed 20% in 2025 [23]. This summary encapsulates the key points from the conference call records, focusing on the pharmaceutical industry and specific companies within it.

睿智医药回复定增审核问询函:业绩回暖,多项业务调整与风险披露

Xin Lang Cai Jing· 2025-10-13 12:54

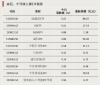

Core Viewpoint - The company has responded to the Shenzhen Stock Exchange's inquiry regarding its application for a specific stock issuance, with the auditing firm conducting a thorough review of related issues [1] Performance Fluctuation Reasons and Improvement Measures - The company reported revenues of 1,326.58 million, 1,138.37 million, 970.20 million, and 533.80 million, with gross profit margins of 25.42%, 25.94%, 21.80%, and 29.01%, and net profits of 362.42 million, -916.94 million, -226.51 million, and 25.35 million over the reporting periods [2] - Revenue and gross margin have declined due to competition in the innovative drug industry, but began to recover in the first half of 2025 [2] - Net profit fluctuations were influenced by business adjustments and goodwill impairments [2] Business Segment Analysis - The chemical business faced reductions due to market competition and shifts in client R&D directions [2] - The large molecule business struggled with order acquisition but saw revenue growth in the first half of 2025 as the market improved [2] - The pharmacodynamics business experienced revenue growth in 2023 due to platform expansion but fell short of expectations in 2024, with recovery in 2025 [2] Measures for Performance Improvement - The company benefits from an improved external industry environment, with increased order volumes and active investment [3] - Internal optimizations include governance improvements, business model enhancements, and refined cost management [3] - Goodwill and long-term asset impairments have been addressed, leading to stable future performance expectations [3] Domestic and International Business Performance - The company’s international business primarily serves U.S. clients, with over 70% revenue share [4] - Gross margins for international business have increased due to a higher proportion of high-margin pharmacodynamics business [4] - R&D expenses have decreased as the company adjusts its strategy to focus on core projects [4] Accounts Receivable and Debt Servicing - The company has made adequate provisions for bad debts, with a decline in accounts receivable aging due to reduced revenue and improved management [5] - Liquidity ratios are below industry averages, but the company maintains stable cash reserves for debt servicing [5] - Inventory provisions are higher than industry peers due to strategic focus and insufficient CDMO orders [5] Related Transactions and Asset Impairment - Related transactions are deemed necessary and fair, with no significant financial mismanagement [6] - Fixed asset depreciation policies align with industry norms, and asset impairment provisions are considered reasonable [7] - The company’s management stability and experience are expected to support business development [7]

美股异动 | 再鼎医药(ZLAB.US)涨逾4% 机构:药品关税对产业链影响有限

智通财经网· 2025-09-30 14:17

Core Viewpoint - The recent announcement by Trump regarding a 100% tariff on all brand/patent drugs starting in October is expected to have limited impact on the Chinese innovative drug industry chain, according to research from CICC [1]. Group 1: Tariff Impact - Trump announced a 100% tariff on all brand/patent drugs unless manufacturers are building production facilities in the U.S. starting in October [1]. - The tariff does not apply to generic drugs, biosimilars, or active pharmaceutical ingredients (APIs) [1]. Group 2: Industry Analysis - CICC believes that most Chinese companies have either established production capacity in the U.S. or outsourced production to local Contract Manufacturing Organizations (CMOs) [1]. - The majority of Chinese innovative drugs exported are in the form of APIs or raw herbal extracts, which are not affected by the new tariff [1]. - The export ratio of finished dosage forms is low, and investments by multinational corporations (MNCs) in building factories will take time, leading to limited short-term impact on CXO orders [1]. Group 3: Future Catalysts - Upcoming catalysts include the ESMO conference scheduled for mid to late October [1]. - Results from medical insurance negotiations and the first version of the commercial insurance innovative drug catalog are expected to be announced in October to November [1].