银行资产质量

Search documents

瑞丰银行(601528):2025年三季报点评:核心营收能力增强,资产质量继续改善

Huachuang Securities· 2025-10-29 07:06

Investment Rating - The report maintains a "Recommendation" rating for Ruifeng Bank, with a target price of 7.49 yuan [2][7]. Core Insights - Ruifeng Bank's core revenue capacity has strengthened, and asset quality continues to improve. The bank reported a 1.03% year-on-year increase in operating income for the first three quarters of 2025, reaching 3.356 billion yuan. Net profit attributable to shareholders increased by 5.85% year-on-year to 1.526 billion yuan [2][7]. - The non-performing loan ratio remained stable at 0.98%, while the provision coverage ratio increased by 5 percentage points to 345% [2][7]. Financial Performance Summary - **Revenue and Profitability**: For the first three quarters of 2025, operating income was 3.356 billion yuan, with a year-on-year growth of 1.03%. Operating profit was 1.541 billion yuan, up 15.96% year-on-year, and net profit attributable to shareholders was 1.526 billion yuan, reflecting a 5.85% increase [2][7]. - **Asset Quality**: The non-performing loan ratio remained at 0.98%, and the provision coverage ratio improved to 345%. The net non-performing loan generation rate decreased to 0.19% [7][10]. - **Loan and Investment Growth**: The bank's interest-earning assets grew by 9.54% year-on-year, with a notable increase in bond investments due to a low base last year. However, credit growth slowed down, particularly in the corporate sector [7][10]. - **Interest Margin**: The net interest margin for the first three quarters increased to 1.49%, with a quarterly increase to 1.55% due to a decrease in funding costs [7][12]. Future Outlook - The report projects revenue growth rates of 3.7%, 6.5%, and 11.9% for 2025 to 2027, respectively. Net profit growth is expected to be 7.0%, 9.3%, and 11.2% over the same period [7][8]. - The bank is expected to benefit from the growing export economy in the Keqiao and Yuecheng districts, as well as from optimized loan structures and increased non-interest income from equity investments in other banks [7][8].

青岛银行(002948):盈利维持高增,资产质量向好:——青岛银行(002948.SZ)2025年三季报点评

EBSCN· 2025-10-29 03:53

Investment Rating - The report maintains a "Buy" rating for Qingdao Bank [1]. Core Views - Qingdao Bank's revenue for the first three quarters of 2025 reached 11 billion yuan, a year-on-year increase of 5%, while net profit attributable to shareholders was 4 billion yuan, up 15.5% year-on-year. The weighted average return on equity (ROAE) was 13.16%, an increase of 0.48 percentage points year-on-year [3][4]. Summary by Sections Financial Performance - Revenue growth was impacted by a decline in non-interest income, but profit maintained a double-digit growth. The year-on-year growth rates for revenue, pre-provision profit, and net profit attributable to shareholders were 5%, 7.6%, and 15.5%, respectively, showing a decline compared to the first half of 2025 [4]. - Net interest income grew by 12% year-on-year, while non-interest income saw a decline of 10.7% [4]. Asset Quality - As of the end of Q3 2025, the non-performing loan (NPL) ratio was 1.1%, and the attention rate was 0.55%, indicating stable asset quality [9]. - The bank's provision coverage ratio improved to 270%, reflecting strong risk compensation capabilities [9]. Capital Adequacy - The core tier 1 capital adequacy ratio stood at 8.75%, with total capital adequacy at 13.14% as of Q3 2025, indicating stable capital levels [9][28]. Profitability Forecast - The report forecasts earnings per share (EPS) for 2025-2027 to be 0.84, 0.91, and 0.97 yuan, respectively, with corresponding price-to-book (PB) ratios of 0.73, 0.66, and 0.60 [10][11].

宁波银行(002142):2025年三季报点评:资产质量持续改善

Guoxin Securities· 2025-10-28 02:47

Investment Rating - The investment rating for the company is "Outperform the Market" [5][3]. Core Views - The company's overall performance is in line with expectations, with a projected net profit growth of 7.6%/8.4%/7.7% for 2025-2027, and a diluted EPS of 4.27/4.64/5.01 yuan [3][4]. - The company has shown a slight recovery in revenue and profit growth, with a 8.3% year-on-year increase in operating income and a 8.4% increase in net profit attributable to shareholders for the first three quarters of 2025 [1][2]. - Asset quality continues to improve, with a non-performing loan ratio of 0.76% and a loan loss provision coverage ratio of 376% as of the end of the third quarter [2][3]. Summary by Sections Financial Performance - For the first three quarters of 2025, the company achieved operating income of 55 billion yuan, a year-on-year increase of 8.3%, and a net profit of 22.4 billion yuan, up 8.4% year-on-year [1]. - The average return on equity for the first three quarters was 13.8%, a decrease of 0.2 percentage points year-on-year [1]. Asset Quality - The company reported a non-performing loan ratio of 0.76%, unchanged from the beginning of the year, and a focus rate of 1.08%, which increased by 0.05 percentage points year-on-year [2]. - The loan loss provision coverage ratio improved to 125% due to a decrease in non-performing loan generation and an increase in provisions [2]. Revenue Sources - Net fee income increased by 29.3% year-on-year to 4.8 billion yuan, primarily driven by growth in agency sales and asset management business [2]. - Other non-interest income decreased by 9.0% year-on-year, mainly due to increased fair value losses related to rising market interest rates [2]. Future Projections - The company is expected to maintain stable performance with projected net profits of 29.2 billion yuan in 2025, with a diluted EPS of 4.27 yuan [3][4]. - The projected price-to-earnings ratio (PE) for 2025 is 6.5x, with a price-to-book ratio (PB) of 0.80x [3][4].

重庆银行净利增10%中收反降27.6%成短板 贷款及投资业务违规被罚220万

Chang Jiang Shang Bao· 2025-10-27 03:03

Core Insights - Chongqing Bank has reported strong financial performance for the first three quarters of 2025, achieving operating income of 11.74 billion yuan, a year-on-year increase of 10.4%, and a net profit of 4.879 billion yuan, up 10.19% [1][3] - The bank's total assets reached 1.02 trillion yuan by the end of September 2025, marking a 19.39% increase from the end of the previous year [1][4] - Despite the growth in net interest income, the bank faced challenges in its intermediary business, with net commission income declining by 27.6% [1][8] Financial Performance - For Q3 2025, Chongqing Bank's operating income was 4.081 billion yuan, reflecting a growth of 17.38% compared to the same quarter last year [3] - The bank's net profit for Q3 2025 was 1.69 billion yuan, with a significant year-on-year growth of 20.54%, the highest quarterly growth since its A-share listing in February 2021 [3][4] - The bank's net interest income for the first three quarters was 9.12 billion yuan, a 15.22% increase year-on-year [6] Asset Quality and Risks - As of September 2025, the bank's non-performing loan balance was 5.894 billion yuan, with a non-performing loan ratio of 1.14%, a decrease of 0.11 percentage points from the end of the previous year [4][10] - The bank faced regulatory penalties for inadequate loan checks and imprudent investment practices, resulting in a fine of 2.2 million yuan [2][9] - The rapid expansion of the bank's assets has led to a decline in capital adequacy ratios, with the core tier 1 capital ratio dropping by 1.31 percentage points to 8.57% [10] Dividend and Shareholder Returns - Chongqing Bank announced a cash dividend plan, proposing to distribute 1.684 yuan per share, totaling 585 million yuan, which represents 11.99% of its net profit for the first three quarters [3][4] - This marks the second consecutive year the bank has issued dividends in Q3, with total dividends distributed since its A-share listing amounting to 7.465 billion yuan [4]

华夏银行VS北京银行:北京市属商业银行PK

数说者· 2025-10-26 23:31

Core Viewpoint - The article provides a comparative analysis of Huaxia Bank and Beijing Bank, highlighting their similarities and differences in terms of ownership structure, financial performance, asset quality, and operational scale. It emphasizes the growing competitiveness of Beijing Bank, which has shown significant improvements in total assets and net profit, potentially surpassing Huaxia Bank in these areas by mid-2025 [2][12][38]. Ownership and Structure - Huaxia Bank was established in 1992 and transformed into a joint-stock commercial bank in 1995, with its largest shareholder being Shougang Group, a state-owned enterprise [3]. - Beijing Bank originated from 90 city credit cooperatives in 1996 and became a joint-stock bank in 2004, with ING Bank as its largest foreign investor since 2005 [5]. Capital Market - Both banks are listed on the A-share market, with Huaxia Bank listed in 2003 and Beijing Bank in 2007 [6][7][8]. Operational Regions - As of the end of 2024, Huaxia Bank operates in 120 cities across 30 provinces, with a total of 963 branches [9]. - Beijing Bank's operations are primarily concentrated in Beijing and several other provinces, with a more limited geographical reach compared to Huaxia Bank [9]. Subsidiaries - Huaxia Bank controls one financial leasing company and one wealth management subsidiary, while Beijing Bank has a broader range of subsidiaries, including insurance and consumer finance companies [10]. Employee Situation - By the end of 2024, Huaxia Bank had approximately 38,900 employees, while Beijing Bank had around 23,500 employees, with a higher percentage of master's degree holders in Beijing Bank [11]. Financial Performance - In 2024, Huaxia Bank's total assets were approximately 4.38 trillion yuan, while Beijing Bank's were about 4.22 trillion yuan. By mid-2025, Beijing Bank's total assets are projected to reach 4.75 trillion yuan, surpassing Huaxia Bank's 4.55 trillion yuan [12][21]. - Huaxia Bank's net profit for the first half of 2025 is expected to be 11.47 billion yuan, while Beijing Bank's is projected at 15.05 billion yuan, indicating a shift in profitability [19][21]. Asset Quality - Beijing Bank outperforms Huaxia Bank in terms of non-performing loan ratios, provision coverage ratios, and overdue loan ratios, indicating better asset quality management [13][30][35]. Business Structure - Both banks primarily generate revenue from net interest income, but Huaxia Bank's proportion has fluctuated significantly, dropping below 64% in 2024 [22]. - The loan-to-asset ratio for Beijing Bank has stabilized around 52%, while Huaxia Bank's has varied, indicating different lending strategies [24]. Salary and Compensation - Huaxia Bank has higher overall employee costs due to a larger workforce, but Beijing Bank's average salary is higher at 490,000 yuan compared to Huaxia Bank's 410,000 yuan [35][36]. Conclusion - Overall, while Huaxia Bank has historically led in several financial metrics, Beijing Bank is closing the gap and may surpass Huaxia Bank in total assets and net profit by mid-2025, reflecting a significant shift in the competitive landscape [38][39].

两家股份行率先披露三季报

Huan Qiu Wang· 2025-10-26 01:43

Core Insights - The financial reports for the third quarter of 2025 from Huaxia Bank and Ping An Bank indicate a decline in revenue and net profit, attributed to various market factors and operational challenges [1][4]. Group 1: Huaxia Bank - Huaxia Bank reported a revenue of 648.81 billion yuan for the first three quarters, a year-on-year decrease of 8.79%, and a net profit of 179.82 billion yuan, down 2.86% [1][3]. - The bank's non-performing loan (NPL) ratio decreased by 0.02 percentage points to 1.58%, while the provision coverage ratio fell to 149.33% and the loan provision ratio decreased to 2.36% [1][3]. - The CEO attributed the revenue decline primarily to fluctuations in the bond market, which affected fair value changes, while net interest income remained stable [3]. Group 2: Ping An Bank - Ping An Bank achieved a revenue of 1006.68 billion yuan in the first three quarters, a year-on-year decline of 9.8%, with a net profit of 383.39 billion yuan, down 3.5% [4][5]. - The bank cited two main factors for the revenue drop: a decrease in loan interest rates and market volatility affecting non-interest income [4]. - The NPL ratio for Ping An Bank decreased by 0.01 percentage points to 1.05%, with a provision coverage ratio of 229.60% [5].

华夏银行三季度增利不增收,营收同比下降15%

Huan Qiu Lao Hu Cai Jing· 2025-10-24 06:34

Core Insights - Huaxia Bank released its Q3 financial report, showing a decline in operating income but an increase in net profit year-on-year [1] - The bank's total assets and deposits increased, while the non-performing loan ratio improved slightly [1][2] Financial Performance - Q3 operating income was 19.359 billion yuan, a year-on-year decrease of 15.02% - Net profit attributable to shareholders was 6.512 billion yuan, a year-on-year increase of 7.62% - For the first three quarters, operating income totaled 64.881 billion yuan, down 8.79%, while net profit was 17.982 billion yuan, down 2.86% [1] Revenue Breakdown - Fee and commission income, as well as investment income, increased compared to the same period last year - Net interest income and fair value changes decreased, with fair value changes significantly impacting performance, reversing from 3.326 billion yuan last year to -4.505 billion yuan this year [1] Asset and Liability Overview - Total assets at the end of the reporting period were 4.59 trillion yuan, up 4.80% from the end of the previous year - Total loans reached 2.44 trillion yuan, an increase of 2.93% - Total liabilities were 4.21 trillion yuan, up 5.06%, and total deposits were 2.34 trillion yuan, up 8.72% [1] Asset Quality - The non-performing loan ratio was 1.58%, a decrease of 0.02 percentage points from the end of the previous year - Provision coverage ratio stood at 149.33%, down 12.56 percentage points, and loan provision ratio was 2.36%, down 0.23 percentage points [1] Market Performance - Huaxia Bank's stock price fell nearly 17% in Q3, while the Shanghai Composite Index and CSI 300 rose nearly 13% during the same period [2] Management Changes - The bank announced several executive changes, including the resignation of the Chief Risk Officer and the appointment of a new Chief Financial Officer - The new Chief Risk Officer's appointment is pending approval from the national financial regulatory authority [2]

上市银行首份三季报来了!这项指标大降,什么原因?

券商中国· 2025-10-23 15:09

华夏银行三季度营收降幅超15% 今年7月至9月,华夏银行营业收入同比降幅明显,单季营收193.59亿元,较上年同比减少15.02%,受此拖累, 今年前三季度该行营收同比下降8.79%。 不过,该行净利润却在营收减少的情况下实现净利润增长。其中该行第三季度归属于上市公司股东的净利润为 65.12亿元,较上年同期增长4.61亿元,增幅7.62%。拉长时间来看,今年前三季度该行净利润仍同比减少5.29 亿元,降幅2.86%。 拆解华夏银行各项财务数据,今年该行前三季度营收较上年变化较大的指标因素主要来源于"公允价值变动收 益",今年前三季度该项数据为-45.05亿元,较上年的33.26亿元下降78.31亿元。另外,收入构成方面,该行利 息净收入为462.94亿元,同比减少7.64亿元,降幅1.62%;手续费及佣金净收入为46.94亿元,同比增长8.33%。 资产负债端来看,截至9月末,华夏银行贷款余额为24355.94亿元,比上年末增加692.77亿元,增长2.93%;存 款总额23389.60 亿元,比上年末增加1875.90亿元,增长8.72%。 资产总额方面,该行9月末总规模达4.59万亿元,尽管资产于年内扩 ...

国泰海通|银行:25Q3银行业绩前瞻:营收利润有望保持正增,资产质量指标稳定

国泰海通证券研究· 2025-10-21 11:58

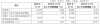

Core Viewpoint - The report anticipates that listed banks will see a cumulative revenue and net profit attributable to shareholders growth of 0.4% and 1.1% respectively in the first three quarters of 2025, with improvements attributed to a narrowing decline in interest margins and a decrease in impairment provisions [1]. Revenue Analysis - Interest net income and net income from fees and commissions are expected to continue improving, with year-on-year growth rates rebounding further compared to mid-year reports. However, other non-interest income may experience a significant decline due to bond market volatility and high base effects, potentially leading to a slight positive growth in cumulative revenue for the first three quarters [2]. - The growth rate of interest net income is projected to decrease by 0.6 percentage points to 9.2% compared to mid-year reports, with new RMB loans from financial institutions in Q3 2025 amounting to 1.83 trillion yuan, a year-on-year decrease of 920 billion yuan. The net interest margin is expected to narrow from 14 basis points to 12 basis points year-on-year, remaining stable at 1.41% quarter-on-quarter [2]. Profitability Insights - The asset quality remains stable, with expectations for credit costs to continue declining, smoothing out profit fluctuations. Banks are likely to maintain a prudent operating style, with excess impairment provisions set aside in the first half of the year to address uncertainties. As the economy stabilizes in the second half, the space for reducing provisions will gradually increase, leading to a potential sequential rise in net profit growth [3]. - The banking sector has disposed of over 14.5 trillion yuan in non-performing assets from 2021 to the first half of 2025, with retail banking risks having peaked. For instance, the retail non-performing loan generation rate for a major bank in Q2 2025 was 1.65%, lower than levels seen in Q4 2024 and Q1 2025. The non-performing loan ratio is expected to remain stable compared to mid-year reports, with a slight decrease in the provision coverage ratio and a year-on-year decline in credit costs of approximately 4 basis points to 0.40% [3]. Investment Recommendations - As the mid-term dividend timeline for banks approaches, there may be opportunities for the sector to catch up if market sentiment shifts towards balance as the year-end approaches [4].

中原银行迎“75”后新行长,资产质量攻坚成首要考验

Hua Xia Shi Bao· 2025-10-21 08:33

Core Viewpoint - Zhongyuan Bank is undergoing a leadership change with the appointment of Zhou Feng as the new president, following the resignation of Liu Kai due to work adjustments. Zhou's qualifications are pending approval from the Henan Financial Regulatory Bureau [2][3]. Leadership Change - On October 17, Zhongyuan Bank announced the resignation of Liu Kai as president, with Zhou Feng appointed as his successor. Zhou's appointment as an executive director is subject to approval at the upcoming shareholders' meeting and regulatory approval [3][4]. Background of Zhou Feng - Zhou Feng, born in 1977, has extensive experience in financial regulatory bodies and local government. He worked for nearly 17 years at the Henan Regulatory Bureau of the China Banking and Insurance Regulatory Commission before transitioning to local government roles [4]. Management Structure - The current management team of Zhongyuan Bank includes members with government backgrounds, such as Chairman Guo Hao. The bank has seen frequent adjustments in its executive team this year, with a current structure of one president, four vice presidents, and six assistants [5]. Asset Quality Concerns - Zhongyuan Bank has faced challenges with asset quality, maintaining a high non-performing loan (NPL) ratio. As of mid-2023, the NPL ratio was 2.01%, which is above the average for city commercial banks [2][6]. Financial Performance - The bank's financial performance has shown mixed results. In 2022, operating income increased by 32.8% to 25.61 billion, but net profit only grew by 5.3% to 3.83 billion due to rising operating expenses and asset impairment losses [7][8]. Cost Management Efforts - To address profitability pressures, Zhongyuan Bank has implemented cost-cutting measures, resulting in a 7.4% reduction in operating expenses in the first half of 2025. The bank's capital adequacy ratios have also improved [8].