锂电设备

Search documents

逸飞激光:三季度实现营收5.75亿元,技术创新与前瞻布局赋能经营趋势长期向好

Quan Jing Wang· 2025-10-31 07:19

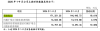

Core Insights - The company reported a revenue of 575 million yuan for the first three quarters of 2025, reflecting a year-on-year growth of 7.55% [1] - Total assets reached 2.884 billion yuan, an increase of 2.18% compared to the end of the previous year, indicating robust growth and resilience in operations [1] Industry Recovery and R&D Investment - The global energy transition and electrification have led to a resurgence in the lithium battery industry, with increased demand for lithium battery equipment [2] - The company's contract liabilities rose to nearly 400 million yuan, a growth of over 30% from the previous year, while inventory increased by 34% to 780 million yuan, signaling a recovery in industry demand [2] - R&D investment for the first three quarters of 2025 reached 76.1 million yuan, a year-on-year increase of 25.67%, accounting for 13.23% of revenue, reinforcing the company's technological edge [2] Global Expansion Strategy - The company has deepened its global strategy, delivering fully automated energy storage container assembly lines to overseas clients, marking international recognition of its comprehensive energy storage solutions [3] - New customer acquisitions include markets in Japan, South Korea, the UK, Germany, and India, with a strategic partnership established with Indian automotive parts manufacturer Endurance [3] - Recent establishment of subsidiaries in Singapore and Hong Kong aims to enhance overseas after-sales service capabilities [3] Diversification into Emerging Businesses - The company is actively expanding into solid-state batteries, perovskite solar cells, and robotics, aiming to build long-term competitiveness [4] - In the solid-state battery sector, the company has developed complete line equipment capabilities and has successfully delivered the first batch of all-solid-state lithium metal cylindrical batteries to international clients [4] - Investments in humanoid robotics and core components through partnerships and joint ventures are intended to enhance the intelligence and flexibility of professional equipment [4] Future Growth Prospects - With the ongoing recovery in the lithium battery industry and accelerated industrialization in emerging fields, the company is positioned to leverage its technological innovations and strategic industry layout for diversified growth [5]

先导智能(300450):三季度业绩如期兑现 关注周期与新技术共振

Xin Lang Cai Jing· 2025-10-31 00:41

Performance Review - The company reported 1-3Q25 revenue of 10.439 billion yuan, a year-on-year increase of 14.56%, and a net profit attributable to shareholders of 1.186 billion yuan, a year-on-year increase of 94.97% [1] - In 3Q25, revenue reached 3.828 billion yuan, a year-on-year increase of 13.95%, and net profit attributable to shareholders was 446 million yuan, a year-on-year increase of 198.92% [1] - The recovery in demand for power batteries and energy storage batteries from leading domestic battery manufacturers has accelerated project deliveries, resulting in a sequential increase in net profit [1] - The domestic lithium battery cycle has been recovering since 2025, while the overseas cycle continues [1] - The gross profit margin for 3Q25 was 30.5%, a year-on-year decrease of 5.4 percentage points, while the net profit margin was 11.7%, a year-on-year increase of 7.2 percentage points [1] Cash Flow - The net cash flow from operating activities for 3Q25 was 1.494 billion yuan, continuing the trend of net cash inflow [2] Development Trends - The domestic energy storage and overseas power battery cycles are expected to continue exceeding expectations [3] - New energy storage plays a crucial role in the development of AI, with 2026 anticipated to be a year of rapid global energy storage growth, leading to higher-than-expected demand for lithium battery equipment capital expenditure [3] - The localization of battery production capacity in markets such as Europe and Southeast Asia is expected to deepen [3] - The company, as a leading provider of lithium battery equipment, is likely to benefit from industry cycle trends [3] - The company is also positioned as a global leader in solid-state battery production lines, which may provide long-term benefits from the implementation of solid-state technology [3] Profit Forecast and Valuation - The company maintains net profit forecasts of 1.77 billion yuan for 2025 and 2.42 billion yuan for 2026, with current stock prices corresponding to PE ratios of 52.6x and 38.4x respectively [4] - Given the upward adjustment in the valuation center for the solid-state battery sector, the company has raised its target price by 11.1% to 70 yuan, corresponding to a 2026 PE of 45x, indicating an upside potential of 18.0% [4]

固态电池技术突破!绿色能源ETF(562010)逆市拉升2%!机构:特高压建设加速叠加锂电设备需求复苏

Xin Lang Ji Jin· 2025-10-30 03:18

Group 1 - The green energy ETF (562010) showed active performance with an intraday price increase of 2.15% as of October 30 [1] - Among the constituent stocks, Aters performed the strongest with a rise of 9.03%, followed by Goldwind Technology and Tianci Materials with increases of 7.02% and 6.9% respectively [1] - Conversely, Deye shares experienced a significant decline of 8.25%, while Jiejia Weichuang and Robotech saw decreases of 2.88% and 2.67% respectively [1] Group 2 - On October 23, XINWANDA launched a new generation of polymer all-solid-state batteries, "Xin·Bixiao," achieving an energy density exceeding 400 Wh/kg and a cycle life of 1200 weeks under low external pressure [1] - Shanlin Group signed a procurement agreement worth 4 billion yuan for solid-state cells and energy storage equipment with Weilan New Energy, focusing on the new energy storage market [1] - Huafu Securities noted that the completion of the Long Electric into Zhejiang ultra-high voltage project by the end of next year will benefit the power equipment industry through accelerated construction [1] - According to招商证券, the lithium battery equipment industry is expected to recover in 2025, driven by new demand for equipment from solid-state battery technology [1] Group 3 - The green energy ETF passively tracks the green energy index, with the top ten weighted stocks including CATL, BYD, Changjiang Power, Sungrow Power, Yiwei Lithium Energy, LONGi Green Energy, Huayou Cobalt, Ganfeng Lithium, Xianlead Intelligent, and Tongwei Co [2]

骄成超声20251029

2025-10-30 01:56

Summary of Conference Call for Jiao Cheng Company Industry Overview - The semiconductor equipment industry is experiencing strong growth, with Jiao Cheng Company expecting semiconductor equipment orders to reach no less than 200 million yuan in 2025, reflecting a robust demand trend despite long acceptance cycles [2][4] - The lithium battery equipment sector is projected to generate revenue of at least 220 million yuan in 2025, with significant contributions from leading lithium battery manufacturers expanding production [2][7] Key Financial Metrics - The overall gross margin for the company remains high, reaching 65% in Q3 2025, with lithium battery equipment gross margin exceeding 50% and consumables over 70% [2][6] - In Q3 2025, lithium battery equipment revenue was approximately 160 million yuan, while revenue from harness and semiconductor businesses was around 150 million yuan, and consumables contributed about 180 million yuan [3] Growth Drivers - The company holds a 70-80% market share in the traditional lithium battery sector, with each additional 1GW of capacity corresponding to approximately 1.2 million yuan in equipment revenue and 200,000 yuan in consumables revenue [8] - The automotive harness segment is expected to see a threefold increase in revenue in 2025, with a domestic market share of about 20%, gradually replacing imported brands [2][14] Emerging Markets and Future Potential - The company is optimistic about emerging markets such as semiconductors and medical devices, as well as niche areas like liquid cooling plate detection and composite material welding, which could yield market opportunities worth billions [5][19] - The semiconductor sector is anticipated to grow significantly, with the company already securing orders for four devices from leading domestic manufacturers for advanced packaging applications [17] Long-term Strategy and R&D Focus - R&D investments are primarily focused on the semiconductor field to ensure technological leadership and continuous innovation [5][15] - The company plans to maintain a strong position in the semiconductor equipment market, with expectations of increasing demand for detection equipment as advanced packaging processes evolve [18] Profitability Outlook - The net profit margin for traditional lithium battery equipment is expected to be around 25-30%, with overall gross margins potentially reaching 50% when including consumables [10] - Consumables are projected to grow at an annual rate of 30%, with total consumables revenue expected to be around 250 million yuan for the year [10][12] Market Position and Competitive Advantage - The company emphasizes its competitive edge in the lithium battery equipment sector, where it has achieved a gross margin of 50% and is positioned as a key supplier to major manufacturers [20] - The unique position of being the only domestic company in the mainstream supply chain for leading manufacturers supports the maintenance of high gross margins [20] Conclusion - Jiao Cheng Company is well-positioned for growth in the semiconductor and lithium battery sectors, with strong financial performance, a focus on R&D, and a strategic approach to emerging markets and technologies [2][5][19]

10.30犀牛财经早报:超五成债基三季度被净赎回 美联储将基准利率下调25个基点

Xi Niu Cai Jing· 2025-10-30 01:37

Group 1: Fund Management Trends - Public funds have shown a tendency to "hug the stocks," with high consensus on certain high-performing stocks among multiple fund managers [1] - ST Huatuo has gained significant attention, transitioning from being overlooked to becoming a heavy stock for hundreds of funds this year [1] - The "hugging" strategy reflects a shared research resource among fund managers within the same company, indicating a strong belief in specific stocks or industries [1] Group 2: Bond Market Dynamics - Over 55% of bond funds experienced net redemptions in Q3, totaling over 500 billion units, marking the highest net redemption among fund types [1] - Despite the redemptions, convertible bond funds performed well, with some achieving returns exceeding 20% [1] - A fund manager noted that while long-term interest rates may rise, a sustained bear market in bonds is unlikely, with expectations of a return to fundamentals after debt pressure eases [1] Group 3: Federal Reserve Actions - The Federal Reserve lowered the benchmark interest rate by 25 basis points to a range of 3.75%-4.00%, marking the second consecutive meeting with a rate cut [2] - This reduction aligns with market expectations and represents the fifth cut since September 2024 [2] Group 4: Corporate Earnings Reports - Microsoft reported Q1 net profit of $27.7 billion, an increase of 12% year-on-year, with revenues of $77.7 billion, up 18% [5][6] - Meta's Q3 net profit fell by 83% year-on-year to $2.709 billion, despite a revenue increase of 26% to $51.242 billion [6] - Alphabet's Q3 revenue reached $102.35 billion, exceeding market expectations, with significant contributions from Google Cloud and advertising [6] - Starbucks reported Q4 net revenue of $9.6 billion, surpassing expectations, with same-store sales growth of 1% [6] - Samsung Electronics saw a 32% increase in Q3 operating profit, driven by a strong traditional chip market [6] Group 5: Company-Specific Developments - OpenAI plans to submit an IPO application as early as the second half of 2026, with a potential valuation of around $100 billion [4] - Rongsheng Petrochemical reported a net profit of 888 million yuan for the first three quarters, a year-on-year increase of 1.34% [8] - China Nuclear Power's net profit for the first three quarters was 8 billion yuan, a decrease of 10.42% year-on-year [8] - Xian Dao Intelligent reported a net profit of 446 million yuan for Q3, a year-on-year increase of 198.92% [10] - Diya Co. achieved a net profit increase of 407.97% year-on-year for the first three quarters, driven by brand upgrades and improved operational efficiency [11]

泰金新能科创板IPO:“国家队”市占率领先,高预收款印证强议价

Sou Hu Cai Jing· 2025-10-29 16:04

Core Viewpoint - The announcement of Xi'an Taijin New Energy Technology Co., Ltd.'s (Taijin New Energy) IPO application on the Sci-Tech Innovation Board signifies a significant step for the domestic titanium anode sector in the electrolytic copper foil market, enhancing the localization of the new energy industry chain [2] Group 1: Company Background and Ownership Structure - Taijin New Energy is primarily controlled by the Shaanxi Provincial Finance Department, with the Northwest Nonferrous Metal Research Institute holding 22.83% of shares and an additional 20% through a related company, totaling 42.83% voting rights [3] - The Shaanxi Provincial Finance Department views rare metal materials as "strategic livelihood assets," indicating a long-term commitment to the industry beyond mere financial investment [3] - The company is part of a successful model of "research incubation - asset securitization - capital feedback," with previous entities from the same system achieving a combined market value exceeding 45 billion yuan [3] Group 2: Market Position and Competitive Advantage - Taijin New Energy focuses on titanium anodes (DSA electrodes), essential for copper foil production in lithium batteries, breaking the long-standing market monopoly held by Japanese and European companies [4] - The company has been recognized as a national-level specialized and innovative "little giant," securing a leading position in the industry with a compound annual growth rate (CAGR) of 47.78% in revenue from 1.005 billion yuan in 2022 to 2.194 billion yuan in 2024 [4] - The net profit attributable to the parent company increased from approximately 98.29 million yuan to 195 million yuan during the same period, reflecting strong growth potential [4] Group 3: Financial Performance and Cash Flow - The company has maintained a high debt ratio, with figures of 91.35%, 92.04%, 84.86%, and 79.47% from 2022 to mid-2025, yet has low financial costs, indicating strong bargaining power in the industry [6] - Taijin New Energy employs a "sales-based production, step-by-step payment" model, leading to significant contract liabilities, which reflect customer trust rather than traditional interest-bearing debt [6] - The company faced cash flow challenges in 2023 due to industry-wide adjustments, with net cash flows from operating activities showing fluctuations, but it remains committed to technological innovation and maintaining competitive advantages [7] Group 4: Research and Development - The company has invested significantly in R&D, with cumulative expenditures reaching 202 million yuan from 2022 to mid-2025, demonstrating a commitment to technological advancement [7] - Taijin New Energy holds 90 authorized invention patents, including two in the United States, showcasing its strong technological foundation and competitive moat [8] - In the first nine months of 2025, the company reported revenue of approximately 1.713 billion yuan, an 18.61% increase year-on-year, and a net profit of about 140.62 million yuan, reflecting ongoing growth despite industry challenges [9]

十一月金股汇

Dongxing Securities· 2025-10-29 10:41

Group 1: Company Performance Highlights - Hu Silicon Industry (688126.SH) achieved a revenue of 1.697 billion CNY in H1 2025, a year-on-year increase of 8.16%[9] - Jingzhida (688627.SH) reported a revenue of 444 million CNY in H1 2025, up 22.68% year-on-year[12] - Kingsoft Office (688111.SH) generated a revenue of 2.657 billion CNY in H1 2025, reflecting a 10.12% increase year-on-year[22] Group 2: Market Trends and Projections - The average selling price of 200mm semiconductor wafers has slightly rebounded due to product mix changes, although the market for 200mm and below wafers remains weak[11] - The smart connected vehicle market for wireless communication modules is projected to grow from 2.3 billion CNY in 2020 to 5 billion CNY by 2024, with a CAGR of 21%[19] - The lithium battery equipment sector is expected to see a resonance of cycles and growth, potentially leading to a "Davis Double" effect due to domestic leadership in integration[36] Group 3: Investment Ratings and Forecasts - Hu Silicon Industry is projected to have EPS of 0.02, 0.09, and 0.13 CNY for 2025-2027, maintaining a "recommend" rating[11] - Jingzhida's EPS forecast for 2025-2027 is 1.92, 2.88, and 3.80 CNY, with a "recommend" rating[16] - Kingsoft Office's projected net profit for 2025-2027 is 1.768 billion, 2.150 billion, and 2.693 billion CNY, with a strong recommendation rating[24] Group 4: Risk Factors - Risks include lower-than-expected downstream demand, intensified market competition, and potential technological iteration risks across various sectors[17][35]

泰金新能科创板IPO:“国家队”市占率领先, 高预收款印证强议价

Sou Hu Cai Jing· 2025-10-29 10:37

Core Viewpoint - The announcement of Xi'an Taijin New Energy Technology Co., Ltd.'s IPO application marks a significant step for the domestic titanium anode sector, enhancing the localization of the new energy industry chain in China [1][2]. Group 1: Company Background and Structure - Taijin New Energy is a leading player in the titanium anode market for electrolytic copper foil, with its ultimate control linked to the Shaanxi Provincial Finance Department, indicating its status as a state-owned enterprise [2]. - The company is part of a strategic initiative by the Shaanxi government to develop key industries, including aerospace and new energy, with its IPO seen as a critical step in this strategy [2]. Group 2: Market Position and Financial Performance - Taijin New Energy has established itself as a benchmark for domestic substitution in the titanium anode market, previously dominated by Japanese and European firms, ensuring the stability and cost-effectiveness of copper foil production [3]. - The company has demonstrated strong growth, with revenue projected to increase from 1.005 billion yuan in 2022 to 2.194 billion yuan in 2024, reflecting a compound annual growth rate (CAGR) of 47.78% [4]. - Net profit is expected to rise from approximately 98.29 million yuan to 195 million yuan during the same period, with a CAGR of 40.85% [4]. Group 3: Financial Structure and Competitive Advantage - The company maintains a high debt ratio, with figures of 91.35% in 2022 and 79.47% by mid-2025, yet it has low financial costs, indicating strong market positioning and customer trust [5]. - Taijin New Energy's business model includes significant advance payments from customers, which are recorded as contract liabilities, reflecting its strong bargaining power and industry position [5]. Group 4: Industry Challenges and Resilience - The company faces challenges due to structural overcapacity in the lithium battery industry, leading to a temporary decline in cash flow, with net cash flow projected to be negative in 2023 [6][7]. - Despite these challenges, Taijin New Energy's core competitiveness remains intact, supported by ongoing investments in technology and innovation, with R&D expenditures increasing over the years [7][8]. - The company has secured 90 authorized invention patents and continues to leverage its state-backed resources to maintain a competitive edge [8]. Group 5: Long-term Investment Logic - The investment rationale for Taijin New Energy is based on its combination of technological strength and state-owned enterprise backing, positioning it well for future growth if it navigates the current industry downturn successfully [10].

华自科技:公司锂电后段固态电池设备按计划推进

Zheng Quan Ri Bao· 2025-10-29 09:44

Core Viewpoint - The company is advancing its solid-state battery equipment for lithium batteries as planned and is focusing on core business and technology advantages while enhancing communication with investors [2] Group 1: Business Strategy - The company aims to improve profitability by accelerating production and delivery, controlling costs, and enhancing efficiency to achieve a turnaround [2] - The company expresses confidence in meeting its annual operational goals despite various influencing factors on its stock price [2] Group 2: Investor Relations - The company is committed to strengthening its communication with investors to address concerns and provide updates on its strategic initiatives [2]

研报掘金丨东兴证券:维持金银河“推荐”评级,公司或已正式进入强业绩弹性高速增长期

Ge Long Hui A P P· 2025-10-29 07:48

Core Viewpoint - The report from Dongxing Securities indicates that Jinyinhai has entered a high-growth phase with significant performance elasticity, as evidenced by substantial increases in net profit and operational cash flow [1] Financial Performance - In the first three quarters of 2025, Jinyinhai achieved a net profit attributable to shareholders of 0.12 billion, representing a year-on-year increase of 220.37% [1] - In Q3 2025 alone, the net profit attributable to shareholders reached 0.54 billion, showing a year-on-year growth of 1593.75% and a quarter-on-quarter increase of 125.63% [1] Business Segments - The increase in orders from equipment clients and the significant improvement in operating cash flow are attributed to accelerated acceptance of payments from lithium battery segment clients [1] - The comprehensive gross profit margin of the main business has continued to optimize, supported by increased raw material procurement for lithium resource utilization projects [1] Industry Outlook - The lithium battery industry is on an upward cycle, and the development of solid-state battery technology is expected to drive the performance of the lithium equipment segment into a strong expansion phase [1] - The organic silicon segment is likely to maintain its leading position in the industry with stable growth [1] - The commissioning of the rubidium and cesium salt project in the lithium mica segment is anticipated to facilitate rapid structural expansion of the company's performance [1] Cash Flow and Profitability - The company's cash flow has shown significant improvement, indicating enhanced profitability [1] - The three main business segments are entering a stable and strong growth phase, reflecting an overall increase in the company's profitability [1]