工业

Search documents

天津前三季度GDP同比增长4.7%

Zhong Guo Xin Wen Wang· 2025-10-28 11:23

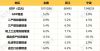

Economic Growth - Tianjin's GDP for the first three quarters reached 13,416.08 billion yuan, with a year-on-year growth of 4.7% [1] - The primary industry added value was 162.72 billion yuan, growing by 2.5%; the secondary industry added value was 4,531.97 billion yuan, growing by 3.6%; and the tertiary industry added value was 8,721.39 billion yuan, growing by 5.2% [1] Agricultural Performance - The total output value of agriculture, forestry, animal husbandry, and fishery increased by 2.7% year-on-year [1] - Vegetable production reached 1,990,400 tons, growing by 5.9%; pork, beef, and poultry production increased by 6.7%, 2.7%, and 3.8% respectively [1] Industrial Development - The industrial added value for large-scale industries grew by 4.5%, with high-tech manufacturing increasing by 5.9% [1] - Key products saw significant growth, including a 34.0% increase in electronic computer production and 27.9% and 11.9% increases in industrial and service robot production respectively [1] Service Sector Growth - The added value of the service industry grew by 5.2%, with modern service sectors performing well [1] - Information transmission, software, and IT services, as well as leasing and business services, saw added value growth of 21.8% and 14.4% respectively [1] Investment Trends - Fixed asset investment (excluding rural households) increased by 3.0% year-on-year, with infrastructure investment growing by 12.8% [2] - Investment in water conservancy, ecological environment, and public facility management rose by 17.5% [2] Consumer Market Insights - Sales of basic living and some upgraded goods performed well, with retail sales of sports and entertainment goods, cultural office supplies, and communication equipment increasing by 52.7%, 50.1%, and 51.2% respectively [2] - Online retail remained active, with a 9.4% increase in retail sales through public networks [2] Employment and Income - The city added 268,100 new urban jobs, with per capita disposable income reaching 44,353 yuan, a year-on-year increase of 4.4% [2] - Urban residents' per capita disposable income was 47,990 yuan, growing by 4.1%, while rural residents' income was 26,112 yuan, growing by 5.3% [2] Price Stability - The price level in Tianjin remained stable, with a 0.1% year-on-year increase in consumer prices, while industrial producer prices and purchase prices both decreased by 3.7% [2]

永太科技:10月28日召开董事会会议

Mei Ri Jing Ji Xin Wen· 2025-10-28 10:20

Group 1 - Yongtai Technology (SZ 002326) announced on October 28 that its seventh fourth board meeting was held to review the "2025 Q3 Report" and other documents [1] - For the first half of 2025, Yongtai Technology's revenue composition was as follows: Industrial accounted for 68.92%, Trade for 30.87%, and Other businesses for 0.21% [1] - As of the report, Yongtai Technology's market capitalization was 16.8 billion yuan [1] Group 2 - The A-share market has surpassed 4000 points, marking a significant resurgence after ten years of stagnation, with a new "slow bull" market pattern emerging [1]

露笑科技:10月28日召开董事会会议

Mei Ri Jing Ji Xin Wen· 2025-10-28 10:20

Group 1 - The core viewpoint of the article highlights the recent board meeting of Luxshare Technology, where the third quarter report for 2025 was discussed [1] - For the first half of 2025, Luxshare Technology's revenue composition is as follows: Industrial sector accounted for 78.31%, photovoltaic industry for 21.17%, other businesses for 0.54%, and the new energy vehicle sector had a negative contribution of -0.03% [1] - As of the report date, Luxshare Technology's market capitalization stands at 16.1 billion yuan [1] Group 2 - The article also notes a significant market development, indicating that the A-share market has surpassed 4000 points, marking a resurgence after a decade of stagnation, with technology leading the market's new "slow bull" trend [1]

永利股份:10月28日召开董事会会议

Mei Ri Jing Ji Xin Wen· 2025-10-28 09:30

Group 1 - The core point of the article is that Yongli Co., Ltd. announced the convening of its 13th meeting of the 6th Board of Directors on October 28, 2025, to review the Q3 2025 report and other documents [1] - For the first half of 2025, Yongli Co., Ltd. reported that its revenue composition was 100.0% from the industrial sector [1] - As of the report date, Yongli Co., Ltd. has a market capitalization of 4.3 billion yuan [1] Group 2 - The A-share market has surpassed 4,000 points, marking a significant resurgence after a decade of stagnation, with technology leading the market's transformation into a "slow bull" new pattern [1]

北京科技经费投入明显提速

Bei Jing Qing Nian Bao· 2025-10-28 02:54

Group 1 - The total R&D expenditure in Beijing reached 327.84 billion yuan, marking an 11.2% increase from the previous year, with an R&D expenditure intensity of 6.58% of GDP, up by 0.36 percentage points [1] - The breakdown of R&D expenditure shows that basic research funding was 50.32 billion yuan (up 6.5%), applied research funding was 86.71 billion yuan (up 15.2%), and experimental development funding was 190.81 billion yuan (up 10.8%) [2] - The growth rate of applied research funding has accelerated significantly, increasing by 12.3 percentage points compared to the previous year, and it now accounts for 26.4% of total R&D expenditure, up by 0.9 percentage points [2] Group 2 - Corporate R&D expenditure reached 155.86 billion yuan, reflecting a 13.5% increase, while government research institutions and higher education institutions contributed 121.91 billion yuan (up 9.1%) and 41.07 billion yuan (up 12.2%) respectively [3] - The proportion of R&D funding from enterprises, government research institutions, and higher education institutions stands at 47.5%, 37.2%, and 12.5% respectively [3] Group 3 - The R&D expenditure in the information transmission, software, and information technology services industry was 73.5 billion yuan, a 6.3% increase, with software and IT services seeing a significant rise of 30.2% to 56.68 billion yuan [4] - In the manufacturing sector, R&D expenditure reached 46.77 billion yuan, with high-tech manufacturing accounting for 29.73 billion yuan; eight major industries contributed 90.4% of the total R&D expenditure in large-scale industrial enterprises [4] - Key sectors such as pharmaceutical manufacturing, specialized equipment manufacturing, automotive manufacturing, and computer, communication, and other electronic equipment manufacturing accounted for 76.5% of R&D expenditure in large-scale industrial enterprises, with specialized equipment and automotive manufacturing seeing increases of 36.4% and 90.2% respectively [4]

冲刺在即,宁波能否再进位?

3 6 Ke· 2025-10-28 02:07

Economic Overview - Ningbo's GDP for the first three quarters of 2025 reached 1,349.29 billion yuan, with a year-on-year growth of 5.0% at constant prices [1] - The primary industry added value was 30.11 billion yuan, growing by 3.6%; the secondary industry added value was 573.65 billion yuan, growing by 4.3%, with industrial output at 526.20 billion yuan, growing by 5.6%; the tertiary industry added value was 745.53 billion yuan, growing by 5.5% [1] Comparative Analysis - Ningbo's GDP growth rate of 5.0% is lower than the national average of 5.2% and the provincial average of 5.7% [2] - The secondary industry's added value growth of 4.3% is also below the national and provincial levels by 0.6 and 0.9 percentage points, respectively [2] - The city's fixed asset investment saw a significant decline of 18.1%, contrasting with a national decrease of 0.5% and a provincial decrease of 3.8% [2] Foreign Trade Performance - Ningbo's total import and export volume exceeded 1 trillion yuan, reaching 1,092.26 billion yuan, with a year-on-year growth of 3.7%, which is below the national growth of 4.0% and provincial growth of 6.2% [3] - The city's foreign trade dependency is notably high at 78.3%, significantly above the national average of 32.5% and the provincial average of 58.4%, indicating greater vulnerability to external shocks [3] Future Outlook - Ningbo aims to achieve a GDP of over 2 trillion yuan by 2025, with a current GDP of 1,814.77 billion yuan in 2024, indicating a close competition with Nanjing [1] - The city faces challenges in maintaining economic momentum and is urged to enhance efforts in stabilizing and improving economic conditions [3]

How earnings and a potential US-China trade deal are driving markets

Youtube· 2025-10-27 17:56

Core Insights - Corporate profits are stable, with S&P 500 net profit margins above the 5-year average for six consecutive quarters, and analysts expect this trend to continue into next year [1][3] Earnings Performance - The earnings season has been solid, particularly for financials and money center banks, driven by trading and investment banking [3] - Industrial companies are reporting strong earnings, supported by demand for AI infrastructure [3] - Tech earnings are anticipated to be a significant market driver this week, with high expectations set [4][5] Market Reactions - Recent earnings reports, such as those from GE Vernova, showed volatility, with stocks initially gapping up but then selling off sharply before stabilizing [8] - Market positioning and options trading are influencing stock movements at both individual and index levels [8] Economic Indicators - There are shifting expectations regarding China and potential Federal Reserve rate cuts, which could impact market dynamics [4][10] - The removal of trade-related overhangs is allowing markets to focus on earnings rather than trade headlines [11][12] Consumer Behavior - The economy is holding up well, with a K-shaped recovery observed; higher-income consumers are faring better than lower-income consumers, who are struggling with inflation [16] - There is caution in hiring, but mass layoffs are not being reported [16] Federal Reserve Outlook - A 25 basis point rate cut is largely expected, with discussions around the end of quantitative tightening (QT) gaining traction [17][18] - Markets are pricing in further rate cuts, with expectations for a third cut in January being slightly better than a coin flip [20]

江丰电子:10月27日召开董事会会议

Mei Ri Jing Ji Xin Wen· 2025-10-27 16:27

截至发稿,江丰电子市值为267亿元。 每经头条(nbdtoutiao)——拉1人入伙返1500元,投10万元成亿万富翁?这家公司大肆宣传将房产海外 代币化,有交了钱的人称是"牙签撬动地球" (记者 贾运可) 每经AI快讯,江丰电子(SZ 300666,收盘价:100.65元)10月27日晚间发布公告称,公司第四届第二 十七次董事会会议于2025年10月27日在公司会议室,以现场及通讯相结合的方式召开。会议审议了《关 于 <公司2025年第三季度报告> 的议案》等文件。 2024年1至12月份,江丰电子的营业收入构成为:工业占比100.0%。 ...

拓斯达:10月24日召开董事会会议

Mei Ri Jing Ji Xin Wen· 2025-10-27 13:29

Group 1 - The core point of the article is that TuoSiDa (SZ 300607) held its fourth board meeting on October 24, 2025, to discuss the use of temporarily idle raised funds and idle self-owned funds for cash management [1] - For the year 2024, TuoSiDa's revenue composition is entirely from the industrial sector, with a 100.0% share [1] - As of the report date, TuoSiDa has a market capitalization of 15.6 billion yuan [1]

瑞凌股份:10月25日召开董事会会议

Mei Ri Jing Ji Xin Wen· 2025-10-27 11:59

每经AI快讯,瑞凌股份(SZ 300154,收盘价:9.12元)10月27日晚间发布公告称,公司第六届第八次 董事会会议于2025年10月25日在公司会议室以现场及通讯相结合的方式召开。会议审议了《关于<2025 年第三季度报告>的议案》等文件。 2024年1至12月份,瑞凌股份的营业收入构成为:工业占比98.42%,其他业务占比1.58%。 截至发稿,瑞凌股份市值为41亿元。 每经头条(nbdtoutiao)——拉1人入伙返1500元,投10万元成亿万富翁?这家公司大肆宣传将房产海外 代币化,有交了钱的人称是"牙签撬动地球" (记者 胡玲) ...