芯片ETF龙头

Search documents

存储芯片板块开盘走强

Xin Lang Cai Jing· 2025-12-22 01:39

Group 1 - The storage chip sector opened strong, with companies such as Jingzhida and Kema Technology rising over 10% [1] - Other companies including Jingce Electronics, Chengdu Huamei, Changchuan Technology, Purun Shares, and Lianang Micro also experienced gains [1] - Related ETFs showed positive performance, with the leading chip ETF (159801) increasing by 1.33% and a trading volume of 8.32 million yuan, while the Chip 50 ETF (516920) rose by 1.21% with a trading volume of 2.90 million yuan [1]

国家大基金持股板块短线拉升

Xin Lang Cai Jing· 2025-12-12 05:07

Core Viewpoint - The National Integrated Circuit Industry Investment Fund has led to a short-term surge in stock prices of several companies in the semiconductor sector, indicating positive market sentiment and potential growth in this industry [1] Group 1: Stock Performance - Yandong Microelectronics saw a price increase of over 10% [1] - Other companies such as Tuojing Technology, Zhongwei Company, Beifang Huachuang, Saiwei Electronics, and Xingfu Electronics also experienced price increases [1] Group 2: ETF Performance - The leading chip ETF (159801) rose by 1.55% with a transaction volume of 83.3727 million yuan [1] - The leading chip ETF (516640) increased by 1.65% with a transaction volume of 62.236 million yuan [1]

大涨!“硬科技”爆发

Zhong Guo Zheng Quan Bao· 2025-10-27 14:44

Group 1: Market Performance - On October 27, the Shanghai Composite Index approached 4000 points, with the "hard technology" sector, including storage chips and optical modules, leading the gains [1][4] - The three major A-share indices collectively rose, with the ChiNext Index and the Sci-Tech Innovation 50 Index increasing by 1.98% and 1.50%, respectively [4] - Several ETFs related to communication and semiconductors saw gains exceeding 3%, with some 5G communication-themed ETFs rising over 5% [4] Group 2: ETF Trends - The semiconductor ETF (159801) tracking the National Securities Semiconductor Index has seen a net inflow of over 480 million yuan in October, bringing its total size to over 5.1 billion yuan [4] - The Hong Kong Stock Connect Technology ETF (159262) has continuously attracted net inflows for 11 weeks, with its latest size surpassing 5.7 billion yuan [5] - The chip equipment ETF (560780) has gained over 55% this year, with a net inflow of over 300 million yuan in October, bringing its size to over 1.6 billion yuan [5] Group 3: Gold ETFs - Gold ETFs and Shanghai Gold ETFs experienced a net inflow of over 15.5 billion yuan from October 20 to October 23, but saw a net outflow of nearly 2 billion yuan on October 24 [2][11] - The recent decline in gold prices is attributed to high short-term congestion and reduced geopolitical risks, according to Huazhang Fund [7] Group 4: Cross-Border ETF Premium Risks - Several fund managers have issued warnings regarding premium risks associated with cross-border ETFs, with many tracking indices like the Nasdaq 100 and Nikkei 225 showing premium rates above 5% as of October 27 [3][15]

ETF投资高手实战大赛丨哪些ETF备受“牛人”青睐?9月18日十大买入ETF榜:芯片概念ETF霸榜(明细)

Xin Lang Zheng Quan· 2025-09-18 09:27

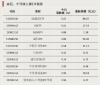

Group 1 - The "Second Golden Unicorn Best Investment Advisor Selection" event is currently ongoing, with over 3,000 professional investment advisors participating in simulated trading competitions [1] - The event aims to provide a platform for investment advisors to showcase their capabilities, expand their services, and enhance their skills, thereby promoting the healthy development of China's wealth management industry [1] Group 2 - The top ten most frequently bought ETFs on September 18 include the Hong Kong Securities ETF, Sci-Tech Chip ETF, and Robot ETF, indicating strong interest in these sectors [2] - The top ten ETFs by purchase amount on the same day also feature the Hong Kong Securities ETF and Robot ETF, suggesting significant capital flow into these investment vehicles [3] Group 3 - The data for the top bought stocks/ETFs is based on the frequency of purchases by all participating advisors, while the purchase amount data reflects the total investment amounts in these stocks/ETFs [4] - The competition includes categories for stock simulation, on-site ETF simulation, and public fund simulation, with specific trading rules regarding holding proportions, maximum drawdown, and rebalancing frequency [4]

专业选手实战大赛丨哪些ETF备受“牛人”青睐?9月16日十大买入ETF榜、十大买入金额ETF榜出炉

Xin Lang Zheng Quan· 2025-09-16 08:17

Group 1 - The "Second Golden Unicorn Best Investment Advisor Selection" event is currently ongoing, with over 3,000 professional investment advisors participating in simulated trading competitions [1] - The event aims to provide a platform for investment advisors to showcase their capabilities, expand services, and enhance skills, thereby promoting the healthy development of China's wealth management industry [1] Group 2 - The top ten most frequently bought ETFs on September 16 include the Robot ETF, Tourism ETF, and Hong Kong Securities ETF, indicating strong interest in sectors like robotics and tourism [2] - The top ten ETFs by purchase amount on the same day also feature the Robot ETF and the Korean Semiconductor ETF, highlighting significant investment in technology and robotics [3] Group 3 - The data for the top bought stocks/ETFs is based on the frequency of purchases by all participating advisors, while the purchase amount data reflects the total investment amounts [4] - The competition includes categories for stock simulation, on-site ETF simulation, and public fund simulation, with specific trading rules regarding holding proportions, maximum drawdown, and rebalancing frequency [4]

半导体板块盘初拉升,华虹公司盘中创新高

Xin Lang Cai Jing· 2025-09-01 01:43

Group 1 - The semiconductor sector experienced a significant rise at the beginning of trading, with companies such as Allwinner Technology and Hua Hong Semiconductor reaching new highs during the session [1] - Li Yang Chip and Demingli stocks hit the daily limit up, while Yutai Microelectronics saw an increase of over 10% [1] - Other companies including SourceJ Technology, Guoxin Technology, Jinghe Integration, Huafeng Measurement and Control, and Aojie Technology also saw gains [1] Group 2 - Related ETFs showed positive performance, with the leading chip ETF (159801) rising by 2.31% and a trading volume of 40.8161 million yuan [1] - The Southern Semiconductor ETF (159325) increased by 2.59%, with a trading volume of 4.9692 million yuan [1]

8月14日涨幅居前的ETF

Zhong Guo Zheng Quan Bao· 2025-08-14 20:16

Core Insights - The article highlights the performance of various ETFs, particularly in the biotechnology and semiconductor sectors, indicating a positive trend in these industries [1] Group 1: Biotechnology ETFs - The S&P Biotechnology ETF increased by 2.70% [1] - The NASDAQ Biotechnology ETF rose by 2.45% [1] Group 2: Semiconductor ETFs - The Chip ETF saw a rise of 1.76% [1] - The Semiconductor Leaders ETF increased by 1.71% [1] - The Chip ETF Leaders rose by 1.69% [1] - The Semiconductor ETF gained 1.67% [1] - The Semiconductor Industry ETF increased by 1.51% [1] Group 3: Other ETFs - The Hong Kong Stock Connect Non-Bank ETF rose by 1.63% [1] - The S&P 500 ETF increased by 1.62% [1] - The Zhongchuang 400 ETF saw a rise of 1.49% [1]

“寒王”股价续创新高!重仓寒武纪9.98%的芯片ETF龙头(159801)盘中涨超3%

Xin Lang Cai Jing· 2025-08-14 05:24

Group 1 - The semiconductor industry continues to strengthen, with the National Securities Semiconductor Index rising by 3.64% as of 11:07 [1] - The second-largest weighted stock, Cambricon (688256), increased by 12.33%, reaching a market capitalization of over 400 billion yuan [1] - Haiguang Information (688041), the third-largest weighted stock, reported a revenue of 3.06 billion yuan for Q2 2025, a year-on-year growth of 41%, and a net profit of 700 million yuan, up 23% year-on-year [1] Group 2 - Other stocks such as Rockchip (603893) rose by 6.04%, with several other stocks also experiencing gains [2] - The leading semiconductor ETF (159801) surged by 3.38%, marking its fourth consecutive increase, with a cumulative rise of 2.52% over the past week [2] - Tianfeng Securities indicates a continued optimistic growth trend in the global semiconductor market, driven by AI, with a bright outlook for Q3 during the semiconductor peak season [2]

半导体板块午后异动,寒武纪20cm涨停!芯片ETF龙头(159801)盘中涨超3%

Xin Lang Cai Jing· 2025-08-12 05:48

Group 1 - The National Semiconductor Chip Index (980017) has shown a strong increase of 3.40% as of August 12, 2025, with key stocks like Cambricon (688256) hitting the daily limit up, and others such as Haiguang Information (688041) and Tongfu Microelectronics (002156) also experiencing significant gains [1] - The leading chip ETF (159801) has seen a trading volume of 1.18 billion yuan with a turnover rate of 3.57% during the session, and its average daily trading volume over the past year is 77.29 million yuan [1] - The leading chip ETF has reached a scale of 3.242 billion yuan, with an increase of 22.5 million shares over the past year, ranking it among the top two in comparable funds [1] Group 2 - The top ten weighted stocks in the National Semiconductor Chip Index (980017) account for 67.23% of the index, with major players including SMIC (688981) and Cambricon (688256) [2] - The electronic industry is experiencing a mild recovery, with storage chip prices rebounding since February 2025, and global pure semiconductor foundry revenue expected to grow by 17% year-on-year [2] - The semiconductor industry is projected to fully recover in 2025, with improved profitability for related companies, particularly in the AIOT SoC chip, analog chip, and driver chip sectors [3]

为什么没人愿意认购ETF了?

Sou Hu Cai Jing· 2025-05-15 12:05

Core Viewpoint - The article discusses the challenges faced by financial institutions in Taiwan and mainland China regarding the practice of "self-funding" to meet ETF sales targets, highlighting the negative returns associated with this practice in recent years [1][2][3]. Group 1: Self-Funding and Negative Returns - The phenomenon of "self-funding" exists across various industries, but negative expected returns in the fund industry are rare [3]. - For example, newly launched stock ETFs in 2020 had an average net value increase of approximately 1.5% from establishment to listing, allowing managers to lock in profits through market transactions [5]. - However, by 2021, self-funding behavior began to yield negative returns, with an average net value performance of -1% for self-funded ETF subscriptions [6]. - In some cases, such as a specific startup board ETF, losses could exceed 10% by the time of listing [8]. Group 2: Accelerated Construction Periods - The article notes that the construction period for ETFs has significantly decreased, from an average of 28 days in 2020 to just 11 days by 2025 [12]. - This rapid construction leaves fund managers with limited opportunities for market timing, leading to a mechanical approach to building positions [13][19]. - The average construction time for ETFs has remained under 15 days from 2021 to 2025, making it challenging for managers to find suitable entry points [18]. Group 3: Successful Timing by Fund Managers - Data shows that certain fund managers have successfully timed their ETF launches, resulting in significant profits for initial investors [20]. - For instance, the "Chip ETF Leader" managed by GF Fund earned nearly 386 million yuan for its initial subscribers [21]. - The timing of these successful launches often coincided with favorable market conditions, such as the semiconductor industry's growth during the trade war [23]. Group 4: Investor Experience and Fund Management - The article emphasizes that while ETF products are primarily tools for market participation, the experience of initial investors is crucial [28]. - It suggests that fund managers should consider the timing of product issuance and the length of the construction period to enhance investor returns [29].