HUA HONG SEMI(01347)

Search documents

智通港股通资金流向统计(T+2)|10月22日

智通财经网· 2025-10-21 23:36

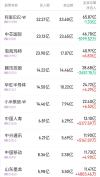

Core Insights - The article highlights the net inflow and outflow of capital in the Hong Kong stock market, with specific focus on the top companies experiencing significant changes in capital flow [1][2][3] Net Inflow Summary - Meituan-W (03690) leads with a net inflow of 1.151 billion, representing a 16.66% increase in capital [2] - The second highest is the Tracker Fund of Hong Kong (02800) with a net inflow of 1.053 billion, showing a 7.08% increase [2] - Zijin Mining International (02259) follows closely with a net inflow of 1.031 billion, reflecting a 46.10% increase [2] - Other notable inflows include Southern Hang Seng Technology (03033) with 0.905 billion and China Mobile (00941) with 0.763 billion, both showing significant percentage increases [2] Net Outflow Summary - Alibaba-W (09988) experiences the largest net outflow at -2.161 billion, a decrease of 10.40% [2] - SMIC (00981) follows with a net outflow of -1.578 billion, reflecting a 13.52% decrease [2] - Hua Hong Semiconductor (01347) has a net outflow of -0.904 billion, showing a 17.29% decrease [2] - Other significant outflows include Lao Pu Gold (06181) at -0.554 billion and Jiangxi Copper (00358) at -0.444 billion, both with substantial percentage declines [2] Net Inflow Ratio Summary - GX Hang Seng Technology (02837) leads with a net inflow ratio of 80.84%, indicating strong investor interest [3] - Red Star Macalline (01528) follows with a net inflow ratio of 58.56% [3] - China National Foreign Trade (00598) has a net inflow ratio of 56.81%, showcasing robust demand [3] Net Outflow Ratio Summary - Nexperia (01316) has the highest net outflow ratio at -55.33%, indicating significant capital withdrawal [3] - Delta Electronics (00179) follows with a net outflow ratio of -51.63% [3] - Gao Xin Retail (06808) shows a net outflow ratio of -44.66%, reflecting investor caution [3]

山东墨龙近一个月首次现身港股通成交活跃榜 净买入0.48亿港元

Zheng Quan Shi Bao Wang· 2025-10-21 13:41

Core Insights - On October 21, Shandong Molong made its first appearance on the Hong Kong Stock Connect active trading list in the past month, with a trading volume of 1.147 billion HKD and a net buying amount of 48 million HKD, closing up 8.39% [1] Trading Activity Summary - The total trading volume of active stocks on the Hong Kong Stock Connect reached 44.268 billion HKD, accounting for 35.00% of the day's total trading amount, with a net buying amount of 868 million HKD [1] - Alibaba-W led the trading volume with 10.33 billion HKD, followed by SMIC and Pop Mart with trading amounts of 7.805 billion HKD and 5.897 billion HKD, respectively [1] Stock Performance Overview - The most frequently listed stocks in the past month include Alibaba-W and Huahong Semiconductor, each appearing 16 times, indicating strong interest from Hong Kong Stock Connect investors [1] - Shandong Molong's trading activity on October 21 marked its first listing in the past month, with a notable increase in its stock price [1]

南向资金今日净买入11.71亿港元,泡泡玛特净买入11.21亿港元

Zheng Quan Shi Bao Wang· 2025-10-21 13:39

Market Overview - On October 21, the Hang Seng Index rose by 0.65%, with total southbound trading amounting to HKD 126.49 billion, including buy transactions of HKD 63.83 billion and sell transactions of HKD 62.66 billion, resulting in a net buying amount of HKD 1.17 billion [1] Southbound Trading Details - The southbound trading through Stock Connect (Shenzhen) had a cumulative trading amount of HKD 45.84 billion, with buy transactions of HKD 22.25 billion and sell transactions of HKD 23.60 billion, leading to a net selling amount of HKD 1.35 billion [1] - Conversely, the Stock Connect (Shanghai) recorded a cumulative trading amount of HKD 80.65 billion, with buy transactions of HKD 41.59 billion and sell transactions of HKD 39.06 billion, resulting in a net buying amount of HKD 2.52 billion [1] Active Stocks - Among the actively traded stocks, Alibaba-W had the highest trading amount at HKD 103.30 billion, followed by SMIC with HKD 78.05 billion and Pop Mart with HKD 58.97 billion [1] - In terms of net buying, Pop Mart led with a net buying amount of HKD 11.21 billion despite a closing price drop of 8.08%, followed by Xiaomi Group-W with HKD 4.81 billion and Hua Hong Semiconductor with HKD 4.41 billion [1] - The stock with the highest net selling was the Tracker Fund of Hong Kong, with a net selling amount of HKD 11.02 billion, while Alibaba-W and Innovent Biologics experienced net selling amounts of HKD 4.30 billion and HKD 0.78 billion, respectively [1] Detailed Stock Performance - The following table summarizes the trading performance of selected stocks on October 21: - Pop Mart: Total trading amount of HKD 589.69 million, net buying of HKD 112.07 million, with a price drop of 8.08% [3] - Xiaomi Group-W: Total trading amount of HKD 357.59 million, net buying of HKD 48.11 million, with a price drop of 1.44% [3] - Hua Hong Semiconductor: Total trading amount of HKD 366.72 million, net buying of HKD 44.13 million, with a price drop of 0.26% [3] - Tencent Holdings: Total trading amount of HKD 461.03 million, net selling of HKD 3.19 million, with a price increase of 0.48% [3] - Alibaba-W: Total trading amount of HKD 1,033.04 million, net selling of HKD 42.98 million, with a price increase of 1.98% [3] - Tracker Fund of Hong Kong: Total trading amount of HKD 111.86 million, net selling of HKD 110.23 million, with a price increase of 0.68% [3]

港股通(深)净卖出13.53亿港元

Zheng Quan Shi Bao Wang· 2025-10-21 13:39

Core Points - The Hang Seng Index rose by 0.65% to close at 26,027.55 points on October 21, with a net inflow of HKD 1.171 billion from southbound funds through the Stock Connect [1] - The total trading volume for the Stock Connect on the same day was HKD 126.489 billion, with a net buy of HKD 1.171 billion [1] - In the Shanghai Stock Connect, the trading volume was HKD 80.647 billion with a net buy of HKD 2.524 billion, while the Shenzhen Stock Connect had a trading volume of HKD 45.843 billion with a net sell of HKD 1.353 billion [1] Trading Activity - The most actively traded stock in the Shanghai Stock Connect was Alibaba-W, with a trading volume of HKD 6.587 billion, followed by SMIC and Pop Mart, with trading volumes of HKD 4.678 billion and HKD 4.097 billion, respectively [1] - In terms of net buying, Pop Mart led with a net inflow of HKD 0.683 billion, despite its stock price dropping by 8.08% [1] - Alibaba-W had the highest net sell amount of HKD 0.133 billion, while its stock price increased by 1.98% [1] Shenzhen Stock Connect Activity - In the Shenzhen Stock Connect, Alibaba-W also topped the trading volume with HKD 3.743 billion, followed by SMIC and Pop Mart with HKD 3.127 billion and HKD 1.800 billion, respectively [2] - Pop Mart again had the highest net buy amount of HKD 0.438 billion, despite a closing price drop of 8.08% [2] - The stock with the largest net sell was the Tracker Fund of Hong Kong, with a net sell of HKD 1.102 billion, while its stock price rose by 0.68% [2]

智通港股通活跃成交|10月21日

智通财经网· 2025-10-21 11:03

Group 1 - On October 21, 2025, Alibaba-W (09988), SMIC (00981), and Pop Mart (09992) ranked as the top three companies by trading volume in the Southbound Stock Connect, with transaction amounts of 6.587 billion, 4.678 billion, and 4.097 billion respectively [1] - In the Southbound Stock Connect for the Shenzhen-Hong Kong Stock Connect, Alibaba-W (09988), SMIC (00981), and Pop Mart (09992) also held the top three positions, with transaction amounts of 3.743 billion, 3.127 billion, and 1.800 billion respectively [1] Group 2 - In the Southbound Stock Connect, the top active trading companies included Alibaba-W (09988) with a transaction amount of 6.587 billion and a net buy of -0.133 billion, SMIC (00981) with 4.678 billion and a net buy of -51.9952 million, and Pop Mart (09992) with 4.097 billion and a net buy of +683 million [2] - For the Shenzhen-Hong Kong Stock Connect, the top active trading companies were Alibaba-W (09988) with a transaction amount of 3.743 billion and a net buy of -0.296 billion, SMIC (00981) with 3.127 billion and a net buy of +180 million, and Pop Mart (09992) with 1.800 billion and a net buy of +438 million [2]

南向资金重现净买入!机构称短期调整不改牛市格局

Xin Lang Cai Jing· 2025-10-21 10:22

Market Overview - The Hong Kong stock market continues its upward trend, with the Hang Seng Index rising by 0.65%, the Hang Seng Tech Index increasing by 1.26%, and the Hang Seng China Enterprises Index up by 0.76%, indicating a broad market rally with 1,315 stocks rising and 883 falling [1] - Southbound funds recorded a net purchase of HKD 1.171 billion on a single day, signaling renewed buying interest after a brief outflow [4] Stock Performance - The most favored stocks included Pop Mart, Xiaomi Group-W, and Hua Hong Semiconductor, which saw net purchases of HKD 1.121 billion, HKD 0.481 billion, and HKD 0.441 billion, respectively [4] - Conversely, the iShares Asia 50 ETF, Alibaba-W, and Innovent Biologics experienced varying degrees of net selling, with net sales of HKD 1.102 billion, HKD 4.3 billion, and HKD 0.78 billion, respectively [5] Future Outlook - According to Guotai Junan, historical data suggests that minor pullbacks in the Hong Kong market often occur after profit-taking following market rallies, with the Hang Seng Index typically declining by an average of 7% over 11 trading days [6] - The report emphasizes that short-term fluctuations do not alter the medium-term positive trend, with the technology sector remaining the main investment focus amid an upward industrial cycle and increased capital inflow [6] - Guoyuan International highlights that the primary external uncertainty remains the US-China rivalry, which could impact investor sentiment and lead to short-term market volatility, but there is a significant likelihood that the Hang Seng Index will return to an upward trajectory [6]

图解丨南下资金净买入泡泡玛特超11亿港元,连续3日净卖出阿里

Ge Long Hui A P P· 2025-10-21 10:22

Group 1 - Southbound funds recorded a net purchase of Hong Kong stocks amounting to 1.171 billion HKD today [1] - Notable net purchases include Pop Mart at 1.121 billion HKD, Xiaomi Group-W at 481 million HKD, and Hua Hong Semiconductor at 441 million HKD [1] - Southbound funds have sold Alibaba-W for three consecutive days, totaling a net sell of 4.329 billion HKD [1] Group 2 - Southbound funds ended an eight-day net selling streak for SMIC, with a net purchase of 128 million HKD [1] - The net selling of the Tracker Fund of Hong Kong reached 1.102 billion HKD [1] - Cumulatively, southbound funds have sold Alibaba for a total of 4.33685 billion HKD over the last three days [1]

北水动向|北水成交净买入11.71亿 泡泡玛特盘后发布盈喜 北水全天抢筹超11亿港元

Zhi Tong Cai Jing· 2025-10-21 10:02

Core Insights - The Hong Kong stock market saw a net inflow of 11.71 billion HKD from northbound trading on October 21, with a net buy of 25.24 billion HKD from the Shanghai Stock Connect and a net sell of 13.53 billion HKD from the Shenzhen Stock Connect [1] Group 1: Stock Performance - The most bought stocks included Pop Mart (09992), Xiaomi Group-W (01810), and Hua Hong Semiconductor (01347) [1] - The most sold stocks included the Tracker Fund of Hong Kong (02800), Alibaba Group-W (09988), and Innovent Biologics (01801) [1] Group 2: Individual Stock Details - Pop Mart (09992) received a net buy of 11.2 billion HKD, with projected revenue growth of 245%-250% year-on-year for Q3 2025 [4] - Xiaomi Group-W (01810) had a net buy of 4.81 billion HKD, with the company repurchasing 10.7 million shares at prices between 45.9 and 46.76 HKD [5] - Hua Hong Semiconductor (01347) saw a net buy of 4.29 billion HKD, supported by positive sentiment around the semiconductor sector driven by AI [5] - China Mobile (00941) received a net buy of 1.77 billion HKD, reporting Q3 service revenue of 216.2 billion HKD, a 0.8% year-on-year increase [5] - China Life (02628) had a net buy of 517.7 million HKD, with expected net profit growth of 50% to 70% year-on-year for the first three quarters [6] Group 3: Market Sentiment - The Tracker Fund of Hong Kong (02800) experienced a net sell of 11.02 billion HKD, attributed to increased market volatility and high valuations of global risk assets [6] - Tencent (00700), Innovent Biologics (01801), and Alibaba Group-W (09988) faced net sells of 318.7 million, 776.4 million, and 4.29 billion HKD respectively [7]

南向资金 | 泡泡玛特获净买入11.21亿港元

Di Yi Cai Jing· 2025-10-21 10:00

(本文来自第一财经) 南向资金今日净买入11.71亿港元。其中泡泡玛特、小米集团-W、华虹半导体净买入额位列前三,分别 获净买入11.21亿港元、4.81亿港元、4.41亿港元。净卖出方面,盈富基金、阿里巴巴-W、信达生物分别 遭净卖出11.02亿港元、4.3亿港元、0.78亿港元。 ...

上银数字经济A三季度涨56.67%,基金经理赵治烨押注“双主线配置+动态风控”核心策略

Xin Lang Ji Jin· 2025-10-21 08:17

Core Insights - The report highlights the significant growth of the Shangyin Digital Economy A fund, with a net asset value of 0.21 billion yuan as of September 30, 2025, representing a 69.34% increase from the previous quarter [3][5] - The fund achieved a remarkable 56.67% return in Q3 2025, outperforming the average of 1.62% for similar funds and the CSI 300 index's 25.43% increase [5] - The fund's investment strategy focuses on the semiconductor industry, particularly in domestic computing chips and AI edge chips, capitalizing on the accelerating demand driven by AI advancements [5][10] Fund Performance - As of October 20, 2025, the fund's unit net value reached 1.5092 yuan, with a daily increase of 0.87% and a total return of 50.92% since its inception on August 6, 2024 [1][8] - Over the past three months, the fund has seen a growth of 37.71%, and over six months, a cumulative increase of 51.03% [1] Investment Strategy - The fund employs a "dual mainline configuration + dynamic risk control" strategy, focusing on structural opportunities in the semiconductor sector [5] - The first mainline targets domestic computing chips, with a focus on companies that have clear technological barriers and positive customer validation [5] - The second mainline centers on AI edge chips, anticipating the market growth of smart glasses, panoramic cameras, and service robots from 2025 to 2027 [5] Top Holdings - The fund's top ten holdings are entirely concentrated in the semiconductor sector, including companies like SMIC, Hua Hong Semiconductor, and Cambrian [6][7] - The total market value of the top ten holdings amounts to approximately 207 million yuan [7] Management Team - The fund is managed by Zhao Zhiyue and Hui Jun, with Zhao having managed the fund since its inception and achieving a total return of 50.92% [8] - Hui Jun joined the management team on May 19, 2025, with a total return of 48.02% [8] Future Outlook - The fund managers express optimism about the semiconductor industry's prospects, particularly in computing and edge chips, driven by ongoing AI advancements and domestic substitution processes [10]