Cambricon(688256)

Search documents

A股三大股指盘中弱势震荡整理,银行板块拉升,石油板块走高

Zheng Quan Shi Bao· 2025-10-22 09:55

Market Overview - The Shanghai Composite Index experienced weak fluctuations, closing down 0.07% at 3913.76 points, while the Shenzhen Component Index fell 0.62% to 12996.61 points, and the ChiNext Index dropped 0.79% to 3059.32 points [1] - The North Exchange 50 Index showed relative strength, rising 0.87% [1] - Total trading volume in the Shanghai, Shenzhen, and North exchanges was 169.05 billion yuan, a decrease of over 20 billion yuan compared to the previous day [1] Banking Sector - The banking sector saw significant gains, with Agricultural Bank of China rising over 2%, marking its 14th consecutive trading day of gains and reaching a historical high [2][3] - Other banks also performed well, with Jiangyin Bank up 3.56% and several major banks like Industrial and Commercial Bank of China and China Construction Bank rising over 1% [3][4] - Analysts from Everbright Securities noted that the banking sector currently offers good value for investment, with stable earnings expected in the upcoming quarterly reports [6] Oil Sector - The oil sector experienced a strong rally, with Keli Co. rising over 12% and several other companies like Junyou Co. and Beiken Energy hitting the daily limit [8][9] - The U.S. Department of Energy announced plans to purchase 1 million barrels of crude oil to replenish its strategic reserves, which may influence market dynamics [10] - International agencies like IEA, EIA, and OPEC have adjusted their forecasts for oil production, indicating a continued oversupply situation [10] AI Chip Sector - Cambrian (688256) saw a significant surge, with its stock price rising over 7% during the day and closing up 4.42%, leading the A-share market in trading volume at nearly 20 billion yuan [12][14] - The company reported a substantial year-on-year revenue increase of 2386% for the first three quarters, driven by the strong performance of its cloud products [14] - Analysts highlighted the growing demand for domestic AI chips amid U.S.-China tech tensions, positioning Cambrian favorably in the market [14]

科创板资金动向:9股主力资金净流入超亿元

Zheng Quan Shi Bao Wang· 2025-10-22 09:52

Market Overview - The net outflow of main funds in the Shanghai and Shenzhen markets reached 44.231 billion yuan, with the Sci-Tech Innovation Board experiencing a net outflow of 290 million yuan [1] - A total of 251 stocks saw net inflows, while 338 stocks experienced net outflows [1] Sci-Tech Innovation Board Performance - On the Sci-Tech Innovation Board, 156 stocks rose, with one stock, Silin Jie, hitting the daily limit, while 423 stocks declined [1] - The top three stocks with the highest net inflow of main funds were Haiguang Information (net inflow of 642 million yuan), Dingtong Technology (228.6018 million yuan), and Hanwujing-U (198.2726 million yuan) [2] Continuous Fund Flow Analysis - There are 58 stocks with continuous net inflows for more than three trading days, with Kangwei Century leading at 14 consecutive days of inflow [2] - Conversely, 143 stocks experienced continuous net outflows, with Hangke Technology leading at 15 consecutive days of outflow [2] Key Stocks with Significant Fund Flows - The top stocks by net inflow include: - Haiguang Information: 64.192 million yuan, 7.43% inflow rate, 2.06% increase [2] - Dingtong Technology: 22.860 million yuan, 16.22% inflow rate, 1.24% increase [2] - Hanwujing-U: 19.827 million yuan, 1.00% inflow rate, 4.42% increase [2] - The stocks with the highest net outflows include: - Huahong Company: 31.8 million yuan outflow, 1.59% decrease [1] - Yuanjie Technology: 30.3 million yuan outflow [1] - Kingsoft Office: 15.9 million yuan outflow [1]

科创板百元股达71只,寒武纪-U股价最高

Zheng Quan Shi Bao Wang· 2025-10-22 09:43

Core Insights - The average stock price on the STAR Market is 40.50 yuan, with 71 stocks priced over 100 yuan, and the highest priced stock is Cambrian-U at 1429.50 yuan, which increased by 4.42% today [2][3] Stock Performance - A total of 156 stocks on the STAR Market rose today, while 423 stocks fell. Among the stocks priced over 100 yuan, the average decline was 0.14%, with 22 stocks increasing and 49 stocks decreasing [2][3] - The highest closing price was Cambrian-U at 1429.50 yuan, followed by SourceJet Technology at 481.50 yuan and GuoDun Quantum at 380.00 yuan [2][3] Premium Analysis - The average premium of stocks priced over 100 yuan relative to their issue price is 476.88%, with the highest premiums seen in SourceJet Technology (4271.18%), Cambrian-U (2120.07%), and Anji Technology (1545.58%) [2][3] Industry Distribution - The stocks priced over 100 yuan are concentrated in the electronics, pharmaceutical, and computer industries, with 35, 11, and 9 stocks respectively [2][3] Capital Flow - There was a net inflow of 264 million yuan into stocks priced over 100 yuan today, with the highest net inflows in Haiguang Information (641.92 million yuan), Cambrian-U (198.27 million yuan), and Canxin Technology (194.87 million yuan) [3] - The total margin financing balance for stocks priced over 100 yuan is 91.22 billion yuan, with Cambrian-U, SMIC, and Haiguang Information having the highest balances [3]

小作文突袭,股价一度涨超7%,寒武纪回应

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-22 09:41

10月22日午后,寒武纪(688256.SH)一度飙涨超7%,股价再度超越贵州茅台(600519.SH),带动人工智能板块震荡走强,随后回落,收1429.50元/股,涨 超4%。 消息面上,多篇关于寒武纪的订单小作文在各大平台刷屏,引起市场广泛关注。 (声明:文章内容仅供参考,不构成投资建议。投资者据此操作,风险自担。) 对此,21财经·南财快讯记者以投资者身份致电寒武纪,公司证券部工作人员表示,股价波动可能是受到了多种因素影响,小作文涉及公司的经营业绩的相 关情况请以公司公告为准。经营合作的情况,可以参考过去的定期报告里面的经营分析的章节。 公开资料显示,寒武纪成立于2016年,专注于人工智能芯片产品的研发与技术创新,致力于打造人工智能领域的核心处理器芯片。寒武纪产品广泛应用于服 务器厂商和产业公司,面向互联网、金融、交通、能源、电力和制造等领域的复杂AI应用场景提供充裕算力,推动人工智能赋能产业升级。 2025年中报显示,在运营商领域,寒武纪公司聚焦核心应用,持续提供深度优化的算力解决方案,保持客户业务场景的领先性与稳定性。在金融领域,公司 不断加深与银行、保险公司及基金公司的业务探索。在支持传统人工智能 ...

再度爆发!601288 14连阳!688256 突然拉升

Zheng Quan Shi Bao· 2025-10-22 09:36

Market Overview - The Shanghai Composite Index experienced weak fluctuations but managed to hold above 3900 points, closing at 3913.76, down 0.07% [2] - The Shenzhen Component Index fell by 0.62% to 12996.61, while the ChiNext Index decreased by 0.79% to 3059.32 [2] - The Northbound 50 Index rose by 0.87%, with total trading volume in the Shanghai and Shenzhen markets reaching 16905 billion, a decrease of over 2000 billion from the previous day [2] Sector Performance - The coal, non-ferrous metals, brokerage, and semiconductor sectors saw declines, while the oil sector showed strong gains [2] - Notable performers in the oil sector included Keli Co., which rose over 10%, and several others that hit the daily limit [10] - The banking sector also rebounded, with Agricultural Bank of China rising over 2%, marking its 14th consecutive trading day of gains [6][4] Noteworthy Stocks - Cambrian (688256) surged over 7% during the afternoon session, closing up 4.42% with a trading volume of nearly 200 billion, making it the top stock by trading volume in A-shares [14] - The stock price of Cambrian reached a peak of 1468 yuan, surpassing that of Kweichow Moutai during trading [14] - The newly listed Marco Polo on the Shenzhen main board saw a significant increase of 128.8%, closing at 31.46 yuan per share [2] Banking Sector Insights - Analysts from Guangda Securities noted that the banking sector currently offers good value after market adjustments, with stable earnings expected in the upcoming quarterly reports [8] - The sector is characterized by high dividends and low valuations, with a notable preference for Hong Kong-listed banks [8] - Citic Securities indicated that the banking sector is likely to see continued demand for stocks due to their defensive attributes amid rising risk aversion [8] Oil Sector Developments - The oil sector's rise is attributed to the U.S. Department of Energy's plan to purchase 1 million barrels of crude oil to replenish strategic reserves [12] - International agencies have adjusted their forecasts for oil production, indicating a potential oversupply situation in the near term [12] - Despite short-term price fluctuations, the long-term outlook for oil supply and demand remains optimistic, particularly for major oil companies and service providers [12] Cambrian's Financial Performance - Cambrian reported a significant revenue increase of 2386% year-on-year for the first three quarters, totaling 4.607 billion yuan [16] - The net profit attributable to shareholders reached 1.605 billion yuan, driven by the strong performance of its cloud products [16] - The company is positioned to benefit from the growing demand for domestic AI chip solutions amid increasing capital expenditures from major cloud providers [17]

再度爆发!601288,14连阳!688256,突然拉升

Zheng Quan Shi Bao· 2025-10-22 09:19

Market Overview - The Shanghai Composite Index experienced weak fluctuations but managed to hold above 3900 points, closing at 3913.76, down 0.07% [1] - The Shenzhen Component Index fell 0.62% to 12996.61, while the ChiNext Index decreased by 0.79% to 3059.32 [1] - The Northbound 50 Index rose by 0.87%, with total trading volume across the three markets reaching 169.05 billion yuan, a decrease of over 20 billion yuan from the previous day [1] Banking Sector Performance - The banking sector showed strength, with Agricultural Bank of China rising over 2%, marking its 14th consecutive trading day of gains [2][4] - Other banks such as Jiangyin Bank and Industrial and Commercial Bank of China also saw increases, with Jiangyin Bank up 3.56% [2][3] Oil Sector Activity - The oil sector saw significant gains, with Keli Co. rising over 12% and several other companies hitting the daily limit [7][8] - The U.S. Department of Energy announced plans to purchase 1 million barrels of crude oil to replenish strategic reserves, which may influence market dynamics [9] Company-Specific Highlights - Cambricon Technologies (688256) experienced a notable surge, with its stock price rising over 7% during the day, closing up 4.42% with a trading volume of 19.8 billion yuan [10] - The company reported a substantial increase in revenue for the first three quarters, achieving 4.607 billion yuan, a year-on-year growth of 2386% [11] - The growth was attributed to the strong performance of its cloud products, particularly the Siyuan 590, amid increasing domestic demand for AI-related technologies [11]

再度爆发!601288,14连阳!688256,突然拉升

证券时报· 2025-10-22 09:11

Market Overview - The Shanghai Composite Index experienced weak fluctuations, closing slightly down by 0.07% at 3913.76 points, while the Shenzhen Component Index fell by 0.62% to 12996.61 points, and the ChiNext Index dropped 0.79% to 3059.32 points [1] - The North Stock 50 Index showed relative strength, increasing by 0.87% [1] - Total trading volume in the Shanghai, Shenzhen, and North Stock markets was 169.05 billion yuan, a decrease of over 200 billion yuan compared to the previous day [1] Banking Sector Performance - The banking sector saw significant gains, with notable performances from Jiangyin Bank, which rose by 3.56%, and Agricultural Bank of China, which increased by 2.66%, marking its 14th consecutive day of gains [2][3][4] - Other major banks, including Industrial and Commercial Bank of China, China Construction Bank, and Bank of China, also saw increases of over 1% [3][4] Oil Sector Activity - The oil sector experienced a strong rally, with Keli Co. rising over 12%, and several other companies, including Beiken Energy and Sinopec Oilfield Service, hitting their daily price limits [9][10] - The U.S. Department of Energy announced plans to purchase 1 million barrels of crude oil to replenish its strategic reserves, which may influence market dynamics [11] Semiconductor and AI Sector Highlights - Cambrian (688256) saw a significant surge, with its stock price rising over 7% during the day, closing up 4.42% with a trading volume of 19.8 billion yuan, making it the top traded stock in A-shares [13][15] - Cambrian reported a substantial year-on-year revenue increase of 2386% for the first three quarters, driven by the strong performance of its cloud products [15]

小作文突袭 寒武纪直线拉升!A股收跌 深地经济概念股持续活跃

Zhong Guo Ji Jin Bao· 2025-10-22 08:45

Market Overview - A-shares experienced slight fluctuations, with the Shanghai Composite Index down 0.07%, the Shenzhen Component Index down 0.62%, and the ChiNext Index down 0.79% [2] - A total of 2,280 stocks rose, 72 stocks hit the daily limit up, while 2,965 stocks declined [3] Sector Performance - The deep earth economy concept stocks remained active, with ShenKai Co. and CITIC Heavy Industries achieving three consecutive limit ups. The Hubei state-owned assets concept stocks continued to show strength, with Wuhan Holdings hitting the daily limit up [4] - Real estate stocks continued to rebound, with Tianbao Infrastructure and Jingtou Development hitting the limit up [5] - Agricultural Bank of China saw a 14-day consecutive rise, with its stock price surpassing 8 yuan, closing at 8.09 yuan per share, marking a year-to-date increase of over 58% [6] Technology Sector - Computing power chip concept stocks showed strong fluctuations, with Cambrian Technology rising over 7%, and its total market value returning above 60 billion yuan. This surge was driven by a viral article regarding Cambrian's orders [7] Commodity Market - Gold concept stocks declined, with Hunan Silver dropping over 7%. This was influenced by a significant drop in spot gold prices, which fell 6.3%, marking the largest single-day decline since April 2013. Spot silver also saw a drop of 8.7%, the largest since 2021 [8] Investment Outlook - Goldman Sachs predicts a 30% upside for the Chinese stock market by the end of 2027, driven by favorable policies, profit growth, and strong capital inflows. The report suggests that the Chinese stock market is entering a more sustained upward trend with lower volatility [9] - The firm also notes that further demand-side stimulus, profit growth driven by AI, and steady capital inflows from both domestic and foreign investors will support the market. Corporate earnings are expected to grow by 12% over the next three years, with valuation multiples potentially increasing by 5% to 10% [10]

午后突发!寒武纪点爆AI,什么情况?

天天基金网· 2025-10-22 08:20

牛市来了还没上车?上天天基金APP搜索777注册即可领500元券包,优选基金10元起投!限 量发放!先到先得! 人工智能再度起飞! 午后,寒武纪突然快速拉升,一度涨超7%,股价再次超越贵州茅台。市场上,亦有关于该公司的"小作文"刷 屏。 在寒武纪的带动之下,涉及人工智能算力板块集体爆发。并带动市场人气复苏,科创50显著反弹。 与此同时,广东国资传来重磅利好。10月22日,广东省政府新闻办举办新闻发布会,介绍《广东省人工智能 赋能制造业高质量发展行动方案(2025—2027年)》相关情况。广东省国资委二级巡视员吕宁介绍, 近年 来广东省属国资国企全力实施制造业投资五年倍增计划,制定拓展人工智能产业工作方案,加大产业投资力 度,力争到2027年人工智能相关投资超200亿元,带动相关产业规模超1000亿元。 最近,广东省涉及人工智能的利好密集发布。南方网昨日发布消息称,广东省人民政府办公厅关于印发《广东 省人工智能赋能制造业高质量发展行动方案(2025—2027年)》的通知指出,培育工业软件和智能装备。推 进核心软件攻关等工程,实施一批技术攻关项目,推动人工智能赋能重点工业软件迭代升级。推动人工智能与 工业互联网协 ...

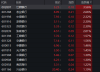

半导体板块10月22日跌0.07%,帝奥微领跌,主力资金净流出55.17亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-22 08:19

Core Insights - The semiconductor sector experienced a slight decline of 0.07% on October 22, with DiAo Micro leading the losses [1][2] - The Shanghai Composite Index closed at 3913.76, down 0.07%, while the Shenzhen Component Index closed at 12996.61, down 0.62% [1] Semiconductor Sector Performance - Notable gainers included: - Canxin Co., Ltd. (688691) with a closing price of 151.26, up 7.28% and a trading volume of 136,600 shares, totaling 2 billion yuan [1] - Cambricon Technologies (688256) closed at 1429.50, up 4.42% with a trading volume of 141,300 shares, totaling 19.815 billion yuan [1] - Major decliners included: - DiAo Micro (688381) with a closing price of 27.04, down 8.96% and a trading volume of 158,100 shares, totaling 434 million yuan [2] - Starlight Semiconductor (603290) closed at 105.50, down 7.06% with a trading volume of 129,300 shares, totaling 1.393 billion yuan [2] Capital Flow Analysis - The semiconductor sector saw a net outflow of 5.517 billion yuan from institutional investors, while retail investors contributed a net inflow of 3.7 billion yuan [2][3] - Key stocks with significant capital flow included: - Haiguang Information (688041) with a net inflow of 666 million yuan from institutional investors [3] - Canxin Co., Ltd. (688691) experienced a net outflow of 520 million yuan from retail investors [3]