Haitong Securities(600837)

Search documents

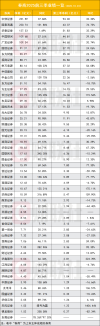

全业务线复苏 上市券商前三季度业绩劲增

Zheng Quan Ri Bao· 2025-10-31 15:52

Core Insights - The overall performance of A-share listed securities firms in the first three quarters of the year showed strong growth, with total operating income reaching 421.42 billion yuan, a year-on-year increase of 42.57%, and net profit attributable to shareholders reaching 169.29 billion yuan, up 62.48% [1] Group 1: Performance Highlights - 42 out of 43 listed securities firms reported year-on-year growth in both operating income and net profit [1] - Leading firms such as CITIC Securities and Guotai Junan achieved significant revenue, with CITIC Securities reporting 55.81 billion yuan in operating income, a 32.7% increase, and net profit of 23.16 billion yuan, up 37.86% [2] - Guotai Junan's operating income reached 45.89 billion yuan, a remarkable 101.6% increase, with net profit soaring to 22.07 billion yuan, up 131.8% [2] Group 2: Mergers and Acquisitions Impact - Mergers and acquisitions have been pivotal for securities firms to overcome growth bottlenecks, with firms like Guolian Minsheng and Guotai Junan showing over 100% growth in operating income [3] - Guolian Minsheng's net profit surged by 345.3%, reaching 1.76 billion yuan, while Huaxi Securities and Guohai Securities also reported net profit increases exceeding 200% [3] Group 3: Business Segment Performance - All five core business segments (brokerage, investment banking, asset management, proprietary trading, and credit) experienced growth, indicating a comprehensive recovery across the industry [4] - Brokerage business net income reached 111.78 billion yuan, a 74.64% increase, with Guolian Minsheng leading with a 293.05% growth rate [4] - Proprietary trading, the largest income source for securities firms, generated 186.86 billion yuan, up 43.83%, with CITIC Securities leading at 31.60 billion yuan [5]

43家上市券商,三季报出炉!六成净利增超50%,投行业务触底回升

Sou Hu Cai Jing· 2025-10-31 04:46

Core Insights - The performance of listed securities firms in the first three quarters has significantly improved, with over 60% of firms reporting a net profit growth exceeding 50% [1][2] - The main drivers of this growth are the brokerage and proprietary trading businesses, benefiting from active market trading [1][8] - Investment banking business shows signs of recovery, with net income from fees totaling 25.15 billion yuan, a year-on-year increase of 23.46% [1][14] Financial Performance - Among 43 listed securities firms, all except Western Securities reported revenue and net profit growth [1] - CITIC Securities remains the industry leader with revenue of 55.81 billion yuan, up 32.70%, and net profit of 23.16 billion yuan, up 37.86% [2][5] - Over 60% of firms reported net profit growth exceeding 50%, with 12 firms achieving over 100% growth, including Guolian Minsheng and Huaxi Securities [2][3] Brokerage Business - The brokerage business has seen substantial growth, with net income from fees increasing by at least 47.91% across firms [8][9] - Notable firms with over 100% growth in brokerage fees include Guolian Minsheng (293.05%) and Guotai Junan (142.80%) [9][10] - CITIC Securities and Guotai Junan lead in brokerage fee income, with 10.94 billion yuan and 10.81 billion yuan, respectively [8][9] Proprietary Trading - Proprietary trading income has shown uneven performance, with 37 firms reporting growth [11][15] - Leading firms in proprietary trading income include CITIC Securities (31.60 billion yuan) and Guotai Junan (20.37 billion yuan) [15][16] - Some firms, such as Huatai Securities and Guohai Securities, reported declines in proprietary trading income [11][15] Investment Banking - The investment banking sector is recovering, with net income from fees increasing by 23.46% year-on-year [14] - Major firms like CITIC Securities and Guotai Junan dominate the investment banking fee income, while smaller firms like Huaxi Securities and Xibu Securities show significant growth [13][14] - The overall market environment for equity financing has improved, benefiting investment banking activities [14] Asset Management - The asset management business has faced challenges, with more firms reporting declines in fee income than increases [16] - Only about 30% of firms achieved positive growth in asset management fees, with significant declines observed in several firms [16] - The pressure on asset management income is attributed to declining management fee rates [16]

上市券商业绩前十,共赚超1000亿

21世纪经济报道· 2025-10-31 04:30

Core Viewpoint - The performance of listed securities firms in the A-share market has significantly improved in the first three quarters of 2025, driven by a recovery in market conditions and various business lines [1][6][10]. Performance Overview - All 42 listed securities firms reported a year-on-year increase in both revenue and net profit for the first three quarters of 2025, with notable performances from firms like CITIC Securities, Guotai Junan, and Huatai Securities [6][7]. - The top five firms by net profit were CITIC Securities (23.16 billion), Guotai Junan (22.07 billion), Huatai Securities (12.73 billion), China Galaxy (10.97 billion), and GF Securities (10.93 billion) [1][6]. - The total net profit of the top ten firms accounted for over 70% of the total net profit of all 42 firms, amounting to 119.55 billion [6][7]. Growth Rates - Among the top ten firms, Guotai Junan, CICC, and Shenwan Hongyuan achieved net profit growth rates exceeding 100%, with increases of 131.80%, 129.75%, and 108.22% respectively [7][9]. - Smaller securities firms showed even more impressive growth rates, with Huaxi Securities and Northeast Securities achieving net profit increases of 316.89% and 125.21% respectively [9][10]. Market Conditions - The significant growth in the securities industry is attributed to a recovery in market conditions, with the average daily trading volume in A-shares reaching 2.1 trillion, a year-on-year increase of 211% [10][12]. - The improvement in market activity has led to a stable increase in margin financing, which has risen to 2.4 trillion, compared to approximately 1.4 trillion a year ago [10][12]. Valuation Potential - Despite the strong performance, the securities sector has underperformed relative to major indices, with the CSI Securities Index rising only 7.21% year-to-date, compared to 19.70% for the CSI 300 Index [12][13]. - Analysts suggest that there is potential for valuation recovery in the securities sector, driven by ongoing improvements in the fundamentals of various business lines, including investment banking and asset management [12][13][14]. Strategic Opportunities - The current market environment, characterized by a market capitalization exceeding 100 trillion and increased trading activity, presents significant long-term growth opportunities for securities firms [14]. - Analysts recommend focusing on firms with strong retail advantages, those benefiting from cross-border asset management trials, and large firms with robust wealth management capabilities [14].

上市券商业绩前十,共赚超1000亿

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-31 04:28

Core Insights - The performance of listed securities firms in A-shares has significantly improved in the first three quarters of 2025, driven by a recovery in market activity and high trading volumes [2][10] - All 42 listed securities firms reported year-on-year growth in net profit, with notable performance from mid-sized firms compared to larger ones [4][9] Performance Overview - The top five securities firms by net profit for the first three quarters of 2025 are: CITIC Securities (23.16 billion), Guotai Junan (22.07 billion), Huatai Securities (12.73 billion), China Galaxy (10.97 billion), and GF Securities (10.93 billion) [2][5] - The total net profit of the top ten firms reached 119.55 billion, accounting for over 70% of the total net profit of all 42 firms [7] Growth Rates - Among the top ten firms, Guotai Junan, CICC, and Shenwan Hongyuan achieved net profit growth rates of 131.80%, 129.75%, and 108.22% respectively [7] - Mid-sized firms like Huaxi Securities and Dongbei Securities reported substantial growth, with net profits increasing by 316.89% and 125.21% respectively [9] Market Conditions - The average daily trading volume in A-shares reached 2.1 trillion, a year-on-year increase of 211%, contributing to a stable margin financing scale of 2.4 trillion [10] - The recovery in various business lines, including investment banking and asset management, has been noted as a key factor in the improved performance of the securities industry [10][14] Valuation and Future Outlook - Despite strong earnings growth, the securities sector's index has only risen by 7.21% this year, lagging behind other indices, indicating potential for valuation recovery [13] - Analysts suggest that the sector's performance is expected to improve further, driven by ongoing market activity and the expansion of capital markets [14][15]

43家上市券商,三季报出炉!六成净利增超50%,投行业务触底回升

券商中国· 2025-10-31 04:13

Core Viewpoint - The performance of listed securities firms in the first three quarters has significantly improved, with over 60% of firms reporting a net profit growth exceeding 50%, driven by active market trading and robust brokerage and proprietary trading businesses [2][3][4]. Group 1: Overall Performance - All but one of the 43 listed securities firms reported revenue and net profit growth, with the exception of Western Securities, which saw a revenue decline of 2.17% to 4.335 billion yuan [3][4]. - The leading firm, CITIC Securities, achieved a revenue of 55.815 billion yuan, a year-on-year increase of 32.70%, and a net profit of 23.159 billion yuan, up 37.86% [3][5]. - Notable performers include Guolian Minsheng and Huaxi Securities, both of which reported net profit growth exceeding three times [2][3]. Group 2: Business Segments Brokerage and Proprietary Trading - Brokerage and proprietary trading are identified as the main growth engines, with brokerage fee income increasing by at least 47.91% across firms, and some firms reporting over 100% growth [2][8]. - The average daily trading volume in the A-share market reached 2.1 trillion yuan, a year-on-year increase of 211%, contributing to the growth in brokerage income [8]. Investment Banking - Investment banking showed signs of recovery, with total fee income reaching 25.151 billion yuan, a year-on-year increase of 23.46% [14]. - Major firms like CITIC Securities and Guotai Junan led in investment banking income, while smaller firms like Huaxi Securities and Xibu Securities showed significant growth rates [14]. Asset Management - The asset management segment exhibited mixed results, with only about 30% of firms reporting positive growth in fee income, while 10 firms experienced declines exceeding 30% [16]. - The decline in asset management income is attributed to reduced management fee rates [16]. Group 3: Future Outlook - Analysts predict continued improvement in investment banking, derivatives, and public fund businesses, with head firms expected to drive return on equity (ROE) expansion [17]. - The securities sector remains undervalued, presenting strategic investment opportunities for institutions [17].

券商三季报排位大洗牌:国信证券跃升2位,招商证券掉队降4名

Xin Lang Zheng Quan· 2025-10-31 04:05

Core Insights - The third quarter performance of 50 A-share listed securities firms shows that all achieved profitability, but only 32 firms experienced both revenue and net profit growth, indicating a recovery in the industry beyond traditional brokerage and proprietary trading businesses [1][3]. Revenue Performance - CITIC Securities led the revenue rankings with 55.815 billion yuan, followed by Guotai Junan at 45.892 billion yuan, creating a significant gap with other firms [1]. - Huatai Securities, GF Securities, and China Galaxy ranked third, fourth, and fifth, with revenues of 27.129 billion yuan, 26.164 billion yuan, and 22.751 billion yuan respectively [1]. Net Profit Rankings - The top ten securities firms by net profit for the first three quarters are CITIC Securities, Guotai Junan, Huatai Securities, China Galaxy, GF Securities, Guoxin Securities, Dongfang Caifu Securities,招商证券, Shenwan Hongyuan, and CITIC Construction Investment [3]. - CITIC Securities achieved a net profit of 23.159 billion yuan, while Guotai Junan followed closely with 22.074 billion yuan [3]. Year-on-Year Changes - The top ten firms saw slight changes in rankings compared to the previous year, with Huatai Securities and CITIC Construction Investment dropping one position, and招商证券 falling four places [3]. - Notably, Guoxin Securities improved by two positions, while China Galaxy, GF Securities, Shenwan Hongyuan, and Zhongjin Company each moved up one position [3]. Performance of Smaller Firms - Smaller securities firms demonstrated stronger performance resilience, with 12 firms doubling their net profit year-on-year, including Guolian Minsheng and Huaxi Securities [5]. - Guolian Minsheng's net profit surged by 345.3%, while Huaxi Securities increased by 316.89% compared to the previous year [5]. Business Segment Performance - The significant growth in the securities industry is attributed to the recovery of market conditions, with brokerage business fees reaching 112.785 billion yuan, a 72.24% increase year-on-year [6]. - Investment banking revenue also showed signs of recovery, with a total of 28.294 billion yuan, reflecting a 37.52% year-on-year growth [6]. - Asset management revenue saw a slight increase of 2.32%, totaling 33.305 billion yuan [6].

券商三季报放榜:国联民生、华西证券、国海证券等净利翻倍

Xin Lang Zheng Quan· 2025-10-31 04:01

Core Insights - The performance of 50 A-share listed securities firms in the third quarter of 2025 shows that all firms achieved profitability, but only 32 firms experienced "double growth" in both operating revenue and net profit, indicating a recovery in the industry [1][3] Revenue Performance - CITIC Securities led the revenue rankings with 55.815 billion yuan, followed by Guotai Junan with 45.892 billion yuan, showing a significant gap from other firms [1] - Huatai Securities, GF Securities, and China Galaxy ranked third, fourth, and fifth, with revenues of 27.129 billion yuan, 26.164 billion yuan, and 22.751 billion yuan respectively [1] Net Profit Analysis - The top ten securities firms by net profit for the first three quarters are CITIC Securities, Guotai Junan, Huatai Securities, China Galaxy, GF Securities, Guoxin Securities, Dongfang Caifu Securities,招商证券, Shenwan Hongyuan, and CITIC Construction Investment [3] - CITIC Securities achieved a net profit of 23.159 billion yuan, while Guotai Junan followed closely with 22.074 billion yuan, with the top ten firms collectively accounting for over 60% of the total net profit of all 50 listed firms [3] Year-on-Year Comparison - Compared to the previous year, there were slight changes in the rankings of the top ten firms, with Huatai Securities and CITIC Construction Investment dropping one position each, and招商证券 dropping four positions [3] Performance of Smaller Firms - Smaller securities firms demonstrated stronger performance resilience, with 12 firms doubling their net profit year-on-year, including Guolian Minsheng, Huaxi Securities, Guohai Securities, and Xiangcai Securities [5] - Guolian Minsheng's net profit surged by 345.3%, while Huaxi Securities saw an increase of 316.89% [5] Business Segment Growth - The significant growth in the securities industry is attributed to the recovery of market conditions, with brokerage business becoming a key driver of performance [6] - In Q3 2025, the total brokerage commission income of 44 comparable A-share listed securities firms reached 112.785 billion yuan, a substantial increase of 72.24% year-on-year [6] - The investment banking business also showed signs of recovery, with net income from investment banking reaching 28.294 billion yuan, up 37.52% year-on-year [6]

2万亿券商再增一家

财联社· 2025-10-31 02:35

Core Viewpoint - The securities industry is experiencing a significant increase in performance, with a notable rise in profitability and market activity as of the third quarter of 2025 [2][6]. Performance Overview - As of October 30, 2025, 52 securities firms reported a total net profit of 183.78 billion yuan for the first three quarters, marking a year-on-year increase of 61.25%. The net profit for the third quarter alone reached 70.36 billion yuan, up 59.08% year-on-year and 26.45% quarter-on-quarter [2][6]. - Among the top-performing firms, five achieved net profits exceeding 10 billion yuan: CITIC Securities (23.16 billion yuan), Guotai Junan (22.07 billion yuan), Huatai Securities (12.73 billion yuan), China Galaxy (10.97 billion yuan), and GF Securities (10.93 billion yuan) [5][6]. Brokerage Income - The brokerage business has seen a substantial increase, with net income from brokerage activities totaling 111.78 billion yuan, reflecting a year-on-year growth of 74.64% [10][12]. - The top three firms in brokerage income are CITIC Securities (10.94 billion yuan), Guotai Junan (10.81 billion yuan), and GF Securities (6.98 billion yuan) [12]. Proprietary Trading - Proprietary trading income reached 186.86 billion yuan, with a year-on-year increase of 43.83%. A total of 37 firms reported positive growth in this area [14][15]. - CITIC Securities led in proprietary trading income with 31.60 billion yuan, followed by Guotai Junan (20.37 billion yuan) and China Galaxy (12.08 billion yuan) [15]. Investment Banking - The investment banking sector is recovering, with net income from investment banking activities totaling 25.15 billion yuan, a year-on-year increase of 23.46% [17][18]. - CITIC Securities topped the investment banking income chart with 3.69 billion yuan, followed by CICC (2.94 billion yuan) and Guotai Junan (2.63 billion yuan) [18]. Asset Management - The asset management business is gradually improving, with net income amounting to 33.25 billion yuan, reflecting a modest year-on-year growth of 2.77% [20][21]. - The leading firms in asset management income include CITIC Securities (8.70 billion yuan), GF Securities (5.66 billion yuan), and Guotai Junan (4.27 billion yuan) [21]. Margin Financing - Margin financing activities have surged, with net interest income totaling 33.91 billion yuan, a year-on-year increase of 54.52%. Several firms have raised their margin financing limits in response to increased demand [23].

券商集体迎来业绩高歌猛进,5家净利破百亿,12家翻倍

Feng Huang Wang· 2025-10-31 01:28

Core Insights - The securities industry is experiencing a significant performance boost, with a notable increase in profitability and market activity as of October 30, 2025 [1] Financial Performance - The total net profit of 52 securities firms for the first three quarters of 2025 reached 183.78 billion yuan, marking a year-on-year increase of 61.25% [1] - In Q3 alone, the net profit totaled 70.36 billion yuan, reflecting a year-on-year increase of 59.08% and a quarter-on-quarter increase of 26.45% [1] Leading Firms - Five firms reported net profits exceeding 10 billion yuan: CITIC Securities (23.16 billion yuan), Guotai Junan (22.07 billion yuan), Huatai Securities (12.73 billion yuan), China Galaxy (10.97 billion yuan), and GF Securities (10.93 billion yuan) [5] - Twelve firms achieved a net profit growth of over 100%, with Guolian Minsheng leading at 345.30% [6] Business Segments - Brokerage income surged by 74.64% year-on-year, totaling 111.78 billion yuan across 42 comparable firms [10] - Proprietary trading income reached 186.86 billion yuan, up 43.83% year-on-year, with 88.1% of firms reporting positive growth [13] - Investment banking revenue increased by 23.46% year-on-year, totaling 25.15 billion yuan, with 64.29% of firms showing positive growth [16] Asset Management - Asset management income showed a modest recovery, totaling 33.25 billion yuan, with a year-on-year increase of 2.77% [19] Market Trends - The total assets of CITIC Securities and Guotai Junan both surpassed 2 trillion yuan, with CITIC's assets at 2.03 trillion yuan, up 18.45% year-on-year, and Guotai's at 2.009 trillion yuan, up 91.7% [8]

券商集体迎来业绩高歌猛进,5家净利破百亿,12家翻倍,2万亿券商再增一家

Xin Lang Cai Jing· 2025-10-31 00:01

Core Insights - The securities industry is experiencing a significant performance boost, with a notable increase in profitability and market activity as of October 30, 2025 [1] Financial Performance - The total net profit of 52 securities firms for the first three quarters of 2025 reached CNY 183.78 billion, marking a year-on-year increase of 61.25% [1] - In Q3 alone, the net profit totaled CNY 70.36 billion, reflecting a year-on-year increase of 59.08% and a quarter-on-quarter increase of 26.45% [1] Individual Firm Performance - Five firms reported net profits exceeding CNY 10 billion: CITIC Securities (CNY 23.16 billion), Guotai Junan (CNY 22.07 billion), Huatai Securities (CNY 12.73 billion), China Galaxy (CNY 10.97 billion), and GF Securities (CNY 10.93 billion) [5] - Twelve firms achieved a net profit growth of over 100%, with Guolian Minsheng leading at 345.30% [6] Business Segments - Brokerage income surged by 74.64% year-on-year, totaling CNY 111.78 billion across 42 comparable firms [10] - Proprietary trading income reached CNY 186.86 billion, up 43.83% year-on-year, with 88.1% of firms reporting positive growth [13] - Investment banking revenue increased by 23.46% year-on-year, totaling CNY 25.15 billion, with 64.29% of firms showing positive growth [16] Market Trends - The overall market activity has positively impacted brokerage and proprietary trading businesses, leading to substantial revenue increases [10][13] - The IPO market is showing signs of recovery, contributing to the resurgence of investment banking revenues [16] Asset Management - Asset management revenues grew modestly by 2.77% year-on-year, totaling CNY 33.25 billion, with only 35.71% of firms reporting positive growth [19] Interest Income - Interest income related to credit business reached CNY 33.91 billion, reflecting a year-on-year increase of 54.52% [22]