NCI(601336)

Search documents

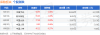

保险板块10月29日涨0.92%,中国平安领涨,主力资金净流出5.05亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-29 08:41

Core Insights - The insurance sector experienced a rise of 0.92% on October 29, with China Ping An leading the gains [1] - The Shanghai Composite Index closed at 4016.33, up 0.7%, while the Shenzhen Component Index closed at 13691.38, up 1.95% [1] Insurance Sector Performance - China Ping An (601318) closed at 58.95, with a gain of 2.06% and a trading volume of 1.0444 million shares, amounting to a transaction value of 6.172 billion [1] - New China Life Insurance (601336) closed at 70.05, up 1.49%, with a trading volume of 169,100 shares [1] - China Pacific Insurance (601601) closed at 37.60, up 0.80%, with a trading volume of 590,700 shares [1] - China Life Insurance (601628) closed at 45.22, up 0.27%, with a trading volume of 175,700 shares [1] - China Reinsurance (601319) closed at 8.83, up 0.46%, with a trading volume of 589,300 shares [1] Fund Flow Analysis - The insurance sector saw a net outflow of 505 million from institutional investors, while retail investors contributed a net inflow of 434 million [1] - Among individual stocks, New China Life Insurance had a net inflow of 27.46 million from institutional investors, while China Ping An experienced a net outflow of 306 million [2] - China Life Insurance saw a net inflow of 19.49 million from retail investors, despite a net outflow of 51.38 million from institutional investors [2]

新华保险举行第22届高峰盛会

Jing Ji Guan Cha Wang· 2025-10-29 08:29

Core Insights - Xinhua Insurance (601336) held its 22nd All-Channel Summit in Yixing, where it announced nine major development achievements across various sectors [1] - The company aims to upgrade its "insurance + service + investment" collaborative development model to create a market-leading and competitive product system [1] Product Development - Xinhua Insurance will focus on three main areas: pension and wealth management product service systems, health care product service systems, and disability care product service systems [1] - New product offerings include the "Shengshi Glory Celebration Edition" whole life insurance (dividend type), "Shengshi Hengying" annuity insurance (dividend type), and "Kanghu Wuyou" nursing insurance [1] Service Expansion - The company has established a nationwide migratory elderly care network and launched renewed home elderly care service rights, along with expanding cross-border travel projects [1] - The first medium asset project, "Yixing Yada," has been launched in Yixing [1] Strategic Goals - Xinhua Insurance aims to build a first-class financial service group in China, serving as a comprehensive financial service provider throughout the customer lifecycle [1] - The company emphasizes a core goal of "five first-class" standards, providing the best sales empowerment system for its team [1] - There is a focus on creating a more stable, professional, and high-value entrepreneurial platform, leveraging strong investment advantages to enhance market competitiveness, product appeal, and team effectiveness [1] - The company plans to fully advance the digitalization and intelligence of customer service and team sales [1]

人保、国寿、太平、信保、中再、新华集体表态!

Jin Rong Shi Bao· 2025-10-29 05:45

Core Insights - The 20th Central Committee of the Communist Party of China approved the "15th Five-Year Plan" for economic and social development, outlining major principles and strategic deployments for the period [2] Group 1: China Life Insurance - China Life emphasized the importance of implementing the spirit of the 20th Central Committee as a major political task, focusing on the financial insurance sector's role in the "15th Five-Year Plan" [4][5] - The company aims to enhance its core competitiveness and foster new growth drivers while ensuring high-quality development and risk management [5] Group 2: China People's Insurance - China People's Insurance Group highlighted its commitment to serving the real economy and the public, focusing on its core functions as an economic stabilizer and social stabilizer [3] - The company plans to support national strategies, enhance healthcare and pension services, and contribute to common prosperity and regional development [3] Group 3: China Pacific Insurance - China Pacific Insurance is set to actively participate in the Guangdong-Hong Kong-Macao Greater Bay Area development, focusing on its main responsibilities and enhancing risk management [6] - The company aims to support technological innovation and green development while increasing the supply of inclusive insurance products [6] Group 4: China Export & Credit Insurance Corporation - China Export & Credit Insurance Corporation plans to expand its export credit insurance coverage and scale, aligning with the "Belt and Road" initiative and promoting balanced trade [7] - The company is focused on high-quality development and ensuring the successful completion of its "14th Five-Year Plan" [7] Group 5: China Reinsurance - China Reinsurance aims to enhance its high-quality development by focusing on its reinsurance functions and aligning its "15th Five-Year Plan" with national strategic goals [8] - The company is committed to risk management and ensuring the completion of its annual objectives while preparing for the "15th Five-Year Plan" [8] Group 6: New China Life Insurance - New China Life Insurance is focused on integrating its development with national reforms, emphasizing the importance of the "insurance + investment + service" model [9][10] - The company aims to leverage its long-term capital to support new productive forces and contribute to social governance and financial stability [9][10]

许昌监管分局同意新华保险鄢陵支公司营业场所变更

Jin Tou Wang· 2025-10-29 03:37

Core Viewpoint - The approval from the Xuchang Regulatory Bureau of the National Financial Supervision Administration indicates that Xinhua Life Insurance Co., Ltd. has successfully obtained permission to change the business address of its Yanling branch to a new location in Xuchang City, Henan Province [1] Group 1 - The new business address for the Yanling branch is specified as No. 5, 1-2 floors, Unit 1, Building 27, Siji Huacheng, Yanling County, Xuchang City, Henan Province [1] - Xinhua Life Insurance Co., Ltd. is required to handle the change and obtain the necessary permits in accordance with relevant regulations [1]

香港中国保险业 - 2025 年二季度香港保费增长加速;竞争持续加剧-Hong KongChina Insurance-2Q25 HK Premiums Growth Accelerated; Continued Intensified Competition

2025-10-29 02:52

Summary of the Conference Call on Hong Kong/China Insurance Industry Industry Overview - The conference call focused on the Hong Kong/China insurance industry, specifically discussing the premium growth and competitive landscape in the market during the second quarter of 2025 [7][2]. Key Points Premium Growth - Hong Kong's annualized premium equivalent (APE) reached HK$47.9 billion in 2Q25, representing a 57% year-on-year increase, significantly higher than the 25% growth observed in 1Q25 [3][2]. - This growth marks the second highest quarterly APE, just below the HK$51.2 billion recorded in 1Q25 [3][2]. - The strong influx of mainland Chinese visitors to Hong Kong is expected to maintain a consistent mix of onshore and offshore contributions to the market [3][2]. Competitive Landscape - Intense competition in the broker channel was highlighted, with its market share increasing by 5 percentage points year-on-year to 34% on an APE basis [4][2]. - In contrast, the banks and agency channels experienced a decline in market share, losing 6 percentage points and 2 percentage points, respectively, to 37% and 22% [4][2]. - Manulife's broker channel saw an impressive APE growth of 171%, while FWD's broker channel grew by 70% year-on-year [4][2]. - AIA and Prudential experienced a slight decline in market share, losing 2.2 percentage points and 3.2 percentage points year-on-year, while Manulife gained 0.5 percentage points [4][2]. Payment Patterns - The payment pattern for new business showed some growth, with single pay's first-year premium (FYP) remaining stable year-on-year at 45% of overall FYP, while the mix for policies with a duration of less than 5 years increased by 5 percentage points to 30% [5][2]. - The dominance of USD currency policies continued, accounting for 77% of total APE, while HKD policies gained 4 percentage points to represent 19% of total APE in 2Q25 [5][2]. Future Outlook - The competitive environment is expected to see some relief due to an illustrative rate cut at the end of June and further commission cuts anticipated in early 2026 [4][2]. Additional Insights - The report indicates that the overall industry view remains attractive, suggesting potential investment opportunities within the Hong Kong/China insurance sector [7][2]. - The data presented in the call is supported by various exhibits detailing market share, payment patterns, and visitor statistics, which provide a comprehensive view of the current market dynamics [12][2][18][2]. Conclusion - The Hong Kong/China insurance industry is experiencing robust growth in premiums, particularly in the broker channel, amidst intense competition. The future outlook suggests potential stabilization in competitive pressures, making it an attractive sector for investment.

广发中证港股通非银ETF(513750):业绩高增筑底,估值修复在途,保险板块景气回升助力港股通非银稳健领跑

Soochow Securities· 2025-10-28 12:02

Investment Rating - The report maintains an "Overweight" rating for the Guangfa CSI Hong Kong Stock Connect Non-Bank ETF (513750.SH) [1] Core Insights - The insurance sector is experiencing a recovery in profitability, driven by strong performance in Q3 2025, with major companies like China Life, New China Life, and China Property & Casualty reporting net profit growth rates of 106%, 101%, and 122% respectively [11][12] - The report emphasizes the importance of the PEV (Price of Embedded Value) valuation system for insurance companies, which reflects long-term profitability potential more accurately than traditional PE or PB metrics [20][22] - The report highlights the low valuation levels of the insurance sector, with average PEV ratios for A/H shares at 0.72x and 0.51x, indicating a significant margin of safety and potential for value appreciation [34][37] - The Guangfa CSI Hong Kong Stock Connect Non-Bank Index focuses heavily on the insurance sector, providing a unique investment opportunity with a high concentration of insurance assets [41][47] Summary by Sections 1. Q3 Performance and Investment Value of Insurance Stocks - The report notes that listed insurance companies achieved high net profit growth in Q3 2025, exceeding expectations despite a high base from the previous year [11][12] - The increase in investment income from equity investments is identified as a key driver of this growth, with insurance funds significantly increasing their equity allocations [13][17] - The high proportion of FVTPL (Fair Value Through Profit or Loss) assets among insurance companies enhances profit elasticity, allowing for direct reflection of market gains in profit figures [17][19] 2. Guangfa CSI Hong Kong Stock Connect Non-Bank ETF (513750.SH) Overview - The ETF is noted for its unique focus on insurance, with a significant portion of its holdings in major insurance companies, making it a rare investment vehicle in the market [41][47] - The ETF has shown strong liquidity and growth, with an average daily trading volume of 1.818 billion yuan and a fund size of 21.214 billion yuan as of October 24, 2025 [5][41] - The ETF's performance is highlighted, with a cumulative return of 66.68% and an annualized return of 36.83%, positioning it favorably compared to other financial sector ETFs [5][41]

保险板块10月28日跌0.13%,新华保险领跌,主力资金净流入1.15亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-28 08:40

Core Insights - The insurance sector experienced a slight decline of 0.13% on October 28, with Xinhua Insurance leading the drop [1] - The Shanghai Composite Index closed at 3988.22, down 0.22%, while the Shenzhen Component Index closed at 13430.1, down 0.44% [1] Insurance Sector Performance - China Pacific Insurance (601601) closed at 37.30, up 0.46% with a trading volume of 389,600 shares and a transaction value of 1.453 billion [1] - China Life Insurance (601628) closed at 45.10, up 0.09% with a trading volume of 141,200 shares and a transaction value of 634 million [1] - Ping An Insurance (601318) closed at 57.76, up 0.02% with a trading volume of 491,300 shares and a transaction value of 2.843 billion [1] - China Reinsurance (601319) closed at 8.79, down 1.01% with a trading volume of 588,200 shares and a transaction value of 518 million [1] - Xinhua Insurance (601336) closed at 69.02, down 1.29% with a trading volume of 167,600 shares and a transaction value of 1.15977 billion [1] Fund Flow Analysis - The insurance sector saw a net inflow of 115 million from institutional investors, while retail investors experienced a net outflow of 626.947 million [1] - Among individual stocks, Ping An Insurance had a net inflow of 175 million from institutional investors, but a net outflow of 90.5114 million from retail investors [2] - China Life Insurance had a net inflow of 12.908 million from institutional investors, with retail investors also experiencing a net outflow of 4.6734 million [2] - China Pacific Insurance had a net inflow of 3.2091 million from institutional investors, while retail investors faced a net outflow of 16.8047 million [2] - Xinhua Insurance had a net outflow of 44.6415 million from institutional investors, but a net inflow of 10.2975 million from retail investors [2]

多家大型险企深入学习党的二十届四中全会精神

Zheng Quan Ri Bao Wang· 2025-10-28 04:51

Core Viewpoint - Major insurance companies are studying the spirit of the 20th National Congress and aim to implement the "five major articles" of finance to achieve long-term sustainable high-quality development in the industry [1][5]. Industry Development Potential - The 20th National Congress has outlined a blueprint for China's development over the next five years, emphasizing the broad development space for the insurance industry, which plays a crucial role in financial services and modern market economy [2][9]. - The insurance sector is expected to focus on its role as an "economic shock absorber" and "social stabilizer," supporting economic construction, social governance, and addressing the needs of small and micro enterprises [2][7]. Company Strategies - China Life is committed to deepening reforms and high-quality development, aligning with the spirit of the 20th National Congress to seize development opportunities and address risks [3][5]. - China Pacific Insurance aims to enhance its service capabilities and focus on the core functions of insurance to support national strategies and economic stability [3][7]. - New China Life Insurance is focusing on a customer-centric approach and aims to integrate insurance with investment and services to enhance its operational model [4][8]. Implementation of High-Quality Development - Insurance companies are translating the Congress's directives into actionable plans, focusing on their business positioning and resource allocation to ensure sustainable high-quality development [5][9]. - China Ping An emphasizes serving the real economy and enhancing financial services in key areas such as small and micro enterprises and healthcare [6][9]. - China Re is committed to supporting national strategies and enhancing its role in social welfare and economic stability through various insurance products [7][9]. Conclusion - Overall, major insurance companies are adopting clear strategies and practical measures to leverage their functional value, support national strategies, and drive their own high-quality development, thereby contributing to the high-quality development of China's economy and society [9].

新华保险跌2.05%,成交额4.14亿元,主力资金净流出5477.24万元

Xin Lang Cai Jing· 2025-10-28 02:21

Core Points - Xinhua Insurance's stock price decreased by 2.05% on October 28, reaching 68.49 CNY per share, with a total market capitalization of 213.658 billion CNY [1] - The company has seen a year-to-date stock price increase of 43.55%, with a 0.28% rise over the last five trading days and a 15.93% increase over the last 20 days [1] - The main business revenue composition includes traditional insurance (60.77%), dividend insurance (34.75%), and other businesses (5.09%) [1] Financial Performance - As of June 30, 2025, Xinhua Insurance reported a net profit of 14.799 billion CNY, representing a year-on-year growth of 33.53% [2] - The company has distributed a total of 35.939 billion CNY in dividends since its A-share listing, with 13.913 billion CNY distributed over the last three years [2] Shareholder Information - The number of shareholders decreased by 15.88% to 61,000 as of June 30, 2025, while the average circulating shares per person increased by 18.96% to 34,325 shares [2] - Hong Kong Central Clearing Limited is the fourth largest circulating shareholder, holding 60.5095 million shares, an increase of 6.6977 million shares from the previous period [2]

非银金融行业周报:把握非银三季报业绩增长和金融街论坛政策催化机遇-20251027

Donghai Securities· 2025-10-27 14:59

Investment Rating - The report assigns an "Overweight" rating to the non-bank financial industry, indicating that it is expected to outperform the CSI 300 index by at least 10% over the next six months [34]. Core Insights - The non-bank financial index rose by 2% last week, outperforming the CSI 300 index by 1.2 percentage points. The brokerage and insurance indices also saw increases of 2.1% and 1.8%, respectively, indicating a synchronized upward trend in these sectors [3][8]. - The report highlights the rapid growth in third-quarter earnings for brokerages, driven by a market recovery. Major brokerages like CITIC Securities and Huaxin Securities reported year-on-year profit increases of 37.9% and 66.4%, respectively, with a significant rise in average daily A-share trading volume [4][8]. - The upcoming Financial Street Forum is expected to provide policy-driven catalysts that could further enhance market activity and valuations in the brokerage sector [4]. Market Data Tracking - The average daily trading volume for stock funds was 23,307 billion yuan, a decrease of 16.2% from the previous week. The margin trading balance increased by 1.1% to 2.46 trillion yuan, while the stock pledge market value rose by 2.1% to 2.99 trillion yuan [16][22]. - The report notes that the insurance sector is also experiencing strong earnings growth, with major insurers like China Life and New China Life projecting profit increases of 50%-70% and 45%-65%, respectively, for the first three quarters of 2025 [4][14]. Industry News - The China Securities Regulatory Commission (CSRC) emphasized the importance of enhancing the resilience and risk management capabilities of the capital market during a recent meeting. This includes improving the inclusiveness and adaptability of market regulations and promoting deeper capital market openness [32]. - The report mentions that the new regulatory framework aims to support high-quality development in the financial sector, focusing on risk prevention and regulatory compliance [32].