Bank of Chengdu(601838)

Search documents

“牛市旗手”,突然拉升!这些板块大爆发→

Zheng Quan Shi Bao· 2025-10-29 04:21

Market Overview - The A-share market showed overall strength on October 29, with the Shanghai Composite Index surpassing the 4000-point mark [2][3] - The ChiNext Index experienced a strong performance, with an intraday increase exceeding 2% before narrowing [3] Index Performance - As of the midday close, the Shanghai Composite Index rose by 0.37% to 4002.83 points, the Shenzhen Component Index increased by 0.90% to 13550.65 points, and the ChiNext Index gained 1.35% to 3273.28 points [4][3] Sector Performance - The non-bank financial sector saw a significant rally, particularly in brokerage stocks, which are referred to as the "bull market flag bearers" [6] - The power equipment sector led the gains, with an intraday increase approaching 3% [4] - The non-ferrous metals sector also performed strongly, with gains exceeding 2.5% [6] Notable Stocks - In the power equipment sector, stocks such as Tongguan Copper Foil (301217) hit the daily limit, while Artis (688472) surged over 13% [4][5] - In the non-bank financial sector, Huazhong Securities (600909) and Northeast Securities both reached the daily limit [7] - The non-ferrous metals sector saw notable performances from stocks like Zhongtung High-tech (000657), which hit the daily limit, and Shengxin Lithium Energy (002240) with a 7.35% increase [6] Company-Specific News - Yashi Chuangneng (603378) hit the daily limit for the fourth consecutive trading day, following a significant price increase [9] - Shikong Technology (605178) reached the daily limit for the sixth consecutive trading day, with a cumulative increase of 123.90% since September [12][14] - Both companies issued announcements regarding stock trading anomalies and potential risks associated with their rapid price increases [11][14]

成都银行:前三季度实现归母净利润94.93亿元 同比增长5.03%

Shang Hai Zheng Quan Bao· 2025-10-29 04:09

Core Insights - Chengdu Bank reported a revenue of 17.761 billion yuan for the first three quarters of the year, representing a year-on-year growth of 3.01% [1] - The bank achieved a net profit attributable to shareholders of 9.493 billion yuan, with a year-on-year increase of 5.03% [1] Financial Performance - Revenue for the first three quarters: 17.761 billion yuan, up 3.01% year-on-year [1] - Net profit attributable to shareholders: 9.493 billion yuan, up 5.03% year-on-year [1] Asset Quality - As of September 30, 2025, Chengdu Bank's non-performing loan (NPL) ratio stood at 0.68%, with a provision coverage ratio of 433.08% [1] - The NPL ratio at the end of the previous year was 0.66%, with a provision coverage ratio of 479.29% [1]

A股午评:创业板指涨超1% 证券板块集体上涨

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-29 04:09

Market Overview - The A-share market experienced a morning rally, with the Shanghai Composite Index rising above 4000 points and the ChiNext Index increasing by over 2% [1] - The total trading volume in the Shanghai and Shenzhen markets reached 1.42 trillion yuan, an increase of 71.9 billion yuan compared to the previous trading day [1] Sector Performance - The Hainan sector showed strong performance, with Zhongtung High-tech hitting the daily limit [1] - The financial sector saw a partial explosion, led by the securities sector, with Huashan Securities and Northeast Securities both reaching the daily limit [1] - The non-ferrous metals sector also strengthened, with CITIC Metals hitting the daily limit [1] - The quantum technology concept stocks were active, with Keda Guokuan, Geer Software, and Shenzhou Information all hitting the daily limit [1] Declining Stocks - The banking sector showed weakness, with Chengdu Bank declining by over 5% [1] - The logistics sector also experienced declines, contributing to the overall market dynamics [1] Closing Summary - At the close, the Shanghai Composite Index rose by 0.37%, the Shenzhen Component Index increased by 0.9%, and the ChiNext Index was up by 1.35% [1]

成都银行(601838):非息拖累营收,扩表保持积极

Ping An Securities· 2025-10-29 04:05

Investment Rating - The report maintains a "Strong Buy" rating for Chengdu Bank, expecting the stock to outperform the market by over 20% within the next six months [13]. Core Views - Chengdu Bank's revenue growth is being impacted by non-interest income, but the bank is actively expanding its balance sheet. The bank's total assets grew by 13.4% year-on-year, with loans increasing by 17.4% and deposits by 12.6% [4][7]. - The bank's net profit for the first three quarters of 2025 reached 9.49 billion yuan, a 5.0% increase year-on-year, while operating income grew by 3.0% [4][7]. - The report highlights a narrowing decline in interest margins, with the annualized net interest margin for the third quarter at 1.45%, down 3 basis points from the second quarter [7]. Summary by Sections Financial Performance - Chengdu Bank reported operating income of 17.8 billion yuan for the first three quarters of 2025, reflecting a year-on-year growth of 3.0%. The net interest income increased by 8.2% year-on-year [4][7]. - The bank's total assets reached 1,385.3 billion yuan by the end of the third quarter, with a year-on-year growth of 13.4% [4][8]. Asset Quality - The non-performing loan (NPL) ratio slightly increased to 0.68% as of the end of the third quarter, attributed to fluctuations in retail and small micro-business asset quality [7][10]. - The bank's provision coverage ratio stood at 433%, indicating stable risk compensation capabilities [7][10]. Future Outlook - The report projects earnings per share (EPS) for 2025-2027 to be 3.26, 3.58, and 3.98 yuan, respectively, with corresponding profit growth rates of 7.6%, 9.8%, and 11.1% [10][11]. - The bank's price-to-book (P/B) ratios for 2025-2027 are expected to be 0.87x, 0.77x, and 0.69x, suggesting potential for valuation premium and upward movement [10][11].

A股银行股集体下跌:成都银行跌5%,浦发银行跌超3%

Ge Long Hui A P P· 2025-10-29 04:03

Group 1 - The A-share market saw a collective decline in bank stocks, with Chengdu Bank dropping by 5% and several others, including Xiamen Bank, Shanghai Pudong Development Bank, and Qingdao Bank, falling over 3% [1] - Specific declines included Jiangyin Bank, Qilu Bank, Hangzhou Bank, Shanghai Bank, and Hu Nong Commercial Bank, all experiencing drops exceeding 2% [1] Group 2 - Chengdu Bank's market capitalization is reported at 72.9 billion, with a year-to-date increase of 5.28% despite the recent decline of 5.08% [2] - Xiamen Bank has a market capitalization of 18.1 billion, with a year-to-date increase of 24.69%, but it fell by 3.92% today [2] - Shanghai Pudong Development Bank's market capitalization stands at 396.7 billion, with a year-to-date increase of 19.25%, experiencing a decline of 3.87% [2] - Qingdao Bank's market capitalization is 29.2 billion, with a year-to-date increase of 33.50%, and it dropped by 3.28% [2] - Jiangsu Bank has a market capitalization of 194.5 billion, with a year-to-date increase of 13.38%, and it fell by 3.11% [2] - Other banks like Jiangyin Bank, Qilu Bank, Hangzhou Bank, Shanghai Bank, and Hu Nong Commercial Bank also reported declines, with respective market capitalizations of 11.8 billion, 36.4 billion, 114.4 billion, 133.3 billion, and 82.1 billion [2]

成都银行(601838):非息扰动无碍长期韧性

HTSC· 2025-10-29 03:58

证券研究报告 成都银行 (601838 CH) 非息扰动无碍长期韧性 华泰研究 季报点评 投资评级(维持): 买入 目标价(人民币): 23.25 沈娟 研究员 SAC No. S0570514040002 SFC No. BPN843 贺雅亭 研究员 heyating@htsc.com +(86) 10 6321 1166 蒲葭依 研究员 SAC No. S0570525090001 SFC No. BVL774 李润凌* 联系人 SAC No. S0570123090022 lirunling@htsc.com 基本数据 | 收盘价 (人民币 截至 10 月 28 日) | 18.11 | | --- | --- | | 市值 (人民币百万) | 76,758 | | 6 个月平均日成交额 (人民币百万) | 478.81 | | 52 周价格范围 (人民币) | 15.36-20.88 | 股价走势图 (10) 1 13 24 35 Oct-24 Feb-25 Jun-25 Oct-25 (%) 成都银行 沪深300 资料来源:Wind 经营预测指标与估值 | 会计年度 (人民币) | 2024 | 2 ...

成都银行(601838):盈利增长韧性强,风险抵补能力高:——成都银行(601838.SH)2025年三季报点评

EBSCN· 2025-10-29 03:09

Investment Rating - The report maintains an "Accumulate" rating for Chengdu Bank (601838.SH) with a current price of 18.11 CNY [1]. Core Views - Chengdu Bank's revenue for the first three quarters of 2025 reached 17.8 billion CNY, a year-on-year increase of 3%, while net profit attributable to shareholders was 9.5 billion CNY, up 5% year-on-year [2]. - The bank's return on average equity (ROAE) stands at 15.2%, reflecting a year-on-year decline of 2.4 percentage points [2]. - The bank's performance shows resilience in profit growth despite a slowdown in revenue and profit growth rates compared to the first half of the year [3]. Summary by Sections Financial Performance - Chengdu Bank's revenue, pre-provision profit, and net profit growth rates for the first three quarters of 2025 were 3%, 2.4%, and 5% respectively, indicating a decline in growth rates compared to the first half of the year [3]. - Net interest income and non-interest income growth rates were 8.2% and -16.5% respectively, with non-interest income showing a significant negative growth [3]. Asset and Loan Growth - As of the end of Q3 2025, Chengdu Bank's interest-earning assets and loans grew by 13.9% and 17.4% year-on-year, indicating a steady expansion in scale [4]. - The bank's corporate loans showed strong growth, while retail loans faced pressure, with corporate loans growing at 19% year-on-year [4]. Liability and Deposit Trends - The growth rate of interest-bearing liabilities and deposits was 11.4% and 12.6% respectively, showing a slight slowdown compared to the previous quarter [5]. - The trend towards more fixed-term deposits continues, with a significant increase in the proportion of fixed-term deposits [5]. Non-Interest Income - Non-interest income for the first three quarters was 3.04 billion CNY, down 16.5% year-on-year, with a notable decline in net fee and commission income [6]. - The bank's other non-interest income also decreased by 13% year-on-year, affected by fluctuations in the bond market [7]. Asset Quality and Risk Management - Chengdu Bank's non-performing loan (NPL) ratio was 0.68% at the end of Q3 2025, indicating stable asset quality [7]. - The bank's provision coverage ratio remains high at 433.1%, reflecting strong risk absorption capacity [8]. Capital Adequacy - As of the end of Q3 2025, the bank's core tier 1 capital ratio, tier 1 capital ratio, and total capital ratio were 8.77%, 10.52%, and 14.39% respectively, showing an increase from the previous quarter [8]. - The issuance of 11 billion CNY in perpetual bonds has effectively supplemented the bank's capital [8]. Earnings Forecast and Valuation - Chengdu Bank is expected to benefit from strategic opportunities in the Chengdu metropolitan area, with EPS forecasts for 2025-2027 at 3.16, 3.27, and 3.35 CNY respectively [9]. - The current stock price corresponds to PB valuations of 0.86, 0.77, and 0.70 for 2025-2027, and PE valuations of 5.73, 5.53, and 5.41 [9].

小红日报|银行板块彰显韧性,标普红利ETF(562060)标的指数收跌0.41%

Xin Lang Ji Jin· 2025-10-29 01:42

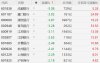

Group 1 - The article highlights the top 20 stocks in the S&P China A-Share Dividend Opportunity Index, showcasing their daily and year-to-date performance along with dividend yields [1] - Xiamen Bank (601187.SH) leads with a daily increase of 5.46% and a year-to-date increase of 29.77%, offering a dividend yield of 4.34% [1] - Other notable performers include Jian Sheng Group (603558.SH) with a daily rise of 5.40% and a year-to-date increase of 13.62%, and Jinbei Electric (002533.SZ) with a daily increase of 5.28% and a year-to-date increase of 37.17% [1] Group 2 - The article also mentions that MACD golden cross signals have formed, indicating a positive trend for certain stocks [3]

成都银行(601838.SH):2025年三季报净利润为94.93亿元、同比较去年同期上涨5.03%

Xin Lang Cai Jing· 2025-10-29 01:36

2025年10月29日,成都银行(601838.SH)发布2025年三季报。 公司营业总收入为177.61亿元,较去年同报告期营业总收入增加5.20亿元,实现5年连续上涨,同比较去年同期上涨3.01%。归母净利润为94.93亿元,较去年 同报告期归母净利润增加4.54亿元,实现5年连续上涨,同比较去年同期上涨5.03%。经营活动现金净流入为575.90亿元,较去年同报告期经营活动现金净流 入增加775.35亿元,实现2年连续上涨。 公司摊薄每股收益为2.24元。 公司最新总资产周转率为0.01次。 公司最新资产负债率为92.65%,较上季度资产负债率减少0.90个百分点,较去年同期资产负债率减少1.04个百分点。 公司最新ROE为9.32%。 公司股东户数为5.34万户,前十大股东持股数量为25.60亿股,占总股本比例为60.39%,前十大股东持股情况如下: | 序号 | 股东名称 | 持股 | | --- | --- | --- | | 1 | 成都交子金融控股集团有限公司 | 20.00 | | 2 | HONG LEONG BANK BERHAD | 17.7 | | 3 | 香港中央结算有限公司 | ...

成都银行股份有限公司 2025年第三季度报告

Shang Hai Zheng Quan Bao· 2025-10-28 23:08

Core Points - The company reported a steady growth in its business scale, with total assets reaching 1,385.255 billion yuan, an increase of 135.139 billion yuan or 10.81% compared to the end of the previous year [6][7] - The company achieved an operating income of 17.761 billion yuan for the first nine months of 2025, representing a year-on-year increase of 520 million yuan or 3.01% [7] - The net profit attributable to shareholders was 9.493 billion yuan, up by 454 million yuan or 5.03% year-on-year [7] - The company maintained a good risk management profile, with a non-performing loan ratio of 0.68% and a provision coverage ratio of 433.08% as of September 30, 2025 [8] Financial Data - As of September 30, 2025, the total deposits amounted to 986.432 billion yuan, reflecting a growth of 100.573 billion yuan or 11.35% from the previous year [6] - The total loans reached 847.481 billion yuan, increasing by 104.913 billion yuan or 14.13% compared to the end of the previous year [6] - The basic earnings per share were reported at 2.24 yuan, with an annualized asset return rate of 0.96% and a weighted average return on equity of 11.40% [7] Shareholder Information - The company confirmed that there were no changes in the top ten shareholders and the total number of shareholders holding more than 5% of shares remained stable [6] Meeting Resolutions - The board of directors approved the third-quarter report for 2025 with unanimous support, indicating compliance with legal and regulatory requirements [20][26] - The board also reviewed and approved a related party transaction with Chengdu Jiaozi Financial Holding Group Co., Ltd., which is included in the company's expected daily related party transaction limits for 2025 [21][22]