FINANCIAL STREET(000402)

Search documents

2025金融街论坛年会在北京开幕

Xin Hua She· 2025-10-28 00:58

Core Points - The 2025 Financial Street Forum Annual Conference opened in Beijing with the theme "Global Financial Development under Innovation, Transformation, and Reshaping" [2] - Over 400 guests from more than 30 countries and regions attended the forum [2] - The event framework includes a main forum, parallel forums, a financial technology conference, and supporting activities, featuring 27 topic activities and 6 investment and financing matching events [2] - Established in 2012, the Financial Street Forum was upgraded to a national and international professional forum in 2020 [2] - The conference is co-hosted by the Beijing Municipal Government, the People's Bank of China, the National Financial Regulatory Administration, the China Securities Regulatory Commission, Xinhua News Agency, and the State Administration of Foreign Exchange [2]

金融街论坛|创造良好的货币金融环境——中国人民银行行长潘功胜谈经济金融热点问题

Xin Hua Wang· 2025-10-28 00:58

Core Viewpoint - The People's Bank of China (PBOC) emphasizes the continuation of a supportive monetary policy stance to foster economic recovery and maintain financial market stability amid complex domestic and international challenges [2][3]. Group 1: Monetary Policy - As of the end of September, the total social financing stock grew by 8.7% year-on-year, broad money (M2) increased by 8.4%, and the RMB loan balance rose by 6.6%, indicating a state of moderately loose monetary policy [2]. - The PBOC has utilized various monetary policy tools to ensure ample liquidity, creating a favorable monetary environment for economic recovery and stable financial market operations [2][3]. - The PBOC plans to continue implementing a moderately loose monetary policy and will resume operations in the secondary market for government bonds to enhance the monetary policy toolkit [3]. Group 2: Credit System and Personal Financing - The PBOC is developing a one-time personal credit relief policy to help individuals who have defaulted on loans due to the pandemic but have since repaid them, aiming to improve their credit records [4]. - This policy will prevent certain default information from being displayed in the credit system, facilitating personal financing and economic participation [4]. Group 3: Digital Currency Management - The PBOC is committed to optimizing the management system for digital currency, having established operational centers in Shanghai and Beijing for international cooperation and system maintenance [5]. - The central bank will continue to monitor and regulate virtual currency activities while promoting the development of the digital RMB ecosystem [5]. Group 4: Macro-Prudential Management - The PBOC is advancing the construction of a comprehensive macro-prudential management system, focusing on systemic financial risk monitoring, risk prevention measures for key institutions, and enhancing the macro-prudential management toolkit [6]. - The central bank aims to create a dynamic and collaborative process for building this system, which is essential for maintaining overall financial stability and supporting high-quality economic development [6].

金融街论坛|证监会将启动实施深化创业板改革

Xin Hua Wang· 2025-10-28 00:32

Group 1 - The core viewpoint is the initiation of reforms in the ChiNext board to establish listing standards that better align with the characteristics of innovative and entrepreneurial enterprises in emerging fields and future industries [1] - The China Securities Regulatory Commission (CSRC) aims to deepen the comprehensive reform of investment and financing by enhancing market stability, expanding high-level institutional openness, and improving investor rights protection [1] - The first batch of newly registered companies on the Sci-Tech Innovation Board will be listed on October 28, indicating a commitment to support innovative small and medium-sized enterprises [1] Group 2 - The CSRC has officially launched the "Qualified Foreign Institutional Investor System Optimization Work Plan," which includes optimizing access management, improving investment operation efficiency, and expanding investment scope to create a more transparent and efficient environment for foreign investors [2] - The CSRC has released several opinions aimed at enhancing the protection of small and medium investors, introducing 23 practical measures to strengthen the investor protection framework [2]

金融街论坛 | 2025金融街论坛年会嘉宾共话全球金融发展

Xin Hua She· 2025-10-27 21:47

Group 1: Monetary Policy and Financial Stability - The People's Bank of China (PBOC) emphasizes a supportive monetary policy stance to create a favorable financial environment for economic recovery and market stability [1] - The PBOC plans to implement a moderately loose monetary policy and maintain relatively loose social financing conditions while enhancing the macro-prudential management system [1] - The National Financial Regulatory Administration aims to improve economic and financial adaptability, deepen reforms, and enhance the vitality of the financial sector [2] Group 2: Financial Market Reforms - The China Securities Regulatory Commission (CSRC) is focused on advancing sector reforms to enhance the inclusiveness and coverage of the multi-tiered market system [2] - The CSRC aims to strengthen market stability and expand high-level institutional openness while enhancing investor rights protection [2] - The State Administration of Foreign Exchange (SAFE) is committed to deepening reforms in the foreign exchange sector while ensuring systemic risk prevention [3] Group 3: International Cooperation and Financial Governance - International financial leaders discussed global economic growth and the importance of cooperation in maintaining financial stability during the forum [3] - The forum highlighted the potential for international financial cooperation and the need to address global challenges collaboratively [3] - The event was co-hosted by various Chinese financial authorities, indicating a unified approach to financial governance [3]

金融街论坛共塑创新变革新图景

Sou Hu Cai Jing· 2025-10-27 21:38

Core Viewpoint - The 2025 Financial Street Forum in Beijing focuses on "Innovation, Transformation, and Reshaping Global Financial Development," with key discussions on economic conditions, monetary policy, financial openness, and reforms in the ChiNext market [2] Group 1: Monetary Policy - The People's Bank of China (PBOC) emphasizes the implementation of a moderately accommodative monetary policy, utilizing various tools to maintain ample liquidity and support economic recovery [2][3] - The PBOC plans to restore open market operations for government bonds and optimize the digital RMB management system, including establishing international and operational centers for digital RMB [3] Group 2: Financial Regulation - The National Financial Regulatory Administration aims to enhance economic and financial adaptability, promoting a new financial service model that balances direct and indirect financing, and supports key sectors and industries [4][5] - The administration will deepen structural reforms in financial supply, improve the quality and resilience of financial institutions, and expand the scope of financial services for small and micro enterprises [5] Group 3: Capital Market Development - The China Securities Regulatory Commission (CSRC) is set to deepen reforms in the ChiNext market, establishing listing standards that cater to emerging industries and technologies [6] - The CSRC has launched an optimization plan for the Qualified Foreign Institutional Investor (QFII) system, aiming to provide a more transparent and efficient environment for foreign investors [6][7]

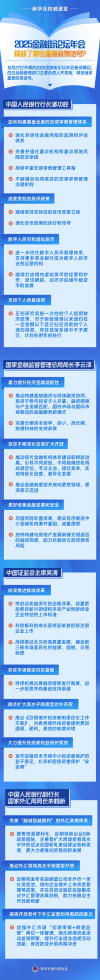

一图速览|2025金融街论坛年会释放了哪些重要政策信号?

Xin Hua She· 2025-10-27 21:05

Group 1 - The 2025 Financial Street Forum released important policy signals regarding macroeconomic management and financial stability [2][3] - The People's Bank of China emphasized the need to strengthen systemic financial risk monitoring and assessment [4][6] - A supportive monetary policy stance will be maintained, with a focus on enhancing the execution and transmission of monetary policy [7][8] Group 2 - The National Financial Regulatory Administration aims to improve economic and financial adaptability by promoting a new financial service model that balances direct and indirect financing [9][10] - There will be a focus on long-term capital investment policies and the construction of a modern financial institution system [10][11] - Efforts will be made to consolidate risk disposal achievements and facilitate the restructuring of small and medium-sized financial institutions [11] Group 3 - The China Securities Regulatory Commission plans to deepen the reform of the ChiNext board and introduce new listing standards for innovative enterprises [12][13] - The introduction of a refinancing framework and the optimization of the Qualified Foreign Institutional Investor system are also on the agenda [13][14] - Enhancements in investor protection measures will be implemented to strengthen the safety net for small investors [14] Group 4 - The State Administration of Foreign Exchange is set to introduce new policies to facilitate trade and expand cross-border trade pilot programs [15][16] - A unified foreign exchange policy system will be developed to promote trade innovation and improve the management of funds for domestic companies listed abroad [16]

2025金融街论坛年会释放了哪些重要政策信号?

Xin Hua She· 2025-10-27 19:14

Core Insights - The 2025 Financial Street Forum highlighted significant policy signals from key financial management officials in China [3] Group 1: Monetary Policy and Financial Management - The People's Bank of China (PBOC) is accelerating the establishment of a comprehensive macro-prudential management system and maintaining a moderately loose monetary policy [4] - The PBOC plans to enhance the management system for digital currency and support more commercial banks to operate digital currency businesses [4] - A one-time personal credit relief policy is being studied, which will not display certain overdue information in credit systems for individuals who have repaid loans below a specified amount since the COVID-19 pandemic [5] Group 2: Financial Reform and Development - The head of the National Financial Supervision Administration emphasized the importance of improving economic and financial adaptability and deepening reforms [6][7] - The China Securities Regulatory Commission (CSRC) will initiate reforms in the Growth Enterprise Market to better align listing standards with the characteristics of emerging industries [9] - A new financial service model will be developed that balances direct and indirect financing, and aligns financing terms with industrial development [10] Group 3: Capital Market and Investor Protection - The first batch of newly registered companies in the Sci-Tech Innovation Board is expected to go public soon [11] - The CSRC plans to enhance the protection of small investors in the capital market through new policies [11] - The PBOC is set to introduce nine new policies to facilitate trade and expand the scope of high-level cross-border trade openness [12]

金融街论坛丨创造良好的货币金融环境——中国人民银行行长潘功胜谈经济金融热点问题

Xin Hua Wang· 2025-10-27 16:35

Core Viewpoint - The People's Bank of China (PBOC) emphasizes the importance of maintaining a supportive monetary policy stance to foster a favorable economic and financial environment amid complex domestic and international challenges [2][3]. Monetary Policy - As of the end of September, the total social financing stock grew by 8.7% year-on-year, broad money (M2) increased by 8.4%, and the RMB loan balance rose by 6.6%, indicating a state of moderately loose monetary policy [2]. - The PBOC has utilized various monetary policy tools to ensure ample liquidity, supporting economic recovery and stabilizing financial markets [2][3]. Debt Market Operations - The PBOC plans to resume government bond trading operations in the open market after a pause earlier this year due to imbalances in supply and demand in the bond market [3]. - The central bank will continue to implement a supportive monetary policy stance, providing liquidity arrangements across short, medium, and long terms [3]. Credit System and Personal Financing - The PBOC is developing a one-time personal credit relief policy to assist individuals who have defaulted on loans due to the pandemic but have since repaid them, aiming to improve their credit records [4]. - This policy is expected to be implemented early next year after necessary technical preparations [4]. Digital Currency Management - The PBOC has established a digital RMB international operation center in Shanghai and an operation management center in Beijing to enhance the digital currency ecosystem [5]. - The central bank will continue to optimize the management system for digital RMB and support more commercial banks in its implementation [5]. Macro-Prudential Management - The PBOC is advancing the construction of a comprehensive macro-prudential management system, focusing on monitoring systemic financial risks and enhancing risk prevention measures in key sectors [6]. - The central bank aims to build a dynamic and collaborative macro-prudential management framework to promote high-quality economic and financial development [6].

新华社权威速览|2025金融街论坛年会释放了哪些重要政策信号?

Xin Hua Wang· 2025-10-27 16:13

Core Insights - The 2025 Financial Street Forum released significant policy signals regarding macroeconomic management and financial stability [2] Group 1: Macro Prudential Management - The People's Bank of China aims to accelerate the establishment of a comprehensive macro-prudential management system [3] - There will be a focus on enhancing the monitoring and assessment of systemic financial risks [4] - The central bank will continue to support a moderately accommodative monetary policy stance [7] Group 2: Digital Currency and Credit Policies - Efforts will be made to optimize the management system for digital renminbi [5] - The central bank is researching a one-time personal credit relief policy for individuals who have defaulted on loans below a certain amount since the COVID-19 pandemic, with plans to implement this by early next year [8] Group 3: Financial Adaptability and Reform - The National Financial Regulatory Administration emphasizes improving economic and financial adaptability [9] - There will be a push to create a new financial service model that balances direct and indirect financing, and aligns financing terms with industry development [10] - The administration will also focus on enhancing long-term capital investment policies and promoting the development of modern financial institutions [10] Group 4: Capital Market Reforms - The China Securities Regulatory Commission will deepen reforms in the ChiNext board, introducing listing standards that better fit emerging industries [12] - There are plans to launch a refinancing framework and expand support channels for mergers and acquisitions [13] Group 5: Foreign Exchange Policy - The State Administration of Foreign Exchange is set to introduce new policies to enhance trade facilitation, including expanding cross-border trade pilot programs [15] - Upcoming measures will include the implementation of a unified currency pool for multinational companies and integrated foreign exchange management reforms in free trade zones [16]

2025金融街论坛年会在京开幕

Sou Hu Cai Jing· 2025-10-27 16:04

Group 1 - The 2025 Financial Street Forum Annual Conference opened in Beijing with the theme "Innovation, Transformation, and Reshaping Global Financial Development" [1] - Over 400 guests from more than 30 countries and regions attended the forum [1] - The conference framework includes a main forum, parallel forums, a financial technology conference, and supporting activities, featuring 27 topic activities and 6 investment and financing matching events [1] Group 2 - The Financial Street Forum was established in 2012 and has been upgraded to a national and international professional forum since 2020 [1] - The event is co-hosted by the Beijing Municipal Government, the People's Bank of China, the National Financial Regulatory Administration, the China Securities Regulatory Commission, Xinhua News Agency, and the State Administration of Foreign Exchange [1]