Huangshanghuang(002695)

Search documents

煌上煌第三季度净利增超三成,徐桂芬家族四人去年薪酬均超百万

Sou Hu Cai Jing· 2025-10-21 10:22

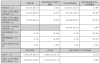

Core Insights - The company, Huang Shang Huang (SZ002695), reported a revenue of 1.379 billion yuan for the first three quarters of 2025, a decrease of 5.08% year-on-year, while the net profit attributable to shareholders increased by 28.59% to 101 million yuan [1][2] - In the third quarter alone, the company achieved a revenue of 394 million yuan, reflecting a slight growth of 0.62% year-on-year, and a net profit of approximately 24.11 million yuan, which is a significant increase of 34.31% compared to the same period last year [1][2] Financial Performance - Revenue for Q3 2025: 394,413,529.79 yuan, up 0.62% YoY [2] - Net profit for Q3 2025: 24,107,890.80 yuan, up 34.31% YoY [2] - Year-to-date revenue: 1,378,551,622.97 yuan, down 5.08% YoY [2] - Year-to-date net profit: 101,027,759.53 yuan, up 28.59% YoY [2] - Basic earnings per share for Q3: 0.043 yuan, up 34.38% YoY [2] - Total assets at the end of the reporting period: 3.845 billion yuan, an increase of 17.15% from the previous year [2] Management and Ownership - The actual controller of the company is the Xu Guifen family, with key members including Xu Guifen, Chu Jiange, Chu Jun, and Chu Jian [1][2] - Current management includes Chu Jun as Chairman and General Manager, and Chu Jian as Vice Chairman and Deputy General Manager [3][4] - Salaries for 2024: Xu Guifen - 1.3209 million yuan, Chu Jiange - 1.1913 million yuan, Chu Jun - 1.3115 million yuan, Chu Jian - 1.1815 million yuan [3][4]

10月21日晚间重要公告一览

Xi Niu Cai Jing· 2025-10-21 10:17

Group 1 - Pinggao Electric reported a 6.98% increase in revenue to 8.436 billion yuan and a 14.62% increase in net profit to 982 million yuan for the first three quarters of 2025 [1] - Wanchen Group achieved a 77.37% increase in revenue to 36.562 billion yuan and a staggering 917.04% increase in net profit to 855 million yuan for the first three quarters of 2025 [2] - Xintian's revenue decreased by 10.42% to 481 million yuan, with a net profit decline of 35.19% to 91.9 million yuan for the first three quarters of 2025 [3] Group 2 - Chuangye Heima reported a revenue drop of 35.68% to 102 million yuan and a net loss of 24.93 million yuan for the first three quarters of 2025 [4] - Huaxin New Materials saw a 16.11% increase in revenue to 265 million yuan and an 18.56% increase in net profit to 40.81 million yuan for the first three quarters of 2025 [5] - Meihua Medical's revenue increased by 3.28% to 1.194 billion yuan, but net profit fell by 19.25% to 208 million yuan for the first three quarters of 2025 [6] Group 3 - Silica Technology reported a 24.30% increase in revenue to 2.651 billion yuan and a 44.63% increase in net profit to 229 million yuan for the first three quarters of 2025 [7] - Anada experienced a revenue decline of 6.03% to 1.31 billion yuan and a net loss of 46.37 million yuan for the first three quarters of 2025 [8] - StarNet Ruijie achieved a 19.20% increase in revenue to 14.168 billion yuan and a 31.06% increase in net profit to 344 million yuan for the first three quarters of 2025 [9] Group 4 - New Link Electronics reported a revenue decrease of 0.37% to 550 million yuan but a significant net profit increase of 421.43% to 535 million yuan for the first three quarters of 2025 [10] - Tianyin Electromechanical's revenue fell by 22.75% to 581 million yuan, with a net profit decline of 56.10% to 24.27 million yuan for the first three quarters of 2025 [11] - Hengtong Co. reported a revenue decrease of 39.29% to 1.05 billion yuan, but a net profit increase of 78.33% to 176 million yuan for the first three quarters of 2025 [12] Group 5 - Xigao Institute achieved a 15.05% revenue increase to 651 million yuan and a 21.28% net profit increase to 198 million yuan for the first three quarters of 2025 [13] - Good Housewife reported a revenue decrease of 0.91% to 1.059 billion yuan and a net profit decline of 24.79% to 143 million yuan for the first three quarters of 2025 [14] - China Pharmaceutical's subsidiary received approval for Vitamin B6 injection, indicating a positive development in its product pipeline [20] Group 6 - Xi Zhong Technology received approval for the issuance of convertible bonds, indicating potential for future capital raising [22] - Chengda Bio signed a strategic cooperation agreement with the Chinese Academy of Microbiology, focusing on infectious disease prevention [25] - Fuyuan Pharmaceutical received a drug registration certificate for Dydrogesterone tablets, enhancing its product offerings [26] Group 7 - Zhehai Deman received 8.1202 million yuan in land acquisition compensation, indicating a successful resolution of land-related issues [27] - Zhongjin Irradiation announced the resignation of its deputy general manager, indicating potential changes in management [29] - Hendi Pharmaceutical received a drug registration certificate for Febuxostat tablets, expanding its product portfolio [30] Group 8 - David Medical's subsidiary received a medical device registration certificate for a surgical stapler, enhancing its product offerings [32] - Liaoning Energy announced plans for a share reduction by a major shareholder, indicating potential changes in ownership structure [34] - Fengyuan Co. signed a framework agreement for the supply of lithium iron phosphate, indicating growth in its supply chain [35] Group 9 - Shengda Resources announced the resumption of construction at a mining site, indicating recovery from previous operational disruptions [37] - Shiyuan Co. reported a revenue increase of 5.45% to 18.087 billion yuan, but a net profit decline of 6.81% to 867 million yuan for the first three quarters of 2025 [39] - Feilida reported a revenue decrease of 6.81% to 4.659 billion yuan, but a net profit increase of 49.1% to 33.19 million yuan for the first three quarters of 2025 [40] Group 10 - Changyuan Donggu reported a revenue increase of 29.75% to 1.648 billion yuan and a net profit increase of 76.71% to 274 million yuan for the first three quarters of 2025 [41] - Liyuanheng reported a net profit of 47.49 million yuan for the first three quarters of 2025, indicating stable performance [42] - Fangyuan Co. reported a net loss of 121 million yuan for the first three quarters of 2025, indicating challenges in its operations [43] Group 11 - China Mobile reported a revenue increase of 0.4% to 794.7 billion yuan and a net profit increase of 4% to 115.4 billion yuan for the first three quarters of 2025 [44] - Huangshanghuang reported a revenue decrease of 5.08% to 1.379 billion yuan but a net profit increase of 28.59% to 101 million yuan for the first three quarters of 2025 [46] - Youcai Resources announced plans to invest approximately 150 million yuan in a new materials production base project [47] Group 12 - Huawei Technology announced plans to invest up to 20 million euros in two German subsidiaries [49] - China Shipbuilding projected a net profit increase of 144.42% to 170.85% for the first three quarters of 2025, indicating strong performance [51] - Aeston's subsidiary plans to transfer a 48% stake in a company for 245 million yuan, indicating strategic divestment [52] Group 13 - Jinxinno plans to raise up to 292 million yuan through a private placement, indicating potential for expansion [53] - China Power Construction reported a 5.04% increase in new contract amounts to 904.527 billion yuan for the first three quarters of 2025 [54] - Helitai reported a net profit increase of 101.45% to 17.81 million yuan for the first three quarters of 2025 [55] Group 14 - Xuefeng Technology reported a revenue decrease of 8.28% to 4.183 billion yuan and a net profit decline of 34.6% to 394 million yuan for the first three quarters of 2025 [57] - Juzhi Technology reported a revenue increase of 21.40% to 615 million yuan and a net profit increase of 33.78% to 82.47 million yuan for the first three quarters of 2025 [59] - Jinxi Axle reported a revenue decrease of 0.11% to 872 million yuan but a net profit increase of 268.03% to 22.11 million yuan for the first three quarters of 2025 [60] Group 15 - Longsheng Technology reported a revenue increase of 10.13% to 1.810 billion yuan and a net profit increase of 36.89% to 210 million yuan for the first three quarters of 2025 [62] - Shannon Chip Creation announced plans for a share reduction by a major shareholder, indicating potential changes in ownership structure [63]

煌上煌(002695):门店端积极调整,冻干业务带来新增量

EBSCN· 2025-10-21 08:47

Investment Rating - The report maintains a "Buy" rating for the company, indicating a positive outlook for future performance [6]. Core Insights - The company reported a revenue of 1.379 billion yuan for the first three quarters of 2025, a year-on-year decline of 5.08%, while the net profit attributable to shareholders reached 101 million yuan, an increase of 28.59% [1]. - The company is actively adjusting its store model and integrating freeze-dried products, which are expected to contribute to revenue growth [2]. - The gross margin improved to 35.65% in Q3 2025, reflecting a recovery in profitability despite a slight year-on-year decline [3]. - The acquisition of a 51% stake in Lixing Food for 495 million yuan is anticipated to enhance revenue and profit, leveraging Lixing's strong market position in freeze-dried products [2][4]. Summary by Sections Financial Performance - For Q3 2025, the company achieved a revenue of 394 million yuan, a year-on-year increase of 0.62%, and a net profit of 24 million yuan, up 34.31% [1]. - The gross margin for Q1-Q3 2025 was 33.02%, with Q3 showing a margin of 35.65%, indicating a recovery trend [3]. Business Strategy - The company is closing unprofitable stores and experimenting with new store models that include non-marinated snacks and beverages, which have shown improved performance in pilot locations [2]. - The integration of Lixing Food is expected to diversify product offerings and reduce transportation costs associated with the hot marinated food model [2]. Profitability and Valuation - The report projects net profits for 2025-2027 to be 111 million, 153 million, and 177 million yuan respectively, with significant upward revisions of 26%, 50%, and 59% from previous estimates [4]. - The estimated EPS for 2025-2027 is projected at 0.20, 0.27, and 0.32 yuan, with corresponding P/E ratios of 65, 47, and 41 [4].

“卤味第一股”商誉飙升!“买来的”净利润高增长能否持续?

Shen Zhen Shang Bao· 2025-10-21 07:54

Core Viewpoint - The financial report of Huangshanghuang (002695) for Q3 2025 shows a mixed performance with a slight revenue increase but significant profit growth, largely driven by non-recurring gains from acquisitions and government subsidies [1][3]. Financial Performance Summary - Q3 revenue reached 394.41 million yuan, a year-on-year increase of 0.62% [2] - Net profit attributable to shareholders was 24.11 million yuan, up 34.31% year-on-year [2] - For the first three quarters, revenue totaled 1.38 billion yuan, a decline of 5.08% compared to the previous year [2] - Net profit for the first three quarters was 101.03 million yuan, an increase of 28.59% year-on-year [2] - The company received government subsidies amounting to 14.21 million yuan in Q3, contributing over 14% to net profit [3] Acquisition Impact - In August 2025, the company acquired 51% of Fujian Lixing Food Co., Ltd. for 495 million yuan, which was included in the consolidated financial statements in September [3] - This acquisition significantly contributed to the net profit growth, with a substantial portion of the increase being "bought" through this transaction [3] - Accounts receivable surged by 603.71% to 128 million yuan due to the consolidation of the new subsidiary [3] Financial Position Changes - Prepayments increased by 64.43%, and short-term borrowings rose from 0 to 91.79 million yuan, attributed to the new acquisition [4] - Goodwill skyrocketed from 22.42 million yuan to 335 million yuan, indicating potential future impairment risks [5] - Other payables increased by 154.27% to 320 million yuan, primarily due to installment payments for the equity acquisition [5] Business Growth Challenges - The company has faced ongoing challenges with sluggish growth in its core business, with revenue declining for several consecutive years [7] - Historical revenue figures from 2021 to 2024 show a consistent downward trend, with 2025 Q3 continuing this pattern [8][10] - Despite attempts to expand through acquisitions, the core processed food business remains slow-growing [10]

煌上煌10月20日获融资买入1942.89万元,融资余额2.32亿元

Xin Lang Cai Jing· 2025-10-21 01:33

Core Insights - The stock of Jiangxi Huangshanghuang Group Food Co., Ltd. increased by 2.96% on October 20, with a trading volume of 137 million yuan [1] - The company reported a financing buy-in amount of 19.43 million yuan and a financing repayment of 21.15 million yuan on the same day, resulting in a net financing buy of -1.72 million yuan [1] - As of October 20, the total financing and securities lending balance for the company was 232 million yuan, which is 3.22% of its market capitalization [1] Financing and Securities Lending - On October 20, the financing buy-in for Huangshanghuang was 19.43 million yuan, with a current financing balance of 232 million yuan, exceeding the 90th percentile level over the past year [1] - In terms of securities lending, the company repaid 2,600 shares and sold 900 shares on October 20, with a selling amount of 11,600 yuan [1] - The remaining securities lending volume was 4,900 shares, with a balance of 63,200 yuan, which is below the 30th percentile level over the past year [1] Company Overview - Jiangxi Huangshanghuang Group Food Co., Ltd. was established on April 1, 1999, and went public on September 5, 2012 [1] - The company's main business includes the development, production, and sales of marinated meat products and quick-consumption side dishes [1] - The revenue composition of the company is as follows: fresh products 60.71%, rice products 31.67%, slaughter processing 4.12%, packaging products 1.97%, others 1.49%, and testing services 0.04% [1] Shareholder and Financial Performance - As of October 10, the number of shareholders for Huangshanghuang was 35,400, a decrease of 0.55% from the previous period [2] - The average circulating shares per person increased by 0.55% to 14,439 shares [2] - For the period from January to September 2025, the company achieved an operating income of 1.379 billion yuan, a year-on-year decrease of 5.08%, while the net profit attributable to shareholders increased by 28.59% to 101 million yuan [2] Dividend and Institutional Holdings - Since its A-share listing, Huangshanghuang has distributed a total of 518 million yuan in dividends, with 169 million yuan distributed over the past three years [2] - As of September 30, 2025, Hong Kong Central Clearing Limited was the sixth-largest circulating shareholder, holding 3.8874 million shares, an increase of 2.4422 million shares from the previous period [2]

煌上煌:前三季度归母净利润为1.01亿元,同比增长28.59%

Bei Jing Shang Bao· 2025-10-20 13:05

Core Viewpoint - The company reported its Q3 2025 financial results, showing a slight increase in revenue and a significant rise in net profit compared to the previous year [1] Financial Performance - In Q3 2025, the company achieved a revenue of 394 million yuan, representing a year-on-year growth of 0.62% [1] - The net profit attributable to shareholders for Q3 2025 was 24.11 million yuan, marking a year-on-year increase of 34.31% [1] - For the first three quarters of 2025, the company recorded a total revenue of 1.379 billion yuan, which is a decline of 5.08% compared to the same period last year [1] - The net profit attributable to shareholders for the first three quarters was 101 million yuan, reflecting a year-on-year growth of 28.59% [1]

煌上煌(002695.SZ):前三季净利润1.01亿元 同比增长28.59%

Ge Long Hui A P P· 2025-10-20 12:10

Core Viewpoint - The company reported a decline in revenue for the first three quarters, while net profit showed significant growth, indicating a mixed performance in financial results [1] Financial Performance - The company's operating revenue for the first three quarters was 1.379 billion, a year-on-year decrease of 5.08% [1] - The net profit attributable to shareholders was 101 million, reflecting a year-on-year increase of 28.59% [1] - The net profit attributable to shareholders after deducting non-recurring gains and losses was 88.46 million, which represents a year-on-year growth of 38.87% [1]

煌上煌(002695.SZ)发布前三季度业绩,归母净利润1.01亿元,增长28.59%

智通财经网· 2025-10-20 11:28

Core Viewpoint - The company reported a decrease in revenue for the first three quarters of 2025, while net profit showed significant growth compared to the previous year [1] Financial Performance - The company's operating revenue for the first three quarters was 1.379 billion yuan, a year-on-year decrease of 5.08% [1] - Net profit attributable to shareholders was 101 million yuan, reflecting a year-on-year increase of 28.59% [1] - The net profit attributable to shareholders after deducting non-recurring gains and losses was 88.46 million yuan, which represents a year-on-year growth of 38.87% [1] - Basic earnings per share were 0.181 yuan [1]

煌上煌:部分募集资金投资项目延期

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-20 11:21

Core Viewpoint - The company announced delays in the completion of certain fundraising investment projects, specifically the Zhejiang and Hainan food processing projects, due to various reasons [1] Group 1: Project Delays - The Zhejiang project, originally scheduled for completion by June 30, 2025, has been postponed to December 31, 2025 [1] - The Hainan project, initially set to finish by December 31, 2025, is now delayed until December 31, 2026 [1] Group 2: Reasons for Delays - The delay for the Zhejiang project is attributed to the expectation of obtaining the production license and organizing production by December 31, 2025 [1] - The Hainan project's delay is due to changes in the market environment and underperformance in the expansion of stores in the Hainan market [1] Group 3: Impact and Future Actions - The company stated that these delays will not significantly adversely affect its operational status in 2025 [1] - The company plans to enhance project progress supervision to ensure the implementation of these projects and maximize benefits for all shareholders [1]

煌上煌(002695) - 国金证券股份有限公司关于江西煌上煌集团食品股份有限公司部分募集资金投资项目延期的核查意见

2025-10-20 11:16

关于江西煌上煌集团食品股份有限公司 部分募集资金投资项目延期的核查意见 国金证券股份有限公司(以下简称"国金证券""保荐机构")作为江西煌上 煌集团食品股份有限公司(以下简称"煌上煌""公司")向特定对象发行股票(以 下简称"本次发行")的保荐人,根据《证券发行上市保荐业务管理办法》《深圳 证券交易所股票上市规则》《深圳证券交易所上市公司自律监管指引第 1 号——主 板上市公司规范运作》《上市公司募集资金监管规则》等相关法律法规和规范性文 件的规定,对煌上煌部分募集资金投资项目延期情况进行了审核,具体核查情况如 下: 一、募集资金基本情况 根据中国证券监督管理委员会《关于同意江西煌上煌集团食品股份有限公司向 特定对象发行股票注册的批复》(证监许可﹝2023﹞1896 号),公司向特定对象发 行人民币普通股股票(A 股)44,642,857 股(每股面值 1 元),发行价格为每股人 民币 10.08 元,募集资金总额为人民币 449,999,998.56 元,扣除发行费用 8,464,185.14 元(不含增值税),实际募集资金净额为人民币 441,535,813.42 元。以上募集资金 已由深圳久安会计师事务 ...