POP MART(PMRTY)

Search documents

北水动向|北水成交净买入11.71亿 泡泡玛特(09992)盘后发布盈喜 北水全天抢筹超11亿港元

智通财经网· 2025-10-21 09:59

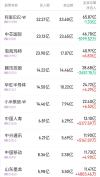

智通财经APP获悉,10月21日港股市场,北水成交净买入11.71港元,其中港股通(沪)成交净买入25.24亿港元,港股通(深)成 交净卖出13.53亿港元。 港股通(深)活跃成交股 泡泡玛特(09992)获净买入11.2亿港元。消息面上,今日盘后,泡泡玛特发布三季度最新业务状况公告,2025年第三季度整体 收益同比增长245%-250%。其中,中国收益同比增长185%-190%,海外收益同比增长365%-370%。小摩预计,泡泡玛特未来 催化剂包括:圣诞强劲销售,"Labubu&Friends"动画预期在12月发布,Labubu4.0料在明年3至4月出炉。 小米集团-W(01810)获净买入4.81亿港元。消息面上,小米集团披露,10月17日,公司回购1070万股,每股作价45.9港元至 46.76港元,涉及总额约4.94亿港元。今年以来该股累计进行12次回购,合计回购3412.52万股,累计回购金额15.37亿港元。 内资重新加仓芯片股,华虹半导体(01347)、中芯国际(00981)分别获净买入4.41亿、1.28亿港元。消息面上,华金证券表示, 持续看好人工智能推动半导体超级周期,建议关注半导体全产业 ...

泡泡玛特股价大跌8.08%,创下近半年来单日最大跌幅

Xin Lang Cai Jing· 2025-10-21 09:42

Core Viewpoint - The stock of Pop Mart (09992.HK) experienced a significant decline of 8.08% on October 21, closing at 250.4 HKD per share, influenced by a broader downturn in new consumer stocks in the Hong Kong market [1] Group 1: Stock Performance - Pop Mart's stock price reached a historical high of 339.8 HKD per share on August 26, 2023, but has since declined nearly 15% over the past three days [1] - The total market capitalization of Pop Mart is approximately 336.27 billion HKD [1] Group 2: Financial Performance - For Q3 2025, Pop Mart expects overall revenue to increase by 245%-250% compared to Q3 2024, with Chinese revenue projected to grow by 185%-190% and overseas revenue by 365%-370% [1] - Revenue from offline channels in China is anticipated to rise by 130%-135%, while online channels are expected to grow by 300%-305% [1] - Overseas revenue growth is expected to be 170%-175% in the Asia-Pacific region, 1265%-1270% in the Americas, and 735%-740% in Europe and other regions [1] Group 3: Product Performance - Several new products from Pop Mart have become bestsellers, including the "WHY SO SERIOUS" Halloween blind box series, which sold out within minutes [2] - The price of the LABUBU-themed "Moon Shadow Mask" surged from 159 RMB to a peak transaction price of 2289 RMB, representing a premium of 13.4 times [2] - The "Delicious Moments Series" featuring the Starry People character saw a peak price increase from 59 RMB to 929 RMB, with a premium of nearly 14.7 times [2] Group 4: Analyst Ratings - On October 16, JPMorgan upgraded Pop Mart's investment rating to "Overweight," raising the target price from 300 HKD to 320 HKD [2] - The bank adjusted its earnings estimates for 2025 to 2027 upwards by 5% to 7%, forecasting a year-on-year sales increase of 165% and a 276% rise in adjusted profit for this year [2][4] - JPMorgan noted that Pop Mart's stock price has significantly corrected from its August peak, suggesting that investor expectations have become overly conservative [5]

泡泡玛特,第三季度整体收益同比大涨

Di Yi Cai Jing Zi Xun· 2025-10-21 09:24

Group 1 - The core point of the announcement is that Pop Mart's overall revenue for the third quarter is expected to increase by 245%-250% year-on-year, with Chinese revenue growing by 185%-190% and overseas revenue increasing by 365%-370% [1] Group 2 - As of the latest market close, Pop Mart's stock price is 250.4 HKD per share, with a total market capitalization of 336.3 billion HKD [2]

泡泡玛特:2025年Q3整体收益同比增245%-250%

Ge Long Hui A P P· 2025-10-21 09:07

Core Insights - The company, Pop Mart, is projected to achieve an overall revenue growth of 245%-250% year-on-year for the third quarter of 2025, based on unaudited figures [1] Revenue Breakdown - Revenue from China is expected to grow by 185%-190% year-on-year [1] - Overseas revenue is anticipated to increase by 365%-370% year-on-year [1]

泡泡玛特:2025年Q3整体收益同比增245%-250%!中国收益同比增长185%-190%,海外收益同比增长365%-370%

Ge Long Hui· 2025-10-21 08:46

【免责声明】本文仅代表作者本人观点,与和讯网无关。和讯网站对文中陈述、观点判断保持中立,不对所包含内容 的准确性、可靠性或完整性提供任何明示或暗示的保证。请读者仅作参考,并请自行承担全部责任。邮箱: news_center@staff.hexun.com (责任编辑:宋政 HN002) 格隆汇10月21日|泡泡玛特:2025年第三季度整体收益(未经审核),同比增长245%-250%,其中中国收 益同比增长185%-190%,海外收益同比增长365%-370%。 ...

泡泡玛特(09992)第三季度整体收益同比增长245%-250%

Zhi Tong Cai Jing· 2025-10-21 08:45

该信息由智通财经网提供 智通财经APP讯,泡泡玛特(09992)发布公告,2025年第三季度整体收益(未经审核),较2024年第三季度 同比增长245%-250%,其中中国收益同比增长185%-190%,海外收益同比增长365%-370%。 2025年第 三季度中国各渠道收益(未经审核),与2024年第三季度比较为:(1)线下渠道同比增长130%-135%;(2)线 上渠道同比增长300%-305%。 2025年第三季度海外各区域收益(未经审核),与2024年第三季度比较为:(1)亚太同比增长170%-175%; (2)美洲同比增长1265%-1270%;(3)欧洲及其他地区同比增长735%-740%。 ...

泡泡玛特预计第三季度整体收入增长245%至250%

Mei Ri Jing Ji Xin Wen· 2025-10-21 08:44

每经AI快讯,10月21日,泡泡玛特在港交所公告,2025年第三季度整体收益(未经审核)较2024第三 季度同比增长245%~250%,其中中国收益同比增长185%~190%,海外收益同比增长365%~370%。 (文章来源:每日经济新闻) ...

泡泡玛特:第三季度整体收益同比增长245%—250%

Zheng Quan Shi Bao Wang· 2025-10-21 08:42

人民财讯10月21日电,泡泡玛特在港交所公告,2025年第三季度整体收益较2024年同期增长245%— 250%。其中,中国收益同比增长185%—190%,海外收益同比增长365%—370%。 ...

泡泡玛特:第三季度整体收益同比增长245%-250%

Di Yi Cai Jing· 2025-10-21 08:35

(文章来源:第一财经) 泡泡玛特在港交所公告,第三季度整体收益(未经审核),较二零二四年第三季度同比增长 245%-250%,其中中国收益同比增长185%-190%,海外收益同比增长365%-370%。 ...

泡泡玛特(09992.HK):第三季度整体收益同比增长245%-250%

Ge Long Hui· 2025-10-21 08:34

Core Viewpoint - Pop Mart (09992.HK) announced that its overall revenue for Q3 2025 is expected to increase by 245%-250% year-on-year compared to Q3 2024, with significant growth in both domestic and overseas markets [1] Group 1: Revenue Growth - The overall revenue for Q3 2025 is projected to grow by 245%-250% year-on-year [1] - Domestic revenue in China is expected to increase by 185%-190% year-on-year [1] - Overseas revenue is anticipated to rise by 365%-370% year-on-year [1] Group 2: Channel Performance in China - Offline channel revenue in China is projected to grow by 130%-135% year-on-year [1] - Online channel revenue in China is expected to increase by 300%-305% year-on-year [1] Group 3: Regional Performance Overseas - Revenue in the Asia-Pacific region is expected to grow by 170%-175% year-on-year [1] - Revenue in the Americas is projected to increase by 1,265%-1,270% year-on-year [1] - Revenue in Europe and other regions is anticipated to rise by 735%-740% year-on-year [1]