数字人民币

Search documents

央行双支柱调控框架方向渐明 潘功胜详解我国宏观审慎管理体系

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-27 23:13

Core Points - The 2025 Financial Street Forum focused on "Innovation, Transformation, and Reshaping Global Financial Development" and highlighted the importance of establishing a comprehensive macro-prudential management system [1] - The People's Bank of China (PBOC) emphasized the need for a robust macro-prudential management framework to address systemic financial risks and improve the correlation between macroeconomic operations and financial risks [1][3] - Key initiatives announced include the resumption of open market operations for government bonds, optimization of the digital RMB management system, and measures to support personal credit recovery [2][6] Group 1: Macro-Prudential Management - The PBOC's focus on enhancing the macro-prudential management system includes better coverage of macroeconomic operations, financial market dynamics, systemically important financial institutions, and international economic risks [1][3] - The PBOC plans to strengthen additional supervision for systemically important banks and insurance companies, and will publish a list of such institutions to facilitate targeted regulatory measures [2][5] - The macro-prudential assessment (MPA) will be split into two parts: one focusing on monetary policy execution and the other on macro-prudential and financial stability assessments [3][4] Group 2: Open Market Operations and Digital Currency - The PBOC announced the resumption of open market operations for government bonds, which had been suspended due to market imbalances earlier in the year [6][7] - The resumption aims to stabilize bond market interest rates and enhance the effectiveness of monetary policy transmission [6][7] - The establishment of a digital RMB management center in Beijing is intended to support the development and operational management of digital currency, with a focus on optimizing its role within the monetary system [8]

大跳水!黄金失守;郑智化就“连滚带爬”表述致歉;西部航空通报“旅客充电宝突然冒烟”;河南新蔡致歉:已责成纪委调查丨每经早参

Mei Ri Jing Ji Xin Wen· 2025-10-27 23:01

Group 1 - Gold prices fell below $4000, with spot gold down 3.15% at $3981.98 per ounce and COMEX gold futures down 3.40% at $3997.00 per ounce [6][14] - The U.S. stock market indices collectively rose, with the Nasdaq up 1.86%, S&P 500 up 1.23%, and Dow Jones up 0.71%, marking new highs [6][29] - International oil prices saw slight increases, with WTI crude oil up 0.08% at $61.55 per barrel [7] Group 2 - The China Securities Regulatory Commission (CSRC) released 23 measures to enhance the protection of small and medium investors in the capital market [9] - The CSRC announced the optimization of the Qualified Foreign Institutional Investor (QFII) system, aiming to attract more long-term foreign capital [10] - The CSRC plans to implement deeper reforms in the ChiNext board to better serve emerging industries and innovative enterprises [11] Group 3 - Meituan announced nationwide coverage of social security subsidies for delivery riders, marking a significant step in improving labor relations in the industry [19][20] - JD.com launched a national recruitment plan for its "National Good Car" delivery centers, aiming to enhance service quality and user experience [21] - Douyin e-commerce announced the removal of logistics providers that violated platform rules, emphasizing consumer rights protection [22] Group 4 - Qualcomm introduced new AI chips aimed at competing with Nvidia in the data center market, with significant stock price increases following the announcement [26] - Xiaopeng Motors addressed internal changes in executive positions, indicating ongoing organizational optimization [23] - Tesla's chairman urged shareholders to support Elon Musk's nearly $1 trillion compensation plan, highlighting the importance of Musk's leadership for the company's future [28]

重大利好!央行、证监会,最新发声!

Sou Hu Cai Jing· 2025-10-27 16:31

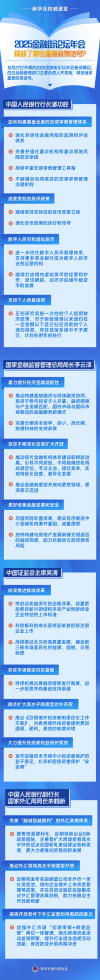

2025金融街论坛年会今天在北京举行,央行、证监会负责人出席论坛,并发布一系列重要消息。 中国人民银行行长潘功胜在论坛年会上表示,目前,债市整体运行良好,央行将恢复公开市场国债买卖 操作。 研究实施 支持个人修复信用的政策措施 潘功胜在论坛年会上表示,将研究实施支持个人修复信用的政策措施。 为帮助个人加快修复信用记录,同时发挥违约信用记录的约束效力,央行正在研究实施一次性的个人信 用救济政策,对于疫情以来违约在一定金额以下且已归还贷款的个人违约信息,将在征信系统中不予展 示。计划在明年初执行。 进一步优化数字人民币管理体系 潘功胜在论坛年会上表示,未来,央行将进一步优化数字人民币管理体系,研究优化数字人民币在货币 层次之中的定位,支持更多商业银行成为数字人民币业务运营机构。 继续打击境内虚拟货币经营和炒作 将恢复公开市场国债买卖操作 将启动实施深化创业板改革 中国证监会主席吴清在论坛年会上表示,将启动实施深化创业板改革,设置更加契合新兴领域和未来产 业创新创业企业特征的上市标准,为新产业、新业态、新技术企业提供更加精准、包容的金融服务。 为境外投资者提供更加高效的制度环境 吴清在论坛年会上表示,《合格境外投资 ...

新华社权威速览|2025金融街论坛年会释放了哪些重要政策信号?

Xin Hua Wang· 2025-10-27 16:13

Core Insights - The 2025 Financial Street Forum released significant policy signals regarding macroeconomic management and financial stability [2] Group 1: Macro Prudential Management - The People's Bank of China aims to accelerate the establishment of a comprehensive macro-prudential management system [3] - There will be a focus on enhancing the monitoring and assessment of systemic financial risks [4] - The central bank will continue to support a moderately accommodative monetary policy stance [7] Group 2: Digital Currency and Credit Policies - Efforts will be made to optimize the management system for digital renminbi [5] - The central bank is researching a one-time personal credit relief policy for individuals who have defaulted on loans below a certain amount since the COVID-19 pandemic, with plans to implement this by early next year [8] Group 3: Financial Adaptability and Reform - The National Financial Regulatory Administration emphasizes improving economic and financial adaptability [9] - There will be a push to create a new financial service model that balances direct and indirect financing, and aligns financing terms with industry development [10] - The administration will also focus on enhancing long-term capital investment policies and promoting the development of modern financial institutions [10] Group 4: Capital Market Reforms - The China Securities Regulatory Commission will deepen reforms in the ChiNext board, introducing listing standards that better fit emerging industries [12] - There are plans to launch a refinancing framework and expand support channels for mergers and acquisitions [13] Group 5: Foreign Exchange Policy - The State Administration of Foreign Exchange is set to introduce new policies to enhance trade facilitation, including expanding cross-border trade pilot programs [15] - Upcoming measures will include the implementation of a unified currency pool for multinational companies and integrated foreign exchange management reforms in free trade zones [16]

信息量巨大!潘功胜金融街论坛演讲全文来了

Sou Hu Cai Jing· 2025-10-27 15:08

Core Viewpoint - The speech by the Governor of the People's Bank of China emphasizes the importance of establishing a comprehensive macro-prudential management system to enhance financial stability and prevent systemic risks in the financial sector [9][10]. Monetary Policy - The People's Bank of China has maintained a supportive monetary policy stance, with key indicators reflecting this approach: as of September, the social financing scale grew by 8.7% year-on-year, M2 increased by 8.4%, and loans rose by 6.6% [4]. - The central bank plans to continue implementing an appropriately loose monetary policy, utilizing various tools to ensure liquidity remains ample [4]. Government Bonds and Market Operations - The People's Bank of China has engaged in buying and selling government bonds in the secondary market to enhance monetary policy tools and support the bond market's development [5]. - Operations were paused earlier this year due to market imbalances but are set to resume as the bond market stabilizes [5]. Digital Currency and Virtual Currencies - The digital yuan, a legal digital currency issued by the People's Bank of China, has seen the establishment of an initial ecosystem, with plans for further optimization and support for more commercial banks to operate in this space [6]. - The central bank remains cautious about the development of virtual currencies, particularly stablecoins, due to their potential financial risks and regulatory challenges [7]. Credit Repair Policies - The People's Bank of China is researching policies to support individuals in repairing their credit records, particularly for those who have defaulted due to the pandemic but have since repaid their debts [8]. Macro-Prudential Management Framework - China has made significant progress in establishing a macro-prudential management framework since the 2008 financial crisis, focusing on systemic risk prevention and enhancing financial stability [10][12]. - The framework includes various measures such as differentiated reserve requirements and a macro-prudential assessment (MPA) system to link credit growth with financial stability [13]. Future Directions - The People's Bank of China aims to enhance the macro-prudential management system by improving the monitoring of systemic financial risks, reinforcing regulations for systemically important financial institutions, and addressing international financial market risks [14][15][16]. - The central bank plans to expand its toolkit for macro-prudential management, ensuring a comprehensive approach to financial stability [18]. Governance and Coordination - A macro-prudential and financial stability committee has been established to enhance coordination among various financial regulatory bodies, ensuring a unified approach to managing financial risks [19].

央行双支柱调控框架方向渐明,潘功胜详解我国宏观审慎管理体系

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-27 14:31

党的十九大提出,健全货币政策和宏观审慎政策双支柱调控框架。近年来,中国人民银行有序推进,取 得重要进展。刚刚召开的党的二十届四中全会进一步提出,构建科学稳健的货币政策体系和覆盖全面的 宏观审慎管理体系。 21世纪经济报道记者唐婧 10月27日下午,以"创新、变革、重塑下的全球金融发展"为主题的2025金融 街论坛年会在京开幕。会上,中国人民银行行长潘功胜以"中国宏观审慎管理体系的建设实践与未来演 进"发表演讲。 在去年6月份的陆家嘴论坛上,潘功胜对中国未来货币政策框架的演进作了比较系统的介绍。在2025金 融街论坛开幕式上,潘功胜对中国宏观审慎管理体系的演进方向进行了深入阐释。 潘功胜坦言,比较来看,货币政策是中央银行传统职责,制度框架比较清晰成熟;宏观审慎管理全球虽 然也有不少实践,但起步不久,仍处于不断探索和完善的过程中。在构建覆盖全面的宏观审慎管理体系 方面,人民银行主要有以下四大重点工作方向:一是更好覆盖宏观经济运行和金融风险的关联性;二是 更好覆盖金融市场的运行;三是更好覆盖系统重要性金融机构;四是更好覆盖国际经济和金融市场风险 的外溢影响。 记者了解到,夯实系统重要性金融机构附加监管将是央行完善宏 ...

最新!央行、证监会、金融监管总局一把手金融街论坛重磅发声!

Sou Hu Cai Jing· 2025-10-27 14:23

中国人民银行行长潘功胜在会上发表讲话。他表示,去年,人民银行落实中央金融工作会议部署,在二级市场开始国债买卖操作。这是丰富货币 政策工具箱、增强国债金融功能、发挥国债收益率曲线定价基准作用、增进货币政策与财政政策相互协同的重要举措,也有利于我国债券市场改 革发展和金融机构提升做市定价能力。实践中,人民银行根据基础货币投放需要,兼顾债券市场供求和收益率曲线形态变化等情况,灵活开展国 债买卖双向操作,保障货币政策顺畅传导和金融市场平稳运行。今年初,考虑到债券市场供求不平衡压力较大、市场风险有所累积,人民银行暂 停了国债买卖。目前,债市整体运行良好,人民银行将恢复公开市场国债买卖操作。 央行将恢复公开市场国债买卖操作 10月27日下午,以"创新、变革、重塑下的全球金融发展"为主题的2025金融街论坛年会在北京开幕。中国人民银行行长潘功胜、金融监管总局局 长李云泽、中国证监会主席吴清出席论坛,并发布一系列重要消息。 潘功胜指出,研究实施支持个人修复信用的政策措施。人民银行运营的征信系统是一项重要的金融基础设施,对企业和个人的金融违约行为进行 记录,并供金融机构在开展业务时进行查询和风险评估,20多年来,对我国社会信用 ...

2025金融街论坛年会在京开幕 这些重磅发声透露了什么|金融街论坛聚焦

Sou Hu Cai Jing· 2025-10-27 13:42

Core Points - The 2025 Financial Street Forum opened in Beijing, focusing on global financial development under the theme of "Innovation, Transformation, and Reshaping" with over 400 key guests from more than 30 countries and regions in attendance [1] Monetary Policy - The People's Bank of China (PBOC) has maintained a supportive monetary policy stance, utilizing various tools to ensure ample liquidity in response to complex domestic and international conditions [3][4] - The PBOC plans to continue implementing a moderately loose monetary policy, providing liquidity arrangements across short, medium, and long terms [3] Government Bonds - The PBOC initiated government bond trading in the secondary market last year to enhance the financial function of government bonds and improve the pricing benchmark role of the yield curve [4] - The PBOC temporarily suspended government bond trading earlier this year due to market imbalances but plans to resume operations as the bond market stabilizes [4] Stablecoins - The PBOC expressed caution regarding the development of stablecoins, highlighting their inability to meet basic requirements for customer identification and anti-money laundering, which increases global financial system vulnerabilities [5] - The PBOC will continue to combat domestic virtual currency trading and speculation while monitoring the development of overseas stablecoins [5] Digital Currency - The PBOC aims to optimize the management system for the digital yuan and support more commercial banks in becoming operational entities for digital yuan services [6] - The establishment of international and operational management centers for the digital yuan in Shanghai and Beijing is intended to promote its development and facilitate cross-border cooperation [6] Financial Regulation - The Financial Regulatory Administration will enhance economic and financial adaptability to promote sustainable economic development while deepening reforms and expanding openness [8] - New financial service models will be developed to support strategic projects and improve financing for traditional and emerging industries [8] Capital Market Development - The China Securities Regulatory Commission (CSRC) will continue to position Beijing as a key window for capital market reform and opening up, enhancing the capital market's role in economic development [10][12] - The CSRC plans to implement reforms in the ChiNext board and improve the New Third Board's systems to better serve new industries and technologies [12][13] Trade and Foreign Exchange - The State Administration of Foreign Exchange (SAFE) will introduce nine new policy measures to promote trade innovation and facilitate cross-border trade [14] - China aims to maintain global supply chain stability and actively participate in global governance while enhancing foreign exchange management and promoting high-level openness [15][16]

重磅!央行、金监总局最新发声,涉国债买卖、虚拟货币及稳定币

Xin Lang Cai Jing· 2025-10-27 13:21

Group 1 - The 2025 Financial Street Forum focuses on "Innovation, Transformation, and Reshaping Global Financial Development" [1] - The People's Bank of China (PBOC) has made significant progress in establishing a dual-pillar framework for monetary policy and macro-prudential management [2][3] - The PBOC will continue to implement a supportive monetary policy stance, utilizing various tools to maintain liquidity and support economic recovery [3][4] Group 2 - The PBOC plans to enhance the monitoring and assessment of systemic financial risks, improving the national financial database and risk prevention measures [4] - The PBOC will resume open market operations for government bonds, which is crucial for the development of the bond market and the coordination of monetary and fiscal policies [5] - The PBOC is committed to combating domestic virtual currency operations and speculation, maintaining financial order [6][7] Group 3 - The PBOC is researching a one-time personal credit relief policy to help individuals with overdue debts during the pandemic [7] - The PBOC is optimizing the management system for digital currency, establishing operational centers in Shanghai and Beijing to promote its development [8] - The National Financial Regulatory Administration emphasizes enhancing financial adaptability to support sustainable economic development [8][9] Group 4 - The National Financial Regulatory Administration aims to deepen financial supply-side structural reforms and enhance the resilience and quality of financial institutions [9] - The administration will focus on improving the financing system related to real estate development to mitigate local government debt risks [9][10] - The State Administration of Foreign Exchange plans to introduce new policies to promote trade facilitation and cross-border trade innovation [10]

关于货币政策、国债买卖、稳定币,央行重磅发声

Sou Hu Cai Jing· 2025-10-27 12:56

谈及稳定币,潘功胜表示,近年来,市场机构发行的虚拟货币特别是稳定币不断涌现,但整体还处在发 展早期。国际金融组织和中央银行等金融管理部门对稳定币的发展普遍持审慎态度。10天前,在华盛顿 召开的IMF/世界银行年会上,稳定币及其可能产生的金融风险成为各国财长、央行行长讨论最多的话 题之一,比较普遍的观点主要集中在,稳定币作为一种金融活动,现阶段无法有效满足客户身份识别、 反洗钱等方面的基本要求,放大了全球金融监管的漏洞,如洗钱、违规跨境转移资金、恐怖融资等,市 场炒作投机的氛围浓厚,增加了全球金融系统的脆弱性,并对一些欠发达经济体的货币主权产生冲击。 2017年以来,人民银行会同相关部门先后发布了多项防范和处置境内虚拟货币交易炒作风险的政策文 件,目前这些政策文件仍然有效。下一步,人民银行将会同执法部门继续打击境内虚拟货币的经营和炒 作,维护经济金融秩序,同时密切跟踪、动态评估境外稳定币的发展。 潘功胜还表示,人民银行将进一步优化数字人民币管理体系,研究优化数字人民币在货币层次之中的定 位,支持更多商业银行成为数字人民币业务运营机构。人民银行已经在上海设立数字人民币国际运营中 心,负责数字人民币跨境合作和使用; ...