SCC(600740)

Search documents

241只股短线走稳 站上五日均线

Zheng Quan Shi Bao Wang· 2025-10-23 03:23

Core Viewpoint - The A-share market shows a slight decline with the Shanghai Composite Index at 3883.98 points, down 0.76%, while the total trading volume reaches 797.39 billion yuan, indicating a mixed performance among stocks [1]. Group 1: Market Performance - As of 10:30 AM, the Shanghai Composite Index is at 3883.98 points, with a decrease of 0.76% [1]. - The total trading volume in the A-share market is reported at 797.39 billion yuan [1]. Group 2: Stock Performance - A total of 241 A-shares have surpassed their five-day moving average, with notable stocks showing significant deviation rates [1]. - The stocks with the highest deviation rates include: - 深赛格 (Shenzhen Saige) with a deviation rate of 7.52% and a price increase of 10.04% [1]. - 特力A (TeLi A) with a deviation rate of 7.34% and a price increase of 10.01% [1]. - 上海能源 (Shanghai Energy) with a deviation rate of 7.10% and a price increase of 10.04% [1]. - Other stocks with smaller deviation rates that have just crossed the five-day moving average include 亿纬锂能 (EVE Energy), 众诚科技 (Zhongcheng Technology), and 南微医学 (Nanwei Medical) [1].

利好引爆!刚刚,罕见涨停潮!

Zhong Guo Ji Jin Bao· 2025-10-23 02:44

Market Overview - On October 23, A-shares opened weakly with the three major indices declining, particularly the ChiNext Index which fell over 1% [1] - Over 4,200 stocks experienced declines, while local Shenzhen stocks and the coal sector showed strong performance [1] Shenzhen Local Stocks - Shenzhen local stocks opened significantly higher, with notable gainers including JianKaoYuan which hit a 20% limit up, and other stocks like ShenSaiGe, TeFa Information, and ShenWuA also reaching their upper limits [3][4] - JianKaoYuan's current price is 20.74 with a 20.02% increase, and its total market capitalization is 30 billion [4] Coal Sector Performance - The coal sector exhibited strong gains, with stocks such as ShanXi HeiMao, ZhengZhou Coal, and YunMei Energy hitting their upper limits [6][7] - The price of coking coal has been adjusted upwards by 80 yuan/ton in the Yan'an Huangling area, reflecting a positive market sentiment and tight supply-demand structure [8] Banking Sector Developments - The banking sector saw a rise, with Agricultural Bank of China increasing over 1%, marking a 15-day consecutive rise since September 25, with a cumulative increase of nearly 25% [9][10] - Agricultural Bank's total market capitalization is approaching 2.8 trillion [9] Policy and Future Outlook - Shenzhen has issued a notification regarding the "Shenzhen City Action Plan for Promoting High-Quality Development of Mergers and Acquisitions (2025-2027)", aiming for a total market capitalization of domestic and foreign listed companies to exceed 20 trillion by the end of 2027 [5] - Morgan Stanley anticipates that upcoming dividend distributions, stable interest rates, and structural financial policy tools will support a revaluation of Chinese banking stocks [12]

A股煤炭股逆势走强,云煤能源、郑州煤电等多股涨停

Ge Long Hui A P P· 2025-10-23 02:34

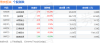

Group 1 - The A-share market saw a strong performance in coal stocks, with several companies hitting the daily limit up [1] - Notable companies that experienced significant gains include Shaanxi Black Cat, Yunnan Coal Energy, Shanghai Energy, Zhengzhou Coal Electricity, Dayou Energy, and Liaoning Energy, all reaching the daily limit [1] - Other companies such as Baotailong and Shanxi Coking Coal rose over 6%, while Pingmei Shares increased by 5% [1] Group 2 - Shaanxi Black Cat (601015) had a price increase of 10.12% with a total market capitalization of 9.334 billion and a year-to-date increase of 36.83% [2] - Yunnan Coal Energy (600792) rose by 10.06%, with a market cap of 5.705 billion and a year-to-date increase of 37.43% [2] - Shanghai Longyuan (600508) increased by 10.04%, with a market cap of 10.1 billion and a year-to-date increase of 8.65% [2] - Zhengzhou Coal Electricity (600121) saw a 10.02% increase, with a market cap of 6.823 billion and a year-to-date increase of 29.33% [2] - Dayou Energy (600403) rose by 10.01%, with a market cap of 23.1 billion and a remarkable year-to-date increase of 228.91% [2] - Liaoning Energy (600758) increased by 10.00%, with a market cap of 6.253 billion and a year-to-date increase of 38.54% [2] - Baotailong (601011) rose by 6.51%, with a market cap of 7.835 billion and a year-to-date increase of 35.88% [2] - Shanxi Coking Coal (600740) increased by 6.00%, with a market cap of 11.3 billion and a year-to-date increase of 10.28% [2] - Pingmei Shares (601666) saw a 5.02% increase, with a market cap of 22.2 billion but a year-to-date decrease of 3.81% [2] - Hengyuan Coal Electricity (600971) rose by 3.79%, with a market cap of 8.868 billion and a year-to-date decrease of 16.40% [2]

焦炭板块10月22日跌2.82%,宝泰隆领跌,主力资金净流出1.63亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-22 08:26

Core Insights - The coke sector experienced a decline of 2.82% on October 22, with Baotailong leading the drop [1] - The Shanghai Composite Index closed at 3913.76, down 0.07%, while the Shenzhen Component Index closed at 12996.61, down 0.62% [1] Sector Performance - Key stocks in the coke sector showed mixed performance, with Yunwei Co. rising by 3.18% to a closing price of 3.89, while other stocks like Yutailong and Shanxi Coking fell by 6.34% and 1.65% respectively [1] - The trading volume for Yunwei Co. was 687,400 shares, with a transaction value of 264 million yuan, while Yutailong had a trading volume of 3,113,100 shares and a transaction value of 1.222 billion yuan [1] Capital Flow - The coke sector saw a net outflow of 163 million yuan from main funds, while retail investors contributed a net inflow of 145 million yuan [1] - Individual stock capital flows indicated that Baotailong had the highest net outflow from main funds at 80.61 million yuan, while Yunwei Co. had a net inflow of 4.28 million yuan from main funds [2]

焦炭板块10月21日跌0.86%,安泰集团领跌,主力资金净流出3.76亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-21 08:28

Core Insights - The coke sector experienced a decline of 0.86% on October 21, with Antai Group leading the losses [1] - The Shanghai Composite Index closed at 3916.33, up 1.36%, while the Shenzhen Component Index closed at 13077.32, up 2.06% [1] Sector Performance - Key stocks in the coke sector showed mixed performance, with Yunmei Energy rising by 3.44% and Antai Group falling by 7.34% [1] - The trading volume for Yunmei Energy was 1.5663 million shares, while Antai Group had a trading volume of 2.7398 million shares [1] Capital Flow - The coke sector saw a net outflow of 376 million yuan from main funds, while retail investors contributed a net inflow of 158 million yuan [1] - The detailed capital flow indicates that major funds withdrew from several stocks, including Antai Group and Shanxi Coking, while retail investors showed interest in stocks like Yunmei Energy and Meijin Energy [2]

焦炭板块10月20日涨6.02%,陕西黑猫领涨,主力资金净流入5.08亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-20 08:37

Core Insights - The coke sector experienced a significant increase of 6.02% on October 20, with Shaanxi Black Cat leading the gains [1] - The Shanghai Composite Index closed at 3863.89, up 0.63%, while the Shenzhen Component Index closed at 12813.21, up 0.98% [1] Sector Performance - Shaanxi Black Cat (601015) closed at 4.24, with a rise of 10.13% and a trading volume of 1.5557 million shares, amounting to a transaction value of 632 million yuan [1] - Antai Group (600408) closed at 3.27, up 10.10%, with a trading volume of 2.8265 million shares [1] - Baotailong (601011) closed at 4.40, increasing by 10.00%, with a trading volume of 4.7728 million shares, resulting in a transaction value of 2.059 billion yuan [1] - Yunmei Energy (600792) closed at 4.65, up 9.93%, with a trading volume of 508,000 shares [1] - Shanxi Coking Coal (600740) closed at 4.34, increasing by 4.58%, with a trading volume of 803,700 shares [1] - Meijin Energy (000723) closed at 5.01, up 3.09%, with a trading volume of 1.404 million shares [1] - Yunwei Co. (600725) closed at 3.75, increasing by 2.74%, with a trading volume of 520,200 shares [1] Capital Flow - The coke sector saw a net inflow of 508 million yuan from main funds, while retail funds experienced a net outflow of 340 million yuan [1] - The detailed capital flow for individual stocks indicates that Baotailong had a net inflow of 254 million yuan from main funds, while it faced a net outflow of 132 million yuan from retail investors [2] - Shaanxi Black Cat had a net inflow of 104 million yuan from main funds, but also saw a net outflow of approximately 90 million yuan from retail investors [2] - Yunmei Energy recorded a net inflow of 81.515 million yuan from main funds, with a net outflow of around 39 million yuan from retail investors [2] - Meijin Energy had a net inflow of 56.43 million yuan from main funds, while retail investors experienced a net outflow of about 5.12 million yuan [2]

焦炭板块10月16日涨2.01%,安泰集团领涨,主力资金净流入2.24亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-16 08:27

Core Insights - The coke sector experienced a 2.01% increase on October 16, with Antai Group leading the gains [1] - The Shanghai Composite Index closed at 3916.23, up 0.1%, while the Shenzhen Component Index closed at 13086.41, down 0.25% [1] Sector Performance - Antai Group's stock price rose by 10.20% to 2.70, with a trading volume of 1.8985 million shares and a transaction value of 500 million yuan [1] - Baotailong's stock price increased by 10.03% to 3.95, with a trading volume of 3.8671 million shares and a transaction value of 1.456 billion yuan [1] - Shanxi Coking Coal's stock price rose by 1.70% to 4.18, with a trading volume of 521,600 shares and a transaction value of 217 million yuan [1] - Shaanxi Black Cat's stock price increased by 1.56% to 3.90, with a trading volume of 789,100 shares and a transaction value of 306 million yuan [1] - Yunnan Coal Energy's stock price rose by 1.23% to 4.12, with a trading volume of 386,400 shares and a transaction value of 159 million yuan [1] - Yunwei Co.'s stock price increased by 0.28% to 3.61, with a trading volume of 215,000 shares and a transaction value of 77.4935 million yuan [1] - Meijin Energy's stock price decreased by 0.60% to 5.00, with a trading volume of 778,800 shares and a transaction value of 389.7 million yuan [1] Capital Flow - The coke sector saw a net inflow of 224 million yuan from main funds, while retail funds experienced a net outflow of 113 million yuan and 111 million yuan respectively [1] - Baotailong had a main fund net inflow of 131 million yuan, while retail funds saw a net outflow of 90.41 million yuan [2] - Antai Group experienced a main fund net inflow of 60.25 million yuan, with retail funds seeing a net outflow of 44.32 million yuan [2] - Shanxi Coking Coal had a main fund net inflow of 29.04 million yuan, with retail funds experiencing a net outflow of 8.61 million yuan [2] - Shaanxi Black Cat saw a main fund net inflow of 12.34 million yuan, while retail funds had a net inflow of 0.33 million yuan [2] - Yunnan Coal Energy had a main fund net inflow of 7.76 million yuan, with retail funds seeing a net inflow of 0.86 million yuan [2] - Yunwei Co. experienced a main fund net outflow of 2.72 million yuan, while retail funds had a net inflow of 0.26 million yuan [2] - Meijin Energy had a main fund net outflow of 13.91 million yuan, with retail funds seeing a net inflow of 1.78 million yuan [2]

山西焦化股份有限公司2025年第二次临时股东大会决议公告

Shang Hai Zheng Quan Bao· 2025-10-15 19:40

Group 1 - The second extraordinary general meeting of shareholders for Shanxi Coking Coal Chemical Co., Ltd. was held on October 15, 2025, at the company's office building [2] - The meeting was legally convened and presided over by Chairman Li Feng, utilizing both on-site and online voting methods [2][3] - All resolutions presented at the meeting were approved, including amendments to the company's articles of association and the cancellation of the supervisory board [4][5] Group 2 - The meeting had a high attendance rate, with 8 out of 9 directors and all 7 supervisors present [3] - The legal proceedings of the meeting were verified by Beijing Deheng (Taiyuan) Law Firm, confirming compliance with relevant laws and regulations [6] - The company announced its third-quarter operational data on October 16, 2025, indicating no significant events affecting its operations during the quarter [8][9]

山西焦化(600740) - 山西焦化股份有限公司2025年第三季度主要经营数据公告

2025-10-15 09:45

证券代码:600740 证券简称:山西焦化 编号:临 2025-030 号 山西焦化股份有限公司 2025年第三季度主要经营数据公告 重要提示:本公司及董事会全体成员保证公告内容不存在任何虚假记载、 误导性陈述或者重大遗漏,并对其内容的真实性、准确性和完整性承担个别 及连带责任。 根据《上海证券交易所上市公司自律监管指引第3号——行业信息披露第 十三号—化工》有关规定和披露要求,公司2025年第三季度主要经营数据如 下: 山西焦化股份有限公司董事会 2025 年 10 月 16 日 一、主要产品的产量、销量及收入实现情况 | | 平均售价 | 元/吨 | 4,300.69 | 4,386.29 | -1.95 | | --- | --- | --- | --- | --- | --- | | | (不含税) | | | | | | 甲醇 | 产量 | 吨 | 59,584.12 | 67,615.45 | -11.88 | | | 销量 | 吨 | 56,128.70 | 67,870.42 | -17.30 | | | 销售收入 (不含税) | 元 | 106,524,708.07 | 130,614,38 ...

山西焦化(600740) - 山西焦化股份有限公司2025年第二次临时股东大会决议公告

2025-10-15 09:45

山西焦化股份有限公司 2025年第二次临时股东大会决议公告 本公司董事会及全体董事保证本公告内容不存在任何虚假记载、误导性陈述 或者重大遗漏,并对其内容的真实性、准确性和完整性承担法律责任。 重要内容提示: 本次会议是否有否决议案:无 一、 会议召开和出席情况 证券代码:600740 证券简称:山西焦化 公告编号:2025-029 (一) 股东大会召开的时间:2025 年 10 月 15 日 (二) 股东大会召开的地点:公司办公楼四楼会议室 (三) 出席会议的普通股股东和恢复表决权的优先股股东及其持 有股份情况: | 1、出席会议的股东和代理人人数 | 497 | | --- | --- | | 2、出席会议的股东所持有表决权的股份总数(股) | 1,573,239,022 | | 3、出席会议的股东所持有表决权股份数占公司有表决权股 | 61.4037 | | 份总数的比例(%) | | (四) 表决方式是否符合《公司法》及《公司章程》的规定,大 会主持情况等。 本次股东大会由公司董事会召集,李峰董事长主持。会议采用现 场投票和网络投票相结合的方式进行表决。会议召开和表决符合《公 司法》及《公司章程》的规定 ...