Bank Of Jiangsu(600919)

Search documents

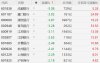

城商行板块10月29日跌2.43%,成都银行领跌,主力资金净流出7.42亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-29 08:41

Core Viewpoint - The city commercial bank sector experienced a decline of 2.43% on October 29, with Chengdu Bank leading the drop, while the overall stock market indices showed an increase [1][2]. Market Performance - The Shanghai Composite Index closed at 4016.33, up 0.7% - The Shenzhen Component Index closed at 13691.38, up 1.95% [1]. Individual Stock Performance - Chengdu Bank saw a significant decline of 5.74%, closing at 17.07 - Other notable declines included Xiamen Bank (-4.90%), Jiangsu Bank (-3.84%), and Qingdao Bank (-3.66%) [2]. - Chongqing Bank was one of the few gainers, with a slight increase of 0.84%, closing at 10.76 [1]. Trading Volume and Turnover - Chengdu Bank had a trading volume of 1.298 million shares, with a turnover of 22.27 million yuan - Jiangsu Bank had a trading volume of 2.039 million shares, with a turnover of 2.164 billion yuan [2]. Capital Flow Analysis - The city commercial bank sector saw a net outflow of 742 million yuan from institutional investors, while retail investors contributed a net inflow of 410 million yuan [2]. - The data indicates that speculative funds had a net inflow of 331 million yuan [2]. Individual Stock Capital Flow - Qingdao Bank had a net inflow of 61.11 million yuan from institutional investors, while it experienced a net outflow of 59.42 million yuan from speculative funds [3]. - Nanjing Bank also saw a net inflow of 43.97 million yuan from institutional investors, but a net outflow of 34.08 million yuan from speculative funds [3].

A股银行股集体下跌:成都银行跌5%,浦发银行跌超3%

Ge Long Hui A P P· 2025-10-29 04:03

Group 1 - The A-share market saw a collective decline in bank stocks, with Chengdu Bank dropping by 5% and several others, including Xiamen Bank, Shanghai Pudong Development Bank, and Qingdao Bank, falling over 3% [1] - Specific declines included Jiangyin Bank, Qilu Bank, Hangzhou Bank, Shanghai Bank, and Hu Nong Commercial Bank, all experiencing drops exceeding 2% [1] Group 2 - Chengdu Bank's market capitalization is reported at 72.9 billion, with a year-to-date increase of 5.28% despite the recent decline of 5.08% [2] - Xiamen Bank has a market capitalization of 18.1 billion, with a year-to-date increase of 24.69%, but it fell by 3.92% today [2] - Shanghai Pudong Development Bank's market capitalization stands at 396.7 billion, with a year-to-date increase of 19.25%, experiencing a decline of 3.87% [2] - Qingdao Bank's market capitalization is 29.2 billion, with a year-to-date increase of 33.50%, and it dropped by 3.28% [2] - Jiangsu Bank has a market capitalization of 194.5 billion, with a year-to-date increase of 13.38%, and it fell by 3.11% [2] - Other banks like Jiangyin Bank, Qilu Bank, Hangzhou Bank, Shanghai Bank, and Hu Nong Commercial Bank also reported declines, with respective market capitalizations of 11.8 billion, 36.4 billion, 114.4 billion, 133.3 billion, and 82.1 billion [2]

公募十大重仓股出炉!这些股票被增持

Zhong Guo Zheng Quan Bao· 2025-10-28 15:00

Core Insights - Public funds have disclosed their top ten holdings for Q3 2025, with CATL (宁德时代) returning as the largest holding, followed by Tencent and several other tech stocks [1][2] Group 1: Top Holdings - CATL regained its position as the largest holding among public funds with a market value of 75.881 billion yuan [2] - Tencent Holdings dropped to the second position with a market value of 69.938 billion yuan [2] - New entrants to the top ten holdings include Zhongji Xuchuang and Industrial Fulian, while Midea Group and Xiaomi Group exited the list [1][2] Group 2: Increased Holdings - The most significant increases in holdings for Q3 were seen in Zhongji Xuchuang and New Yisheng, with increases of 40.174 billion yuan and 36.930 billion yuan, respectively [2] - Industrial Fulian, Alibaba-W, and CATL also saw substantial increases, each exceeding 20 billion yuan [2] Group 3: Decreased Holdings - Xiaomi Group was the most significantly reduced holding, with a decrease of 10.834 billion yuan [3] - Other notable reductions included Midea Group, China Merchants Bank, and SF Express, each with reductions exceeding 7 billion yuan [3][5] Group 4: Sector Performance - The technology sector performed exceptionally well in Q3, with many of the top increased holdings being tech stocks, particularly in AI-related fields [4] - Zhongji Xuchuang, New Yisheng, and Industrial Fulian saw stock price increases of over 170%, 180%, and 210%, respectively [4] Group 5: Fund Manager Insights - Fund managers express optimism about the technology sector, particularly regarding AI and its related investment opportunities [8] - There is a cautious approach towards the long-term outlook of tech stocks due to uncertainties in competition and technology evolution [8]

城商行板块10月28日涨0.02%,厦门银行领涨,主力资金净流入2.23亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-28 08:40

Market Performance - The city commercial bank sector increased by 0.01% compared to the previous trading day, with Xiamen Bank leading the gains [1] - The Shanghai Composite Index closed at 3988.22, down by 0.22%, while the Shenzhen Component Index closed at 13430.1, down by 0.44% [1] Individual Bank Performance - Xiamen Bank's closing price was 7.15, with a rise of 5.46% and a trading volume of 582,400 shares, amounting to a transaction value of 412 million yuan [1] - Chongqing Bank closed at 10.67, up by 2.11%, with a trading volume of 225,000 shares [1] - Chengdu Bank's closing price was 18.11, increasing by 0.84% with a trading volume of 314,100 shares [1] - Other banks such as Changsha Bank, Lanzhou Bank, and Jiangsu Bank showed minimal changes in their stock prices [1] Capital Flow Analysis - The city commercial bank sector saw a net inflow of 223 million yuan from institutional investors, while retail investors experienced a net outflow of 356 million yuan [2] - The main capital inflow was observed in banks like Nanjing Bank and Chengdu Bank, with significant net inflows from institutional investors [3] - Retail investors showed a negative net flow in several banks, indicating a cautious sentiment among smaller investors [3]

城商行洗牌启示录:南下失利的北京银行,何以“腹背受敌”

Hua Er Jie Jian Wen· 2025-10-28 02:42

Core Insights - The competitive landscape of city commercial banks is undergoing a historic reshuffle, with Jiangsu Bank surpassing Beijing Bank in total assets for the first time in 18 years as of mid-2025 [1][3]. Financial Performance - Jiangsu Bank's total assets reached 4.79 trillion yuan, surpassing Beijing Bank by 400 billion yuan, marking a significant milestone [1][3]. - In the first half of 2025, Jiangsu Bank reported revenue and net profit attributable to shareholders of 44.864 billion yuan and 20.238 billion yuan, respectively, reflecting year-on-year growth of 7.78% and 8.05%, outperforming Beijing Bank by 6.76 and 6.93 percentage points [3][4]. - Jiangsu Bank's total asset yield was 21.16%, exceeding Beijing Bank by 8.63 percentage points, while its net interest margin was 1.78%, higher by 0.47 percentage points [3][4]. Market Position - As of October 24, 2023, Jiangsu Bank's market capitalization reached 2.00213 trillion yuan, 1.64 times that of Beijing Bank, with a year-to-date stock price increase of 10.96%, outpacing Beijing Bank by 18.27 percentage points [5][6]. - Jiangsu Bank has established a strong presence in the Long Triangle region, with 84.06% of its loans concentrated in Jiangsu Province and 8.17% in other areas of the Long Triangle [19]. Strategic Developments - Beijing Bank has initiated a "reconstruction plan" to enhance its competitiveness in the Long Triangle region, focusing on new industries and advanced manufacturing [13][14]. - The bank's loan growth in the Long Triangle region was 10.66% in the first half of 2025, which, while higher than its overall growth, still lags behind local competitors like Jiangsu Bank [15][16]. Industry Context - The Long Triangle region, contributing nearly a quarter of China's GDP despite occupying only 2.3% of its land area, has become a fertile ground for financial institutions, with over half of the top 10 city commercial banks by asset size originating from this area [17][18]. - Jiangsu Bank's strong performance is supported by the robust economic growth and diverse financing needs of the Long Triangle region, which has fostered a competitive banking environment [17][18].

A股银行股普跌,浦发银行跌超5%

Ge Long Hui· 2025-10-28 02:14

Core Viewpoint - The A-share market experienced a widespread decline in bank stocks, with notable drops in several major banks [1] Group 1: Market Performance - Shanghai Pudong Development Bank saw a decline of over 5% [1] - Other banks such as Minsheng Bank, Chongqing Rural Commercial Bank, Xi'an Bank, Jiangyin Bank, Jiangsu Bank, Zhangjiagang Bank, Shanghai Bank, Everbright Bank, Wuxi Bank, Bank of Communications, and China Construction Bank all experienced declines of over 1% [1]

江苏银行发布“沿沪宁产业创新贷” 三个维度创新金融服务场景

Xin Hua Cai Jing· 2025-10-27 15:04

Core Viewpoint - The launch of the "Yanghu-Ning Industrial Innovation Loan" by Jiangsu Bank aims to empower regional innovation development through financial support, aligning with the national strategy for integrated development in the Yangtze River Delta region [1] Group 1: Financial Product Launch - Jiangsu Bank introduced its first aggregated supply chain financial product, "Yanghu-Ning Industrial Innovation Loan," to provide financial resources for regional innovation [1] - The initiative is part of a broader strategy to support the Yangtze River Delta, which is one of China's most dynamic and innovative economic areas, with a projected GDP of over 15.9 trillion yuan in 2024, contributing approximately 12% to the national GDP [1] Group 2: Service Ecosystem Development - Jiangsu Bank has supported 17,000 technology enterprises, emphasizing the importance of a specialized risk control system and service model for serving innovative companies [2] - The bank plans to expand its financial service scenarios from a "unified" approach to a "precise" regional focus, tailoring products to specific industries in different cities, such as integrated circuits in Nanjing and high-end manufacturing in Nantong [2] - The bank aims to enhance its "three-dimensional service ecosystem" by collaborating with local governments, industrial parks, and investment institutions to create a "regional industrial financial alliance" [2] Group 3: Mechanism Innovation - Jiangsu Bank intends to innovate its mechanisms by deepening data cooperation with regional industrial chain platforms, utilizing diverse data sources like orders, patents, and carbon emissions to optimize risk control models [3] - The goal is to develop more financing products based on data credit, allowing enterprises' intellectual assets to become capital for development, fostering a symbiotic relationship between finance and regional industries [3]

行业深度报告:零售风险及新规影响有限,兼论信贷去抵押化

KAIYUAN SECURITIES· 2025-10-27 05:44

Investment Rating - The investment rating for the industry is "Positive" (maintained) [1] Core Insights - The report highlights that retail non-performing loan (NPL) rates and generation rates are currently high, indicating ongoing pressure on bank profitability. Despite a low overall NPL rate, the retail sector shows signs of risk, with a marginal increase in the NPL rate to 1.28% [14][15] - The transition period for new risk regulations is nearing its end, with concerns about the impact on banks' provisioning levels. However, the report suggests that the actual impact may be less severe than market expectations [16] - The trend of de-collateralization in bank lending is evident, driven by both business characteristics and strategic choices made by banks to reduce reliance on collateralized loans [17] Summary by Sections 1. Retail NPL and Generation Rates - The retail NPL rate has increased to 1.28%, with a steepening curve indicating ongoing risk. The generation rate for retail loans remains high, with significant increases noted in certain banks [14][18] - The report indicates that while the overall NPL rate is low, the divergence between overdue and NPL indicators suggests underlying risks in the retail sector [19] 2. Impact of New Risk Regulations - The new risk regulations will require banks to classify impaired loans as NPLs, potentially increasing reported NPL rates. However, the report anticipates that the actual provisioning pressure may be manageable [16][17] 3. De-Collateralization in Lending - The report notes a significant decline in the proportion of collateralized loans, with banks shifting towards non-collateralized lending strategies. This shift is influenced by the need to manage risk more effectively [17][18] 4. Investment Recommendations - The report recommends certain state-owned banks due to their customer base advantages and manageable retail risk pressures. It also highlights specific banks such as CITIC Bank and Agricultural Bank of China as beneficiaries of this trend [6]

本周在售部分纯固收产品近3月年化收益率逼近10%

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-27 01:20

Core Insights - The article emphasizes the abundance of bank wealth management products with similar names and vague characteristics, urging investors to carefully select and differentiate among them [1] - The South Finance Wealth Management team focuses on pure fixed-income products issued by wealth management companies, providing a performance ranking of these products to assist investors in making informed choices [1] Summary by Category Product Performance - The ranking showcases annualized performance over the past month, three months, and six months, sorted by the three-month annualized yield to reflect multi-dimensional performance amid recent market fluctuations [1] - A total of 28 distribution institutions are involved in the ranking, including major banks such as Industrial and Commercial Bank of China, Bank of China, and Agricultural Bank of China [1] Product Availability - The ranking is based on the "on-sale" status of wealth management products, which may vary due to factors like sold-out quotas or differences in product listings for different customers [1] - Investors are advised to refer to the actual display on the distribution bank's app for the most accurate information regarding product availability [1]

银行渠道本周在售最低持有期产品榜单(10/27-11/2)

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-27 01:20

Core Insights - The article emphasizes the abundance of bank wealth management products with similar names and vague characteristics, urging investors to carefully select and differentiate among them [1] - The South Finance Wealth Management team aims to reduce investors' selection costs by focusing weekly on the performance of wealth management products available through various distribution channels [1] Summary by Category Performance Rankings - The current focus is on the performance of public offering products with a minimum holding period in RMB, categorized by holding periods of 7 days, 14 days, 30 days, and 60 days, with annualized returns as the performance metric [1] - The ranking includes 28 distribution institutions such as Industrial and Commercial Bank of China, Bank of China, Agricultural Bank of China, and others [1] Product Availability - The list of products is based on their "on-sale" status, which is determined by their investment cycle; however, actual availability may vary due to factors like sold-out quotas or differences in product listings for different customers [1] - Investors are advised to refer to the actual display on the distribution bank's app for the most accurate information [1] Weekly Updates - The article provides a weekly update on the performance of wealth management products, with specific attention to the lowest holding period products for the week of October 27 to November 2 [5][8][11]