PING AN OF CHINA(601318)

Search documents

“国家队”持仓动向揭秘!Q3持仓超100亿A股上市公司名单一览

Xin Lang Cai Jing· 2025-11-02 00:45

Core Insights - The latest holdings of the "national team" in A-share listed companies have been revealed, with 233 companies having the "national team" as one of their top ten shareholders [1][2] - In the third quarter, the "national team" held over 10 billion yuan in market value in 30 stocks, including major banks and insurance companies [1] Group 1: Major Holdings - The top three holdings by market value are: - China Construction Bank: 13,288.15 billion yuan - Agricultural Bank of China: 11,429.52 billion yuan - Bank of China: 11,138.27 billion yuan [1] - Other significant holdings include: - Industrial and Commercial Bank of China: 9,914.42 billion yuan - New China Life Insurance: 751.22 billion yuan - Ping An Insurance: 734.02 billion yuan [1][2] Group 2: New Additions - Farah Electronics is a new addition to the "national team" holdings, with a market value of 1.58 billion yuan [2] - The company reported a revenue of 3.944 billion yuan for the first three quarters, a year-on-year increase of 14.69%, and a net profit of 888 million yuan, also up 14.58% [2] - In the third quarter alone, Farah Electronics achieved a revenue of 1.445 billion yuan, reflecting a year-on-year growth of 9.31% [2]

中国平安在华南布局的首家康复医院正式开业,落子广东深圳

Xin Lang Cai Jing· 2025-11-01 14:28

Core Viewpoint - The opening of Shenzhen Beiyi Rehabilitation Hospital marks a significant step for Ping An in its healthcare strategy, aligning with national health initiatives and enhancing rehabilitation services in the Greater Bay Area [1] Company Summary - Ping An, in collaboration with Peking University Health Group, has launched its first rehabilitation hospital in South China, with over 300 approved beds and a total construction area of nearly 30,000 square meters [1] - The hospital is positioned as a tertiary rehabilitation specialty hospital, aiming to upgrade rehabilitation medical standards in Shenzhen [1] Industry Summary - The establishment of Shenzhen Beiyi Rehabilitation Hospital is part of a broader strategy to integrate insurance, rehabilitation, and elderly care services, creating a synergistic model for healthcare delivery [1] - The hospital features a multi-specialty rehabilitation treatment matrix, family-style rehabilitation living facilities, and an AI-driven precise rehabilitation loop [1] - The new hospital complements Peking University Health Group's existing network, which includes six comprehensive hospitals and 14 health management centers, forming a complete service system from prevention to treatment and rehabilitation [1]

中国平安旗下深圳北医康复医院开业,汇聚领军专家、打造六大康复专科 “保险+康复+养老”深度协同

Quan Jing Wang· 2025-11-01 08:50

Core Viewpoint - The opening of Shenzhen Beida Rehabilitation Hospital marks a significant step for Ping An in enhancing healthcare services in the Greater Bay Area, aligning with the national strategy of building a healthy China and advancing the company's medical and elderly care strategy [4][19]. Group 1: Hospital Overview - Shenzhen Beida Rehabilitation Hospital, operated by Beida Medical Group under Ping An, officially opened in Bao'an District, Shenzhen, with a total construction area of nearly 30,000 square meters and 301 approved beds [1]. - The hospital is expected to handle an annual patient volume of up to 100,000, providing comprehensive rehabilitation services from acute to chronic care [1]. Group 2: Service Features - The hospital aims to provide high-quality rehabilitation services by leveraging a "family-style service + AI empowerment" model, ensuring a full-cycle service from pre-hospital to post-hospital care [4][8]. - It will feature a multi-specialty rehabilitation treatment matrix, including six major rehabilitation specialties, and plans to establish expert studios in collaboration with top hospitals for remote diagnosis [13]. Group 3: Technological Integration - The hospital will incorporate advanced technologies into its operations, including exoskeleton robots and 3D posture analysis systems, to enhance rehabilitation services [13]. - A focus on smart rehabilitation will drive the hospital's development, integrating cutting-edge technology into diagnosis, service, and management processes [6]. Group 4: Strategic Collaboration - Shenzhen Beida Rehabilitation Hospital will collaborate with Ping An's insurance, medical, and elderly care services to create an innovative "insurance + rehabilitation + elderly care" model [14]. - The hospital is set to integrate with Ping An Health Insurance's high-end medical direct payment system, facilitating a seamless payment experience for patients [17]. Group 5: Market Positioning - The hospital is positioned as a benchmark for professional rehabilitation medical services in the Greater Bay Area, aiming to meet the increasing demand for high-quality rehabilitation resources [10][8]. - As part of Ping An's broader healthcare ecosystem, the hospital will contribute to the integration of healthcare and elderly care services, enhancing the overall quality of care in the region [19].

赵宇龙任保险业协会党委书记;邱智坤拟接任董事长;赵雪军辞任总经理;第四套生命表自2026年1月1日起实施;|13精周报

13个精算师· 2025-11-01 04:03

Regulatory Dynamics - Five departments are promoting the implementation of a long-term care insurance system, supporting the inclusion of qualified medical and nursing institutions as designated service providers [6] - As of the end of September, the cumulative balance of three social insurance funds reached 9.85 trillion yuan, with total income of 6.69 trillion yuan and total expenditure of 6.04 trillion yuan for the first nine months [7] - The Financial Regulatory Bureau announced that the fourth set of life tables will be implemented starting January 1, 2026, which includes various tables for different insurance products [9] - The Financial Regulatory Bureau supports domestic insurance companies in issuing "sidecar" insurance-linked securities in the Hong Kong market [10] - The Financial Regulatory Bureau expects insurance premium income to reach 6 trillion yuan this year [24] Company Dynamics - Ping An Life increased its stake in China Merchants Bank H-shares to 18.02% [30] - China Life plans to invest 2 billion yuan in a private equity investment plan focusing on semiconductors, digital energy, and smart electric vehicles [31] - China Life reported a strong growth of 41.8% in new business value for the first three quarters [32] - China Ping An's net profit attributable to shareholders grew by 45.4% year-on-year in the third quarter [33] - China Reinsurance achieved a net profit of 51.97 billion yuan, a significant increase of 131.49% year-on-year [39] - AIA Group's new business value rose by 25% to 1.476 billion USD in the third quarter [40] Industry Dynamics - The five major insurance companies in A-shares collectively earned over 426 billion yuan in net profit for the first three quarters, a year-on-year increase of 33.5% [53][54] - The first report on reinsurance business in China showed that the ceded business exceeded 200 billion yuan, covering 14 countries and regions [55] - The insurance industry is expected to see a gradual stabilization or decrease in premium rates for new energy vehicle insurance in the short to medium term [26] - The insurance sector is exploring a comprehensive grading system for insurance models to reduce costs across the entire lifecycle of vehicles [26] - The comprehensive expense ratio of the property insurance industry reached a 20-year low, while the comprehensive cost ratio hit a 10-year low in the first nine months of this year [27]

中国平安的前世今生:营收8329.4亿行业居首,净利润1550.67亿仅次于国寿

Xin Lang Zheng Quan· 2025-10-31 14:28

Core Viewpoint - China Ping An is a leading comprehensive financial group in China, primarily focused on insurance, and has shown strong performance in revenue and net profit in the industry [1][2]. Business Performance - In Q3 2025, China Ping An achieved an operating revenue of 832.94 billion yuan, ranking first in the industry, significantly higher than the industry average of 474.8 billion yuan and the median of 520.99 billion yuan [2]. - The net profit for the same period was 155.07 billion yuan, ranking second in the industry, above the industry average of 93.65 billion yuan and the median of 63.40 billion yuan [2]. Financial Ratios - As of Q3 2025, China Ping An's debt-to-asset ratio was 89.94%, slightly up from 89.79% year-on-year and above the industry average of 88.71% [3]. - The gross profit margin was 21.84%, an increase from 20.52% year-on-year but still below the industry average of 23.85% [3]. Executive Compensation - Chairman Ma Mingzhe's compensation for 2024 was 6.0997 million yuan, a slight decrease from 6.0998 million yuan in 2023 [4]. - General Manager Xie Yonglin's compensation for 2024 was 6.7116 million yuan, an increase from 6.7066 million yuan in 2023 [4]. Shareholder Information - As of September 30, 2025, the number of A-share shareholders decreased by 12.89% to 692,100, while the average number of circulating A-shares held per shareholder increased by 13.70% to 15,400 [5]. - The top ten circulating shareholders included Hong Kong Central Clearing Limited and Huaxia SSE 50 ETF, with notable decreases in their holdings [5]. Business Highlights - The new business value (NBV) for life and health insurance grew by 46.2% year-on-year to 35.724 billion yuan in the first three quarters of 2025, with a quarterly increase of 58.3% [5][6]. - Property insurance premium income increased by 7.1% year-on-year to 256.247 billion yuan [5][6]. - The non-annualized comprehensive investment return rate improved to 5.4%, up by 1.0 percentage point year-on-year [5][6].

中国平安(601318):2025年三季报点评:Q3单季寿险NBV和净利润均增长强劲

HUAXI Securities· 2025-10-31 13:12

Investment Rating - The investment rating for the company is "Buy" [1] Core Insights - The company reported strong growth in both new business value (NBV) and net profit for Q3 2025, with NBV increasing by 46.2% year-on-year to 35.724 billion yuan and net profit rising by 45.4% year-on-year [2][3] - The overall business performance is stable, with core operations showing high-quality development, particularly in the life insurance sector [6] Summary by Sections Financial Performance - For the first three quarters of 2025, the company achieved operating revenue of 832.94 billion yuan, a year-on-year increase of 7.4%, and a net profit attributable to shareholders of 132.856 billion yuan, up 11.5% year-on-year [2] - The operating profit for the same period was 116.264 billion yuan, reflecting a 7.2% year-on-year growth [2] - The company's net assets at the end of the period were 986.406 billion yuan, an increase of 6.2% from the beginning of the year [2] Life and Health Insurance - The NBV for life and health insurance business grew significantly, with a year-on-year increase of 46.2% to 35.724 billion yuan, and a quarterly increase of 58.3% [3] - The first-year premium income for the first three quarters increased by 2.3% year-on-year, while Q3 saw a 21.1% increase [3] - The agent channel contributed significantly to NBV, with a year-on-year increase of 23.3% [3] Property and Casualty Insurance - The company’s property and casualty insurance premium income rose by 7.1% year-on-year to 256.247 billion yuan [4] - The combined ratio improved by 0.8 percentage points year-on-year to 97.0%, although it increased from 95.2% in the first half of the year [4] Investment Performance - The company’s investment portfolio achieved a non-annualized net investment return of 2.8%, a decrease of 0.3 percentage points year-on-year, while the overall investment return increased by 1.0 percentage points to 5.4% [5] - As of September 30, 2025, the investment portfolio size exceeded 6.41 trillion yuan, an increase of 11.9% from the beginning of the year [5] Earnings Forecast and Valuation - The revenue forecast for 2025 has been adjusted to 1,054.039 billion yuan, up from a previous estimate of 1,035.9 billion yuan [6] - The net profit forecast for 2025 has been raised to 138.458 billion yuan, compared to the previous estimate of 127.3 billion yuan [6] - The estimated earnings per share (EPS) for 2025 is now projected at 7.60 yuan, an increase from the previous estimate of 6.99 yuan [6]

中国平安三季度业绩飙涨,战略升级重构金融生态

Di Yi Cai Jing· 2025-10-31 11:30

Core Insights - China Ping An reported strong Q3 results with a 15.2% increase in operating profit and a 45.4% increase in net profit attributable to shareholders [1][2] - The company's stock price rose by 2.06% on October 29, reflecting market satisfaction with its performance, with a year-to-date increase of 17.1% [1][2] Financial Performance - For the first three quarters of the year, China Ping An achieved revenue of 901.67 billion yuan, a year-on-year increase of 4.6% [2] - Operating profit attributable to shareholders reached 116.26 billion yuan, up 7.2%, while net profit attributable to shareholders was 132.86 billion yuan, growing by 11.5% [2] - The Q3 operating profit saw a significant increase of 15.2%, and net profit surged by 45.4% compared to the same period last year [2] New Business Value (NBV) Growth - The NBV for Ping An's life insurance business grew by 46.2% year-on-year in the first three quarters of 2025 [2] - The growth was primarily driven by a substantial increase in multi-channel distribution, with the bancassurance channel's NBV rising by 170.9% [2] - The number of agents decreased by 2.5% to 354,000, but productivity improved, with per capita NBV increasing by 29.9% [2] Investment Performance - The investment portfolio of Ping An achieved a non-annualized comprehensive investment return of 5.4%, an increase of 1.0 percentage points year-on-year [3] - The company capitalized on rising equity markets to enhance its equity allocation, ensuring stable long-term investment returns [3] Healthcare and Elderly Care Strategy - The healthcare and elderly care services were emphasized in the report, with the term "service" mentioned 86 times, highlighting its importance [4] - As of September 30, 2025, Ping An had over 87,000 paying clients in its healthcare and elderly care sectors [5] - The company has established a comprehensive service network, including partnerships with over 50,000 doctors and more than 37,000 hospitals in China [5] Unique Business Model - Ping An's approach combines elements of e-commerce and standardized service delivery, creating a unique business model in the insurance sector [4][6] - The company has expanded its elderly care services to cover 85 cities, with nearly 240,000 clients receiving home care services [6] - The integration of financial, technological, and healthcare services positions Ping An as an ecosystem service provider rather than a traditional financial institution [7]

“三省”为“道”,AI为“术”:“AI in All”背后,中国平安重新定义服务边际 沈安蓓

Di Yi Cai Jing· 2025-10-31 11:30

Core Insights - China Ping An's Q3 report highlights strong growth momentum, exceptional new business value, and significant investment performance, attracting industry attention [1] - The construction of an AI moat is also a key highlight, as the financial industry undergoes transformative changes in the AI era, enhancing service efficiency and customer experience [1] Group 1: Service Transformation - The insurance industry has faced challenges in maintaining frequent interactions with customers, leading to a shift from a low-frequency model to embedding services within the protection chain, creating new competitive barriers [2] - China Ping An has prioritized service alongside product innovation since its inception, upgrading its "Three Savings" concept to a top priority for the entire group, integrating it with a dual strategy of comprehensive finance and healthcare [2] Group 2: AI Integration - AI is becoming the core technology driving the "Three Savings" service philosophy, with a goal of transforming the entire value chain in finance and healthcare by 2025 [3] - The implementation of AI has led to significant operational efficiencies, such as achieving 94% instant underwriting for life insurance policies and handling over 12.92 billion AI service interactions [3][4] Group 3: Data Advantage - China Ping An possesses a vast database of 30 trillion bytes, covering nearly 250 million individual customers, which serves as a critical foundation for AI value creation [4] - The company has accumulated over 3.2 trillion high-quality text data, 310,000 hours of annotated voice data, and over 7.5 billion image data, enhancing its AI model training capabilities [4] Group 4: Service Scenarios - AI is integrated into various service scenarios, such as the "111 Rapid Compensation" service for life insurance, which allows for quick claims processing with minimal human intervention [7] - In property insurance, AI streamlines the claims process for minor accidents, significantly improving customer experience and reducing operational costs [7] Group 5: Predictive Service - The goal of AI is to transition from reactive to proactive service, anticipating customer needs before they arise, exemplified by the "Eagle Eye System" for disaster risk management [9] - This proactive approach not only enhances customer experience but also transforms service from a cost center to a value creation center, benefiting both customers and the company [10]

合赚4260亿,五大上市险企三季报详细解读

Xin Lang Cai Jing· 2025-10-31 10:49

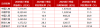

Core Insights - The five major listed insurance companies in China reported a total operating income of 23,739.81 billion RMB for the first three quarters of 2025, representing a 13.6% increase compared to the same period in 2024. The net profit reached 4,260.39 billion RMB, a year-on-year growth of 33.54% [1][3] Group 1: Company Performance - China Life Insurance maintained its leading position in the life insurance sector with a premium growth of 25.9%, achieving a net profit of 1,678.04 billion RMB, up 60.5% [3][4] - Ping An Insurance reported an operating income of 8,329.40 billion RMB, with a net profit of 1,328.56 billion RMB, reflecting an 11.5% increase [3][4] - China Pacific Insurance achieved a net profit of 457 billion RMB, a growth of 19.3%, with an operating income of 3,449.04 billion RMB [3][4] - New China Life Insurance saw a significant net profit increase of 58.0%, totaling 328.57 billion RMB, with a premium growth of 28.3% [3][4] - China Property & Casualty Insurance reported a net profit of 468.22 billion RMB, up 28.9%, with an operating income of 5,209.90 billion RMB [3][4] Group 2: Premium Growth and Channels - The life insurance sector is experiencing a recovery, with total premiums and new business premiums showing double-digit growth across multiple companies [4][6] - China Life achieved total premiums of 6,696.45 billion RMB, a 10.1% increase, with renewal premiums growing by 10.0% [4][6] - New China Life reported a 59.8% increase in first-year premiums for long-term insurance [4][6] - The bancassurance channel has become a significant growth driver, with China Pacific Insurance's bancassurance premiums reaching 583.10 billion RMB, up 63.3% [6][7] Group 3: Investment Performance - All five companies highlighted significant increases in investment income as a key driver of profit growth, benefiting from a recovering capital market [10][11] - China Life's total investment income reached 3,685.51 billion RMB, a 41.0% increase, with an investment return rate of 6.42% [10][11] - Ping An's investment portfolio exceeded 6.41 trillion RMB, with a non-annualized comprehensive investment return rate of 5.4% [10][11] - China Property & Casualty Insurance reported total investment income of 862.50 billion RMB, a 35.3% increase [10][11] Group 4: Asset Growth - The total assets of the five major insurance companies reached 27.82 trillion RMB, an 8.3% increase from the end of 2024 [12][13] - Ping An's total assets amounted to 13.65 trillion RMB, a 5.3% increase, while China Life's total assets reached 7.42 trillion RMB, growing by 9.6% [12][13]

保险板块10月31日跌2.14%,中国太保领跌,主力资金净流出4.98亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-31 08:42

Core Points - The insurance sector experienced a decline of 2.14% on October 31, with China Pacific Insurance leading the drop [1] - The Shanghai Composite Index closed at 3954.79, down 0.81%, while the Shenzhen Component Index closed at 13378.21, down 1.14% [1] Insurance Sector Performance - China Life Insurance (601628) closed at 43.97, down 0.92%, with a trading volume of 218,700 shares and a transaction value of 970 million [1] - Ping An Insurance (601318) closed at 57.83, down 1.40%, with a trading volume of 572,500 shares and a transaction value of 3.33 billion [1] - China Property & Casualty Insurance (616109) closed at 8.44, down 2.99%, with a trading volume of 1,056,100 shares and a transaction value of 902 million [1] - New China Life Insurance (601336) closed at 67.81, down 4.36%, with a trading volume of 323,900 shares and a transaction value of 2.23 billion [1] - China Pacific Insurance (601601) closed at 35.50, down 5.96%, with a trading volume of 861,600 shares and a transaction value of 3.10 billion [1] Fund Flow Analysis - The insurance sector saw a net outflow of 498 million from main funds, while retail funds experienced a net inflow of 231 million [1] - Speculative funds had a net inflow of 267 million [1]