PICC(601319)

Search documents

赵宇龙任保险业协会党委书记;邱智坤拟接任董事长;赵雪军辞任总经理;第四套生命表自2026年1月1日起实施;|13精周报

13个精算师· 2025-11-01 04:03

Regulatory Dynamics - Five departments are promoting the implementation of a long-term care insurance system, supporting the inclusion of qualified medical and nursing institutions as designated service providers [6] - As of the end of September, the cumulative balance of three social insurance funds reached 9.85 trillion yuan, with total income of 6.69 trillion yuan and total expenditure of 6.04 trillion yuan for the first nine months [7] - The Financial Regulatory Bureau announced that the fourth set of life tables will be implemented starting January 1, 2026, which includes various tables for different insurance products [9] - The Financial Regulatory Bureau supports domestic insurance companies in issuing "sidecar" insurance-linked securities in the Hong Kong market [10] - The Financial Regulatory Bureau expects insurance premium income to reach 6 trillion yuan this year [24] Company Dynamics - Ping An Life increased its stake in China Merchants Bank H-shares to 18.02% [30] - China Life plans to invest 2 billion yuan in a private equity investment plan focusing on semiconductors, digital energy, and smart electric vehicles [31] - China Life reported a strong growth of 41.8% in new business value for the first three quarters [32] - China Ping An's net profit attributable to shareholders grew by 45.4% year-on-year in the third quarter [33] - China Reinsurance achieved a net profit of 51.97 billion yuan, a significant increase of 131.49% year-on-year [39] - AIA Group's new business value rose by 25% to 1.476 billion USD in the third quarter [40] Industry Dynamics - The five major insurance companies in A-shares collectively earned over 426 billion yuan in net profit for the first three quarters, a year-on-year increase of 33.5% [53][54] - The first report on reinsurance business in China showed that the ceded business exceeded 200 billion yuan, covering 14 countries and regions [55] - The insurance industry is expected to see a gradual stabilization or decrease in premium rates for new energy vehicle insurance in the short to medium term [26] - The insurance sector is exploring a comprehensive grading system for insurance models to reduce costs across the entire lifecycle of vehicles [26] - The comprehensive expense ratio of the property insurance industry reached a 20-year low, while the comprehensive cost ratio hit a 10-year low in the first nine months of this year [27]

中国人保(601319):投资及承保双轮驱动业绩快增

ZHESHANG SECURITIES· 2025-10-31 14:49

Investment Rating - The investment rating for the company is "Buy" with an upward adjustment [7] Core Insights - The company reported a net profit attributable to shareholders of 46.822 billion yuan for the first three quarters of 2025, representing a year-on-year increase of 28.9%, with a return on equity (ROE) of 16%, up 1.8 percentage points year-on-year [1] - The new business value (NBV) for life insurance increased by 76.6% year-on-year, indicating strong growth in the life insurance segment [1] - The comprehensive cost ratio (COR) for property insurance improved to 96.1%, a year-on-year optimization of 2.1 percentage points, reflecting effective cost management [1] Summary by Sections Performance Overview - For the first three quarters of 2025, the company achieved a net profit of 46.822 billion yuan, a 28.9% increase year-on-year, with a single-quarter profit growth of 48.7% in Q3 2025 [1] - The ROE was reported at 16%, an increase of 1.8 percentage points compared to the previous year [1] Property Insurance - The insurance service revenue from property insurance reached 385.921 billion yuan, up 5.9% year-on-year, with underwriting profit soaring by 130.7% to 14.865 billion yuan [2] - The COR for property insurance was 96.1%, reflecting a significant year-on-year improvement of 2.1 percentage points, attributed to cost reduction and efficiency enhancement measures [2] Life Insurance - The life insurance segment saw a substantial increase in NBV, with a year-on-year growth of 76.6% [3] - New single premium income for life insurance was 54.756 billion yuan, a 23.8% increase year-on-year, with first-year premium income for long-term insurance rising by 33.8% [3] - The net profit for life insurance was reported at 13.974 billion yuan, a decrease of 10.3% year-on-year [3] Health Insurance - The new single premium income for health insurance reached 37.524 billion yuan, a year-on-year increase of 16.1%, with first-year premium income for long-term insurance growing by 62.8% [3] - The net profit for health insurance was 7.856 billion yuan, reflecting a year-on-year growth of 41% [3] Investment Performance - As of the end of Q3 2025, the investment scale of insurance funds was 1.83 trillion yuan, an increase of 11.2% since the beginning of the year [4] - The total investment return rate was 5.4%, up 0.8 percentage points year-on-year, with total investment income reaching 86.25 billion yuan, a 35.3% increase year-on-year [4] Profit Forecast and Valuation - The company is expected to maintain strong performance in both underwriting and investment, leading to an upward revision of profit forecasts and valuations [5] - Projected net profit growth rates for 2025-2027 are 25.5%, 14.1%, and 22% respectively, with a target price set at 11.79 yuan per share [5]

合赚4260亿,五大上市险企三季报详细解读

Xin Lang Cai Jing· 2025-10-31 10:49

Core Insights - The five major listed insurance companies in China reported a total operating income of 23,739.81 billion RMB for the first three quarters of 2025, representing a 13.6% increase compared to the same period in 2024. The net profit reached 4,260.39 billion RMB, a year-on-year growth of 33.54% [1][3] Group 1: Company Performance - China Life Insurance maintained its leading position in the life insurance sector with a premium growth of 25.9%, achieving a net profit of 1,678.04 billion RMB, up 60.5% [3][4] - Ping An Insurance reported an operating income of 8,329.40 billion RMB, with a net profit of 1,328.56 billion RMB, reflecting an 11.5% increase [3][4] - China Pacific Insurance achieved a net profit of 457 billion RMB, a growth of 19.3%, with an operating income of 3,449.04 billion RMB [3][4] - New China Life Insurance saw a significant net profit increase of 58.0%, totaling 328.57 billion RMB, with a premium growth of 28.3% [3][4] - China Property & Casualty Insurance reported a net profit of 468.22 billion RMB, up 28.9%, with an operating income of 5,209.90 billion RMB [3][4] Group 2: Premium Growth and Channels - The life insurance sector is experiencing a recovery, with total premiums and new business premiums showing double-digit growth across multiple companies [4][6] - China Life achieved total premiums of 6,696.45 billion RMB, a 10.1% increase, with renewal premiums growing by 10.0% [4][6] - New China Life reported a 59.8% increase in first-year premiums for long-term insurance [4][6] - The bancassurance channel has become a significant growth driver, with China Pacific Insurance's bancassurance premiums reaching 583.10 billion RMB, up 63.3% [6][7] Group 3: Investment Performance - All five companies highlighted significant increases in investment income as a key driver of profit growth, benefiting from a recovering capital market [10][11] - China Life's total investment income reached 3,685.51 billion RMB, a 41.0% increase, with an investment return rate of 6.42% [10][11] - Ping An's investment portfolio exceeded 6.41 trillion RMB, with a non-annualized comprehensive investment return rate of 5.4% [10][11] - China Property & Casualty Insurance reported total investment income of 862.50 billion RMB, a 35.3% increase [10][11] Group 4: Asset Growth - The total assets of the five major insurance companies reached 27.82 trillion RMB, an 8.3% increase from the end of 2024 [12][13] - Ping An's total assets amounted to 13.65 trillion RMB, a 5.3% increase, while China Life's total assets reached 7.42 trillion RMB, growing by 9.6% [12][13]

中国人保(601319):COR和NBV增速均向好

HTSC· 2025-10-31 08:47

Investment Rating - The investment rating for the company is "Buy" [7] Core Insights - The company reported a significant increase in net profit for 3Q25, reaching RMB 20.292 billion, a year-on-year increase of 48.7% [1] - Strong performance in both insurance services and investment sectors contributed to the positive results, with insurance service earnings growing by 24.6% and investment earnings increasing by 64.7% [1] - The combined ratio (COR) for property insurance improved, decreasing by 2.1 percentage points to 96.1%, indicating better underwriting performance [2] - The new business value (NBV) for life insurance grew by 76.6%, significantly outpacing the growth of new premiums [3] - Total investment income for the first three quarters reached RMB 86.25 billion, a year-on-year increase of 35.3%, with an overall investment yield of 5.4% [4] - The company adjusted its earnings per share (EPS) forecasts for 2025, 2026, and 2027 to RMB 1.22, RMB 1.30, and RMB 1.42 respectively, reflecting positive trends in both insurance and investment performance [5] Summary by Sections Property Insurance - The company has improved its underwriting and claims management, leading to a decrease in COR to 96.1% [2] - Premium income for property insurance grew by 3.1% year-on-year, with motor insurance premiums increasing by 2.7% and non-motor insurance premiums by 3.7% [2] - The underwriting profit for property insurance increased by 130.7% to RMB 14.865 billion [2] Life Insurance - The NBV for life insurance showed a strong growth of 76.6%, indicating a significant improvement in profitability [3] - Total premiums for life insurance reached RMB 36.399 billion, with a year-on-year growth of 43.9% [3] - The company expects the NBV growth rate for life insurance to reach 65.9% in 2025 [3] Investment Performance - The investment performance for 3Q25 was robust, with earnings of RMB 26.916 billion, a 64.7% increase year-on-year [4] - The total investment assets grew by 11.2% year-to-date, reaching RMB 1,825.647 billion [4] - The company has effectively utilized its investment strategies to capitalize on market opportunities, particularly in fixed income and equity investments [4]

保险板块10月31日跌2.14%,中国太保领跌,主力资金净流出4.98亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-31 08:42

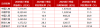

Core Points - The insurance sector experienced a decline of 2.14% on October 31, with China Pacific Insurance leading the drop [1] - The Shanghai Composite Index closed at 3954.79, down 0.81%, while the Shenzhen Component Index closed at 13378.21, down 1.14% [1] Insurance Sector Performance - China Life Insurance (601628) closed at 43.97, down 0.92%, with a trading volume of 218,700 shares and a transaction value of 970 million [1] - Ping An Insurance (601318) closed at 57.83, down 1.40%, with a trading volume of 572,500 shares and a transaction value of 3.33 billion [1] - China Property & Casualty Insurance (616109) closed at 8.44, down 2.99%, with a trading volume of 1,056,100 shares and a transaction value of 902 million [1] - New China Life Insurance (601336) closed at 67.81, down 4.36%, with a trading volume of 323,900 shares and a transaction value of 2.23 billion [1] - China Pacific Insurance (601601) closed at 35.50, down 5.96%, with a trading volume of 861,600 shares and a transaction value of 3.10 billion [1] Fund Flow Analysis - The insurance sector saw a net outflow of 498 million from main funds, while retail funds experienced a net inflow of 231 million [1] - Speculative funds had a net inflow of 267 million [1]

美银证券:升中国人民保险集团(01339.HK)目标价8.2港元 第三季度投资收益表现强劲

Sou Hu Cai Jing· 2025-10-31 06:36

Core Insights - China People's Insurance Group (01339.HK) reported a net profit of 46.8 billion RMB for the first nine months of 2025, representing a year-on-year growth of 29% [1] - The company's underwriting profit in Q3 2025 increased by 25% year-on-year, driven by the contribution from property insurance [1] - Investment income exceeded expectations, with a year-on-year growth of 42% in Q3 2025 and 60% for the first nine months [1] Financial Performance - The company’s return on equity (ROE) stands at 16.61%, outperforming the industry average of 13.8% [2] - The operating revenue for China People's Insurance Group is 654 billion RMB, ranking second in the industry [2] - The net profit margin is 11.15%, which is below the industry average of 17.41% [2] Market Position and Ratings - The market capitalization of China People's Insurance Group is 65.272 billion HKD, ranking 8th in the insurance industry [1] - Recent upgrades in earnings forecasts for 2025 to 2027 range from 1% to 8% [1] - The target price for H-shares has been raised to 8.2 HKD, while the A-shares target price is set at 7.2 RMB [1] - The stock has received a "Buy" rating for H-shares and an "Underperform" rating for A-shares [1]

美银证券:升中国人民保险集团(01339)目标价8.2港元 第三季度投资收益表现强劲

智通财经网· 2025-10-31 06:27

Core Viewpoint - Bank of America Securities reports that China People's Insurance Group (01339) achieved a net profit of 46.8 billion RMB for the first nine months of 2025, representing a year-on-year growth of 29% [1] Financial Performance - The company's underwriting profit in Q3 2025 increased by 25% year-on-year, benefiting from the contributions of the property insurance business [1] - Investment income exceeded expectations, with a year-on-year growth of 42% in Q3 2025 and a 60% increase for the first nine months [1] Earnings Forecast and Target Price - Bank of America Securities raised the earnings forecast for the group for 2025 to 2027 by 1% to 8% [1] - The target price for H-shares was increased by 8% to 8.2 HKD, while the target price for A-shares (601319.SH) was raised by 8% to 7.2 RMB [1] Ratings - The H-share rating is maintained as "Buy," with a projected price-to-book ratio of 1x for 2026 [1] - The A-share rating is set as "Underperform," with a projected price-to-book ratio of 1.3x for 2026 [1]

美银证券:升中国人民保险集团目标价8.2港元 第三季度投资收益表现强劲

Zhi Tong Cai Jing· 2025-10-31 06:25

Core Viewpoint - Bank of America Securities reports that China People's Insurance Group (01339) achieved a net profit of 46.8 billion RMB for the first nine months of 2025, representing a year-on-year growth of 29% [1] Financial Performance - The company benefited from its property insurance business, recording an underwriting profit growth of 25% year-on-year in Q3 2025 [1] - Investment income exceeded expectations, with a year-on-year increase of 42% in Q3 2025 and a 60% increase for the first nine months [1] Earnings Forecast and Target Price - Bank of America Securities raised the earnings forecast for the group for 2025 to 2027 by 1% to 8% [1] - The target price for H-shares was increased by 8% to 8.2 HKD, while the target price for A-shares was raised by 8% to 7.2 RMB [1] Ratings - The H-share rating is maintained as "Buy," with a projected price-to-book ratio of 1x for 2026 [1] - The A-share rating is set as "Underperform," with a projected price-to-book ratio of 1.3x for 2026 [1]

贵州监管局同意撤销中国人保财险贵阳市南明支公司花果园营销服务部

Jin Tou Wang· 2025-10-31 04:14

Core Points - The Guizhou Regulatory Bureau of the National Financial Supervision Administration approved the request from China People's Property Insurance Company to revoke the marketing service department of its Nanming branch in Huaguoyuan [1] - The company is required to cease all business activities immediately upon receiving the approval and return its license to the Guizhou Financial Regulatory Bureau within 15 working days [1] - The company must ensure proper handling of all aftermath work to protect the legal rights of financial consumers and make announcements as required by relevant laws and regulations [1]

中国人保(601319):COR边际大幅改善 人身险业务维持高增

Xin Lang Cai Jing· 2025-10-31 00:30

Core Insights - China Life Insurance reported a net profit of 46.8 billion yuan for the first nine months of 2025, representing a year-on-year increase of 28.9% [1] - The company achieved a net profit of 20.3 billion yuan in Q3 2025, up 48.7% year-on-year, primarily due to reduced natural disaster impacts and improved investment returns [1] - The combined ratio (COR) for the property and casualty insurance business improved to 96.1%, a decrease of 2.1 percentage points year-on-year [1] Group 1: Financial Performance - The net profit for 9M25 was 46.8 billion yuan, with a year-on-year growth of 28.9% [1] - In Q3 2025, the net profit reached 20.3 billion yuan, marking a 48.7% increase year-on-year, attributed to lower natural disaster impacts and a rising equity market [1] - The total investment return rate was 5.4%, reflecting a year-on-year increase of 0.8 percentage points [1] Group 2: Business Segments - The property and casualty insurance segment reported premium income of 443.2 billion yuan, a year-on-year increase of 3.5%, with underwriting profit of 14.865 billion yuan, up 130.7% [1] - The life insurance segment achieved insurance service income of 19.8 billion yuan, a year-on-year increase of 18.2%, with a net profit of 14 billion yuan and a new business value (NBV) growth of 76.6% [2] - The health insurance segment generated insurance service income of 23.2 billion yuan, a year-on-year increase of 12.9%, with a net profit of 7.9 billion yuan, up 41% [2] Group 3: Investment Strategy - The total investment asset scale reached 1.83 trillion yuan, an 11.2% increase from the beginning of the year [2] - The company is gradually increasing its allocation to long-duration bonds and expanding its equity holdings, focusing on innovative investment opportunities [2] - Total investment income for 9M25 was 86.25 billion yuan, reflecting a year-on-year increase of 35.3% [2] Group 4: Future Outlook - The company maintains a strong recommendation rating, with expectations for continued profit growth across all business lines [3] - The property and casualty insurance business is expected to maintain a low COR of around 96%-97% for the full year, driven by improved operational efficiency [3] - Forecasted net profits for 2025-2027 are 54.1 billion, 57 billion, and 58.9 billion yuan, with growth rates of 26.2%, 5.4%, and 3.4% respectively [3]