China Life(601628)

Search documents

中国人寿(601628):2025年三季报点评:Q3单季NBV和净利润增速环比显著提升

HUAXI Securities· 2025-10-31 12:48

Investment Rating - The investment rating for the company is "Buy" [1] Core Views - The company reported significant growth in both new business value (NBV) and net profit in Q3, with a year-on-year increase of 91.5% in net profit for the quarter [2] - The company has successfully diversified its product offerings and managed liability costs, leading to improved investment returns [2][3] - The total investment income for the first three quarters increased by 41.0% year-on-year, driven by a favorable stock market environment [4] Financial Performance Summary - For the first three quarters of 2025, the company achieved operating revenue of 537.895 billion yuan, a year-on-year increase of 25.9%, with Q3 alone showing a 54.8% increase [2] - The net profit attributable to shareholders reached 167.804 billion yuan, up 60.5% year-on-year, with Q3 showing a remarkable 91.5% increase [2] - The company's total investment assets amounted to 7,282.982 billion yuan, reflecting a 10.2% increase from the beginning of the year [4] New Business Value (NBV) Analysis - The NBV for the first three quarters increased by 41.8% year-on-year, significantly up from 20.3% in the first half of the year [3] - New single premium income for the first three quarters was 218.034 billion yuan, a 10.4% increase year-on-year, with Q3 showing a 52.5% increase [3] - The proportion of new single premium income from life insurance, annuity insurance, and health insurance was 31.95%, 32.47%, and 31.15%, respectively [3] Investment Income and Asset Management - The company achieved total investment income of 368.551 billion yuan in the first three quarters, a year-on-year increase of 41.0%, with Q3 alone contributing 241.045 billion yuan, up 73.3% [4] - The total investment yield reached 6.42%, an increase of 104 basis points year-on-year [4] Earnings Forecast and Valuation - The earnings forecast for 2025-2027 has been revised upwards, with expected revenues of 542.479 billion yuan, 542.017 billion yuan, and 554.381 billion yuan for the respective years [5] - The projected net profit for 2025-2027 is 170.686 billion yuan, 130.353 billion yuan, and 133.327 billion yuan [5] - The estimated earnings per share (EPS) for 2025-2027 is 6.04 yuan, 4.61 yuan, and 4.72 yuan [5]

三季报发布,中国人寿总资产、投资资产双双超过7.2万亿,取得亮眼投资业绩

Xin Hua Cai Jing· 2025-10-31 11:42

Core Insights - China Life Insurance reported a net profit attributable to shareholders exceeding 167.8 billion yuan for the first three quarters, representing a 60.5% increase year-on-year from a high base in the previous year [1] Financial Performance - Total investment income for the first three quarters reached 368.55 billion yuan, an increase of 107.13 billion yuan compared to the same period in 2024, with a growth rate exceeding 40% [1] - The total investment yield was 6.42%, reflecting a year-on-year increase of 104 basis points from last year’s high base [1] - As of September 30, 2025, total assets amounted to 7,417.98 billion yuan, and investment assets reached 7,282.98 billion yuan, marking increases of 9.6% and 10.2% respectively compared to the end of 2024 [1] - Shareholder equity attributable to the parent company reached 625.83 billion yuan, a growth of 22.8% from the end of the previous year [1] Risk Management and Ratings - As of September 30, 2025, the company maintained a high level of solvency, with a core solvency adequacy ratio of 137.50% and a comprehensive solvency adequacy ratio of 183.94% [1] - The company has maintained an A rating in the comprehensive risk assessment for insurance companies for 29 consecutive quarters [1]

合赚4260亿,五大上市险企三季报详细解读

Xin Lang Cai Jing· 2025-10-31 10:49

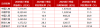

Core Insights - The five major listed insurance companies in China reported a total operating income of 23,739.81 billion RMB for the first three quarters of 2025, representing a 13.6% increase compared to the same period in 2024. The net profit reached 4,260.39 billion RMB, a year-on-year growth of 33.54% [1][3] Group 1: Company Performance - China Life Insurance maintained its leading position in the life insurance sector with a premium growth of 25.9%, achieving a net profit of 1,678.04 billion RMB, up 60.5% [3][4] - Ping An Insurance reported an operating income of 8,329.40 billion RMB, with a net profit of 1,328.56 billion RMB, reflecting an 11.5% increase [3][4] - China Pacific Insurance achieved a net profit of 457 billion RMB, a growth of 19.3%, with an operating income of 3,449.04 billion RMB [3][4] - New China Life Insurance saw a significant net profit increase of 58.0%, totaling 328.57 billion RMB, with a premium growth of 28.3% [3][4] - China Property & Casualty Insurance reported a net profit of 468.22 billion RMB, up 28.9%, with an operating income of 5,209.90 billion RMB [3][4] Group 2: Premium Growth and Channels - The life insurance sector is experiencing a recovery, with total premiums and new business premiums showing double-digit growth across multiple companies [4][6] - China Life achieved total premiums of 6,696.45 billion RMB, a 10.1% increase, with renewal premiums growing by 10.0% [4][6] - New China Life reported a 59.8% increase in first-year premiums for long-term insurance [4][6] - The bancassurance channel has become a significant growth driver, with China Pacific Insurance's bancassurance premiums reaching 583.10 billion RMB, up 63.3% [6][7] Group 3: Investment Performance - All five companies highlighted significant increases in investment income as a key driver of profit growth, benefiting from a recovering capital market [10][11] - China Life's total investment income reached 3,685.51 billion RMB, a 41.0% increase, with an investment return rate of 6.42% [10][11] - Ping An's investment portfolio exceeded 6.41 trillion RMB, with a non-annualized comprehensive investment return rate of 5.4% [10][11] - China Property & Casualty Insurance reported total investment income of 862.50 billion RMB, a 35.3% increase [10][11] Group 4: Asset Growth - The total assets of the five major insurance companies reached 27.82 trillion RMB, an 8.3% increase from the end of 2024 [12][13] - Ping An's total assets amounted to 13.65 trillion RMB, a 5.3% increase, while China Life's total assets reached 7.42 trillion RMB, growing by 9.6% [12][13]

大摩:中国人寿(02628)多项数据表现优于同行 新业务价值增长强劲

智通财经网· 2025-10-31 09:57

Core Viewpoint - Morgan Stanley reports that China Life (02628) has the highest profit growth among peers in the third quarter, with a year-to-date growth of 60.5% [1] Financial Performance - The annual Return on Equity (ROE) for the third quarter and the first nine months stands at 88.3% and 39.4% respectively [1] - The new business value for the first nine months accelerated to a growth of 41.8%, compared to 20.3% in the first half of the year [1] Comparative Analysis - China Life's performance metrics are superior to most of its competitors, indicating a strong market position [1] - The management's outlook for the company in the coming year is positive, suggesting confidence in continued growth [1] Investment Recommendation - Morgan Stanley sets a target price of HKD 25.7 for China Life, with a rating of "Overweight" [1]

美银证券:中国人寿首三季总投资回报率跑赢同业 上调目标价至29.3港元

Zhi Tong Cai Jing· 2025-10-31 09:13

国寿第三季度净利润1,269亿元人民币,多于去年全年的1,069亿元人民币。其中季度投资收入同比升 92%,受惠已实现收益与公允值收益贡献,显示公司显著受惠A股市场升势。首三季总投资回报率达 6.4%,为同业最高,高于其他领先寿险公司的5.5%至5.8%。该行指,国寿首三季盈利已超过该行此前 的全年预估,上调对公司全年盈利预测91%,基于投资收入高于预期,明年及后年盈利预测上调14%, 预期投资回报率将正常化。 美银证券发布研报称,中国人寿(601628)(02628)首三季净利润达1,678亿元人民币,在高基数下同比 升61%,远超市场预期。该行对国寿H股重申"买入"评级,目标价由25.7港元上调至29.3港元。 ...

美银证券:中国人寿(02628)首三季总投资回报率跑赢同业 上调目标价至29.3港元

智通财经网· 2025-10-31 09:12

Core Viewpoint - Bank of America Securities reports that China Life Insurance (02628) achieved a net profit of 167.8 billion RMB in the first three quarters, representing a 61% year-on-year increase, significantly exceeding market expectations [1] Financial Performance - The net profit for the third quarter reached 126.9 billion RMB, surpassing the total net profit of 106.9 billion RMB for the entire previous year [1] - Quarterly investment income increased by 92%, benefiting from realized gains and fair value gains, indicating substantial advantages from the rising A-share market [1] - The total investment return rate for the first three quarters was 6.4%, the highest among peers, compared to 5.5% to 5.8% for other leading life insurance companies [1] Forecast Adjustments - Bank of America has raised its full-year profit forecast for China Life by 91%, based on higher-than-expected investment income [1] - Profit forecasts for the next two years have been increased by 14%, with expectations for investment return rates to normalize [1]

中国人寿(601628):NBV强劲增长

HTSC· 2025-10-31 08:47

Investment Rating - The investment rating for the company is "Buy" [7][5]. Core Insights - The company reported a strong growth in net profit for Q3 2025, reaching RMB 126.87 billion, a year-on-year increase of 92%, aligning with previous forecasts [1]. - The annualized total investment return for the first three quarters was 6.42%, up by 1.04 percentage points year-on-year, driven by strong equity investment performance [3]. - The new business value (NBV) for life insurance increased by 41.8% year-on-year, with a significant acceleration from the 20.3% growth in the first half of 2025, indicating robust sales performance [2]. - The company’s new single premium income grew by 52% year-on-year in Q3 2025, contributing to the overall profit increase [2]. - The net asset value at the end of Q3 2025 rose by 19% compared to the end of Q2 2025, reflecting strong profit growth [1]. Summary by Sections Financial Performance - The company achieved a total investment income of RMB 368.55 billion in the first three quarters, a 41% increase year-on-year, primarily due to strong equity investments [3]. - The insurance service performance saw a significant increase of 229% in Q3 2025, influenced by interest rate fluctuations [4]. - The estimated EPS for 2025 is adjusted to RMB 6.08, with target prices maintained at RMB 52 for A-shares and HKD 29 for H-shares [5]. Business Growth - The sales force at the end of Q3 2025 comprised 607,000 agents, a 3% increase from the previous quarter, indicating stable growth despite a 5% year-on-year decline [2]. - The proportion of floating products in the first-year premium income increased by over 45 percentage points, reflecting a shift in product structure [2]. Valuation - The valuation is based on a DCF method, with target prices reflecting an average of intrinsic value and book value methods [12].

保险板块10月31日跌2.14%,中国太保领跌,主力资金净流出4.98亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-31 08:42

Core Points - The insurance sector experienced a decline of 2.14% on October 31, with China Pacific Insurance leading the drop [1] - The Shanghai Composite Index closed at 3954.79, down 0.81%, while the Shenzhen Component Index closed at 13378.21, down 1.14% [1] Insurance Sector Performance - China Life Insurance (601628) closed at 43.97, down 0.92%, with a trading volume of 218,700 shares and a transaction value of 970 million [1] - Ping An Insurance (601318) closed at 57.83, down 1.40%, with a trading volume of 572,500 shares and a transaction value of 3.33 billion [1] - China Property & Casualty Insurance (616109) closed at 8.44, down 2.99%, with a trading volume of 1,056,100 shares and a transaction value of 902 million [1] - New China Life Insurance (601336) closed at 67.81, down 4.36%, with a trading volume of 323,900 shares and a transaction value of 2.23 billion [1] - China Pacific Insurance (601601) closed at 35.50, down 5.96%, with a trading volume of 861,600 shares and a transaction value of 3.10 billion [1] Fund Flow Analysis - The insurance sector saw a net outflow of 498 million from main funds, while retail funds experienced a net inflow of 231 million [1] - Speculative funds had a net inflow of 267 million [1]

瑞银:中国人寿(02628)新业务价值增长胜预期 评级“买入”

Zhi Tong Cai Jing· 2025-10-31 08:05

智通财经APP获悉,瑞银发布研报称,中国人寿(02628)首九个月新业务价值同比升42%,似乎好过市场 预期;除税后净利润增61%至1,680亿元人民币,处于早前盈利预告的中位。该行表示,随着今年新业务 价值增长强劲,国寿对明年的前景持更建设性态度。该行予公司"买入"评级,目标价29港元。 该信息 由智通财经网提供 ...

行业点评:NBV增速走阔,投资助国寿25Q3利润高增

Ping An Securities· 2025-10-31 06:49

Investment Rating - The industry investment rating is "stronger than the market" [3] Core Viewpoints - The report highlights that China Life achieved a premium income of 669.645 billion yuan in the first three quarters of 2025, representing a year-on-year increase of 10.1%, and a net profit attributable to shareholders of 167.804 billion yuan, up 60.5% year-on-year [1] - The new business value (NBV) for the first three quarters of 2025 increased by 41.8% year-on-year, driven primarily by the development of floating income products [2] - The report indicates a significant improvement in the company's investment income, with total investment income reaching 368.551 billion yuan, a year-on-year increase of 41.0% [2] Summary by Sections Life Insurance - The new single premium for life insurance in Q1-Q3 2025 was 218.034 billion yuan, up 10.4% year-on-year, with a significant increase in the proportion of floating income products [2] - The company adjusted the maximum guaranteed interest rate for newly filed insurance products starting September 1, which is expected to release customer demand [2] - The sales force remained stable at 607,000 agents, with improvements in quality and retention rates [2] Investment - The report notes a favorable trend in the capital market, with the company increasing its equity investment efforts, leading to a substantial rise in investment returns [2] - The total investment return rate was 6.42%, an increase of 1.04 percentage points year-on-year, attributed to strategic asset allocation [2] Investment Recommendations - The report suggests that in a low-interest-rate environment, the attractiveness of competing products is declining, while demand for savings remains strong, making floating income products competitive [2] - It is recommended to focus on companies with greater asset-side elasticity, such as China Life and Xinhua Insurance, if the equity market continues to perform well [2]