HUATIE(603300)

Search documents

多元金融板块10月31日涨0.21%,*ST熊猫领涨,主力资金净流出2.96亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-31 08:42

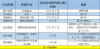

Core Insights - The diversified financial sector experienced a slight increase of 0.21% on October 31, with *ST Xiongmao leading the gains [1] - The Shanghai Composite Index closed at 3954.79, down 0.81%, while the Shenzhen Component Index closed at 13378.21, down 1.14% [1] Stock Performance Summary - The top gainers in the diversified financial sector included: - *ST Nengmao: Closed at 9.46, up 4.99% with a trading volume of 73,500 shares and a turnover of 68.298 million yuan [1] - Hainan Huatie: Closed at 7.83, up 3.57% with a trading volume of 2.1866 million shares and a turnover of 1.712 billion yuan [1] - Jiangsu Jinzu: Closed at 6.10, up 2.52% with a trading volume of 503,000 shares and a turnover of 303 million yuan [1] - The top decliners included: - Bohai Leasing: Closed at 3.57, down 2.72% with a trading volume of 971,400 shares and a turnover of 349 million yuan [2] - Yuexiu Capital: Closed at 8.09, down 1.46% with a trading volume of 544,800 shares and a turnover of 442 million yuan [2] - State Grid Yingda: Closed at 6.45, down 0.77% with a trading volume of 1.3344 million shares and a turnover of 872 million yuan [2] Capital Flow Analysis - The diversified financial sector saw a net outflow of 296 million yuan from institutional investors, while retail investors experienced a net inflow of 355 million yuan [2] - Notable capital flows for specific stocks included: - Hainan Huatie: Institutional net inflow of 89.2452 million yuan, retail net outflow of 80.1449 million yuan [3] - Haide Co.: Institutional net inflow of 39.5294 million yuan, retail net outflow of 50.1897 million yuan [3] - Sichuan Shuangma: Institutional net inflow of 18.0664 million yuan, retail net outflow of 3.8132 million yuan [3]

海南华铁三季度业绩亮眼,仍难掩立案阴影,维权不容错过!

Xin Lang Cai Jing· 2025-10-31 07:49

Group 1 - The company reported a total revenue of 4.447 billion yuan, a year-on-year increase of 19.38%, and a net profit of 530 million yuan, up 8.83% year-on-year for the first three quarters of 2025 [1] - The company received a notice from the China Securities Regulatory Commission (CSRC) regarding an investigation into alleged violations of information disclosure, which has caused stock price fluctuations [1][3] - The investigation is likely linked to the termination of a 36.9 billion yuan service agreement with "Hangzhou X Company," which was announced on September 30, 2025 [1][2] Group 2 - The terminated contract was for a five-year service agreement for computing power, which had not generated any purchase orders since its signing [2] - The termination of this significant contract may serve as a basis for the CSRC's investigation and for shareholder claims [3] - Investors are now concerned about potential losses and are seeking legal avenues to protect their rights following the company's performance announcement [3]

A股算力租赁跨界:有梦想照进现实也有一戳就破的泡沫|焦点

Tai Mei Ti A P P· 2025-10-31 04:44

Core Insights - The recent failure of Qunxing Toys in the computing power rental sector marks another setback for traditional companies attempting to diversify into this field, highlighting the challenges faced by many A-share companies in pursuing new growth avenues amidst stagnating core businesses [1][2]. Industry Overview - The surge in generative AI since 2024 has led to an exponential increase in demand for computing power, creating a rapidly growing market that many A-share companies are eager to enter as they seek new growth opportunities [2][10]. - A diverse range of companies, from toy manufacturers to construction firms, have announced their entry into the computing power rental business, driven primarily by the need to overcome growth bottlenecks in their core operations [2][3]. Company Examples - Qunxing Toys reported a nearly 500% year-on-year revenue increase in 2024 but still faced significant losses, prompting its entry into the computing power sector through a planned acquisition of a computing service provider [2]. - Hainan Huatie, previously focused on construction equipment rental, announced a significant investment of 10 billion in computing power and secured a contract worth nearly 3.7 billion, indicating a strong push for transformation [3]. - Lianhua Holdings, despite facing losses in its computing power business, managed to achieve a breakeven point in the first half of 2025, although it still contends with rising interest expenses [7]. Market Reactions - The capital market has responded positively to announcements related to computing power, with stock prices of companies involved in this sector experiencing significant increases following such news [4][6]. - However, as the initial excitement wanes, a clear differentiation is emerging among companies based on their actual performance and the sustainability of their computing power ventures [6][11]. Future Outlook - The computing power rental market is projected to grow at a compound annual growth rate of 53% over the next three years, with the market size expected to reach 1,346 EFlops by 2027, supported by national strategic initiatives [10][12]. - Despite the promising outlook, the industry presents high barriers to entry, including the need for stable supply chains, strong operational capabilities, and effective financial management [11][12].

海南华铁的前世今生:张祺奥掌舵下租赁业务亮眼,2025年Q3营收44.47亿,高分红预期下的算力拓展之路

Xin Lang Cai Jing· 2025-10-30 13:00

Core Viewpoint - Hainan Huatie is a significant player in the domestic leasing industry, primarily engaged in equipment leasing, with a focus on aerial work platforms and other related services [1] Group 1: Business Performance - In Q3 2025, Hainan Huatie achieved a revenue of 4.447 billion yuan, ranking third in the industry, behind Bohai Leasing and Jiangsu Jinzhong [2] - The main business revenue from operating leasing and services was 2.775 billion yuan, accounting for 98.93% of total revenue [2] - The net profit for the same period was 526 million yuan, ranking second in the industry, with Jiangsu Jinzhong leading at 2.447 billion yuan [2] Group 2: Financial Ratios - As of Q3 2025, Hainan Huatie's debt-to-asset ratio was 74.68%, lower than the industry average of 80.96% [3] - The gross profit margin for the same period was 39.63%, which is below the industry average of 46.81% [3] Group 3: Management and Shareholder Information - The chairman, Zhang Qiao, has extensive experience in securities investment banking, while the general manager, Hu Danfeng, saw a salary increase to 960,400 yuan in 2024, up from 663,400 yuan in 2023 [4] - As of September 30, 2025, the number of A-share shareholders decreased by 4.50% to 214,800, while the average number of shares held per shareholder increased by 5.03% [5] Group 4: Market Outlook and Strategic Initiatives - Hainan Huatie is focusing on expanding its traditional leasing business and preparing for overseas markets, with an increase in online orders and revenue [6] - The company has signed contracts for heavy-duty drones worth over 15 million yuan and established a motorhome rental division [6] - Hainan Huatie is actively pursuing opportunities in the Web3 sector and plans to list in Singapore, with a gradual improvement expected in its main business [6]

浙江海控南科华铁数智科技股份有限公司 2025年第三季度报告

Xin Lang Cai Jing· 2025-10-30 00:13

Core Viewpoint - The company emphasizes the accuracy and completeness of its quarterly report, ensuring no false statements or significant omissions exist, and holds its board and management accountable for the report's content [2][3]. Financial Data Summary - The financial statements for the third quarter are not audited, indicating that the figures presented are preliminary and subject to change [3]. - The report includes major accounting data and financial indicators, although specific figures are not detailed in the provided text [3]. - Non-recurring gains and losses are applicable, but the report does not specify the amounts or details of these items [3]. Shareholder Information - There is no change in the number of shareholders or significant changes in the top ten shareholders' holdings compared to the previous period [4]. - The report does not indicate any participation in securities lending by major shareholders [4]. Other Important Information - The company has not provided additional reminders regarding its operational performance during the reporting period [5]. - The financial statements, including the consolidated balance sheet and cash flow statement, are prepared by the company and are not audited [5].

海南华铁:拟以自有资金向华铁大黄蜂增资人民币10亿元

Sou Hu Cai Jing· 2025-10-29 16:15

Core Viewpoint - Hainan Huatie plans to increase its wholly-owned subsidiary, Huatie Dahuangfeng's registered capital by 1 billion RMB to enhance its financial structure and competitiveness in the market [1] Group 1: Company Financials - Hainan Huatie's subsidiary, Huatie Dahuangfeng, currently has a registered capital of 800 million RMB [1] - The company aims to reduce the asset-liability ratio and improve financing capabilities through this capital increase [1] - After the capital increase, Huatie Dahuangfeng's registered capital will rise to 1.8 billion RMB [1] Group 2: Revenue Composition - For the year 2024, Hainan Huatie's revenue composition is projected as follows: operating leasing will account for 96.92%, other businesses will contribute 1.71%, and processing and sales will make up 1.37% [1] Group 3: Market Valuation - As of the report date, Hainan Huatie's market capitalization stands at 14.8 billion RMB [1]

海南华铁(603300.SH):第三季度净利润1.89亿元,同比增长24.21%

Ge Long Hui A P P· 2025-10-29 15:21

Core Viewpoint - Hainan Huatie reported a significant increase in revenue and net profit for Q3 2025, indicating strong financial performance and growth potential in the coming periods [1] Financial Performance - For Q3 2025, the company achieved a revenue of 1.642 billion yuan, representing a year-on-year growth of 20.21% [1] - The net profit attributable to shareholders for Q3 2025 was 189 million yuan, showing a year-on-year increase of 24.21% [1] - Basic earnings per share for Q3 2025 stood at 0.1 yuan [1] Year-to-Date Performance - In the first three quarters of 2025, the company reported a total revenue of 4.447 billion yuan, which is a year-on-year growth of 19.38% [1] - The net profit attributable to shareholders for the first three quarters was 530 million yuan, reflecting a year-on-year increase of 8.83% [1] - Basic earnings per share for the first three quarters was 0.27 yuan [1]

海南华铁第三季度净利增24.21% 拟10亿元增资子公司

Zheng Quan Shi Bao Wang· 2025-10-29 13:57

Core Insights - Hainan Huatie reported a revenue of 4.447 billion yuan for the first three quarters of 2025, representing a year-on-year growth of 19.38% [1] - The net profit attributable to shareholders for the same period was 530 million yuan, an increase of 8.83% year-on-year [1] - In Q3 2025, the company achieved a revenue of 1.642 billion yuan, with a year-on-year growth of 20.21%, and a net profit of 189 million yuan, up 24.21% year-on-year [1] Financial Performance - The company's net profit after deducting non-recurring gains and losses for Q3 was 174 million yuan, reflecting a year-on-year increase of 31.89%, driven by the expansion of the aerial work platform and intelligent computing segments [1] - The intelligent computing segment generated a revenue of 212 million yuan in the first three quarters, with a net profit exceeding 50 million yuan [1] - The net cash flow from operating activities for the first three quarters was 2.362 billion yuan, a year-on-year increase of 38.1%, primarily due to increased revenue and improved cash collection from the aerial work platform rental business [2] Business Expansion - Hainan Huatie has signed contracts for computing services amounting to 2.475 billion yuan by the end of 2024, with asset delivery nearing 700 million yuan [2] - By the end of March 2025, the total signed computing service contracts reached 6.67 billion yuan, with asset delivery exceeding 900 million yuan [2] - As of September 30, 2025, the cumulative delivery of computing assets was 1.512 billion yuan [2] Capital Investment - The company plans to increase its investment in its wholly-owned subsidiary, Huatie Dahuangfeng, by 1 billion yuan to improve its financial structure and reduce the debt ratio [2] - This capital increase will enhance the subsidiary's financing capabilities and support equipment procurement and business expansion, thereby improving market competitiveness [2] - Following the capital increase, the registered capital of Huatie Dahuangfeng will rise from 800 million yuan to 1.8 billion yuan [2]

海南华铁前三季度营收、净利双增长 累计交付算力资产达15.12亿元

Zheng Quan Ri Bao Wang· 2025-10-29 13:44

Core Insights - Hainan Huatie reported a revenue of 4.447 billion yuan for the first three quarters of 2025, marking a year-on-year increase of 19.38% [1] - The net profit attributable to shareholders reached 530 million yuan, up 8.83% year-on-year [1] - In Q3 alone, the company achieved a revenue of 1.642 billion yuan, reflecting a growth of 20.21%, and a net profit of 189 million yuan, which is a 24.21% increase [1] Financial Performance - The net cash flow from operating activities was 2.362 billion yuan, showing a robust growth of 38.10% [1] - The adjusted net profit after excluding non-recurring items was 1.746 billion yuan, with a significant increase of 31.89% [1] Business Development - Hainan Huatie has accelerated its layout in the computing power business, establishing a smart technology division and forming service teams [1] - The smart computing segment generated a revenue of 212 million yuan and a net profit exceeding 50 million yuan, indicating rapid growth [1] - Cumulative delivery of computing power assets reached 1.512 billion yuan by the end of September [1] Market Position - Hainan Huatie has expanded its offline network to 380 locations and improved its ranking in global rental lists, now 27th in the IRN100 and 3rd in the Access50 [2] - The company is aligning its strategy with the digital economy development policies of Hainan Free Trade Port, which includes various supportive regulations [2] - Hainan Huatie is actively integrating data, models, and computing power to enhance its presence in the AI industry [2]

海南华铁前三季度营收增19.38% 智算板块净利润破5000万

智通财经网· 2025-10-29 10:50

Core Insights - Hainan Huatie's overall performance shows significant growth in synergy with its computing power business, indicating successful strategic transformation [1] Financial Performance - For the first three quarters of 2025, the company achieved operating revenue of 4.447 billion yuan, a year-on-year increase of 19.38% [1] - In Q3 alone, revenue reached 1.642 billion yuan, with a further year-on-year growth rate of 20.21%, indicating a trend of accelerating growth [1] - The net profit attributable to shareholders for the first three quarters was 530 million yuan, up 8.83% year-on-year, while Q3 net profit was 189 million yuan, reflecting a 24.21% increase [1] - The net cash flow from operating activities for the first three quarters was 2.362 billion yuan, a substantial year-on-year growth of 38.10% [1] Strategic Transformation - Hainan Huatie has established a dual-driven model of "traditional equipment leasing + intelligent computing services" [1] - Following the entry of Hainan State-owned Assets in 2024, the company is focusing on various engineering equipment operation services while accelerating its strategic transformation into the intelligent computing sector [1] - The intelligent computing segment reported impressive performance, with revenue of 212 million yuan and net profit exceeding 50 million yuan for the first three quarters [2] - As of the end of September, the company had delivered computing power assets totaling 1.512 billion yuan, showing continuous growth from the previously disclosed 1.4 billion yuan [2] Industry Position - Hainan Huatie ranked 27th in the global rental top 100 (IRN100) and 3rd in the global aerial work platform rental ranking (Access50) [2]