Cambricon(688256)

Search documents

数据看盘机构、外资联手抢筹特一药业 多路资金甩卖合锻智能

Sou Hu Cai Jing· 2025-10-22 10:48

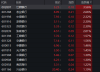

Group 1: Market Overview - The total trading volume of the Shanghai and Shenzhen Stock Connect today reached 213.79 billion, with Cambricon and Zhongji Xuchuang leading in trading volume for Shanghai and Shenzhen stocks respectively [1] - The Shanghai Stock Connect had a total trading amount of 105.13 billion, while the Shenzhen Stock Connect totaled 108.67 billion [2] Group 2: Top Stocks by Trading Volume - In the Shanghai Stock Connect, Cambricon (688256) topped the trading volume with 2.768 billion, followed by Industrial Fulian (601138) at 2.505 billion and Sanfang (601899) at 2.082 billion [3] - In the Shenzhen Stock Connect, Zhongji Xuchuang (300308) led with 3.374 billion, followed by CATL (300750) at 2.491 billion and Xinyi Technology (300502) at 2.278 billion [3] Group 3: Sector Performance - The oil and gas sector saw the highest net inflow of funds, amounting to 454 million, while the electronic sector experienced the largest net outflow of 8.775 billion [4][6] - Other sectors with notable net inflows included household appliances (301 million) and building materials (293 million) [5] Group 4: ETF Trading - The top ETF by trading volume was the Gold ETF (518880) with 12.694 billion, followed by the Hong Kong Securities ETF (513090) at 9.949 billion [9][10] - The French CAC40 ETF (513080) saw a remarkable increase in trading volume, growing by 486% compared to the previous trading day [11] Group 5: Futures Market - In the futures market, all major contracts (IH, IF, IC, IM) saw a reduction in both long and short positions, with the short positions decreasing more significantly [12] Group 6: Institutional Activity - Notable institutional buying included Rongxin Culture with 117 million and Te Yi Pharmaceutical with 39.09 million, while significant selling was observed in Blue Feng Biochemical with 73.54 million [13][14] - The overall activity from institutions was relatively low, with limited buying and selling across various stocks [13][16]

小作文突袭,寒武纪一度涨超7%,回应来了

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-22 10:18

记者丨叶映橙 见习记者林健民 编辑丨张楠 对此,21财经·南财快讯记者以投资者身份致电寒武纪,公司证券部工作人员表示,股价波动可能是受到了多种因素影响,小作文涉及公司的经营业绩的相 关情况请以公司公告为准。经营合作的情况,可以参考过去的定期报告里面的经营分析的章节。 2025年中报显示,在运营商领域,寒武纪公司聚焦核心应用,持续提供深度优化的算力解决方案,保持客户业务场景的领先性与稳定性。在金融领域,公司 不断加深与银行、保险公司及基金公司的业务探索。在支持传统人工智能应用的同时,公司通过先进的算力架构,为金融行业的大模型训练与推理提供支 撑,与头部客户共同推进大模型在典型业务中的适配优化与规模化落地,加速了大模型的行业应用。在互联网领域,公司产品持续在大模型、多模态等互联 网核心应用领域展开规模化应用,展现了公司产品在业界领先的产品力。 2025年中报内容均未提及数篇小作文相关客户信息。上述工作人员提醒广大投资者,注意甄别市场上的信息的来源。 公开资料显示,寒武纪成立于2016年,专注于人工智能芯片产品的研发与技术创新,致力于打造人工智能领域的核心处理器芯片。寒武纪产品广泛应用于服 务器厂商和产业公司,面向 ...

寒武纪10月22日现1笔大宗交易 总成交金额5125.4万元 溢价率为-23.39%

Xin Lang Cai Jing· 2025-10-22 10:13

炒股就看金麒麟分析师研报,权威,专业,及时,全面,助您挖掘潜力主题机会! 进一步统计,近3个月内该股累计发生16笔大宗交易,合计成交金额为2.35亿元。该股近5个交易日累计 上涨15.10%,主力资金合计净流入8.41亿元。 第1笔成交价格为1,095.17元,成交4.68万股,成交金额5,125.40万元,溢价率为-23.39%,买方营业部为 中信证券股份有限公司上海静安区南京西路证券营业部,卖方营业部为德邦证券股份有限公司上海仙霞 路证券营业部。 责任编辑:小浪快报 10月22日,寒武纪收涨4.42%,收盘价为1,429.50元,发生1笔大宗交易,合计成交量4.68万股,成交金 额5125.4万元。 ...

小作文突袭,寒武纪一度涨超7%,回应来了

21世纪经济报道· 2025-10-22 10:10

对此,21财经·南财快讯记者以投资者身份致电寒武纪,公司证券部工作人员表示, 股价波动可能是受到了多种因素影响,小作文涉及公司的 经营业绩的相关情况请以公司公告为准。经营合作的情况,可以参考过去的定期报告里面的经营分析的章节。 2025年中报显示,在运营商领域,寒武纪公司聚焦核心应用,持续提供深度优化的算力解决方案,保持客户业务场景的领先性与稳定性。在金 融领域,公司不断加深与银行、保险公司及基金公司的业务探索。在支持传统人工智能应用的同时,公司通过先进的算力架构,为金融行业的 大模型训练与推理提供支撑,与头部客户共同推进大模型在典型业务中的适配优化与规模化落地,加速了大模型的行业应用。在互联网领域, 公司产品持续在大模型、多模态等互联网核心应用领域展开规模化应用,展现了公司产品在业界领先的产品力。 记者丨叶映橙 见习记者林健民 编辑丨张楠 10月22日午后,寒武纪(688256.SH)一度飙涨超7%,股价再度超越贵州茅台(600519.SH),带动人工智能板块震荡走强,随后回落,收 1429.50元/股,涨超4%。 消息面上,多篇关于寒武纪的订单小作文在各大平台刷屏,引起市场广泛关注。 2025年中报内容均 ...

A股三大股指盘中弱势震荡整理,银行板块拉升,石油板块走高

Zheng Quan Shi Bao· 2025-10-22 09:55

Market Overview - The Shanghai Composite Index experienced weak fluctuations, closing down 0.07% at 3913.76 points, while the Shenzhen Component Index fell 0.62% to 12996.61 points, and the ChiNext Index dropped 0.79% to 3059.32 points [1] - The North Exchange 50 Index showed relative strength, rising 0.87% [1] - Total trading volume in the Shanghai, Shenzhen, and North exchanges was 169.05 billion yuan, a decrease of over 20 billion yuan compared to the previous day [1] Banking Sector - The banking sector saw significant gains, with Agricultural Bank of China rising over 2%, marking its 14th consecutive trading day of gains and reaching a historical high [2][3] - Other banks also performed well, with Jiangyin Bank up 3.56% and several major banks like Industrial and Commercial Bank of China and China Construction Bank rising over 1% [3][4] - Analysts from Everbright Securities noted that the banking sector currently offers good value for investment, with stable earnings expected in the upcoming quarterly reports [6] Oil Sector - The oil sector experienced a strong rally, with Keli Co. rising over 12% and several other companies like Junyou Co. and Beiken Energy hitting the daily limit [8][9] - The U.S. Department of Energy announced plans to purchase 1 million barrels of crude oil to replenish its strategic reserves, which may influence market dynamics [10] - International agencies like IEA, EIA, and OPEC have adjusted their forecasts for oil production, indicating a continued oversupply situation [10] AI Chip Sector - Cambrian (688256) saw a significant surge, with its stock price rising over 7% during the day and closing up 4.42%, leading the A-share market in trading volume at nearly 20 billion yuan [12][14] - The company reported a substantial year-on-year revenue increase of 2386% for the first three quarters, driven by the strong performance of its cloud products [14] - Analysts highlighted the growing demand for domestic AI chips amid U.S.-China tech tensions, positioning Cambrian favorably in the market [14]

科创板资金动向:9股主力资金净流入超亿元

Zheng Quan Shi Bao Wang· 2025-10-22 09:52

Market Overview - The net outflow of main funds in the Shanghai and Shenzhen markets reached 44.231 billion yuan, with the Sci-Tech Innovation Board experiencing a net outflow of 290 million yuan [1] - A total of 251 stocks saw net inflows, while 338 stocks experienced net outflows [1] Sci-Tech Innovation Board Performance - On the Sci-Tech Innovation Board, 156 stocks rose, with one stock, Silin Jie, hitting the daily limit, while 423 stocks declined [1] - The top three stocks with the highest net inflow of main funds were Haiguang Information (net inflow of 642 million yuan), Dingtong Technology (228.6018 million yuan), and Hanwujing-U (198.2726 million yuan) [2] Continuous Fund Flow Analysis - There are 58 stocks with continuous net inflows for more than three trading days, with Kangwei Century leading at 14 consecutive days of inflow [2] - Conversely, 143 stocks experienced continuous net outflows, with Hangke Technology leading at 15 consecutive days of outflow [2] Key Stocks with Significant Fund Flows - The top stocks by net inflow include: - Haiguang Information: 64.192 million yuan, 7.43% inflow rate, 2.06% increase [2] - Dingtong Technology: 22.860 million yuan, 16.22% inflow rate, 1.24% increase [2] - Hanwujing-U: 19.827 million yuan, 1.00% inflow rate, 4.42% increase [2] - The stocks with the highest net outflows include: - Huahong Company: 31.8 million yuan outflow, 1.59% decrease [1] - Yuanjie Technology: 30.3 million yuan outflow [1] - Kingsoft Office: 15.9 million yuan outflow [1]

科创板百元股达71只,寒武纪-U股价最高

Zheng Quan Shi Bao Wang· 2025-10-22 09:43

Core Insights - The average stock price on the STAR Market is 40.50 yuan, with 71 stocks priced over 100 yuan, and the highest priced stock is Cambrian-U at 1429.50 yuan, which increased by 4.42% today [2][3] Stock Performance - A total of 156 stocks on the STAR Market rose today, while 423 stocks fell. Among the stocks priced over 100 yuan, the average decline was 0.14%, with 22 stocks increasing and 49 stocks decreasing [2][3] - The highest closing price was Cambrian-U at 1429.50 yuan, followed by SourceJet Technology at 481.50 yuan and GuoDun Quantum at 380.00 yuan [2][3] Premium Analysis - The average premium of stocks priced over 100 yuan relative to their issue price is 476.88%, with the highest premiums seen in SourceJet Technology (4271.18%), Cambrian-U (2120.07%), and Anji Technology (1545.58%) [2][3] Industry Distribution - The stocks priced over 100 yuan are concentrated in the electronics, pharmaceutical, and computer industries, with 35, 11, and 9 stocks respectively [2][3] Capital Flow - There was a net inflow of 264 million yuan into stocks priced over 100 yuan today, with the highest net inflows in Haiguang Information (641.92 million yuan), Cambrian-U (198.27 million yuan), and Canxin Technology (194.87 million yuan) [3] - The total margin financing balance for stocks priced over 100 yuan is 91.22 billion yuan, with Cambrian-U, SMIC, and Haiguang Information having the highest balances [3]

小作文突袭,股价一度涨超7%,寒武纪回应

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-22 09:41

10月22日午后,寒武纪(688256.SH)一度飙涨超7%,股价再度超越贵州茅台(600519.SH),带动人工智能板块震荡走强,随后回落,收1429.50元/股,涨 超4%。 消息面上,多篇关于寒武纪的订单小作文在各大平台刷屏,引起市场广泛关注。 (声明:文章内容仅供参考,不构成投资建议。投资者据此操作,风险自担。) 对此,21财经·南财快讯记者以投资者身份致电寒武纪,公司证券部工作人员表示,股价波动可能是受到了多种因素影响,小作文涉及公司的经营业绩的相 关情况请以公司公告为准。经营合作的情况,可以参考过去的定期报告里面的经营分析的章节。 公开资料显示,寒武纪成立于2016年,专注于人工智能芯片产品的研发与技术创新,致力于打造人工智能领域的核心处理器芯片。寒武纪产品广泛应用于服 务器厂商和产业公司,面向互联网、金融、交通、能源、电力和制造等领域的复杂AI应用场景提供充裕算力,推动人工智能赋能产业升级。 2025年中报显示,在运营商领域,寒武纪公司聚焦核心应用,持续提供深度优化的算力解决方案,保持客户业务场景的领先性与稳定性。在金融领域,公司 不断加深与银行、保险公司及基金公司的业务探索。在支持传统人工智能 ...

再度爆发!601288 14连阳!688256 突然拉升

Zheng Quan Shi Bao· 2025-10-22 09:36

Market Overview - The Shanghai Composite Index experienced weak fluctuations but managed to hold above 3900 points, closing at 3913.76, down 0.07% [2] - The Shenzhen Component Index fell by 0.62% to 12996.61, while the ChiNext Index decreased by 0.79% to 3059.32 [2] - The Northbound 50 Index rose by 0.87%, with total trading volume in the Shanghai and Shenzhen markets reaching 16905 billion, a decrease of over 2000 billion from the previous day [2] Sector Performance - The coal, non-ferrous metals, brokerage, and semiconductor sectors saw declines, while the oil sector showed strong gains [2] - Notable performers in the oil sector included Keli Co., which rose over 10%, and several others that hit the daily limit [10] - The banking sector also rebounded, with Agricultural Bank of China rising over 2%, marking its 14th consecutive trading day of gains [6][4] Noteworthy Stocks - Cambrian (688256) surged over 7% during the afternoon session, closing up 4.42% with a trading volume of nearly 200 billion, making it the top stock by trading volume in A-shares [14] - The stock price of Cambrian reached a peak of 1468 yuan, surpassing that of Kweichow Moutai during trading [14] - The newly listed Marco Polo on the Shenzhen main board saw a significant increase of 128.8%, closing at 31.46 yuan per share [2] Banking Sector Insights - Analysts from Guangda Securities noted that the banking sector currently offers good value after market adjustments, with stable earnings expected in the upcoming quarterly reports [8] - The sector is characterized by high dividends and low valuations, with a notable preference for Hong Kong-listed banks [8] - Citic Securities indicated that the banking sector is likely to see continued demand for stocks due to their defensive attributes amid rising risk aversion [8] Oil Sector Developments - The oil sector's rise is attributed to the U.S. Department of Energy's plan to purchase 1 million barrels of crude oil to replenish strategic reserves [12] - International agencies have adjusted their forecasts for oil production, indicating a potential oversupply situation in the near term [12] - Despite short-term price fluctuations, the long-term outlook for oil supply and demand remains optimistic, particularly for major oil companies and service providers [12] Cambrian's Financial Performance - Cambrian reported a significant revenue increase of 2386% year-on-year for the first three quarters, totaling 4.607 billion yuan [16] - The net profit attributable to shareholders reached 1.605 billion yuan, driven by the strong performance of its cloud products [16] - The company is positioned to benefit from the growing demand for domestic AI chip solutions amid increasing capital expenditures from major cloud providers [17]

再度爆发!601288,14连阳!688256,突然拉升

Zheng Quan Shi Bao· 2025-10-22 09:19

Market Overview - The Shanghai Composite Index experienced weak fluctuations but managed to hold above 3900 points, closing at 3913.76, down 0.07% [1] - The Shenzhen Component Index fell 0.62% to 12996.61, while the ChiNext Index decreased by 0.79% to 3059.32 [1] - The Northbound 50 Index rose by 0.87%, with total trading volume across the three markets reaching 169.05 billion yuan, a decrease of over 20 billion yuan from the previous day [1] Banking Sector Performance - The banking sector showed strength, with Agricultural Bank of China rising over 2%, marking its 14th consecutive trading day of gains [2][4] - Other banks such as Jiangyin Bank and Industrial and Commercial Bank of China also saw increases, with Jiangyin Bank up 3.56% [2][3] Oil Sector Activity - The oil sector saw significant gains, with Keli Co. rising over 12% and several other companies hitting the daily limit [7][8] - The U.S. Department of Energy announced plans to purchase 1 million barrels of crude oil to replenish strategic reserves, which may influence market dynamics [9] Company-Specific Highlights - Cambricon Technologies (688256) experienced a notable surge, with its stock price rising over 7% during the day, closing up 4.42% with a trading volume of 19.8 billion yuan [10] - The company reported a substantial increase in revenue for the first three quarters, achieving 4.607 billion yuan, a year-on-year growth of 2386% [11] - The growth was attributed to the strong performance of its cloud products, particularly the Siyuan 590, amid increasing domestic demand for AI-related technologies [11]