Cambricon(688256)

Search documents

A股三大指数均收跌 沪指坚守3900点

Mei Ri Shang Bao· 2025-10-22 22:18

Market Overview - The three major stock indices experienced weak fluctuations, with the Shanghai Composite Index slightly down by 0.07% to 3913.76 points, the Shenzhen Component down by 0.62% to 12996.61 points, and the ChiNext Index down by 0.79% to 3059.32 points, while the Northbound 50 Index rose by 0.87% [1] - The total trading volume in the Shanghai and Shenzhen markets was 1690.5 billion yuan, a decrease of over 200 billion yuan compared to the previous day [1] Energy Sector - The energy-related sectors showed significant activity, with the deep-sea economy and gas extraction sectors leading the gains, as multiple stocks hit the daily limit [2] - China's domestic crude oil production increased to 58.61 million tons, with offshore production contributing over 16 million tons, accounting for more than 70% of the total increase in national crude oil output [2] - The U.S. Department of Energy announced plans to purchase 1 million barrels of crude oil to replenish its strategic reserves, which may influence market dynamics [3] - International agencies IEA, EIA, and OPEC have adjusted their forecasts for oil production, indicating a continued oversupply situation in the short term, while maintaining a stable supply-demand outlook in the long term [3] AI Chip Sector - The stock of Cambricon Technologies surged over 7%, with its market capitalization returning to above 60 billion yuan, driven by strong performance in the AI computing chip sector [4] - Cambricon reported a significant revenue increase of 2386% year-on-year, reaching 4.607 billion yuan, with a net profit of 1.605 billion yuan [4] - The company completed a private placement of 3.3349 million shares at a price of 1195.02 yuan per share, marking a record high for single financing in the domestic AI chip sector [4][5] Real Estate Sector - The real estate sector showed unexpected activity, with several stocks hitting the daily limit, driven by new government policies aimed at promoting high-quality development in the construction industry [6] - The Shanghai government issued an action plan with 21 specific measures to stabilize real estate investment and promote urban renewal [6] - Analysts expect that ongoing policy support will help stabilize the market and restore confidence among homebuyers [6]

基金10月参与定增热情升温大手笔密集布局科技龙头

Zheng Quan Shi Bao· 2025-10-22 17:25

Core Viewpoint - The private placement market is experiencing a recovery, with public funds increasingly participating in high-quality growth companies, particularly in sectors like pharmaceuticals, technology, and advanced manufacturing [1][4]. Group 1: Market Trends - Since October, public funds have actively engaged in private placements, favoring technology stocks such as Cambricon and Shenghong Technology [2]. - The private placement market is transitioning from recovery to warming, with an increase in both the number of projects and the amount raised since the third quarter [6]. - Public funds are focusing on high-quality assets, with notable participation from well-known fund managers in various private placement projects [4][6]. Group 2: Specific Company Activities - Cambricon announced a private placement on October 21, with a subscription price of 1195.02 yuan per share, raising approximately 3.985 billion yuan [2]. - Shenghong Technology's private placement on October 17 had a subscription price of 248.02 yuan per share, raising around 1.9 billion yuan [3]. - Both companies have seen significant stock price increases, with Cambricon's market value reaching 602.8 billion yuan and Shenghong Technology's at 242.5 billion yuan [2][3]. Group 3: Fund Performance - The median return for private placement theme funds was 15.76% for the third quarter and 17.93% for the year as of the end of September [6]. - Notable gains have been observed in projects involving well-known fund managers, with some experiencing floating profits of nearly 30% [6].

公募机构年内豪掷超300亿元掘金定增市场

Zheng Quan Ri Bao· 2025-10-22 16:41

Core Insights - Public institutions have shown increasing enthusiasm for participating in the private placement of listed companies, with a total subscription amount of 30.29 billion yuan in 2023, representing a 28.50% increase compared to 23.57 billion yuan in the same period last year [1][2] Group 1: Participation and Performance - A total of 37 public institutions participated in 74 private placement projects across 18 industries, with notable interest in the electronics and pharmaceutical sectors [1][2] - The floating profit amount from public institutions' participation in private placements has reached 10.84 billion yuan, indicating significant profit potential [1] - 59 companies had private placement projects that attracted over 100 million yuan from public institutions, with six companies receiving over 1 billion yuan [1] Group 2: Industry Preferences - The electronics and pharmaceutical industries are particularly favored by public institutions, with total subscriptions of 8.99 billion yuan and 4.52 billion yuan respectively [2] - Specific companies like Cambrian and Semiconductor Manufacturing International Corporation have attracted substantial investments, with Cambrian receiving 2.53 billion yuan from eight public institutions [1][2] Group 3: Institutional Insights - Among the 37 participating public institutions, 27 had total subscriptions exceeding 100 million yuan, with five institutions surpassing 1 billion yuan [2] - Nord Fund led with a subscription total of 8.90 billion yuan, participating in 70 companies' private placements [2] - The active participation of public institutions reflects their ability to capture market opportunities and indicates an optimized ecosystem in the private placement market [3]

A股市场交投趋冷,后市投资主线在哪?

Guo Ji Jin Rong Bao· 2025-10-22 15:12

Market Overview - The A-share market experienced fluctuations on October 22, with the Shanghai Composite Index slightly down by 0.07%, the Shenzhen Component down by 0.62%, and the ChiNext Index down by 0.79% [1][3] - The total market turnover was 1.69 trillion yuan, a decrease of 200 billion yuan compared to the previous trading day [2][3] - Market sentiment is cautious, with trading volumes consistently below 2 trillion yuan since October 16 [3] Investment Sentiment - Current market conditions suggest that favorable factors slightly outweigh the suppressive ones, leading to a likely horizontal consolidation and slow upward trend [1][7] - Investors are advised to increase liquidity safety margins and wait for clearer directional signals before increasing positions [11] Sector Performance - There has been a recent shift from technology growth stocks to value dividend stocks, although the medium-term outlook remains positive for growth stocks [1][9] - The technology sector, particularly AI, new energy, and domestic substitution, continues to present structural opportunities despite recent adjustments [7][10] Individual Stock Highlights - Notable individual stock movements include Cambrian Technologies (688256) rising by 4.42% to 1429.50 yuan per share, approaching the price of Kweichow Moutai [5] - The trading volume for individual stocks was mixed, with 2,280 stocks rising and 2,965 stocks falling [5] Market Dynamics - The market is currently characterized by a rotation between sectors, with traditional cyclical stocks providing support amid the adjustment in technology stocks [9][10] - Analysts suggest that the recent adjustments are primarily due to profit-taking and the cautious approach of investors during the earnings reporting period [9] Future Outlook - The market is expected to maintain a high-level consolidation, with technology growth remaining the main investment theme [10] - Key macro variables to watch include the clarity of U.S.-China trade policies and the focus of China's 14th Five-Year Plan, which could provide sustained investment themes [11]

寒武纪-U发生大宗交易 成交折价率23.39%

Zheng Quan Shi Bao Wang· 2025-10-22 14:31

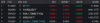

两融数据显示,该股最新融资余额为148.40亿元,近5日增加15.09亿元,增幅为11.32%。(数据宝) 10月22日寒武纪-U大宗交易一览 | 成交量 | 成交金额 | 成交价 | 相对当日收盘 | | | | --- | --- | --- | --- | --- | --- | | (万 | (万元) | 格 | 折溢价(%) | 买方营业部 | 卖方营业部 | | 股) | | (元) | | | | | 4.68 | 5125.40 | 1095.17 | -23.39 | 中信证券股份有限公司上海 | 德邦证券股份有限公司 | | | | | | 静安区南京西路证券营业部 | 上海仙霞路证券营业部 | (文章来源:证券时报网) 寒武纪-U10月22日大宗交易平台出现一笔成交,成交量4.68万股,成交金额5125.40万元,大宗交易成 交价为1095.17元,相对今日收盘价折价23.39%。该笔交易的买方营业部为中信证券股份有限公司上海 静安区南京西路证券营业部,卖方营业部为德邦证券股份有限公司上海仙霞路证券营业部。 进一步统计,近3个月内该股累计发生16笔大宗交易,合计成交金额为2.35亿元。 ...

我们的“十四五”:穿越风浪,中国干成了什么

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-22 13:17

Core Viewpoint - The 20th Central Committee of the Communist Party of China is reviewing the suggestions for the 15th Five-Year Plan, aiming to achieve significant breakthroughs in strategic tasks related to Chinese-style modernization over the next five years [1] Economic Growth and Achievements - During the 14th Five-Year Plan, China's GDP has consistently crossed significant thresholds, reaching approximately 140 trillion yuan in 2023, contributing around 30% to global economic growth [2][3] - China's GDP is projected to reach about 135 trillion yuan in 2024, maintaining a 17.1% share of the global economy, with an average annual growth rate of 5.5%, significantly higher than the global average of 3.9% [3] - The total retail sales of consumer goods in China are expected to reach 48.3 trillion yuan in 2024, with a forecast to exceed 50 trillion yuan in 2025, solidifying its position as the world's second-largest consumer market [6] Domestic Demand and Consumption - Domestic demand has become a major driver of economic growth, contributing an average of 86.8% to economic growth from 2021 to 2024, with final consumption expenditure contributing 59.9% [3][5] - The government has implemented strategies to boost consumption, including tax deductions for childcare and education, and plans to issue long-term special bonds to fund major projects [5] Innovation and Technology - China's R&D expenditure is projected to exceed 3.6 trillion yuan in 2024, marking a 48% increase since 2020, with enterprises accounting for over 77% of this investment [9] - The country aims to transition from a "catch-up" approach to a "leading" position in technology innovation by 2035, focusing on building a self-controlled system for research and industrialization [13] Social Welfare and Employment - The government has prioritized employment, maintaining over 12 million new urban jobs annually during the 14th Five-Year Plan, with an average urban unemployment rate of 5.3% [15] - By 2024, the per capita disposable income of residents is expected to reach 41,000 yuan, reflecting a growth rate of 5.5% after adjusting for inflation [15] Education and Healthcare - Education spending has consistently remained above 4% of GDP, with significant improvements in enrollment rates across various education levels [16] - By the end of 2024, the number of medical institutions in China is expected to reach 1.09 million, with over 95% of residents able to access medical services within 15 minutes [17]

A股集体下跌!场内近3000股飘绿

Qi Huo Ri Bao Wang· 2025-10-22 12:34

Group 1 - A-shares experienced a collective decline on October 22, with the Shanghai Composite Index slightly down by 0.07% to 3913.76 points, the Shenzhen Component down by 0.62% to 12996.61 points, and the ChiNext Index down by 0.79% to 3059.32 points [1] - The total trading volume in the Shanghai, Shenzhen, and Beijing markets was 1690.5 billion yuan, a decrease of over 200 billion yuan compared to the previous day [1] - Nearly 3000 stocks were in the red, with sectors such as coal, non-ferrous metals, brokerage, and semiconductors declining, while the oil sector saw strong gains, with companies like Keli Co., Ltd. rising over 10% [1] Group 2 - Goldman Sachs released a report suggesting that despite potential pullbacks in Chinese stocks, investors should shift their mindset from "selling on highs" to "buying on lows," predicting a 30% increase in the MSCI China Index by the end of 2027 [2] - Dongguan Securities noted that the index is at a high point, with increased capital divergence, warning of potential short-term fluctuations due to profit-taking, but also highlighted that economic recovery in Q4 is expected to be supported by policies [2] - The report emphasized that the expectation of interest rate cuts by the Federal Reserve could attract foreign capital inflows, enhancing the allocation value of A-shares and potentially driving domestic funds into the stock market [2]

寒武纪登顶A股吸金榜,总市值重返6000亿元!DeepSeek宣布开源最新大模型!科创人工智能ETF最高上探1.3%

Xin Lang Ji Jin· 2025-10-22 11:47

Core Insights - The computing chip stocks experienced a strong afternoon rally, with Cambricon leading the gains by over 4%, bringing its total market value back to 600 billion yuan [1] - The AI-focused ETF (589520) saw a significant inflow of 1.564 billion yuan, topping the A-share capital absorption list [1] - The AI industry is expected to see exponential growth driven by a "computing-power-model-application-data" flywheel effect, with a high ceiling for AI output [3] Group 1: Market Performance - Cambricon's stock surged over 4%, with a total market capitalization of 600 billion yuan [1] - The AI ETF (589520) reached a peak increase of 1.33% during the day, ultimately closing with a slight gain of 0.17% [1] - Cambricon attracted a net inflow of 1.564 billion yuan from major funds throughout the day [1] Group 2: Company Developments - Cambricon reported a significant increase in revenue, with a year-on-year growth exceeding 2300% in its latest quarterly report [5] - Chipmaker Chipone is expected to achieve a record high quarterly revenue of 1.284 billion yuan, reflecting a quarter-on-quarter increase of 119.74% and a year-on-year growth of 78.77% [5] Group 3: Policy and Industry Trends - The Ministry of Industry and Information Technology is soliciting opinions on the "Computing Power Standard System Construction Guide (2025 Edition)," aiming to revise over 50 standards by 2027 [3] - The AI sector is positioned as a key driver of the current market rally, with a focus on domestic AI industry chain development amid increasing emphasis on information and industrial security [4] Group 4: ETF Highlights - The AI ETF (589520) is characterized by three main highlights: policy support for AI, emphasis on domestic alternatives, and strong offensive potential due to its 20% price fluctuation limit [4] - The top ten holdings of the ETF account for over 70% of its weight, with semiconductors representing more than half of the portfolio [7]

强者恒强,银行ETF逆市10连阳,“AI双子星”盘中脉冲!BD“新王”诞生,港股通创新药ETF(520880)放量溢价

Xin Lang Ji Jin· 2025-10-22 11:43

Market Overview - The market experienced a day of low trading volume with all three major indices retreating, while the Shanghai Composite Index slightly fell by 0.07% but managed to hold above the 3900-point mark [1] - A-shares saw a trading volume of less than 1.7 trillion yuan, marking the lowest level since August 6 [1] - The banking sector showed resilience, with Agricultural Bank of China rising by 2.66%, achieving a 14-day consecutive increase and setting a new historical high [1][3] Banking Sector - The double-hundred billion bank ETF (512800) recorded a strong performance with a 10-day consecutive rise, closing up 0.85% with a trading volume of 1.189 billion yuan [5][7] - A total of 42 bank stocks in A-shares saw 39 gainers and 3 losers, indicating strong sector performance [3] - The banking sector's price-to-book ratio (PB) is at 0.71, which is in the lower range of the past decade, and the dividend yield stands at 4.04%, enhancing its attractiveness amid rising market uncertainties [6][7] AI Sector - The AI sector showed signs of activity with the "AI twins" - the ChiNext AI ETF (159363) and the Sci-Tech Innovation AI ETF (589520) both experiencing intraday gains exceeding 1% [1] - The total market capitalization of Cambricon Technologies has returned to 600 billion yuan, with its stock rising over 4% [9] - The Sci-Tech Innovation AI ETF (589520) saw a maximum intraday increase of 1.33%, reflecting strong interest in the domestic AI industry chain [11] Innovative Drug Sector - A significant milestone was reached with Innovent Biologics securing a record-breaking 11.4 billion USD business development deal, marking a new high for Chinese innovative drug BD transactions [3][19] - Despite the overall market retreat, the Hong Kong Stock Connect innovative drug ETF (520880) experienced strong buying interest, with a trading volume of 374 million yuan, indicating a potential "bottom-fishing" sentiment [17][19] - The innovative drug sector is expected to remain active, especially in the fourth quarter, which historically sees concentrated BD transactions [19]

寒武纪的加单传闻分析

傅里叶的猫· 2025-10-22 11:05

Core Viewpoint - The article emphasizes the potential growth and market position of domestic AI chip companies, particularly Cambrian, while cautioning against unverified claims circulating in the market [4][10]. Group 1: Cambrian's Business Developments - Cambrian has secured a contract for 10,000 cards per month from the three major telecom operators and received an additional order from ByteDance worth 500 billion, with a requirement to deliver 300,000 chips [1][3]. - The company has invested in Village Dragon, which has increased its production capacity to 8,000 wafers per month, potentially supporting a revenue of 600 billion, exceeding expectations [1][3]. Group 2: Market Dynamics and Demand for AI Chips - Cambrian's current revenue for the first three quarters is 4.6 billion, and with the new contracts, the expected revenue for next year could be ten times this amount, suggesting a potential stock price increase [3]. - The demand for domestic AI chips is expected to grow significantly, with one CSP projected to handle 400 to 500 trillion tokens next year, requiring approximately 330,000 to 350,000 inference cards [6][7]. Group 3: Competitive Landscape and Product Feedback - Cambrian's advantage lies in its established customer base, which includes major CSPs and other industry leaders, providing valuable feedback that enhances product development [5][6]. - The article notes that while domestic chips may not excel in large model training, they are sufficient for inference tasks, which are becoming increasingly important in the AI industry [7][9].