JWIPC TECHNOLOGY CO.(001339)

Search documents

智微智能(001339):AI 云、边、端全面布局,切入具身智能控制器领域

Guoxin Securities· 2025-10-31 13:44

Investment Rating - The investment rating for the company is "Outperform the Market" [6][4]. Core Views - The company has experienced pressure on net profit in Q3 2025, with its intelligent computing business facing demand-side disruptions. For the first three quarters of 2025, the company achieved revenue of 2.973 billion, a year-on-year increase of 6.89%, and a net profit attributable to the parent company of 131 million, a year-on-year increase of 59.30% [8][4]. - The company is strategically positioned in the AI cloud, edge, and endpoint sectors, focusing on embodied intelligent controllers. It has launched various products, including the AI Box and the intelligent controller, which are significant advancements in the robotics field [3][16]. Financial Performance Summary - In Q3 2025, the company reported revenue of 1.026 billion, a year-on-year decrease of 6.8% and a quarter-on-quarter decrease of 6.29%. The net profit attributable to the parent company was 29 million, a year-on-year increase of 13.67% but a quarter-on-quarter decrease of 50.94% [8][4]. - The gross margin for Q3 2025 was 18.4%, a year-on-year increase of 2.6 percentage points but a quarter-on-quarter decrease of 9.1 percentage points, primarily due to the slowdown in the high-margin intelligent computing business [2][12]. - The company has adjusted its profit forecasts downward due to the impact of demand-side disruptions, projecting revenues of 4.693 billion, 5.327 billion, and 5.960 billion for 2025, 2026, and 2027 respectively [4][17]. Business Strategy Summary - The company has made comprehensive layouts in AI cloud, edge, and endpoint sectors. It began its intelligent computing business in 2024, providing comprehensive services throughout the AI computing lifecycle, including computing power planning and hardware supply [3][16]. - The company has launched a new robot brain, the Zhiqing EII6300, in collaboration with Nvidia, which enhances multi-modal perception and high-precision motion control capabilities [3][16].

智微智能(001339):AI云、边、端全面布局,切入具身智能控制器领域

Guoxin Securities· 2025-10-31 13:15

Investment Rating - The investment rating for the company is "Outperform the Market" [6][4]. Core Insights - The company has experienced pressure on net profit in Q3 2025, with revenue of 1.026 billion yuan, a year-on-year decrease of 6.8% and a quarter-on-quarter decrease of 6.29%. The net profit attributable to the parent company was 29 million yuan, a year-on-year increase of 13.67% but a quarter-on-quarter decrease of 50.94% [8][4]. - The company is strategically positioned in the AI cloud, edge, and endpoint sectors, focusing on embodied intelligent controllers. It has launched various products, including the AI Box and the intelligent controller, which have shown significant progress in the robotics field [3][16]. Financial Performance Summary - For the first three quarters of 2025, the company achieved a revenue of 2.973 billion yuan, a year-on-year increase of 6.89%, and a net profit of 131 million yuan, a year-on-year increase of 59.30% [8][4]. - The gross margin for Q3 2025 was 18.4%, a year-on-year increase of 2.6 percentage points but a quarter-on-quarter decrease of 9.1 percentage points, primarily due to demand-side disruptions affecting the high-margin intelligent computing business [2][12]. - The company has adjusted its profit forecasts for 2025-2027, expecting revenues of 46.93 billion yuan, 53.27 billion yuan, and 59.60 billion yuan, respectively, with net profits of 2.21 billion yuan, 2.69 billion yuan, and 3.29 billion yuan [4][17]. Business Strategy Summary - The company has initiated a comprehensive layout in AI cloud, edge, and endpoint sectors, providing full lifecycle services for AI computing, including hardware supply and scheduling [3][16]. - The company has made significant advancements in the robotics sector, particularly with the launch of the intelligent controller, which integrates multi-modal perception and high-precision motion control capabilities [3][16].

智微智能入股宇叠智能 加码具身智能产业链布局

Zheng Quan Shi Bao Wang· 2025-10-31 12:13

Group 1 - The core viewpoint of the articles highlights the accelerated integration of artificial intelligence (AI) into various sectors of the economy and society, driven by national policies and strategic investments in AI technology [1][2] - Zhiwei Intelligent has made a strategic investment in Nanjing Yudie Intelligent Technology Co., Ltd. (UDEXREAL) to enhance its multi-dimensional layout in the embodied intelligence industry chain [1] - UDEXREAL, established in 2022, is the first company globally to commercialize flexible sensing technology for motion capture, with nearly 20 patents and successful applications in high-growth areas such as remote operation, virtual training, and the metaverse [1] Group 2 - Zhiwei Intelligent launched the Zhiqing series of embodied intelligence controllers in September, which utilize multiple chip platforms to provide robust control cores for various robotic applications [2] - The AI high-performance servers from Zhiwei Intelligent offer comprehensive solutions for training, simulation, and application deployment in robot development [2] - The strategic investment in UDEXREAL aims to combine technological strengths to create a solution that integrates robot training, simulation, core control, and tactile perception applications, thereby expanding the robotics industry chain [2]

A股算力租赁跨界:有梦想照进现实也有一戳就破的泡沫|焦点

Tai Mei Ti A P P· 2025-10-31 04:44

Core Insights - The recent failure of Qunxing Toys in the computing power rental sector marks another setback for traditional companies attempting to diversify into this field, highlighting the challenges faced by many A-share companies in pursuing new growth avenues amidst stagnating core businesses [1][2]. Industry Overview - The surge in generative AI since 2024 has led to an exponential increase in demand for computing power, creating a rapidly growing market that many A-share companies are eager to enter as they seek new growth opportunities [2][10]. - A diverse range of companies, from toy manufacturers to construction firms, have announced their entry into the computing power rental business, driven primarily by the need to overcome growth bottlenecks in their core operations [2][3]. Company Examples - Qunxing Toys reported a nearly 500% year-on-year revenue increase in 2024 but still faced significant losses, prompting its entry into the computing power sector through a planned acquisition of a computing service provider [2]. - Hainan Huatie, previously focused on construction equipment rental, announced a significant investment of 10 billion in computing power and secured a contract worth nearly 3.7 billion, indicating a strong push for transformation [3]. - Lianhua Holdings, despite facing losses in its computing power business, managed to achieve a breakeven point in the first half of 2025, although it still contends with rising interest expenses [7]. Market Reactions - The capital market has responded positively to announcements related to computing power, with stock prices of companies involved in this sector experiencing significant increases following such news [4][6]. - However, as the initial excitement wanes, a clear differentiation is emerging among companies based on their actual performance and the sustainability of their computing power ventures [6][11]. Future Outlook - The computing power rental market is projected to grow at a compound annual growth rate of 53% over the next three years, with the market size expected to reach 1,346 EFlops by 2027, supported by national strategic initiatives [10][12]. - Despite the promising outlook, the industry presents high barriers to entry, including the need for stable supply chains, strong operational capabilities, and effective financial management [11][12].

智微智能的前世今生:2025年三季度营收29.73亿元行业排第9,净利润2.42亿元行业排第10

Xin Lang Cai Jing· 2025-10-31 00:00

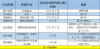

Core Viewpoint - Zhimi Intelligent, established in 2011 and listed in 2022, focuses on AI infrastructure, edge computing, and IoT, with applications in education, finance, and healthcare [1] Financial Performance - For Q3 2025, Zhimi Intelligent reported revenue of 2.973 billion yuan, ranking 9th in the industry, with a year-on-year growth of 6.89% [2][6][7] - The net profit for the same period was 242 million yuan, ranking 10th in the industry, with a year-on-year increase of 59.3% [2][6][7] - The main business segments include terminal products (1.043 billion yuan, 53.57%), ICT infrastructure (307 million yuan, 15.78%), intelligent computing (298 million yuan, 15.31%), and industrial IoT (145 million yuan, 7.46%) [2] Profitability and Debt - As of Q3 2025, the asset-liability ratio was 57.49%, higher than the industry average of 34.38% [3] - The gross profit margin was 22.32%, which is below the industry average of 34.46% but improved from 17.76% in the previous year [3] Shareholder Information - As of September 30, 2025, the number of A-share shareholders increased by 27.30% to 48,800, with an average holding of 2,442.64 shares [5] - Major shareholders include Hong Kong Central Clearing Limited and various mutual funds, with some changes in holdings compared to the previous period [5] Business Highlights - The subsidiary Tengyun Zhican achieved revenue of 298 million yuan in H1 2025, focusing on AIGC lifecycle services [6] - New product launches include the HAT computing rental cloud platform and the Edge AI Box product series [6][7] - Significant progress was made in humanoid robotics with key clients [6][7] Future Projections - Revenue projections for 2025 to 2027 are 4.735 billion, 5.565 billion, and 6.454 billion yuan, respectively, with net profits expected to be 254 million, 483 million, and 716 million yuan [6][7]

智微智能(001339):全面拥抱AI,具身智能获头部客户重大进展

Guotou Securities· 2025-10-30 03:34

Investment Rating - The investment rating for the company is "Buy-A" with a 6-month target price of 66.81 CNY, compared to the current stock price of 55.67 CNY as of October 29, 2025 [5]. Core Insights - The company has embraced AI comprehensively and made significant progress in embodied intelligence, securing major clients [1]. - For the first three quarters of 2025, the company achieved revenue of 2.973 billion CNY, a year-on-year increase of 6.89%, and a net profit attributable to shareholders of 131 million CNY, up 59.3% year-on-year [1]. - The third quarter of 2025 saw a revenue of 1.026 billion CNY, a decrease of 6.08% year-on-year, but the net profit attributable to shareholders increased by 13.67% to 29 million CNY [1][2]. Summary by Sections Financial Performance - In the first three quarters of 2025, the company reported a revenue of 2.973 billion CNY, with a net profit of 131 million CNY, and a non-recurring net profit of 108 million CNY, reflecting increases of 59.3% and 54.28% respectively year-on-year [1]. - For Q3 2025, the company recorded a revenue of 1.026 billion CNY, with a net profit of 29 million CNY, and a non-recurring net profit of 20 million CNY [1]. Business Segments - The company's subsidiary, Tengyun Zhican, has maintained high growth, achieving a revenue of 298 million CNY and a net profit of 162 million CNY in the first half of 2025, with significant demand and successful new client acquisitions [2]. - The company is focusing on AI hardware and software products for cloud and edge computing, providing comprehensive AI computing services [3]. Product Development - The company launched the generative AI BOX and embodied intelligence controllers, achieving significant client progress in humanoid robotics [4]. - The company has introduced a cloud platform for AI computing resource leasing, addressing key demands in fragmented scenarios [3]. Future Projections - The company is expected to benefit from the AI infrastructure wave, with projected revenues of 4.735 billion CNY, 5.565 billion CNY, and 6.454 billion CNY for 2025, 2026, and 2027 respectively, alongside net profits of 254 million CNY, 483 million CNY, and 716 million CNY [9].

格隆汇公告精选︱TCL科技:拟295亿元投资建设第8.6代印刷OLED生产线项目;剑桥科技:目前不生产含CPO技术的芯片

Ge Long Hui· 2025-10-29 17:10

Key Highlights - Cambridge Technology currently does not produce chips containing CPO technology [1] - TCL Technology plans to invest 29.5 billion yuan in the construction of an 8.6-generation printed OLED production line [1] - Huakang Clean has won the bid for a "medical service construction project" [1] - Aotewei intends to acquire an 8.99% stake in its subsidiary Songci Electromechanical [1] - Shanghai Yizhong plans to repurchase shares worth 30 million to 35 million yuan [1] - Huaton Co. reported a pig sales revenue of 338 million yuan in August [1] - Tianma Technology has accumulated approximately 11,921.59 tons of eel out of the pool from January to August [1] - Mars Man's controlling shareholder plans to reduce holdings by no more than 2.94% [1] - Zhiwei Intelligent's actual controller plans to reduce holdings by no more than 2.9749% [1] - Donglin Investment plans to reduce holdings in Jin'an Guoji by no more than 2.878% [1] - Zhonglun New Materials intends to issue convertible bonds not exceeding 1.068 billion yuan [1] - Tuojing Technology plans to raise no more than 4.6 billion yuan through a private placement [1] Investment Projects - TCL Technology (000100.SZ) plans to invest 29.5 billion yuan in the construction of an 8.6-generation printed OLED production line [1] - Guangdong Jianke (301632.SZ) intends to invest in the implementation of the second phase of the Guangdong Jianke·Zhongshan Smart Gathering Project [1] - Nanfeng Co. (300004.SZ) plans to invest 50 million yuan in fixed assets for a 3D printing service project [1] Contracts and Acquisitions - Huakang Clean (301235.SZ) has won the bid for a "medical service construction project" [1] - Aotewei (688516.SH) intends to acquire an 8.99% stake in its subsidiary Songci Electromechanical [1] - Tianhua New Energy (300390.SZ) plans to acquire a 75% stake in Suzhou Tianhua Times [1] Share Buybacks - Chuangyuan Co. (300703.SZ) plans to repurchase 1.55% to 2.05% of its shares [2] - Yishitong (688733.SH) intends to repurchase shares worth 30 million to 55 million yuan [2] - Shanghai Yizhong (688091.SH) plans to repurchase shares worth 30 million to 35 million yuan [2] Operational Data - Huaton Co. (002840.SZ) reported a pig sales revenue of 338 million yuan in August [2] - Tianma Technology (603668.SH) has accumulated approximately 11,921.59 tons of eel out of the pool from January to August [2] Shareholding Changes - Sudda Co. (001277.SZ) plans to reduce holdings by no more than 3% [2] - Mars Man (300894.SZ) plans to reduce holdings by no more than 2.94% [2] - Zhiwei Intelligent (001339.SZ) plans to reduce holdings by no more than 2.9749% [2] - Jin'an Guoji (002636.SZ) plans to reduce holdings by no more than 2.878% [2] Other Financial Activities - China Merchants Shekou (001979.SZ) plans to issue preferred shares to raise no more than 8.2 billion yuan for real estate project construction [2] - Zhonglun New Materials (301565.SZ) intends to issue convertible bonds not exceeding 1.068 billion yuan [2] - Keli'er (002892.SZ) plans to raise no more than 1.006 billion yuan through a private placement [2] - Tuojing Technology (688072.SH) plans to raise no more than 4.6 billion yuan through a private placement [2]

智微智能20251028

2025-10-28 15:31

Summary of the Conference Call for Zhiwei Intelligent (智维智能) Industry Overview - The company is affected by delays in high-performance server tenders, but traditional businesses like industry terminals and ICT infrastructure are expected to remain stable. Server business has growth potential driven by storage servers [2][4] - Domestic internet companies' capital expenditure has surpassed 100 billion, indicating strong global computing power market demand, with the domestic market likely to maintain or even revise upward capital expenditure [2][5] - Domestic chips are primarily used in the general innovation field, with NVIDIA's high-performance computing servers focused on training, while domestic chips emphasize inference [2][6] Company Performance - For the first three quarters, Zhiwei Intelligent reported revenue of less than 3 billion, with a net profit of 131 million, reflecting a revenue growth rate of 6.89% and a net profit growth rate close to 60% [4] - The third-quarter revenue was 1.03 billion, a year-on-year decline, mainly due to the focus on advantageous and high-growth potential businesses, optimizing less promising market segments [4] - The company’s net profit for the third quarter was less than 30 million, impacted by downstream clients delaying tenders due to high-performance server upgrades [4] Market Trends - The global computing power market can be observed through the CAPEX outlook of the four major CSPs in North America, with domestic internet companies benefiting from capital expenditure [5][6] - The computing power leasing market is difficult to assess due to frequent tenders from internet companies, but some competitors have announced procurement of high-performance servers, indicating a robust demand [6][8] Strategic Initiatives - The company is considering entering the domestic card OEM or server assembly business to address market opportunities arising from the US-China trade dispute and NVIDIA's limited graphics card supply [2][7] - Zhiwei Intelligent has made breakthroughs in humanoid robotics, collaborating with leading domestic clients, with products based on various platforms [2][9] Financial Insights - The impact of rising storage prices on the company's gross margin is limited, as high-performance servers primarily use HBM storage, which has seen price declines [3][16] - Storage costs constitute a small portion of total costs, with CPU or GPU being the largest cost items in traditional OEM businesses [18] Future Outlook - The company anticipates that the tendering process will resume in the fourth quarter, with strong procurement demand from internet companies expected to continue [14][15] - The company plans to disclose more data on the robot controller business by the end of the year, as investor interest in this area is high [12] Product Pricing - Different controller pricing reflects performance differences and application needs, with average prices ranging from 1,000-1,500 yuan for RK3,588 to around 35,000-40,000 yuan for SoC controllers [10] Operational Efficiency - The computing power charging business operates on a make-to-order basis, with a quick turnaround from winning bids to delivery, enhancing operational efficiency [25] Conclusion - Zhiwei Intelligent is navigating challenges in the high-performance server market while exploring new opportunities in domestic card OEM and humanoid robotics, with a focus on maintaining stable revenue streams and optimizing its product offerings in response to market demands.

计算机设备板块10月24日涨2.05%,航天智装领涨,主力资金净流入14.94亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-24 08:29

Market Overview - On October 24, the computer equipment sector rose by 2.05%, led by Aerospace Intelligence [1] - The Shanghai Composite Index closed at 3950.31, up 0.71%, while the Shenzhen Component Index closed at 13289.18, up 2.02% [1] Stock Performance - Aerospace Intelligence (300455) saw a closing price of 19.76 with a significant increase of 19.98% and a trading volume of 311,100 shares, amounting to a transaction value of 614 million [1] - Weihong Co., Ltd. (300508) closed at 31.98, up 12.61%, with a trading volume of 94,300 shares [1] - Dahua Intelligent (002512) closed at 4.46, up 10.12%, with a trading volume of 672,500 shares [1] - Other notable performers include Langke Technology (300042) with an 8.93% increase and a closing price of 33.18, and Jiayuan Technology (301117) with a 7.96% increase and a closing price of 43.25 [1] Capital Flow - The computer equipment sector experienced a net inflow of 1.494 billion in main funds, while retail funds saw a net outflow of 575 million [2] - The main funds' net inflow for Zhongke Shuguang (603019) was 914 million, accounting for 12.96% of the total, while retail funds had a net outflow of 578 million [3] - Dahua Intelligent (002512) had a main fund net inflow of 139 million, representing 46.50% of the total, with retail funds experiencing a net outflow of 64.93 million [3]

智微智能前三季度净利润同比增长59.3%,机器人业务实现突破

Ju Chao Zi Xun· 2025-10-22 11:00

Core Viewpoint - Shenzhen Zhimi Intelligent Technology Co., Ltd. reported a decline in revenue for Q3 2025, while net profit showed growth, indicating mixed financial performance amidst strategic advancements in AI technology [1][2]. Financial Performance - Q3 revenue was 1.026 billion yuan, a decrease of 6.08% year-on-year [2]. - Net profit attributable to shareholders was 29.24 million yuan, an increase of 13.67% year-on-year [1][2]. - For the first three quarters, total revenue reached 2.973 billion yuan, up 6.89% year-on-year, while net profit attributable to shareholders was 131 million yuan, reflecting a significant increase of 59.3% [1][2]. AI and Robotics Development - The company is actively embracing AI technology, focusing on cloud, edge, and endpoint solutions in its product planning [2]. - In the cloud AI sector, Zhimi Intelligent offers comprehensive AI computing power lifecycle services and has launched the HAT computing power leasing cloud platform to address core issues such as resource scarcity and low utilization [2]. - In the edge AI domain, the company has introduced a full-stack product series using chips like NVIDIA Jetson and Rockchip [2]. - The company achieved significant progress in humanoid robotics, marking a breakthrough from 0 to 1 with its robot control systems [3].