ELECSPN(002935)

Search documents

天奥电子(002935.SZ):公司存储芯片业务主要应用于国防军工等特定领域

Ge Long Hui· 2025-11-07 08:12

Group 1 - The core viewpoint of the article is that Tianao Electronics (002935.SZ) has reported positive momentum in its storage chip business, which is primarily applied in specific fields such as national defense and military [1] Group 2 - The storage chip business of the company is focused on specialized applications, indicating a niche market strategy [1] - The company is actively engaging with investors through interactive platforms to communicate its business developments [1]

天奥电子(002935.SZ):公司参加并顺利完成了“嫦娥”、“鹊桥”、“神舟”任务的时频同步保障

Ge Long Hui· 2025-10-31 08:02

Core Viewpoint - The company successfully participated in and completed time-frequency synchronization support for the "Chang'e," "Qiao Bridge," and "Shenzhou" missions [1] Group 1 - The company is involved in significant space missions, indicating its capabilities in high-tech synchronization technology [1] - The successful completion of these missions highlights the company's expertise and reliability in the aerospace sector [1]

天奥电子(002935.SZ):DDR系列存储器主要应用于国防军工等特定领域

Ge Long Hui· 2025-10-31 07:37

Core Viewpoint - Tianao Electronics (002935.SZ) indicates that its DDR series memory products are primarily used in specific fields such as national defense and military, with current prices remaining relatively stable [1] Company Summary - The DDR series memory products of Tianao Electronics are focused on applications in national defense and military sectors [1] - The pricing of these memory products is reported to be stable at present [1]

天奥电子(002935.SZ):公司相关产品已配套应用于卫星互联网领域

Ge Long Hui· 2025-10-31 07:37

Core Viewpoint - Tianao Electronics (002935.SZ) is actively involved in the satellite internet sector and is committed to enhancing its technology research and expanding market applications [1] Company Developments - The company has successfully integrated its products into the satellite internet field, indicating a strong alignment with industry demands [1] - Tianao Electronics plans to continue deepening its focus on industry needs and strengthening its technological research efforts [1]

天奥电子(002935.SZ):有开展原子磁强计为主的量子精密测量技术研究和产品开发

Ge Long Hui· 2025-10-31 07:29

Core Viewpoint - Tianao Electronics (002935.SZ) is engaged in research and product development of quantum precision measurement technology, primarily focusing on atomic magnetometers, with small-scale trials in the medical field [1] Group 1 - The company is developing quantum precision measurement technology [1] - The primary product under development is the atomic magnetometer [1] - There are small-scale trials of this product in the medical sector [1]

天奥电子的前世今生:2025年三季度营收行业34,净利润行业28,资产负债率高于行业均值11.92个百分点

Xin Lang Cai Jing· 2025-10-31 04:47

Core Viewpoint - Tianao Electronics is a leading manufacturer of time frequency and BeiDou satellite application products in China, with strong market competitiveness and advanced technology [1] Group 1: Business Performance - In Q3 2025, Tianao Electronics reported revenue of 536 million yuan, ranking 34th among 64 industry companies, with the industry leader AVIC Chengfei achieving 48.286 billion yuan [2] - The net profit for the same period was 15.2232 million yuan, ranking 28th in the industry, with the top performer AVIC Chengfei reporting a net profit of 2.175 billion yuan [2] Group 2: Financial Ratios - As of Q3 2025, the asset-liability ratio of Tianao Electronics was 44.76%, higher than the previous year's 42.15% and above the industry average of 32.84% [3] - The gross profit margin stood at 22.64%, which is below the industry average [3] Group 3: Corporate Governance - The chairman of Tianao Electronics, Zhao Xiaohu, has been in office since October 2021, while the general manager, Liu Jiang, has held the position since January 2020 [4] Group 4: Shareholder Information - As of September 30, 2025, the number of A-share shareholders decreased by 10.67% to 20,700, while the average number of circulating A-shares held per shareholder increased by 11.95% to 20,100 [5] - Hong Kong Central Clearing Limited is the seventh largest circulating shareholder, holding 2.9434 million shares as a new shareholder [5] Group 5: Future Outlook - In H1 2025, Tianao Electronics achieved revenue of 318 million yuan and a net profit of 8.3083 million yuan, with expectations for rapid growth in revenue and net profit due to the release of defense construction demand and new product launches [5] - The company has made progress in various new products and business areas, including time frequency devices and RF components, with forecasts for net profits of 100 million yuan, 138 million yuan, and 180 million yuan for 2025-2027 [5]

天奥电子:公司以时间频率为主责主业,是国内主要的原子钟批量生产企业

Zheng Quan Ri Bao Zhi Sheng· 2025-10-28 10:12

Core Viewpoint - Tian'ao Electronics is a leading domestic manufacturer of atomic clocks, focusing on time frequency as its main business, and is actively engaged in the research and development of cutting-edge technologies such as atomic magnetometers [1] Group 1 - The company is recognized as a major player in the mass production of atomic clocks in China [1] - The technical performance of the company's products has reached an internationally advanced level [1] - The company is also pursuing research in frontier technologies beyond atomic clocks [1]

商业航天活跃,产业拐点已至!卫星ETF(159206)连续四天资金净流入,成分股航天智装领涨

Xin Lang Cai Jing· 2025-10-27 06:20

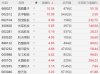

Core Viewpoint - The recent acceleration in China's satellite internet construction is driving significant growth in related stocks, particularly in the satellite ETF sector, with notable increases in stock prices of key companies involved in this industry [2][5][6]. Group 1: Market Performance - The satellite ETF (159206) has risen by 1.89%, with significant gains in constituent stocks such as Aerospace Zhizhuang up over 11% and Guodun Quantum up over 8% [2][3]. - Other stocks showing strong performance include Alliance Electronics, XW Communication, and Guoke Micro, with increases ranging from approximately 5% to 8.5% [3]. Group 2: Industry Developments - China has recently accelerated its satellite internet initiatives, with three successful satellite launches in October, including the sixth batch of the "Thousand Sails Constellation" network [5]. - The successful launch of 12 low-orbit satellites using the Long March 8 rocket and the deployment of 18 satellites in one launch using the Long March 6 rocket highlight advancements in China's satellite capabilities [5]. - The successful launch of the 20th communication technology test satellite marks a significant milestone in satellite communication technology verification [5]. Group 3: Strategic Importance - The recent Fourth Plenary Session emphasized the strategic importance of the aerospace industry, positioning it as a core frontier industry amid international competition [6]. - The recognition of commercial aerospace as a "new growth engine" in the government work report further underscores the industry's elevated status and potential for accelerated development during the 14th Five-Year Plan period [6].

A股异动丨中央定调6大未来产业之一!量子科技股走强,国盾量子涨超10%

Ge Long Hui A P P· 2025-10-27 02:53

Core Insights - The A-share market has seen a collective surge in quantum technology stocks, with notable increases in companies such as GuoDun Quantum and DaHua Intelligent [1][2] - The Central Committee of the Communist Party of China has proposed the development of emerging pillar industries, including quantum technology, as part of the 15th Five-Year Plan, which is expected to create several trillion-yuan markets [1] Company Performance - GuoDun Quantum (688027) rose by 10.54%, with a market capitalization of 47.6 billion and a year-to-date increase of 55.18% [2] - DaHua Intelligent (002512) increased by 10.09%, with a market cap of 5.462 billion and a year-to-date rise of 3.59% [2] - HengBao Co. (002104) reached a 9.99% increase, with a market cap of 15.8 billion and a year-to-date surge of 232.75% [2] - Other notable performers include GuangKu Technology (300620) up 5.85%, GuangXun Technology (002281) up 5.19%, and KeDa GuoChuang (300520) up 4.95% [2] Industry Trends - The proposed 15th Five-Year Plan emphasizes the acceleration of strategic emerging industries such as quantum technology, bio-manufacturing, hydrogen energy, and nuclear fusion, which are expected to become new economic growth points [1] - The plan aims to lay a forward-looking foundation for future industries, potentially reshaping China's high-tech sector over the next decade [1]

天奥电子(002935)2025年三季报简析:净利润同比下降4.51%,公司应收账款体量较大

Sou Hu Cai Jing· 2025-10-25 22:22

Core Viewpoint - Tian'ao Electronics (002935) reported a decline in total revenue and net profit for the third quarter of 2025, despite a quarterly increase in revenue and a significant rise in quarterly net profit compared to the previous year [1]. Financial Performance - Total revenue for the third quarter of 2025 was 536 million yuan, a decrease of 7.12% year-on-year [1]. - Net profit attributable to shareholders was 15.22 million yuan, down 4.51% year-on-year [1]. - In the third quarter alone, total revenue was 218 million yuan, reflecting a 10.0% increase year-on-year [1]. - Quarterly net profit reached 6.91 million yuan, showing a substantial increase of 1329.08% year-on-year [1]. - The gross profit margin was 22.64%, down 8.77% year-on-year, while the net profit margin was 2.84%, up 2.82% year-on-year [1]. Accounts Receivable and Cash Flow - The company has a high level of accounts receivable, with accounts receivable amounting to 1.06 billion yuan, which is 1650.45% of the latest annual net profit [1]. - Operating cash flow per share was -0.19 yuan, a significant decrease of 159.29% year-on-year [1]. Cost and Expenses - Total selling, administrative, and financial expenses amounted to 65.78 million yuan, accounting for 12.28% of revenue, a decrease of 13.44% year-on-year [1]. Market Outlook - Analysts expect the company's performance for 2025 to reach approximately 99.94 million yuan, with an average earnings per share of 0.24 yuan [3]. - The company is focusing on the low-altitude economy sector, leveraging national policy support and its expertise to expand its product applications in this area [4][6]. Business Evaluation - The company's return on invested capital (ROIC) was 3.85%, indicating weak capital returns, with a historical median ROIC of 9.41% since its listing [5]. - The company maintains a healthy cash asset position, but attention is needed on cash flow and accounts receivable management [5].