AI技术

Search documents

短剧相关人才需求明显上涨

Mei Ri Shang Bao· 2025-10-20 22:14

Group 1 - The core viewpoint of the article highlights the continued growth in recruitment within advanced manufacturing and modern service industries, with specific emphasis on the rising demand for talent in short drama production [2][3][6] Group 2 - In advanced manufacturing, the new materials sector leads with a 66.7% year-on-year increase in job postings, followed by optoelectronics at 54.2% and military manufacturing at 54.0% [3] - The modern service industry shows significant growth in the pet services sector, with a 43.7% increase in job postings, particularly for pet doctors and groomers, which surged by 128.2% and 67.3% respectively [3] - The elderly care sector also experienced a 29.2% increase in job postings, driven by rising demand for caregivers and rehabilitation therapists [3] Group 3 - The gaming industry saw a 38.9% increase in job postings, with game operation and promotion roles growing by 233.1% and 30.8% respectively, benefiting from AI technology and global market expansion [4] - The automotive aftermarket also performed well, with job postings increasing by 37.9%, particularly in car washing, maintenance, and beauty services, which grew by 85.4%, 64.2%, and 25.9% respectively [4] Group 4 - The short drama market is experiencing a talent shortage, with a 26% year-on-year increase in demand for related positions, particularly for editors and screenwriters [6][7] - Editors account for 15.9% of job postings in the short drama sector, while screenwriters make up 10.0%, reflecting the industry's focus on high-quality storytelling [6][7] - Actors and models, along with streamers, are also essential for short drama production, comprising 8.6% and 5.4% of job postings respectively [7] Group 5 - Overall, the talent market in Q3 2025 aligns with industry upgrades and consumer changes, with advanced manufacturing focusing on technological breakthroughs and modern services expanding employment opportunities through innovative scenarios [7]

微盟集团(02013)拟与抖音集团开展业务合作

智通财经网· 2025-10-20 09:33

Core Viewpoint - Weimob Group (02013) has announced a business collaboration with Douyin Group's comprehensive digital marketing service platform, Juyuan Engine, positioning itself as a comprehensive advertising agent and Juyuan Qianchuan service provider [1] Group 1: Business Collaboration - Weimob's subsidiary, Shanghai Weimob Information Technology Co., Ltd., will serve as the comprehensive advertising agent for Juyuan Engine and the Juyuan Qianchuan service provider, with a license period from September 26, 2025, to December 31, 2025 [1] Group 2: Strategic Goals - The company aims to leverage its advanced AI technology, established sales channels, excellent service operations, and solid customer base to expand its advertising business share within Juyuan Engine [1] - The collaboration is expected to drive further growth in marketing business revenue and profits while exploring additional business cooperation opportunities [1] Group 3: Future Growth - Weimob will continue to diversify its platform channels to bring new growth momentum to its business development, ultimately providing high-quality long-term value returns to shareholders [1]

微盟集团(02013.HK)宣布与抖音集团开展业务合作

Ge Long Hui· 2025-10-20 09:30

Core Viewpoint - Weimob Group (02013.HK) has officially announced a business collaboration with Douyin Group's comprehensive digital marketing service platform, Juyuan Engine, positioning itself as a comprehensive advertising agent and Juyuan Qianchuan service provider [1] Group 1 - Weimob's subsidiary, Shanghai Weimob Information Technology Co., Ltd., will serve as the comprehensive advertising agent for Juyuan Engine, with a license period from September 26, 2025, to December 31, 2025 [1] - The company aims to leverage its advanced AI technology, established sales channels, excellent service operations, and solid customer base to expand its advertising business share within Juyuan Engine [1] - The collaboration is expected to drive further growth in marketing business revenue and profits, while also exploring additional cooperation opportunities in other business directions [1] Group 2 - Weimob will continue to diversify its platform channels, bringing new growth momentum to its business development [1] - The company is focused on delivering high-quality long-term value returns to its shareholders [1]

金信基金三季报出炉:押注科技主线,金信精选成长A、金信稳健策略A年内收益超60%

Xin Lang Ji Jin· 2025-10-20 08:40

Core Insights - The third-quarter reports of the 2025 funds show a significant divergence in performance, with equity products focused on technology innovation outperforming bond and diversified industry products, indicating a concentrated market interest in technology innovation [1][3] Fund Performance - Jin Xin Selected Growth A leads with a year-to-date return of 63.45%, managed by veteran Kong Xuebing, with a scale of 427 million yuan and a quarterly growth of 31.8 million yuan, achieving a one-year return of 76.30% [3] - Jin Xin Steady Strategy A follows with a year-to-date return of 61.32% [3] - Jin Xin Shenzhen Growth A, managed by Huang Biao and Yang Chao, achieved a year-to-date return of 58.66%, with its scale increasing to 988 million yuan [3] - Jin Xin Transformation Innovation Growth A also performed well with a year-to-date return of 50.48% and a one-year return of 78.51% [3] - These four equity products significantly outperformed the CSI 300 index, highlighting the strong momentum in the technology sector [3] Portfolio Composition - Jin Xin Fund's concentrated investment in the semiconductor equipment sector has been a key driver of performance, with Jin Xin Steady Strategy A's top ten holdings including Chip Source Micro, which accounts for 9.90% and has risen 39.13% in the last three months [3] - Other significant holdings include Zhongwei Company and Tuo Jing Technology, with respective holdings of 9.70% and 9.56%, both seeing increases of over 64% in the last three months [3] Diverse Strategies - Jin Xin Cycle Value A, established in February, achieved a return of 40.01% in eight months, showcasing a more diversified portfolio beyond semiconductor stocks [8] - Jin Xin Intelligent China 2025 A, a flexible allocation fund, recorded a year-to-date return of 10.46% and a one-year return of 15.08%, indicating steady growth despite not matching the technology-focused products [10] Market Outlook - The fund managers express optimism about the semiconductor domestic substitution trend, driven by high R&D, accelerated product validation, and AI sovereignty demands, suggesting a long-term positive outlook [12] - The focus remains on identifying high-growth potential companies within the technology sector while managing risks associated with valuation pressures as tech stocks rise [13]

之学研究院正式成立,探索出行新生态

Zhong Guo Qi Che Bao Wang· 2025-10-20 07:03

Core Insights - The establishment of the Zhixue Research Institute marks a significant step in the evolution of the automotive industry, focusing on the integration of multiple industries and the transition from incremental competition to ecological collaboration [3][4] Group 1: Strategic Focus of Zhixue Research Institute - The institute will focus on three core areas: acting as a connector for problem-solving, promoting ecological collaboration, and supporting sustainable development within the automotive industry [3][4] - It aims to provide comprehensive services from research to implementation for leading enterprises and innovative companies [3] - The institute's core positioning is to offer strategic information and business services, emphasizing commercial implementation and industry collaboration [4] Group 2: Industry Challenges and Opportunities - The domestic automotive market is expected to enter a phase of stock competition with an annual growth rate of only 2%-3%, while exports and overseas markets will become significant growth areas [6] - The demand for new energy vehicles (NEVs) is projected to rise, potentially reaching a market share of around 70% [6] - The Zhixue Research Institute is positioned to conduct in-depth research on the challenges of the automotive supply chain going global, including compliance risks and core component competitiveness [6] Group 3: Expert Opinions and Recommendations - Industry experts emphasize the importance of cultural understanding for Chinese companies expanding into European markets and suggest that the institute can facilitate resource connections for component manufacturers [8] - Recommendations include focusing on ESG compliance, local cultural adaptation, and optimizing the structure of overseas operations to enhance profitability [7][8] - The need for experienced professionals to guide young entrepreneurs in avoiding pitfalls and leveraging industry insights is highlighted as a critical value of the institute [4][7]

Meta推出家长控制功能 助力应对青少年“AI聊天成瘾”

Huan Qiu Wang Zi Xun· 2025-10-20 06:56

Core Insights - Meta has announced new parental control options for its AI chatbots to help parents monitor and manage their teenagers' interactions with digital characters [1][3] - The new features include the ability for parents to completely restrict their children's access to AI chatbots and to block specific AI characters [1][3] - Meta's AI assistant will remain accessible to teenagers, providing educational and information services with age-appropriate safety mechanisms [1][3] Summary by Sections - **Parental Control Features** - Meta's new functionality allows parents to prohibit their children from using AI chatbots entirely or to block specific AI characters [1][3] - The AI assistant will continue to be available to teenagers, ensuring a safe usage experience [1][3] - **Overview Information for Parents** - Parents will receive a summary report detailing their children's interactions with AI characters and the main topics discussed [3] - This initiative aims to facilitate more informed and targeted discussions between parents and children regarding AI usage [3] - **Implementation Timeline and Scope** - The parental control features are set to launch in early next year, initially available to English-speaking users in the US, UK, Canada, and Australia [3] - Meta plans to expand these features to more platforms and will provide additional details soon [3] - **Context of the Update** - This is the first major safety update since the introduction of AI chatbots across Meta's platforms, including Facebook, Instagram, and WhatsApp [3] - Recently, Meta also implemented content restrictions for teenage users on Instagram, aligning browsing standards with PG-13 rated films [3]

家电ETF(159996)涨超1%,家电行业有望实现量价齐升

Mei Ri Jing Ji Xin Wen· 2025-10-20 06:47

Core Viewpoint - The white goods sector exhibits characteristics of "low valuation, high dividends, and stable growth," indicating a high safety margin and significant elasticity in stock prices [1] Group 1: Market Dynamics - The reversal of real estate policies and the implementation of trade-in policies have catalyzed a short-term rise in copper prices, further boosting bullish sentiment in the channel, with the industry expected to achieve simultaneous volume and price growth [1] - The unexpected improvement in the white goods sector's prosperity has led to increased demand for upstream core components, such as rotary compressors and valves, resulting in a significant rise in sales [1] Group 2: Technological Integration - Leading companies in the industry are accelerating the integration of AI technology, exemplified by Haier's collaboration with Alibaba to promote innovation in manufacturing through AI, driving the upgrade of smart technologies [1] Group 3: Investment Vehicle - The home appliance ETF (159996) tracks the home appliance index (930697), which selects listed companies involved in the research, production, and sales of home appliances, covering major categories such as air conditioners, refrigerators, and washing machines [1] - This index provides a comprehensive reflection of the overall performance of the home appliance manufacturing industry, combining characteristics of both the consumer sector and cyclical features [1]

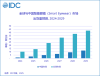

IDC:预计到2029年全球智能眼镜市场出货量将突破4000万台

智通财经网· 2025-10-20 05:49

Core Insights - The global smart glasses market is projected to reach 4.065 million units shipped in the first half of 2025, representing a year-on-year growth of 64.2%, driven by advancements in AI technology, supply chain optimization, and the entry of major players into the ecosystem [1][3] - By 2029, global shipments of smart glasses are expected to exceed 40 million units, with China's market share steadily increasing and a compound annual growth rate (CAGR) of 55.6% from 2024 to 2029, the highest globally [1] Market Overview - In the first half of 2025, Chinese smart glasses manufacturers shipped over 1 million units, capturing 26.6% of the global market share, with a year-on-year growth of 64.2% [3] - Despite the dominance of international brands in the consumer market, Chinese manufacturers are gaining significant ground through aggressive marketing and channel expansion [3] - The supply chain advantages of Chinese firms in optical modules, sensors, and assembly are facilitating their overseas expansion, particularly in North America, Europe, and Southeast Asia [3] Competitive Landscape - The smart glasses market is entering a phase of restructuring, characterized by intense competition among major players and innovative breakthroughs by tech companies in niche segments [5] - The audio and audio-capturing glasses segment saw shipments surpassing 2.4 million units in the first half of 2025, with audio glasses being the primary growth driver [6] - Meta continues to dominate the global market, while Chinese brands like Xiaomi are enhancing market activity, achieving a 35.5% market share in China, surpassing the U.S. [6] Product Segmentation - The extended reality (ER) glasses market experienced a shipment growth rate of 95.2% in the first half of 2025, with Chinese manufacturers holding over 97% of the market share [7] - Non-binary full-color glasses are being optimized for weight reduction, with Chinese firms like Yiwentech and Yingmu Technology capturing over 65% of the global market [9] - The augmented reality (AR) glasses market saw a 1.3% year-on-year growth, with China holding a 57.3% market share, as domestic companies build competitive advantages through rapid product iterations [10] Future Outlook - The mixed reality (MR) headset market is currently experiencing a decline in shipments, influenced by product updates from Meta, while Chinese firms are exploring commercial applications to drive growth [11] - The virtual reality (VR) headset market is witnessing regional disparities, with Chinese manufacturers expanding their influence, particularly in the B2B sector, which accounts for over 50% of the market [12] - As core component costs decrease and display technologies mature, more manufacturers are expected to diversify their product lines to capture market opportunities [14]

海外楚商陆跃锋:拳拳之心报桑梓

Zhong Guo Xin Wen Wang· 2025-10-20 05:17

Core Insights - The article highlights the importance of the Chushang Conference as a platform for overseas Hubei merchants to connect with their hometown and promote collaboration [1][2] - The upcoming seventh Chushang Conference will focus on high-tech investments and education cooperation, particularly in AI technology and emerging industries [1][2] Group 1: Chushang Conference - The Chushang Conference is held every two years to unite global Hubei merchants and support the development of Hubei [1] - The seventh Chushang Conference will take place in Wuhan at the end of October [1] Group 2: Contributions of Overseas Hubei Merchants - Overseas Hubei merchants, particularly in Canada, have been instrumental in fostering economic, educational, technological, and cultural exchanges between China and Canada [2] - Initiatives include establishing cooperation between Hubei universities and Canadian educational institutions, and facilitating product export collaborations in the healthcare sector [2] Group 3: Support Measures for Hubei Merchants - A set of 15 practical measures has been proposed to enhance the support system for overseas Hubei merchants, focusing on information exchange, policy guidance, financial services, and project implementation [3] - The establishment of a global "Chushang Database" and "Chushang Map" is envisioned to help the government understand overseas resource distribution and promote industry chain investment [3] Group 4: Focus on Young Entrepreneurs - There is a growing emphasis on the development of young Hubei merchants, who possess a global perspective and a sense of national pride [3] - The Chushang Conference aims to connect young entrepreneurs with overseas resources to foster innovation [3]

电网升级改造提速,电网设备ETF(159326)持续获资金关注,9日 “吸金”3亿元

Mei Ri Jing Ji Xin Wen· 2025-10-20 05:15

Group 1 - The electric grid equipment sector is experiencing multiple positive developments, with the only ETF tracking the CSI Electric Grid Equipment Index, the Electric Grid Equipment ETF (159326), attracting significant capital inflow, totaling 300 million yuan over nine consecutive trading days as of October 17, with a total size exceeding 384 million yuan [1] - The National Development and Reform Commission issued a three-year action plan (2025-2027) to double the service capacity of electric vehicle charging facilities, emphasizing the need for upgrading and transforming the distribution network to accommodate charging infrastructure [1] - The rapid development of AI technology is driving an explosive increase in electricity demand from global data centers, necessitating upgrades to the electric grid, as highlighted by warnings from the largest U.S. grid operator PJM regarding exhausted grid capacity in high-density data center areas [1] Group 2 - The 14th Five-Year Plan period is critical for the construction of a new power system, with the National Energy Administration focusing on high-quality development in the electricity sector and planning major strategic tasks and projects [2] - By 2025, a preliminary national unified electricity market is expected to be established, with full implementation by 2029, addressing consumption issues and emphasizing the importance of cross-provincial grid channels, digitalization, carbon markets, and electricity market construction [2] - The Electric Grid Equipment ETF (159326) represents a strong index of the electric grid equipment sector, with major holdings including industry leaders such as Guodian NARI, TBEA, and Sifang Electric [2]