GDP

Search documents

10 月 FOMC 会议:降息如期落地,政策进入观察期

Yin He Zheng Quan· 2025-10-30 06:19

Economic Indicators - The U.S. GDP growth rate is projected to be 4.0% for Q1 2024, with a gradual decline to 2.0% by Q4 2025[7] - The Michigan Consumer Sentiment Index is expected to show fluctuations, with a notable drop to -6.0% in Q1 2024[7] Federal Reserve Projections - The Federal Open Market Committee (FOMC) is expected to maintain interest rates between 5.30% and 5.80% through mid-2025[5] - Market expectations for a rate cut in December 2025 are at 67.79% probability, decreasing to 32.21% for a higher rate[10] Inflation Metrics - The Consumer Price Index (CPI) is projected to stabilize around 3.0% by mid-2024, with a potential increase to 4.0% by Q1 2025[14] - The Personal Consumption Expenditures (PCE) inflation rate is anticipated to be 2.5% in 2024, reflecting a slight increase from previous years[14] Housing Market Trends - The median home price in the U.S. is expected to rise steadily, reaching approximately $400,000 by late 2025[8] - Existing home sales are projected to increase by 5% annually, indicating a recovering housing market[8] Labor Market Insights - Initial jobless claims are forecasted to remain below 200,000, indicating a strong labor market[16] - The labor force participation rate is expected to stabilize around 62% by 2025, reflecting a balanced labor market[16]

Bank of America reconsiders gold forecast after tumble

Yahoo Finance· 2025-10-29 18:15

Economic Overview - The U.S. economy is showing signs of weakness, with real GDP growth at 1.6% in the first half of 2025, down from 2.8% in 2024, indicating potential underlying issues despite positive top-line numbers [3] - Unemployment rose to 4.3% in August, the highest since 2021, with nearly 1 million layoffs reported through September, a 55% increase compared to the same period in 2024 [2] Inflation and Consumer Behavior - Inflation has increased by 3% year over year as of September, up from 2.3% in April, largely influenced by tariffs affecting corporate supply chains [1] - Companies are reporting a decline in visits from lower-income customers, with McDonald's and O'Reilly Auto Parts noting reduced spending on dining and auto repairs, respectively [6] Gold Market Dynamics - Gold prices have recently experienced volatility, dropping 3.5% after a significant 6% decline on October 21, with prices falling below $4,000 per ounce, raising concerns among investors [5] - Bank of America has revised its gold forecast, predicting a bearish target of $3,800 per ounce for Q4 2025, but sees potential for prices to rise to $5,000 per ounce in 2026 due to structural drivers remaining in place [11][16] Investment Strategies - Analysts suggest that long-term holders of gold will need to continue supporting demand through exchange-traded funds, while central banks are expected to diversify away from the U.S. Dollar [4] - Historical analysis indicates that adding a 5% gold allocation to traditional investment portfolios could yield higher returns, suggesting a shift towards a 60:20:20 portfolio structure [17]

10月29日上期所沪金期货仓单较上一日增加801千克

Jin Tou Wang· 2025-10-29 09:39

Group 1 - The total amount of gold futures at the Shanghai Futures Exchange is 87,816 kilograms, with an increase of 801 kilograms compared to the previous day [1] - The opening price of gold futures on October 29 was 895.12 CNY per gram, reaching a high of 911.98 CNY and a low of 893.64 CNY, with a current price of 910.88 CNY, reflecting a decrease of 0.55% [1] - The trading volume for the day was 36,239 contracts, with open interest decreasing by 7,225 contracts to a total of 168,691 contracts [1] Group 2 - Trump stated that the Asia-Pacific Economic Cooperation (APEC) will unite Pacific nations for economic development, with the U.S. having secured over 18 trillion USD in new investment commitments [1] - By the end of his second term, projected investment inflows to the U.S. could reach between 21 trillion to 22 trillion USD, with an expected GDP growth of 4% in the next quarter [1] - Trump also mentioned that he would not allow the Federal Reserve to raise interest rates [1]

X @The Economist

The Economist· 2025-10-28 08:00

Britain’s non-pensioner benefits bill this year is 4.8% of GDP, according to our calculations. This is roughly in line with the 30-year average.But beneath that calm surface lie two opposing currents https://t.co/LaDYQWl0FX https://t.co/7hGiAdTNbU ...

冲刺在即,宁波能否再进位?

3 6 Ke· 2025-10-28 02:07

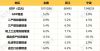

Economic Overview - Ningbo's GDP for the first three quarters of 2025 reached 1,349.29 billion yuan, with a year-on-year growth of 5.0% at constant prices [1] - The primary industry added value was 30.11 billion yuan, growing by 3.6%; the secondary industry added value was 573.65 billion yuan, growing by 4.3%, with industrial output at 526.20 billion yuan, growing by 5.6%; the tertiary industry added value was 745.53 billion yuan, growing by 5.5% [1] Comparative Analysis - Ningbo's GDP growth rate of 5.0% is lower than the national average of 5.2% and the provincial average of 5.7% [2] - The secondary industry's added value growth of 4.3% is also below the national and provincial levels by 0.6 and 0.9 percentage points, respectively [2] - The city's fixed asset investment saw a significant decline of 18.1%, contrasting with a national decrease of 0.5% and a provincial decrease of 3.8% [2] Foreign Trade Performance - Ningbo's total import and export volume exceeded 1 trillion yuan, reaching 1,092.26 billion yuan, with a year-on-year growth of 3.7%, which is below the national growth of 4.0% and provincial growth of 6.2% [3] - The city's foreign trade dependency is notably high at 78.3%, significantly above the national average of 32.5% and the provincial average of 58.4%, indicating greater vulnerability to external shocks [3] Future Outlook - Ningbo aims to achieve a GDP of over 2 trillion yuan by 2025, with a current GDP of 1,814.77 billion yuan in 2024, indicating a close competition with Nanjing [1] - The city faces challenges in maintaining economic momentum and is urged to enhance efforts in stabilizing and improving economic conditions [3]

Euro Zone to Get Hard Data on Tariff Damage as ECB Sets Rates

Yahoo Finance· 2025-10-27 09:10

Economic Overview - The European Central Bank (ECB) has cut interest rates eight times in a year to achieve an inflation target of around 2% and is now prepared to address any sudden economic changes [1] - A rigorous economic health-check is scheduled to assess the impact of US tariffs on growth and inflation as policymakers meet to set interest rates [1] GDP and Economic Growth - The initial reading of the euro zone's gross domestic product (GDP) for the third quarter is expected to show a minimal expansion of 0.1%, consistent with the previous quarter [2][3] - National reports from major economies in the region will provide additional insights into economic performance [3] Inflation and Monetary Policy - October's inflation reading is anticipated to dip to 2.1% from 2.2% in the previous month, which will be crucial for the ECB's monetary policy decisions [4] - The ECB will also release its Bank Lending Survey to evaluate the effectiveness of monetary policy in the real economy [4] Economic Activity and Consumer Confidence - The first half of 2025 was marked by volatility, with initial growth followed by a contraction in Germany's output by 0.3% in the second quarter due to the impact of US tariffs [5] - Consumer confidence remains low despite a strong labor market, raising concerns about the anticipated recovery in private consumption [6] Investment and Future Outlook - There are risks that investment activity may only recover gradually due to weak domestic demand and low capacity utilization in the manufacturing sector [6] - The ECB is expected to maintain borrowing costs at 2% during its meeting in Florence, Italy, with forecasts suggesting a potential economic rebound towards the end of the year [7]

2025年9月经济数据点评:生产提速,需求回落

Shanghai Securities· 2025-10-27 08:02

Economic Performance - In September, industrial production increased significantly with a year-on-year growth of 6.5%, up 1.3 percentage points from the previous month[12] - The GDP for the third quarter was 4.8%, a decrease of 0.4 percentage points from the second quarter[4] - Fixed asset investment (excluding rural households) for January to September was 371,535 billion yuan, a year-on-year decline of 0.5%[12] Investment Trends - Manufacturing investment grew by 4.0%, but the growth rate decreased by 1.1 percentage points, contributing 1.0 percentage points to total investment growth[19] - Infrastructure investment increased by 1.1%, down 0.9 percentage points, contributing 0.2 percentage points to total investment growth[19] - Real estate development investment from January to September was 67,706 billion yuan, down 13.9%, with the decline accelerating by 1 percentage point[20] Consumer Behavior - Retail sales of consumer goods in September totaled 41,971 billion yuan, with a year-on-year growth of 3.0%, a decrease of 0.4 percentage points from the previous month[22] - Excluding automobiles, retail sales grew by 3.2%[12] - The decline in consumption was influenced by a drop in dining consumption, indicating a broader slowdown in consumer spending[26] Future Outlook - The company anticipates that investment will stabilize and grow, supported by infrastructure projects and policies aimed at stabilizing the real estate market[30] - The overall economic performance in the first three quarters suggests a solid foundation for achieving annual targets, with a GDP growth of 5.2%[30] Risk Factors - Potential risks include worsening geopolitical events, changes in the international financial landscape, and unexpected shifts in U.S.-China policies[31]

时报观察丨发展“中国人经济” 拓宽全球价值链新边界

Zheng Quan Shi Bao· 2025-10-27 00:27

Core Insights - The article emphasizes the importance of both "Chinese economy" and "Chinese people economy" in the context of China's economic development, indicating a paradigm shift towards a more open and high-quality growth model [2][3] - The focus on GNI (Gross National Income) alongside GDP (Gross Domestic Product) reflects a comprehensive approach to measuring national strength and wealth, highlighting the significance of overseas investments and income [2][3] Group 1: Economic Indicators - GDP is highlighted as a core indicator of domestic production, showcasing the local foundation of the "Chinese economy" and the importance of attracting foreign investment to strengthen economic growth [2] - GNI represents the total income generated by residents of a country, including overseas investment profits and cross-border labor income, which are crucial for expanding national wealth [2] Group 2: Global Investment Strategy - By 2024, China's foreign investment stock is projected to exceed $3 trillion, maintaining a position among the top three globally for eight consecutive years, with enterprises established in 190 countries and regions [2] - The "Chinese people economy" is seen as a means to diversify global investments, effectively mitigating risks associated with reliance on a single market [3] Group 3: High-Quality Development - The transition from being the "world's factory" to a "global value creator" is essential for domestic companies to ascend the value chain, thereby injecting sustainable momentum into high-quality development [3] - The dual investment policy aims to enhance both the "investment in China" brand and the orderly cross-border layout of supply chains, fostering a win-win cooperation model [3]

时报观察丨发展“中国人经济” 拓宽全球价值链新边界

证券时报· 2025-10-27 00:07

Core Viewpoint - The article emphasizes the importance of both "Chinese economy" and "Chinese people's economy" in the context of high-level openness and high-quality development, indicating a paradigm shift in China's open economy development model [1][2]. Summary by Sections Economic Indicators - GDP and GNI are highlighted as two sides of the same coin reflecting a country's comprehensive strength. GDP showcases the domestic production foundation, while GNI includes overseas investment profits and cross-border labor income, contributing to national wealth [1]. - By the end of 2024, China's foreign investment stock is projected to exceed $3 trillion, maintaining a position among the top three globally for eight consecutive years [1]. Global Investment Strategy - The focus on "Chinese people's economy" allows for a diversified global layout, effectively hedging against risks from a single market. In the first three quarters, China maintained stable trade relations with over 240 countries and regions [2]. - The transition from being the "world's factory" to a "global value creator" is essential for domestic companies to ascend the value chain, injecting sustainable momentum into high-quality development [2]. Policy Implications - The dual investment policy serves as a practical path connecting the two economic dimensions. The "14th Five-Year Plan" aims to enhance the "Invest in China" brand while guiding the rational and orderly cross-border layout of production and supply chains [2]. - This approach not only shapes new advantages for the Chinese economy but also offers a Chinese solution for global economic governance that balances efficiency and fairness [2].