创新药出海

Search documents

创新药板块有望持续迎来重磅催化,关注科创创新药ETF国泰(589720)

Sou Hu Cai Jing· 2025-10-17 01:41

Group 1 - The core viewpoint is that the innovative drug sector remains a strong investment theme despite a recent 15% pullback, with a year-to-date performance still among the best in the market [2] - From January to September, the total contract value for Chinese innovative drugs going overseas exceeded $100 billion, marking a 170% year-on-year increase, indicating a robust long-term outlook for the innovative industry chain [2] - The trend of innovative drugs going global is expected to continue, with more business development (BD) deals anticipated by year-end, reinforcing confidence in the innovative sector [2] Group 2 - The innovative drug sector is expected to receive significant catalysts in the fourth quarter, with 23 Chinese studies selected for presentation at the upcoming ESMO conference, a substantial increase from 7 studies in 2024 [3] - Macroeconomic conditions are favorable for the innovative drug sector, as recent comments from Powell suggest potential interest rate cuts, which are beneficial for rate-sensitive innovative drugs [3] - The innovative drug sector is seen as a good investment choice amid market resistance and a rotation in tech growth, with BD deals expected to drive recovery in the sector [3] Group 3 - The fourth quarter typically sees BD transactions account for about 40% of annual totals, with large products also expected to contribute positively [3] - Recent adjustments in the market provide a favorable entry point for long-term investors in the innovative drug sector [3] - Investors are encouraged to consider ETFs focused on innovative drugs, particularly those targeting the STAR Market and smaller-cap stocks, which may show stronger resilience [3]

ETF日报:煤炭板块具备周期与红利的双重属性,当前煤炭持仓低位,基本面已到拐点右侧,可关注煤炭ETF

Xin Lang Ji Jin· 2025-10-16 15:33

Market Overview - The A-share market showed mixed results with the Shanghai Composite Index rising by 0.10% to close at 3916.23 points, while the Shenzhen Component Index fell by 0.25% to 13086.41 points, and the ChiNext Index increased by 0.38% to 3037.44 points [1] - The trading volume in the Shanghai and Shenzhen markets dropped below 2 trillion, with a total of 193.11 billion, a decrease of 141.7 billion from the previous day [1] Sector Performance - The insurance, coal, shipping, and banking sectors saw the highest gains, while small metals, precious metals, wind power equipment, steel, mining, and fertilizer sectors experienced the largest declines [1] - The coal ETF (515220) rose by 2.97%, with a five-day change of 7.28% [2][3] Seasonal Trends and Demand - There is an increasing expectation of a cold winter, which is anticipated to boost winter demand for coal [4] - The China Electricity Council predicts that electricity consumption growth in the second half of the year will exceed that of the first half, with a projected year-on-year increase of 5% to 6% for 2025 [4] Policy and Market Dynamics - The National Development and Reform Commission and the State Administration for Market Regulation have announced measures to regulate price competition and maintain market order [4] - Analysts from Guosheng Securities expect coal prices to rebound in the second half of 2025, improving coal company profits [4] Investment Opportunities - The coal sector is viewed as having dual attributes of cyclical and dividend investments, making it an attractive area for investment [5] - The innovative pharmaceutical sector remains a key focus, with significant growth in overseas contracts, totaling over 100 billion USD in the first nine months of the year, a 170% increase year-on-year [7] - Upcoming international conferences are expected to provide catalysts for the innovative drug sector, with a notable increase in research presentations from China at the ESMO conference [8]

10月16日大盘简评

Mei Ri Jing Ji Xin Wen· 2025-10-16 13:54

Group 1: Market Overview - The three major A-share indices showed mixed performance, with the Shanghai Composite Index rising by 0.1% to close at 3916.23 points, while the Shenzhen Component Index fell by 0.25% to 13086.41 points, and the ChiNext Index increased by 0.38% to 3037.44 points [1] - The trading volume in the Shanghai and Shenzhen markets dropped below 2 trillion yuan, with a total of 193.11 billion yuan, a decrease of 141.7 billion yuan compared to the previous day [1] - The market is facing resistance after breaking the key 3900-point level, with increased volatility expected in the short term, requiring significant catalysts for further upward movement [1] Group 2: Sector Performance - The insurance, coal, shipping, and banking sectors showed the highest gains, while small metals, precious metals, wind power equipment, steel, mining, and fertilizer sectors experienced the largest declines [1] - The coal sector is anticipated to see seasonal investment opportunities due to expectations of a cold winter and the potential for a rebound in coal prices in the fourth quarter [2] - The innovative drug sector is gaining traction, with leading stocks experiencing significant gains, driven by ongoing drug review reforms and upcoming international conferences expected to release important clinical data [3] Group 3: Investment Opportunities - The coal sector is expected to benefit from a rebound in prices supported by reduced inventory pressures and increased demand during the winter season [2] - The innovative drug sector is highlighted as having strong investment value, particularly with the upcoming ESMO and ASH conferences that may provide short-term momentum [3] - The coal ETF (515220) has surpassed 12 billion yuan in scale, indicating strong market interest [2]

华丽家族参股企业海和药物与大鹏药品达成授权合作

Zheng Quan Ri Bao Zhi Sheng· 2025-10-16 13:41

Core Points - Shanghai Haihe Pharmaceutical Co., Ltd. has entered into an exclusive licensing agreement with Japan's Daikyo Pharmaceutical Co., Ltd. for the development, production, and commercialization of the PI3Kα inhibitor, CYH33, in Japan [1] - This collaboration follows a previous agreement between Haihe Pharmaceutical and Daikyo Pharmaceutical regarding the MET inhibitor, Gomitil, which has successfully been approved for sale in both China and Japan [1] - The agreement will provide Haihe Pharmaceutical with an upfront payment, milestone payments based on development and sales, and royalties based on sales in Japan [1] Group 1 - The partnership highlights Daikyo Pharmaceutical's recognition of Haihe Pharmaceutical's research capabilities [2] - The collaboration reflects Haihe Pharmaceutical's strategy of "Chinese innovation, global layout," supported by the capital investment from Huayi Family [2] - Huayi Family's investment has facilitated Haihe Pharmaceutical's research and global expansion, enhancing the stability and speed of its innovative drug's international journey [2]

医药板块延续涨势,恒生创新药ETF(159316)今日获近3000万份净申购

Mei Ri Jing Ji Xin Wen· 2025-10-16 12:41

Group 1 - The pharmaceutical sector continues to rise, with the Hang Seng Hong Kong Stock Connect Innovative Drug Index increasing by 2.3% and the CSI Hong Kong Stock Connect Pharmaceutical and Health Comprehensive Index rising by 1.6% [1] - The CSI Innovative Drug Industry Index, CSI Biotechnology Theme Index, and CSI 300 Pharmaceutical and Health Index all saw an increase of 0.4% [1] - The Hang Seng Innovative Drug ETF (159316) experienced a net subscription of nearly 30 million shares throughout the day [1] Group 2 - CITIC Securities points out that the competitiveness of China's pharmaceutical industry is continuously improving [1] - On the innovation front, national policies are actively encouraging industry innovation, and global liquidity improvements are beneficial for innovative drug companies' pricing [1] - In terms of international expansion, China possesses manufacturing and supply chain advantages, while its innovation capabilities are rapidly enhancing, leading to a long-term positive outlook for the pharmaceutical industry to develop global large companies [1]

重磅会议召开!新一轮催化即将展开?

Ge Long Hui A P P· 2025-10-16 11:20

Core Viewpoint - The innovative drug sector is experiencing a counter-trend rise despite a pullback in AI technology, with significant interest in upcoming events like the ESMO conference, which is expected to showcase breakthroughs from Chinese pharmaceutical companies [1][2]. Group 1: Market Performance - The Hang Seng Innovative Drug ETF (159316) increased by 2.81%, while the low-fee Hong Kong Stock Connect Medical ETF (513200) rose by 1.32% [1]. - The upcoming ESMO conference from October 17 to 21, 2025, in Berlin is anticipated to be a crucial platform for domestic pharmaceutical companies to present their achievements and secure new business development (BD) partnerships [1][2]. Group 2: International Expansion - The outbound licensing transactions of Chinese biopharmaceutical companies exceeded $50 billion in the first half of the year, surpassing the total for 2024, and reached $87.4 billion by August 2025 [3]. - The quality of outbound transactions has significantly improved, with upfront payments reaching $4.16 billion by August 2025, nearing the total of $4.91 billion for 2024 [4]. - There were 21 major transactions exceeding $1 billion in total value in the first eight months of 2025, almost matching the 23 transactions for the entire year of 2024 [4]. Group 3: Technological Advancements - ADC drugs remain the primary focus for outbound transactions, with 14 ADC-related deals completed in the first eight months of 2025, including a record $13 billion collaboration between Qihuang Dejian and Biohaven [5]. - The metabolic field, particularly GLP-1 products, has emerged as a new hotspot for outbound transactions, with companies like Hansoh Pharmaceutical and Lianbang Pharmaceutical achieving over $2 billion in overseas licensing [6]. Group 4: Future Drivers - The next 5-10 years are expected to present historic development opportunities for the Chinese innovative drug industry [12]. - Chinese companies have demonstrated international competitiveness in ADC research, with significant collaborations indicating global trust in their capabilities [13]. - The dual-track payment system of medical insurance and commercial insurance is facilitating rapid market entry for innovative drugs, despite some price pressures from insurance [15]. Group 5: Investment Opportunities - The innovative drug sector is categorized into three main areas: platform giants, explosive biotech firms, and international pioneers, each representing different investment opportunities [16]. - The Hang Seng Innovative Drug ETF (159316) has seen a net inflow of 849 million yuan over the past 20 days, with a total fund size of 2.961 billion yuan [16].

毕马威中国生物科创领航50企业报告(第三届)

KPMG· 2025-10-16 08:58

Investment Rating - The report does not explicitly provide an investment rating for the industry Core Insights - The Chinese biotechnology sector is experiencing unprecedented development opportunities driven by technological breakthroughs and policy optimization, with a focus on interdisciplinary integration and the application of AI, 5G, and big data in biomedicine [8][9] - The report highlights that the biopharmaceutical sector accounts for 32% of the listed companies, followed by medical devices and cell/gene therapy at 28% each, indicating a strong focus on these areas [26][29] - The report emphasizes the importance of integrating scientific research and business models for success in the biotechnology industry, facilitating collaboration between academia, industry, and investors [10] Summary by Sections Overall Overview of the Industry - The report discusses the launch of the third edition of the "Biotechnology Innovation 50" list, aimed at promoting industry development and identifying innovative companies in the biotechnology sector [16] - It notes that 93% of the listed companies have been established for over three years, indicating a competitive landscape [32] Company Analysis - The distribution of listed companies shows that 32% are in biopharmaceuticals, 28% in medical devices, and 28% in cell and gene therapy, with a total of 50 companies listed, an increase of 7 from the previous year [26][28] - The geographical distribution indicates that 65.3% of the listed companies are from Suzhou, Beijing, Shenzhen, and Shanghai, with Suzhou leading for the first time due to strong local government support [29][30] Trends in Biotechnology - The report identifies key trends such as the systemic support for innovation in the biotechnology sector, including collaborative innovation across the entire value chain and reforms in review and approval processes [40][41] - It highlights the increasing role of AI in drug development and the integration of advanced technologies in the industry, which is expected to enhance efficiency and reduce costs [50][60] Financial Insights - The report indicates that 63% of the listed companies are in the A and B financing rounds, reflecting a trend towards early investment in hard technology [34] - It notes that the market for innovative drugs and devices is projected to reach 162 billion yuan in 2024, with a year-on-year growth of 16% [51] Future Outlook - The report anticipates continued growth in the CDMO (Contract Development and Manufacturing Organization) sector, with the market expected to expand from 95.6 billion yuan in 2024 to 313 billion yuan by 2030, reflecting a compound annual growth rate of 21.9% [55][56] - It emphasizes the strategic shift from cost competition to value creation within the CDMO industry, driven by technological advancements and a focus on high-potential niche markets [60][62]

科创创新药板块连续反弹,三生国健20CM涨停,获超800万美元分红款!科创创新药ETF汇添富(589120)涨超2%,机构:创新药仍是未来的投资主线

Sou Hu Cai Jing· 2025-10-16 03:08

Core Viewpoint - The innovation drug sector in China is experiencing significant growth, driven by increased investment, favorable policies, and a strong pipeline of new drugs entering clinical trials, positioning it for a robust future in both domestic and international markets [6][8][10]. Group 1: Market Performance - As of October 16, the Science and Technology Innovation Drug ETF (Huitianfu, 589120) saw a notable increase of 3.31%, maintaining a rise of over 2% despite a slight pullback [1]. - The ETF has attracted over 40 million yuan in net inflows over the past five days, indicating strong investor interest [1]. - Key constituent stocks such as Sangfor Technology and Yifang Bio have shown significant gains, with Sangfor hitting the daily limit up and Yifang Bio rising by 8.61% [2][3]. Group 2: Industry Trends - The number of License-out transactions in China reached 72 in the first half of 2025, surpassing half of the total for 2024, with a total transaction value 16% higher than the previous year [5]. - The innovation drug sector is primarily driven by business development (BD) expectations, with a significant portion of annual BD activity occurring in the fourth quarter [6]. - The Chinese innovation drug market is expected to see a recovery in confidence as more BD deals materialize, particularly as companies prepare for the upcoming European Society for Medical Oncology (ESMO) conference [6][7]. Group 3: R&D and Financial Outlook - Since 2015, Chinese innovation drug companies have significantly increased R&D investments, leading to a rise in the number of original innovative drugs entering clinical trials, with 704 drugs expected to enter Phase I trials in 2024 [8]. - The revenue of innovation drug companies has been steadily increasing, with projections indicating that one-third of these companies will achieve profitability by 2025, and 70% will reach breakeven by 2026 [8]. - The Chinese government's support for innovation drugs through favorable policies and increased funding is expected to enhance the sector's growth, with healthcare spending on innovation drugs projected to rise from 50 billion yuan in 2022 to 120 billion yuan in 2024 [9]. Group 4: Competitive Landscape - The impending patent cliff for multinational corporations (MNCs) is expected to create a demand for new products, with 190 drugs losing patent protection by 2030, including 69 with annual sales exceeding 1 billion dollars [10]. - Chinese innovation drug companies are well-positioned to fill this gap due to their high R&D efficiency and rich technological outcomes, making them attractive partners for MNCs [10].

创新药继续强势反攻!港股通医疗ETF富国(159506)盘中大涨3.21%

Mei Ri Jing Ji Xin Wen· 2025-10-16 02:45

Core Viewpoint - The Hong Kong pharmaceutical sector continues its upward trend, driven by strong performances in innovative drugs, vaccines, and biopharmaceuticals, with significant gains observed in related ETFs and stocks [1] Group 1: Market Performance - The Hong Kong medical ETF, 富国 (159506), saw an intraday increase of 3.21%, with stocks like 映恩生物-B rising over 8% and 三生制药 and 康方生物 increasing more than 7% [1] - The innovative drug ETF, 富国 (159748), experienced a 2.54% rise during the trading session [1] Group 2: Upcoming Events - The 2025 European Society for Medical Oncology (ESMO) annual meeting is scheduled from October 17 to October 21 in Berlin, Germany, expected to showcase significant clinical research results that may enhance market interest in innovative drug assets [1] Group 3: Industry Trends - The trend of Chinese innovative drugs entering international markets is gaining momentum, with expectations of more business development (BD) deals being finalized by year-end, indicating potential collaborations between Chinese pharmaceutical companies and large overseas firms [1] - Historically, the end of the year has been a peak time for major BD agreements in the innovative drug sector [1] - The current U.S. interest rate cut environment is anticipated to further boost performance in the CXO industry [1] Group 4: ETF Composition - The 富国 medical ETF (159506) closely tracks the Hang Seng Stock Connect Healthcare Index (HSSCHI), with a unique index composition strategy that excludes companies with the lowest average R&D/revenue rankings over the past two years [1] - Companies with high R&D expenditure ratios and significant innovative drug business proportions are prioritized, enhancing the ETF's ability to capture investment opportunities in the Hong Kong pharmaceutical sector [1]

创新药出海产业周期+海外流动性宽松周期,四季度恒生创新药ETF(159316)配置机遇备受关注

Sou Hu Cai Jing· 2025-10-16 02:25

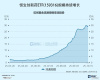

Group 1 - The total amount of contracts for Chinese innovative drug patents going overseas exceeded $100 billion from January to September, representing a year-on-year increase of 170% [1] - A series of overseas pharmaceutical academic conferences will be held in October and November, including the ESMO conference in Berlin from October 17 to 21, where Chinese innovative drug companies and laboratories will showcase their latest achievements [1] - The fourth quarter is expected to be a peak season for business development in innovative drugs, suggesting continued attention to the performance of Chinese pharmaceutical companies going abroad [1] Group 2 - On September 18, the Federal Reserve announced a 25 basis point interest rate cut, with Chairman Powell's speech interpreted as a signal for further rate cuts, leading to a 100% probability of rate cuts according to current federal funds futures contracts [1] - Historically, during interest rate cut cycles, global pharmaceutical and biotech assets have performed well; since September 18, the NBI in the US has increased by 7%, and biotech companies in Europe and South Korea have also performed well [1] - In contrast, Hong Kong's innovative drug sector, which has strong fundamentals, has underperformed, indicating potential medium to long-term investment opportunities in this sector [1]