煤炭

Search documents

ETF日报 | 阿里“千问”催化,科技股多线爆发!哑铃型配置策略怎么挑?

Xin Lang Cai Jing· 2025-11-17 08:03

Computer Industry - Alibaba launched the "Qianwen" app, entering the C-end AI assistant market, aiming to build an intelligent platform and expand globally, creating a technology and commercialization loop [2] - The AI ETF on the STAR Market (588760) has seen a net inflow of 530 million yuan over the last 10 trading days, indicating strong interest in the AI sector [2] - The cloud computing ETF (159527) has increased over 108% year-to-date, reflecting growth in China's cloud computing and big data industries [2] Defense and Military Industry - The defense and military sector reported a total net profit of 24.453 billion yuan for the first three quarters, a year-on-year increase of 17.29% [3] - The third quarter alone saw a net profit of 8.927 billion yuan, a significant year-on-year growth of 73.2%, driven by improved downstream demand and increased product deliveries [3] - The military industry is expected to enter a new growth cycle, supported by new equipment construction and accelerated military trade [3] Coal Industry - The coal sector is experiencing investment opportunities due to tightening supply and increasing demand, with thermal coal prices rising from 621 yuan/ton to 699 yuan/ton in the third quarter [4] - The upcoming winter heating season is expected to boost coal demand, particularly as electricity consumption rises [4] - The energy ETF (159945) that tracks the CSI All-Share Energy Index is highlighted as a potential investment opportunity [4] Hong Kong Innovative Drug Sector - The innovative drug sector in Hong Kong is in a rapid sales growth phase, with significant product approvals and inclusion in medical insurance driving revenue [5] - The largest innovative drug ETF in Hong Kong (513120) has a current scale of 25.988 billion yuan, indicating strong market interest [5] Hang Seng Technology Index - The Hang Seng Technology Index is viewed positively, with recommendations to focus on platform-based internet companies and AI ecosystem enterprises [6] - The Hang Seng Technology ETF (513380) has seen a net inflow of 1.357 billion yuan over the last 20 trading days, reflecting strong investor interest [6] Real Estate Market - The secondary real estate market is expected to continue improving, with a 4.7% year-on-year increase in transaction area for second-hand homes from January to October [9] - Major cities like Shanghai and Shenzhen have seen over 10% growth in second-hand home transactions, indicating a recovery in the real estate sector [9]

有机硅板块领涨 有涨价预期的板块值得期待

Chang Sha Wan Bao· 2025-11-07 10:41

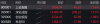

Market Overview - A-shares experienced a slight pullback on November 7, with the Shanghai Composite Index falling below the 4000-point mark, closing at 3997.56 points, down 0.25% [1] - The Shenzhen Component Index decreased by 0.36%, closing at 13404.06 points, while the ChiNext Index dropped 0.51% to 3208.21 points [1] - The total trading volume in the Shanghai and Shenzhen markets was 199.91 billion yuan, a decrease of 56.2 billion yuan from the previous day [1] - The market saw mixed performance across sectors, with energy metals, chemical raw materials, fertilizers, batteries, and photovoltaic equipment leading the gains, while internet services, motors, auto parts, and software development faced declines [1] Industry Performance - The organic silicon sector showed strong performance, with the index rising over 5% in a single day, reaching a three-year high [2] - From 2019 to 2024, China's organic silicon consumption is projected to grow from 1.062 million tons to 1.816 million tons, with a compound annual growth rate of 11.3% [2] - The demand for organic silicon materials is increasing in emerging industries such as electronics, new energy vehicles, and photovoltaic cells, indicating a robust growth outlook for the sector [2] - The chemical sector also performed well, with the yellow phosphorus index rising over 7% in the past two weeks and the market average price of thionyl chloride increasing by 8.61% recently, with a cumulative increase of 19.38% since August [2] Company Spotlight - Huazhu High-Tech, a leading company in industrial-grade additive manufacturing, saw its stock rise by 9.66% on November 7 [4] - The company reported earnings per share of 0.04 yuan and a net profit of 14.5581 million yuan for the third quarter of 2025, with a year-on-year net profit growth rate of -66.76% [4] - The recent stock surge was influenced by news of a shareholding change in Shenzhen Fast Manufacturing, which added new institutional investors, including Meituan and Hillhouse Capital [4] - The 3D printing industry has seen a compound annual growth rate exceeding 30% over the past three years, with many brands achieving annual revenues surpassing 1 billion yuan [4] - Huazhu High-Tech possesses unique capabilities in polymer additive manufacturing, leveraging advanced technologies and proprietary software platforms to enhance product applications [4]

冠通期货资讯早间报-20251104

Guan Tong Qi Huo· 2025-11-04 02:33

Report Summary 1. Market Performance Overnight - US stocks: The three major US stock indexes closed mixed. The Dow fell 0.48%, the S&P 500 rose 0.17%, and the Nasdaq rose 0.46%. The Wande US Tech Seven Giants Index rose 1.04%. Amazon hit a record high, up 4%, and Tesla rose more than 2%. Chinese concept stocks were mixed [5]. - European stocks: The three major European stock indexes closed mixed. The German DAX index rose 0.68%, the French CAC40 index fell 0.14%, and the UK FTSE 100 index fell 0.16%. European stocks were affected by the strength of US tech stocks and weak eurozone manufacturing data [5]. - Precious metals: International precious metals closed mixed. COMEX gold futures rose 0.43% to $4013.7 per ounce, and COMEX silver futures fell 0.52% to $47.91 per ounce. Gold was supported by central bank purchases, geopolitical uncertainty, and Fed rate - cut expectations [5]. - Crude oil: US crude oil futures rose 0.04% to $61.02 per barrel, and Brent crude oil futures rose 0.14% to $64.86 per barrel [6]. - Base metals: London base metals were mixed. LME zinc, aluminum, and lead rose, while tin, copper, and nickel fell [8]. 2. Important Macroeconomic News - China - South Korea currency swap: The People's Bank of China and the Bank of Korea renewed a bilateral currency swap agreement worth 400 billion yuan/70 trillion won for five years, which helps deepen currency and financial cooperation and promote trade [10]. - China's manufacturing PMI: In October, RatingDog's China manufacturing PMI fell to 50.6, with most sub - indicators declining month - on - month, and new export orders falling into contraction [10]. - Fed officials' views: Fed Governor Smilan said current monetary policy is too tight, and Governor Cook said a December rate cut is possible, depending on future data [10][12]. - US Treasury borrowing: The US Treasury estimated borrowing of $569 billion in Q4, $21 billion less than the July estimate [10]. 3. Energy and Chemical Futures - Oil demand outlook: ADNOC CEO said oil demand will remain above 100 million barrels per day after 2040, but warned of near - term challenges [14]. - Oil price forecast: Morgan Stanley raised its Brent crude price forecast to $60 per barrel in H1 2026, and expects supply - demand balance in H2 2027 with prices rising to $65 [14]. - Styrene inventory: As of November 3, 2025, Jiangsu styrene port inventory decreased by 7.10% week - on - week [15]. - Log出库量: Last week, the average daily出库量 of coniferous logs at 13 ports in 7 Chinese provinces decreased by 2.48% [15]. - OPEC's view: OPEC Secretary - General said the organization sees positive oil demand signs, expects 1.3 million barrels per day growth this year, and OPEC+ will pause production increases in Q1 2026 [16]. 4. Metal Futures - Alumina production: In October 2025, China's metallurgical - grade alumina production increased year - on - year and month - on - month, but the operating capacity decreased slightly [19]. - Copper production: Chile's copper production in September was 456,663 tons, up 7.79% month - on - month but down 4.5% year - on - year [19]. - PV component price: JinkoSolar expects component prices to face short - term pressure and recover in Q2 2026 [19]. 5. Black - Series Futures - Iron ore arrivals: From October 27 to November 2, 2025, the arrivals at 47 Chinese ports increased by 1.2298 million tons week - on - week [21]. - Iron ore shipments: Global iron ore shipments decreased by 174,500 tons week - on - week [21]. - Steel inventory: In late October, the social inventory of 5 major steel products in 21 cities decreased by 3.3% month - on - month [21]. 6. Agricultural Futures - Palm oil production: In October 2025, Malaysia's palm oil production increased by 5.55% month - on - month [24]. - Pig farming cost: Muyuan's pig - farming cost in September 2025 was about 11.6 yuan/kg [25]. - Pig and grain prices: As of October 29, the national pig price rose 4.59% week - on - week, and the pig - grain ratio rose 5.52% [25]. - Soybean crushing: In October, the soybean crushing volume of major Chinese oil mills decreased, but is expected to reach 9 million tons in November [25]. - Palm oil exports: Malaysia's palm oil exports from October 1 - 31, 2025, increased by 26.54% year - on - year [26]. - Indian edible oil imports: India's 2024/2025 edible oil imports increased slightly, with palm oil imports down and soybean oil imports up [26]. - Brazilian crop sowing: As of last Thursday, Brazil's 2025/26 soybean sowing rate reached 47%, and the first - crop corn sowing area reached 60% of the planned area [27]. - US soybean exports: As of October 30, 2025, the US soybean export inspection volume decreased week - on - week [27]. 7. Financial Markets Financial - Regulatory official's case: Former CSRC vice - chairman Wang Jianjun was investigated for serious violations [30]. - A - share market: A - shares rebounded. The Shanghai Composite Index rose 0.55%, and the trading volume was 2.13 trillion yuan [30]. - Hong Kong stock market: The Hang Seng Index rose 0.97%, and southbound funds had a net purchase of HK$5.472 billion [30]. - Brokerage "golden stocks": As of November 3, 186 stocks were short - listed for November "golden stocks", and industry insiders are optimistic about tech - growth sectors [32]. - ETF approval: The China Securities Regulatory Commission approved the issuance of the ChinaAMC CSI Smart - Selected Shanghai - Hong Kong - Shenzhen Technology 50 ETF, expected to start in December [32]. Industry - AI development: The Minister of Industry and Information Technology called for promoting the "two - way empowerment" of AI innovation and manufacturing applications [33]. - Display equipment: Three high - end equipment for 8.6 - generation large - size OLED screens were launched at the 2025 World Display Industry Innovation and Development Conference [33]. - Robot industry: In the first three quarters of this year, China's robot industry revenue increased by 29.5% year - on - year [33]. - Marine economy: In the first three quarters, China's marine GDP reached 7.9 trillion yuan, up 5.6% year - on - year [33]. - Water - saving equipment: The MIIT and the MWR issued a plan to promote the high - quality development of water - saving equipment by 2027 [35]. - Auto market: The auto consumption index in October was 90.5, and the November retail sales are expected to increase slightly [36]. - Memory market: Three major memory manufacturers suspended DDR5 quotes, and the resumption is expected in mid - November [36]. Overseas - New Zealand visa policy: Chinese passport holders entering from Australia can enter New Zealand visa - free for up to 3 months from November 3, 2025, on a 12 - month trial basis [37]. - Fed officials' views: Fed Governor Milan called for more aggressive rate cuts, and Governor Cook said a December rate cut is possible [37]. - US aviation safety: US Transportation Secretary Sean Duffy said the government may close the aviation system if the "shutdown" affects safety [37]. - US corporate layoffs: As of September, US corporate layoffs reached nearly 950,000, the highest since 2020 [39]. - US manufacturing PMI: The US ISM manufacturing PMI in October was 48.7, contracting for the eighth consecutive month [39]. - Eurozone economic situation: The eurozone manufacturing PMI in October was 50, with new orders flat and exports falling [39]. International Stock Markets - US stocks: The three major US stock indexes closed mixed, and over 100 S&P 500 companies will release earnings this week [40]. - European stocks: The three major European stock indexes closed mixed, affected by US tech stocks and eurozone manufacturing data [40]. - South Korean stocks: The South Korean Composite Index broke through 4200 points for the first time, driven by the semiconductor sector [42]. - Company news: Beyond Meat postponed its Q3 earnings, and Palliser pressured Rio Tinto to bid for Teck Resources [42][43]. Commodities - Precious metals: International precious metals closed mixed, with gold rising and silver falling [44]. - Crude oil: Crude oil prices rose, supported by OPEC+ production decisions and institutional price forecasts [44]. - Base metals: London base metals were mixed [44]. Bonds - Domestic bonds: The domestic bond market fluctuated narrowly, and most Treasury bond futures contracts declined [46]. - US bonds: US bond yields rose across the board [46]. - Corporate bond issuance: Alphabet plans to raise $17.5 billion in US dollar bonds and at least €3 billion in euro bonds [47]. Foreign Exchange - Currency swap: The People's Bank of China and the Bank of Korea renewed a bilateral currency swap agreement [48]. - RMB exchange rate: The on - shore RMB against the US dollar closed lower, and the RMB exchange rate index reached a new high since April [48]. - Dollar index: The US dollar index rose 0.15%, and most non - US currencies fell [49]. 8. Upcoming Events - Central bank events: The RBA will announce its interest - rate decision, and ECB President Lagarde will speak at multiple events [53]. - Conferences: The 2025 Petrochemical and Chemical Industry Digital Transformation Conference and the 2025 Auto Core Components Advanced Manufacturing Technology Forum will be held [53]. - Budget and reports: Canada will announce its annual budget, and the RBNZ will release its financial stability report [53]. - Earnings reports: AMD, Yum China, and Uber will release earnings [53].

超2900只个股下跌

第一财经· 2025-10-28 07:49

Market Overview - The A-share market experienced a pullback after initially rising, with the Shanghai Composite Index briefly surpassing 4000 points before closing down 0.22% at 3988.22 [3][4] - The Shenzhen Component Index fell 0.44% to 13430.10, while the ChiNext Index decreased by 0.15% to 3229.58 [4] Sector Performance - The Fujian sector continued its strong performance, with multiple stocks such as Haixia Innovation and Fujian Cement hitting the daily limit [4] - The military industry saw a collective surge, with stocks like Jianglong Shipbuilding and Great Wall Military Technology closing at their upper limits [5] - Conversely, the non-ferrous metals sector faced widespread declines, particularly in gold, rare earths, and cobalt mining [4] Trading Volume and Capital Flow - The total trading volume in the Shanghai and Shenzhen markets was 2.15 trillion yuan, a decrease of 192.3 billion yuan from the previous trading day, with over 2900 stocks declining [6] - Main capital inflows were observed in sectors such as bioproducts, cultural media, and software development, while outflows were noted in semiconductors, non-ferrous metals, and communication equipment [8] Stock-Specific Movements - Notable net inflows were recorded for stocks like N He Yuan-U (17.75 billion yuan), N Yi Cai-U (12.91 billion yuan), and Great Wall Military Technology (11.07 billion yuan) [9] - In contrast, Northern Rare Earth, Huayou Cobalt, and ZTE faced significant net outflows of 20.89 billion yuan, 13.77 billion yuan, and 11.97 billion yuan respectively [10] Institutional Insights - According to Qianhai Bourbon Fund, the market's recent breakthrough of 4000 points requires further observation due to external factors like tariff negotiations and the Federal Reserve's decisions [12] - Guodu Securities noted a "slow bull" market pattern, highlighting the frequent rotation between blue-chip dividends and technology sectors, with an emphasis on the potential for increased volatility in the coming months [13]

收盘丨沪指冲高回落跌0.22%,福建、军工板块集体爆发

Di Yi Cai Jing· 2025-10-28 07:12

Market Overview - The A-share market experienced a decline with the Shanghai Composite Index falling by 0.22% to 3988.22 points, the Shenzhen Component Index down by 0.44% to 13430.10 points, and the ChiNext Index decreasing by 0.15% to 3229.58 points [1][2] - The total trading volume in the Shanghai and Shenzhen markets was 2.15 trillion yuan, a decrease of 192.3 billion yuan compared to the previous trading day [1][2] Sector Performance - The Fujian sector showed strong performance with multiple stocks hitting the daily limit, including Haixia Innovation and Fujian Cement [2] - The military industry sector saw a collective surge, with stocks like Jianglong Shipbuilding and Great Wall Military Industry performing well [2] - Conversely, the non-ferrous metals sector experienced widespread declines, particularly in gold, rare earths, and cobalt mining [2] Capital Flow - Main capital inflows were observed in the biopharmaceutical, cultural media, and software development sectors, while outflows were noted in semiconductors, non-ferrous metals, and communication equipment [4][5] - Specific stocks with significant net inflows included N He Yuan-U, N Yi Cai-U, and Great Wall Military Industry, attracting 1.775 billion yuan, 1.291 billion yuan, and 1.107 billion yuan respectively [4] - Stocks facing notable net outflows included Northern Rare Earth, Huayou Cobalt, and ZTE, with outflows of 2.089 billion yuan, 1.377 billion yuan, and 1.197 billion yuan respectively [5] Institutional Insights - Qianhai Bourbon Fund noted that the market's recent breakthrough of 4000 points requires observation due to influences from tariff negotiations and the Federal Reserve's decisions, suggesting a cautious approach [6] - Guodu Securities described the A-share market as exhibiting a "slow bull pattern," with frequent rotations between blue-chip dividends and technology sectors, indicating a potential for increased volatility in the coming months [6]

收盘丨沪指放量涨超1%逼近4000点 存储芯片概念持续爆发

Di Yi Cai Jing· 2025-10-27 07:30

Market Performance - The three major A-share indices experienced a rebound, with the Shanghai Composite Index rising by 1.18% to close at 3996.94 points, reaching a peak of 3999.07 points during the session [1][2] - The Shenzhen Component Index increased by 1.51% to 13489.40 points, while the ChiNext Index rose by 1.98% to 3234.45 points [2] Sector Performance - The storage chip sector saw a significant surge, with stocks like Zhaoyi Innovation hitting the daily limit, alongside strong performances from companies such as Daway Technology and China Electronics Port [2] - Other active sectors included consumer electronics, CPO, circuit boards, rare earths, nuclear fusion, and coal stocks, while gaming, Hainan, and oil and gas sectors faced declines [2] Capital Flow - Main capital inflows were observed in the communication, non-ferrous metals, and public utilities sectors, while there were outflows from battery, banking, and gaming sectors [4] - Notable net inflows were recorded for Industrial Fulian, Shenghong Technology, and Hengbao Co., with net inflows of 1.768 billion, 1.016 billion, and 867 million respectively [5] Institutional Insights - According to Caitong Securities, the Shanghai Composite Index's approach to the 4000-point mark signifies a new, more dynamic phase for the market, driven by policy and restored confidence, although sustained upward momentum requires solid economic fundamentals and improved corporate earnings [6] - Qianhai Rongyue Asset Management suggests that the next resistance level for the Shanghai Composite Index may be around 4100 points [7] - Guocheng Investment indicates that the market's upward trend should be monitored for resistance near 4200 points on the Shanghai Composite Index [8]

市场早间震荡走强,中证A500指数上涨0.81%,3只中证A500相关ETF成交额超27亿元

Sou Hu Cai Jing· 2025-10-24 04:25

Market Overview - The market showed a strong upward trend in the morning, with the Shanghai Composite Index reaching a new high for the year and the CSI A500 Index rising by 0.81% [1] - The storage chip concept led the gains, while the commercial aerospace sector experienced a strong breakout, and computing hardware stocks saw fluctuating increases. Conversely, the coal sector underwent a collective adjustment [1] ETF Performance - As of the morning close, ETFs tracking the CSI A500 Index saw slight increases, with 11 related ETFs having transaction volumes exceeding 100 million yuan, and 3 surpassing 2.7 billion yuan. The transaction amounts for A500 ETFs were 3.566 billion yuan, 3.081 billion yuan, and 2.727 billion yuan respectively [1][2] Market Sentiment - Some brokerages indicated that rising market policy expectations, combined with the potential for interest rate cuts by the Federal Reserve within the year, will support the market. The A-share market is likely to continue exhibiting a consolidating trend, with structural opportunities remaining abundant under the support of domestic policy expectations and third-quarter performance validations [2]

龙虎榜复盘 | 煤炭板块继续强势,量子科技尾盘大幅拉升

Xuan Gu Bao· 2025-10-23 10:47

Group 1: Stock Market Activity - On the institutional trading leaderboard, 26 stocks were listed, with 11 experiencing net buying and 15 facing net selling [1] - The top three stocks with the highest net buying by institutions were: Beifang Co. (CNY 101 million), Xingfu Blue Sea (CNY 96.67 million), and Yunhan Chip City (CNY 86.20 million) [1] Group 2: Coal Industry Insights - Institutions have shown significant interest in coal stocks, particularly in Shanxi and Shaanxi provinces, where winter storage and replenishment have begun early [2] - Shanxi Securities predicts limited supply growth in the coal sector for Q4, with coal prices expected to stabilize due to seasonal demand [2] - The overall valuation of the coal sector is considered low, and there is potential for a rebound as market sentiment shifts [2] Group 3: Quantum Technology Developments - The company has a stake in Guoyi Quantum, focusing on quantum precision measurement and related technologies [4] - Google’s Quantum has made significant advancements in quantum computing, which may pave the way for practical applications in the next five years [4] - Companies in the quantum computing sector, particularly those involved in complete systems, are expected to benefit directly from technological breakthroughs, enhancing their market value [4]

深圳板块火了!煤炭板块上演“反内卷”行情

Mei Ri Jing Ji Xin Wen· 2025-10-23 08:26

Market Overview and Sector Characteristics - The Shanghai Composite Index decreased by 0.22%, with the median individual stock change being a decline of 0.25% [1] - A total of 58 stocks hit the daily limit up, an increase of 2 from the previous day, while 8 stocks hit the limit down, an increase of 3 [2] Sector Performance - The coal industry, cultural media, and specialized equipment sectors had the highest number of limit-up stocks today [3] - In the coal industry, 8 stocks reached the limit up due to strong performance driven by tight supply and demand conditions [4] - The cultural media sector saw 4 stocks limit up, supported by favorable policies and a recovery in consumer demand [4] - The specialized equipment sector also benefited from policy support and growing export demand [4] Conceptual Characteristics - The most notable concepts among limit-up stocks included Shenzhen local stocks, coal, and large consumer concepts [5] - Shenzhen local stocks had 12 limit-up stocks, benefiting from favorable policies and increased funding focus [5] - The coal sector had 8 limit-up stocks, with expectations of recovering demand and tightening supply [5] - Large consumer stocks also saw significant interest due to policy support and demand recovery [5] Limit-Up Stock List - 25 stocks reached a near one-year high among limit-up stocks, indicating significant breakout trends [6] - Notable stocks include Yunkang Energy, Shandong Molong, and Shenzhen Energy, among others [6][7] Main Capital Inflows - The top 5 stocks with the highest net inflows of main capital included China Nuclear Engineering, Shengxin Lithium Energy, and Keda Technology [8] - The stocks with the highest net inflow as a percentage of market capitalization included Jianfa Zhixin and Xinbo Shares, indicating strong capital interest [8] Limit-Up Stock Funding - The top 5 stocks with the highest funding for limit-up included Zhujiang Piano and Yingxin Development, suggesting strong market interest [9] - A total of 49 stocks made their first limit-up today, with 3 stocks achieving a second consecutive limit-up [9]

【财经早晚报】92号汽油或重返6元时代;华为今日发布鸿蒙操作系统6;国际现货黄金创12年来最大单日跌幅

Sou Hu Cai Jing· 2025-10-22 08:52

Group 1: Macroeconomic News - The price of 92-octane gasoline may return to the 6 yuan era, marking a four-year low, with a projected decrease of 320 yuan/ton, translating to a drop of 0.24 to 0.27 yuan per liter [2] - The current average price of 92-octane gasoline is 7.04 yuan/liter, expected to fall to a range of 6.77 to 6.80 yuan/liter after the adjustment [2] Group 2: Satellite and Space Technology - The first "Xiong'an-made" satellite, "Xiong'an No. 1," has completed production, marking a significant milestone in the intelligent manufacturing capabilities of the aerospace industry in Xiong'an New Area [2] - The satellite focuses on three key technological innovations: high-performance onboard computers, large flexible solar wings, and a new generation of Hall electric propulsion systems [2] Group 3: Pharmaceutical Industry - The first AI-assisted new drug MTS-004 has successfully completed Phase III clinical trials, becoming the first of its kind in China [3] - MTS-004 is designed for treating Pseudobulbar Affect (PBA) and addresses common swallowing difficulties with an orally disintegrating tablet formulation [3] Group 4: Technology and Innovation - Guangzhou has introduced a systematic action plan to accelerate the development of future industries, focusing on a dynamic development system that includes six core industries and multiple potential tracks [5] - The plan emphasizes continuous monitoring, technology sourcing, scenario-driven development, and collaborative governance to foster innovation [5] Group 5: Market Movements - The Hang Seng Technology Index fell by 2.12%, with major tech stocks experiencing declines, including NetEase down over 5% and Baidu and Alibaba down nearly 3% [5] - International spot gold prices saw a significant drop, with a one-day decline exceeding 6%, marking the largest drop in 12 years [5][6] Group 6: Corporate Developments - Cambrian Technology saw a surge of over 7%, with its market capitalization returning above 600 billion yuan, driven by positive sentiment in the computing chip sector [7] - Huawei announced the release of HarmonyOS 6, with over 23 million terminal devices now using HarmonyOS, highlighting significant user engagement and ecosystem development [8] - Yushun Technology received a patent for a robot joint control method based on motion capture technology, enhancing human-robot interaction capabilities [8] Group 7: Apple Inc. Developments - Apple's large foldable iPad project faces engineering challenges, potentially delaying its launch to 2029 or later due to issues with weight, functionality, and display technology [9]