存储芯片

Search documents

半导体与半导体生产设备行业周报、月报:长鑫向客户供样HBM3,英特尔晶圆代工业务亏损收窄-20251027

Guoyuan Securities· 2025-10-27 08:20

Investment Rating - The report maintains a "Recommended" investment rating for the semiconductor and semiconductor equipment industry [5] Core Insights - The overseas AI chip index increased by 1.58% this week, with AMD rising by 8.5% and Marvell declining by 4.3% [1] - The domestic AI chip index surged by 12.8%, with all constituent stocks showing gains, particularly Cambricon, which rose over 20% [1] - Intel's Q3 2025 revenue reached $13.65 billion, a 3% year-on-year increase, with a net profit of $4.1 billion, marking a return to profitability despite a $2.3 billion loss in its wafer foundry business [3] - The global smartphone market saw a 2% year-on-year increase in shipments in the first half of 2025, with ODM-designed smartphones accounting for 43% of total shipments, the highest since 2019 [2][27] Market Indices Summary - The overseas chip index rose by 1.58% this week, while the domestic A-share chip index increased by 12.8% [10] - The Nvidia mapping index increased by 12.7%, with Shenghong Technology leading with a 19.1% rise [10] - The storage chip index saw a 14.4% increase, with Shannong Chip and Purun shares rising by 26.9% [15] - The power semiconductor index rose by 2.4%, while the A-share Apple index increased by 12.1% [16] Industry Data Summary - In Q3 2025, China's smartphone shipments fell to 66.6 million units, a 7.7% quarter-on-quarter decline, but are expected to rebound to 76.9 million units in Q4, a 15.4% increase [25][26] - The global smartphone ODM market is dominated by companies like Luxshare Precision, which has strengthened its position through the integration of Wentech's business [27] Major Events Summary - Intel's Q3 2025 report showed a significant recovery, with a notable narrowing of losses in its wafer foundry segment [3][31] - Longxin Storage has provided customers with samples of HBM3, preparing for mass production in 2026 [31] - Samsung's new generation 1c DRAM is nearing an 80% yield target, crucial for HBM4 production [33]

股市三点钟丨沪指收涨1.18%,剑指4000点!两市合计成交额2.34万亿元

Bei Jing Shang Bao· 2025-10-27 07:31

Core Points - A-shares experienced a collective rise with the Shanghai Composite Index reaching a new high, closing at 3996.94 points, just below the 4000-point mark, marking the highest level in over a decade [1] - The Shenzhen Component Index and the ChiNext Index also saw gains, closing at 13489.4 points and 3234.45 points respectively, with increases of 1.51% and 1.98% [1] - The high-bandwidth memory sector led the market, with significant gains in storage chip stocks, including Jiangbolong rising over 19% and several stocks like Daway and Zhaoyi Innovation hitting the daily limit [1] Market Activity - A total of 3361 stocks in the A-share market closed in the green, with 63 stocks hitting the daily limit, while 1862 stocks closed in the red, including 15 stocks that hit the lower limit [2] - The trading volume was substantial, with the Shanghai Stock Exchange recording a turnover of 10,434.04 billion yuan and the Shenzhen Stock Exchange 12,967.27 billion yuan, leading to a combined turnover of 23.4 trillion yuan, indicating a significant increase compared to the previous trading day [2]

汇成股份涨3.28%,成交额13.85亿元,后市是否有机会?

Xin Lang Cai Jing· 2025-10-27 07:31

Core Viewpoint - The company, Hefei Xinhui Microelectronics Co., Ltd., is experiencing growth in its advanced packaging and testing services for integrated circuits, particularly in the context of increasing demand for storage chips and OLED technology, benefiting from the depreciation of the RMB [2][4]. Company Overview - Hefei Xinhui Microelectronics Co., Ltd. specializes in high-end advanced packaging and testing services for integrated circuits, with its main products being integrated circuit packaging and testing [3][8]. - The company was established on December 18, 2015, and went public on August 18, 2022. Its revenue composition includes 90.25% from display driver chip testing and 9.75% from other services [8]. Financial Performance - For the first half of 2025, the company achieved a revenue of 866 million yuan, representing a year-on-year growth of 28.58%, and a net profit attributable to shareholders of 96.04 million yuan, up 60.94% year-on-year [9]. - As of June 30, 2025, the company had a total of 20,300 shareholders, with an average of 28,512 circulating shares per person, reflecting a slight increase in shareholding concentration [9]. Market Position and Strategic Moves - The company has made significant investments, acquiring a 27.5445% stake in Hefei Xinfeng Technology Co., Ltd., and forming a strategic partnership with East China Technology (Suzhou) Co., Ltd. to expand into the 3D DRAM storage chip testing market [2]. - The company’s overseas revenue accounted for 54.15% of total revenue, benefiting from the depreciation of the RMB [4]. Technical Analysis - The average trading cost of the company's shares is 16.72 yuan, with the stock price currently fluctuating between resistance at 19.61 yuan and support at 15.00 yuan, indicating potential for range trading [7].

收盘丨沪指放量涨超1%逼近4000点 存储芯片概念持续爆发

Di Yi Cai Jing· 2025-10-27 07:30

Market Performance - The three major A-share indices experienced a rebound, with the Shanghai Composite Index rising by 1.18% to close at 3996.94 points, reaching a peak of 3999.07 points during the session [1][2] - The Shenzhen Component Index increased by 1.51% to 13489.40 points, while the ChiNext Index rose by 1.98% to 3234.45 points [2] Sector Performance - The storage chip sector saw a significant surge, with stocks like Zhaoyi Innovation hitting the daily limit, alongside strong performances from companies such as Daway Technology and China Electronics Port [2] - Other active sectors included consumer electronics, CPO, circuit boards, rare earths, nuclear fusion, and coal stocks, while gaming, Hainan, and oil and gas sectors faced declines [2] Capital Flow - Main capital inflows were observed in the communication, non-ferrous metals, and public utilities sectors, while there were outflows from battery, banking, and gaming sectors [4] - Notable net inflows were recorded for Industrial Fulian, Shenghong Technology, and Hengbao Co., with net inflows of 1.768 billion, 1.016 billion, and 867 million respectively [5] Institutional Insights - According to Caitong Securities, the Shanghai Composite Index's approach to the 4000-point mark signifies a new, more dynamic phase for the market, driven by policy and restored confidence, although sustained upward momentum requires solid economic fundamentals and improved corporate earnings [6] - Qianhai Rongyue Asset Management suggests that the next resistance level for the Shanghai Composite Index may be around 4100 points [7] - Guocheng Investment indicates that the market's upward trend should be monitored for resistance near 4200 points on the Shanghai Composite Index [8]

A股,冲刺!

Zhong Guo Ji Jin Bao· 2025-10-27 05:07

Market Overview - The A-share market opened positively on October 27, with major indices closing higher: Shanghai Composite Index up 1.04%, Shenzhen Component Index up 1.26%, and ChiNext Index up 1.54%, approaching the 4000-point mark [1][3] - The total market turnover reached 1.58 trillion yuan, showing a significant increase compared to the previous day, with over 3700 stocks rising [3] Sector Performance - Key sectors that performed well included telecommunications, steel, non-ferrous metals, and electronics, with notable gains in controllable nuclear fusion, Fujian local stocks, and storage chips [3][7] - The non-ferrous metals sector was particularly active, with stocks like Antai Technology and Xiamen Tungsten hitting the daily limit, while other companies like Dongfang Tantalum and Zhongtung High-tech also saw significant increases [10][12] Notable Stocks - In the Hong Kong market, Baidu Group led the gains with a rise of over 5%, contributing to a 1.02% increase in the Hang Seng Index [3][4] - Fujian local stocks saw a collective surge, with Haixia Innovation hitting the daily limit and other stocks like Fujian Cement and Zhangzhou Development also performing strongly [7][8] Upcoming Events - The 2025 Financial Street Forum is set to open in the afternoon of October 27, with key financial leaders expected to deliver speeches, which has generated market anticipation for potential policy announcements [5][6] Strategic Insights - Recent signals of easing tensions in US-China relations and the release of the "14th Five-Year Plan" are expected to enhance market risk appetite and provide a clearer growth path for A-shares through technological breakthroughs and industrial upgrades [4][6]

A股突发,A50直线猛拉,发生了什么?

Zheng Quan Shi Bao· 2025-10-27 03:35

Core Viewpoint - The A-share and Hong Kong stock markets experienced a significant rally, with the Shanghai Composite Index nearing 4000 points, driven by positive developments in China-US trade talks and favorable macroeconomic data [1][6]. Market Performance - A-shares showed strong performance with the Shanghai Composite Index rising by 0.8%, Shenzhen Component by 0.77%, and ChiNext by 0.84% [3]. - Key sectors such as photolithography, storage chips, and computing hardware saw substantial gains, with companies like New Yisheng and Zhongji Xuchuang reaching historical highs [3]. - The Hong Kong market also rose, with the Hang Seng Index up by 0.89% and the Hang Seng Tech Index by 1.1%, led by strong performances from tech stocks and pharmaceuticals [3]. Economic Data - The National Bureau of Statistics reported that profits of industrial enterprises above designated size increased by 21.6% year-on-year in September, up from 20.4% in the previous month [6][7]. - For the first nine months of the year, total profits reached 53,732 billion yuan, reflecting a year-on-year growth of 3.2% [6]. Sector Insights - The equipment manufacturing sector showed robust support, with profits growing by 9.4% year-on-year, significantly above the overall industrial average [7]. - High-tech manufacturing also demonstrated strong growth, with a profit increase of 26.8% in September, contributing to the overall profit growth of industrial enterprises [7]. Future Outlook - Multiple brokerage firms anticipate that the market will maintain a strong performance in the short term, supported by new policy deployments and expectations of further interest rate cuts by the Federal Reserve [9][10]. - The "14th Five-Year Plan" is expected to provide a clear growth path for A-shares through technological breakthroughs and industrial upgrades [9]. - The overall positive feedback effect in the market is expected to continue, with an influx of incremental capital and wealth effects anticipated [10].

A股突发,中字头、券商股异动拉升

Zheng Quan Shi Bao· 2025-10-27 02:50

Market Overview - On October 27, A-shares opened higher across the board, with notable gains in sectors such as communication equipment, semiconductors, CPO concepts, components, and electrical equipment [1] - Conversely, sectors like coal, banking, oil, and hotel catering experienced declines [1] Stock Performance - The stock of Xiangcai Co. (600095) saw a significant increase, reaching a peak of 14.57, marking a rise of 9.41% [2] - Securities stocks experienced a surge, with Xiangcai Co. hitting the limit up, and other securities firms like CITIC Securities, Dongxing Securities, GF Securities, and Guosen Securities also rising [3] Hong Kong Market - The Hang Seng Index and Hang Seng Tech Index both opened higher, with tech stocks continuing to rise; Alibaba increased by nearly 3% and Tencent by nearly 2% [4] - Pharmaceutical stocks rebounded, with WuXi AppTec rising by nearly 6%, and precious metals and other sectors saw broad gains, with Luoyang Molybdenum rising over 7% [4] Emerging Concepts - The controllable nuclear fusion concept stocks showed strong fluctuations, with Dongfang Tantalum rising for two consecutive days, and companies like Nuwai Co. and Anhui Instrument Technology hitting the limit up [6] - The Central Committee's proposal for the 15th Five-Year Plan emphasizes the development of future industries, including nuclear fusion energy, as a new economic growth point [8] Computing and Storage - Computing hardware stocks were active, with Dongtian Microelectronics rising over 16% and Shijia Photon increasing over 13% [9] - The storage chip sector was also lively, with Puran Co. surging by 10% to reach a new high, driven by major suppliers like Samsung and SK Hynix adjusting prices by up to 30% to meet the rising demand for AI-driven storage chips [10] Quantum Technology - Quantum technology stocks saw rapid growth, with Dahua Intelligent hitting three consecutive limits up, and companies like Geer Software and Keda Guochuang also rising [12] - Reports indicated that Google's quantum AI lab achieved a verifiable quantum advantage with its "Willow" chip, while China's telecom quantum research institute made breakthroughs in quantum communication [14] Lithium and Other Concepts - Lithium mining stocks rose, with Fangyuan Co. increasing over 12%, alongside other companies like Xinxinda and Guoxuan High-Tech showing significant gains [12] - The photoresist concept stocks opened significantly higher, with Tongcheng New Materials hitting the limit up and other companies like Aisen Co. and Jingrui Electric Materials rising over 10% [12]

创业板指涨逾2% 光刻机、存储芯片等大涨

Zheng Quan Shi Bao Wang· 2025-10-27 02:12

Core Viewpoint - The ChiNext Index rose over 2% on October 27, driven by significant gains in sectors such as photolithography machines, CPO concepts, storage chips, and lithium mining [1] Group 1 - The ChiNext Index experienced a notable increase of over 2% [1] - Key sectors contributing to this rise include photolithography machines, CPO concepts, storage chips, and lithium mining [1]

A股市场大势研判:沪指再创十年新高

Dongguan Securities· 2025-10-26 23:31

Market Performance - The Shanghai Composite Index closed at 3950.31, up by 0.71% with an increase of 27.90 points [2] - The Shenzhen Component Index rose by 2.02%, closing at 13289.18, with an increase of 263.74 points [2] - The ChiNext Index increased by 3.57%, closing at 3171.57, with an increase of 109.41 points [2] - The STAR 50 Index saw a rise of 4.35%, closing at 1462.22, with an increase of 60.97 points [2] Sector Performance - The top-performing sectors included Communication (up 4.73%), Electronics (up 4.72%), and Defense Industry (up 2.34%) [3] - The underperforming sectors were Oil & Petrochemicals (down 1.36%), Coal (down 1.29%), and Food & Beverage (down 1.18%) [3] - Concept sectors showing strong performance included Storage Chips (up 5.66%) and National Fund Holdings (up 4.88%) [3] Market Outlook - The market experienced significant volume increase, with the Shanghai Composite Index reaching a ten-year high, and the ChiNext Index rising over 3% [4] - Positive policy signals from the 20th Central Committee's Fourth Plenary Session are expected to reshape investment themes and boost market risk appetite [6] - Continued focus on dividend assets, technology growth, new energy, and non-ferrous metals is recommended [6]

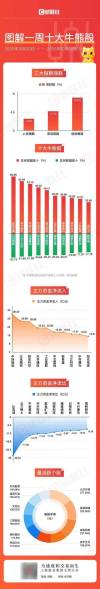

图解牛熊股存储芯片概念涨幅居前,CPO概念股异动拉升

Sou Hu Cai Jing· 2025-10-26 06:39

Market Performance - The three major A-share indices rebounded this week, with the Shanghai Composite Index rising by 2.88%, the Shenzhen Component Index by 4.73%, and the ChiNext Index by 8.05% [1] - The semiconductor, consumer electronics, and components sectors saw significant gains, particularly in storage chips, CPO, and PCB concept stocks [1] Storage Chip Sector - The storage chip concept experienced notable growth, with Yingxin Development rising by 60.98% and Yunhan Chip City by 40.55% this week [1] - Samsung Electronics and SK Hynix announced a price increase of up to 30% for storage products, including DRAM and NAND [1] - Morgan Stanley predicts a "super cycle" for the memory chip industry due to potential supply-demand imbalances in the storage sector next year [1] CPO Concept Stocks - CPO concept stocks also saw significant increases, with Yuanjie Technology rising by 38.00% and Zhongji Xuchuang by 32.23% [1] - Broadcom and Meta announced successful long-term testing of their co-packaged optical technology (CPO), achieving continuous operation for 1 million hours in a 400G test [1] - The demand for high-speed optical modules for data center interconnects has surged due to the "arms race" in computing infrastructure driven by large models, with speeds rapidly evolving from 400G to 800G [1] Capital Flow - Major net inflows of capital were observed in stocks such as Zhongji Xuchuang, Luxshare Precision, and Shenghong Technology, each exceeding 2 billion yuan [2] - Conversely, significant net outflows were noted in stocks like BYD, Northern Rare Earth, and Zijin Mining, each exceeding 1 billion yuan [2]