AI算力产业链

Search documents

储能龙头,历史新高!市值站上4000亿元

Zhong Guo Zheng Quan Bao· 2025-10-30 04:31

Market Performance - The market's profit effect is concentrated in the new energy sector, with wind power equipment, energy metals, and solid-state batteries rising. Leading stock Yangguang Electric (300274) increased by 3.72%, reaching a historical high with a market capitalization of 411.78 billion yuan [1] - Other leading stocks such as Longi Green Energy (601012), CATL (300750), Huayou Cobalt (603799), Tianci Materials (002709), and Goldwind Technology (002202) also saw increases [1] - The Shanghai Composite Index rose by 0.06%, while the Shenzhen Component Index and the ChiNext Index fell by 0.02% and 0.23%, respectively [1] White Wine Sector - The white wine sector rebounded, with stocks like Yingjia Gongjiu (603198), Yanghe Brewery (002304), and Shanxi Fenjiu (600809) rising, while Kweichow Moutai (600519) slightly decreased by 0.16% [2] - Kweichow Moutai reported a total revenue of 130.90 billion yuan for the first three quarters of 2023, a year-on-year increase of 6.32%, and a net profit of 64.63 billion yuan, also up 6.25% [4] - The third quarter revenue for Kweichow Moutai was 39.06 billion yuan, with a growth of 0.56%, and a net profit of 19.22 billion yuan, growing by 0.48% [4] - Guizhou Moutai is expected to enhance shareholder returns through dividends and buybacks, with a potential increase in the dividend rate this year [4] Computing Power Industry - Nvidia's stock rose nearly 3%, reaching a market capitalization of 5.03 trillion yuan, becoming the first company to exceed this valuation [6] - Despite Nvidia's performance, the computing power industry did not see a corresponding rise, with sectors like optical modules, PCB, and liquid cooling servers declining [6] - Newyi Sheng (300502) reported a revenue of 16.51 billion yuan for the first three quarters, a year-on-year increase of 221.70%, and a net profit of 6.33 billion yuan, up 284.37% [9] - Tianfu Communication (300394) experienced a drop of over 9%, with a revenue of 3.92 billion yuan for the first three quarters, a growth of 63.63%, and a net profit of 1.47 billion yuan, up 50.07% [9] - Industrial Fulian (601138) saw a revenue of 603.93 billion yuan for the first three quarters, a year-on-year increase of 38.40%, and a net profit of 22.49 billion yuan, up 48.52% [9] Analyst Insights - Analysts from Huatai Securities have raised revenue and earnings forecasts for Newyi Sheng, anticipating growth from new optical module products [10] - Research firms including Guojin Securities and Huatai Securities are optimistic about Industrial Fulian's future, citing strong overseas demand and potential profit growth [10]

通信相关ETF领涨,机构:光模块需求持续上调丨ETF基金日报

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-28 02:45

Market Overview - The Shanghai Composite Index rose by 1.18% to close at 3996.94 points, with a daily high of 3999.07 points [1] - The Shenzhen Component Index increased by 1.51% to close at 13489.4 points, reaching a high of 13510.71 points [1] - The ChiNext Index saw a rise of 1.98%, closing at 3234.45 points, with a peak of 3241.95 points [1] ETF Market Performance - The median return for stock ETFs was 1.27%, with the highest return from the E Fund CSI 500 Enhanced Strategy ETF at 2.81% [2] - The Southern CSI 500 Information Technology ETF had the highest return among industry index ETFs at 3.61% [2] - The highest return in thematic ETFs was from the Huaxia CSI 5G Communication Theme ETF at 5.07% [2] ETF Gain and Loss Rankings - The top three performing ETFs were: - Huaxia CSI 5G Communication Theme ETF (5.07%) - Yinhua CSI 5G Communication Theme ETF (5.01%) - Bosera CSI 5G Industry 50 ETF (4.88%) [4] - The ETFs with the largest declines included: - Huaxia CSI Animation Game ETF (-1.77%) - Huatai-PB CSI Animation Game ETF (-1.57%) - Guotai Junan CSI Animation Game ETF (-1.51%) [4] ETF Fund Flows - The top three ETFs with the highest inflows were: - Huaxia Shanghai Stock Exchange Sci-Tech Innovation Board 50 ETF (inflow of 984 million yuan) - Guolian An CSI All-Index Semiconductor Products and Equipment ETF (inflow of 618 million yuan) - Huaxia CSI A500 ETF (inflow of 551 million yuan) [6] - The ETFs with the largest outflows included: - Huatai-PB CSI 300 ETF (outflow of 581 million yuan) - Bosera CSI Chengdu Economic Circle ETF (outflow of 527 million yuan) - GF ChiNext ETF (outflow of 487 million yuan) [6] ETF Margin Trading Overview - The top three ETFs by margin buying were: - Huaxia Shanghai Stock Exchange Sci-Tech Innovation Board 50 ETF (855 million yuan) - Guotai Junan CSI All-Index Securities Company ETF (795 million yuan) - E Fund ChiNext ETF (561 million yuan) [8] - The ETFs with the highest margin selling included: - Southern CSI 500 ETF (71.43 million yuan) - Huatai-PB CSI 300 ETF (28.52 million yuan) - Southern CSI 1000 ETF (18.36 million yuan) [8] Institutional Insights - Industrial chain research indicates a continuous increase in demand for 1.6T optical modules, with overseas clients raising their procurement plans for 2026 from 10 million to 20 million units due to the rapid growth in AI training and inference network bandwidth needs [9] - Guojin Securities expresses optimism regarding AI demand, recommending focus on companies benefiting from the AI computing power supply chain, particularly in AI-PCB and core hardware sectors [10][11]

10月16日A股早评:今日观察要点,板块轮动加速,三条主线浮出水面

Sou Hu Cai Jing· 2025-10-16 16:48

Group 1 - The A-share market experienced a significant afternoon reversal, with the Shanghai Composite Index closing at 3912.21 points, up 1.22% for the day [1][3] - The index is approaching a critical breakout level, nearing the previous high of 3918.44 points, with short-term trends appearing strong as indicated by the MACD returning above the zero line [3] - However, there is a concern regarding trading volume, as the market's rise was accompanied by a significant decrease in transaction volume, which could limit upward momentum if not addressed [4] Group 2 - The ChiNext and STAR Market indices showed weaker performance compared to the Shanghai Composite, with the ChiNext exhibiting signs of reduced downward pressure but not yet breaking above the zero line [6] - The current market environment is characterized by clear sector differentiation, with capital showing a rotation between high and low-performing sectors [8] - The new energy and technology sectors, particularly in areas like controlled nuclear fusion and quantum communication, continue to show potential for growth, while the semiconductor sector is stabilizing after recent adjustments [8][9] Group 3 - The overall market liquidity remains positive, with the margin trading balance reaching a historical high of 24,469 billion yuan as of October 14, and new A-share accounts increasing by 60.73% year-on-year [9] - External factors, such as the anticipated interest rate cuts by the Federal Reserve, are providing support to the market, with the likelihood of a rate cut approaching 100% for the upcoming FOMC meeting [9] - Investors are advised to avoid blind chasing of high prices and instead look for opportunities to buy on dips, particularly focusing on volume changes and the movement of northbound capital as indicators of market sentiment [9][10]

创业板ETF(159915)标的指数收涨0.4%,机构称三季度AI算力产业链公司业绩趋势向上

Sou Hu Cai Jing· 2025-10-16 13:07

截至收盘,创业板成长指数上涨0.5%,创业板指数上涨0.4%,创业板中盘200指数下跌1.5%,创业板ETF(159915)全天成交额超45亿元。 财通证券研报称,电子板块三季度业绩趋势保持向上,结构特征明显,其中AI算力产业链相关标的业绩增速高于行业平均,传统下游及周期品等方向业绩 增长相对平稳。展望2025年,机构预计AI需求景气延续,有望继续支撑产业链公司业绩维持较好增长态势。 每日经济新闻 ...

稀土管制风起之时 阿斯麦(ASML.US)顽强托起“AI牛市叙事”

Zhi Tong Cai Jing· 2025-10-15 12:13

(原标题:稀土管制风起之时 阿斯麦(ASML.US)顽强托起"AI牛市叙事") 智通财经APP获悉,光刻机巨头阿斯麦(ASML Holding NV)公布的最新业绩显示Q3光刻机订单超市场预 期,且在史无前例的全球AI热潮催化之下,AI基础设施军备竞赛仍然如火如荼,该公司管理层对于稀 土管制影响以及2026年至2030年的业绩增长预期呈现乐观立场。阿斯麦首席财务官(CFO)表示,该公司 已经为中国限制稀土产品以及相关技术与设备出口的政策做足准备工作。 随着股市财报季开幕,阿斯麦这份亮眼业绩无疑大幅强化全球股票市场的"AI长期牛市"叙事逻辑以及 科技股信徒们的"AI投资信仰",这也意味着英伟达、台积电、博通以及美光科技所主导的全球AI算力 产业链的这轮"超级牛市行情"远未停歇,该产业链在未来一段时间仍将是全球资金最青睐的投资板块。 阿斯麦业绩出炉之后,阿斯麦美股ADR(ASML.US)盘前闻讯涨超4%,欧股市场涨幅类似。 最新业绩显示,阿斯麦第三季度订单累计54亿欧元,高于市场普遍预期的49亿欧元,其中极紫外光刻机 (即EUV)的订单量创下近七个季度以来的最高水平;阿斯麦首席执行官(CEO)富凯(Christo ...

科技股午后多线发力,创业板ETF广发(159952)反转收涨2.35%,近7天获得连续资金净流入近6亿元

Xin Lang Cai Jing· 2025-10-15 08:36

Group 1 - The A-share market showed a collective rise on October 15, 2025, with the ChiNext Index increasing by 2.36%, driven by a rebound in technology stocks and significant activity in sectors like robotics, consumer electronics, and pharmaceuticals [1] - Shenwan Hongyuan Securities noted that the technology industry will continue to see more catalysts compared to cyclical sectors before spring 2026, suggesting a prolonged trend in technology growth [1] - Longjiang Securities expressed optimism about the AI computing power industry, highlighting that leading companies in the optical module sector have a significant upside in valuation compared to historical peaks [1] Group 2 - Chinese photovoltaic companies have recently secured nearly 25 GW of overseas orders since September, showcasing strong performance in international markets [2] - The National Development and Reform Commission and the State Administration for Market Regulation have issued guidelines to combat price disorder in the photovoltaic industry, which is expected to support domestic prices for components and wind turbines [2] - Zhongyuan Securities anticipates a rebound in earnings growth across most industries in the upcoming Q3 reports, driven by low base effects from the previous year, which will bolster market confidence [2] Group 3 - As of October 15, 2025, the ChiNext ETF (159952) rose by 2.35%, with a notable increase of over 37% in the past three months [3] - The top ten weighted stocks in the ChiNext Index account for 57.49% of the index, with significant gains from companies like Longying Precision and Xunwei Communication [3] - The ChiNext ETF has seen a net inflow of 580 million yuan over the past week, indicating strong investor interest [3] Group 4 - The ChiNext ETF closely tracks the ChiNext Index, consisting of 100 stocks with high market capitalization and liquidity, focusing on strategic emerging industries such as power equipment and biomedicine [4]

当微软“AI信仰”撞上数据中心物理边界:AI大浪潮之下的“算力饥荒”愈演愈烈

Zhi Tong Cai Jing· 2025-10-10 00:28

Core Insights - Microsoft is facing a prolonged data center supply shortage, likely extending until 2026, which is longer than previously anticipated by management [1][4] - The demand for AI computing power continues to surge, with global AI startups raising a record $192.7 billion, indicating a fierce competition in the AI sector [1] - Major cloud providers, including Microsoft, Amazon, and Google, are struggling with supply constraints for high-performance AI servers and traditional cloud computing servers [2][3] Group 1: Data Center Supply Constraints - Microsoft’s internal forecasts indicate that new Azure subscriptions in key regions like Northern Virginia and Texas will be limited until mid-2026 due to severe shortages [2][4] - The shortage affects both AI GPU-based servers and traditional CPU-based cloud computing services, impacting Microsoft's Azure platform, which is projected to generate over $75 billion in revenue for FY2025 [3][6] - The ongoing supply constraints are attributed to the rapid expansion of AI infrastructure investments, which are driving the demand for new data centers [3][9] Group 2: Competitive Landscape and Market Dynamics - Microsoft, along with its competitors, has consistently reported an inability to meet all customer demands for cloud computing and AI capabilities over the past six quarters [6] - The AI infrastructure investment wave is expected to reach $2 trillion to $3 trillion, driven by unprecedented demand for AI computing resources [10] - Analysts have raised their forecasts for AI infrastructure spending among major tech companies, projecting a rise from $420 billion in 2026 to $490 billion [14]

AI“烧钱浪潮”仍然汹涌! AI初创公司创纪录吞下1927亿美元 算力产业链继续高歌猛进

智通财经网· 2025-10-03 09:01

Core Insights - The global venture capital (VC) investment in AI startups has reached approximately $192.7 billion in 2023, setting a new record and indicating a strong trend towards AI investment, with expectations that over half of VC funds will flow into AI-related sectors by 2025 [1][4][5] - The majority of VC funding is concentrated in large, established AI companies like Anthropic and xAI, while lesser-known startups, particularly those not focused on AI, are struggling to secure funding [2][4] - The AI infrastructure investment led by major tech giants is accelerating, contributing to a bullish market for AI-related stocks, as evidenced by record-high stock prices for companies like NVIDIA, TSMC, and Broadcom [2][3][7] Investment Trends - In the most recent quarter, AI startups received 62.7% of VC funding in the U.S. and 53.2% globally, highlighting a significant preference for AI investments [4][5] - Despite the overall VC investment totaling $366.8 billion in 2023, the number of companies receiving funding is on track to hit a multi-year low, indicating a challenging environment for non-AI startups [5][6] - The AI investment landscape is characterized by a stark divide, with a clear preference for leading AI companies over others, as noted by PitchBook's research [4][6] Market Dynamics - The demand for AI computing power is expected to grow exponentially, driven by the needs of generative AI applications and AI agents, which will support a long-term bullish narrative for AI infrastructure [3][7] - Major tech companies are planning substantial investments in AI infrastructure, with OpenAI's CEO indicating plans to invest trillions in core AI resources, and Meta's CEO announcing a commitment of at least $600 billion by 2028 [6][7] - Analysts predict that the ongoing AI infrastructure investment wave could reach between $2 trillion to $3 trillion, with NVIDIA's CEO forecasting that AI infrastructure spending could hit $3 trillion to $4 trillion by 2030 [7][8] Future Projections - Citigroup has raised its forecasts for AI infrastructure spending by major tech companies, projecting an increase from $420 billion in 2026 to $490 billion, and from $2.3 trillion to $2.8 trillion by 2029 [8] - The global demand for AI computing power is expected to add 55 gigawatts of power capacity by 2030, translating to an estimated $2.8 trillion in AI-related spending, with the U.S. market accounting for $1.4 trillion [8]

调研速递|大族数控接受超50家机构调研,宝盈基金在列,聚焦经营与行业趋势

Xin Lang Cai Jing· 2025-09-30 09:43

Core Viewpoint - Shenzhen Dazhu CNC Technology Co., Ltd. has attracted over 50 institutional investors for research activities, focusing on the company's operational status, core competitiveness, and PCB industry trends during September 2025 [1][2]. Group 1: Company Performance - In the first half of 2025, the company achieved significant operational results, with revenue reaching 2.38183 billion yuan, a year-on-year increase of 52.26%, and a net profit of 263.27 million yuan, up 83.82% year-on-year [3]. - The company capitalized on the growth of AI server high-layer boards and the increasing technical complexity, enhancing its competitiveness in automotive electronics and consumer electronics multilayer boards [3]. Group 2: Core Competitiveness - The company's core competitiveness lies in providing one-stop optimal processing solutions, enhancing product technology and customer service capabilities through multi-dimensional collaboration in PCB production [4]. Group 3: PCB Industry Trends - The PCB industry is expected to benefit from the strong demand for AI computing-related terminals, with Prismark forecasting a revenue growth of 7.6% and a production increase of 7.8% in 2025 [5]. - The compound annual growth rate (CAGR) for high-layer boards and HDI boards related to AI servers and switches is projected to be 22.1% and 17.7%, respectively, from 2024 to 2029 [5]. - By 2029, the global and domestic PCB industry scale is expected to approach 100 billion USD and 50 billion USD, respectively, with a long-term CAGR of 5.2% from 2024 to 2029 [5]. Group 4: HDI Market - The HDI board market is experiencing rapid growth and technological upgrades, with the company providing differentiated solutions to meet increasing performance and efficiency demands [6]. - The company's newly developed equipment has received industry recognition and orders, which is expected to drive rapid revenue growth in HDI-related equipment [6].

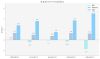

国泰海通:25H1通信行业盈利提速 算力板块表现亮眼

Zhi Tong Cai Jing· 2025-09-18 07:33

Core Insights - The communication industry experienced steady revenue growth and improved profitability in the first half of 2025, with total revenue reaching 17,850.03 billion yuan, a year-on-year increase of 10.07%, and net profit attributable to shareholders at 1,604.32 billion yuan, up 11.26% year-on-year [1][2]. Revenue and Profit Analysis - In Q2 2025, the communication industry continued to show robust growth, achieving revenue of 9,424.83 billion yuan, a year-on-year increase of 10.91%, and net profit attributable to shareholders of 986.82 billion yuan, up 12.33% year-on-year [2]. - The adjusted net profit after excluding non-recurring items for Q2 2025 was 912.62 billion yuan, reflecting a year-on-year growth of 12.94% [2]. Sector Performance - The top-performing sectors in terms of revenue growth in H1 2025 included optical modules, communication PCBs, network equipment manufacturers, IoT modules, and base station RF components [2]. - The sectors with the highest net profit growth in H1 2025 were optical modules, communication PCBs, network security and visualization analysis, IoT modules, and network equipment manufacturers [2]. Market Trends - The industry is currently underweight, with capital expenditure on computing power maintaining high growth. The domestic market is accelerating in line with global AI development trends, indicating significant upward potential for the communication industry [3]. - The AI computing power supply chain is expected to continue its rapid development in 2025, driven by evolving demand in inference, which will benefit the communication industry's related supply chain [3]. Recommended Stocks - Key stocks recommended include: - Optical Modules: Zhongji Xuchuang, Xinyi Sheng, Guangxun Technology, Huagong Technology, Dekeli [4]. - CPO/Silicon Photonics: Tianfu Communication, Shijia Photonics, Yuanjie Technology, Guangku Technology, Changguang Huaxin, Taicheng Light [4]. - PCB: Hudian Co., Shenzhen South Circuit [4]. - End-side: Guanghetong, ZTE Corporation [4]. - IDC/Liquid Cooling: Wangsu Technology, Aofei Data, Guanghuan New Network [5]. - Network Side: ZTE Corporation, Ruijie Networks, Unisplendour, Fenghuo Communication, Feiling Kesi [5]. - High-speed Copper Cables: Zhaolong Interconnect [5]. - Operators: China Mobile, China Telecom, China Unicom [5]. - Military Communication Related Stocks: Haige Communication, Qiyi Er, Changying Tong [5]. US Stock Recommendations - Related US stocks include Credo, MaxLinear, Arista Networks, Century Internet, Coherent, Lumentum, Broadcom, Marvell, AXT [6].