CPO概念

Search documents

滚动更新丨A股三大指数高开,光刻胶概念股集体大涨

Di Yi Cai Jing· 2025-10-27 01:35

Group 1 - The domestic market has made significant breakthroughs in the photolithography sector, leading to a collective surge in related concept stocks [1] - The storage chip sector continues to perform strongly, with companies like Shikong Technology, Dwei Co., and Yingxin Development hitting the daily limit up, while others like Puran Co. and Weice Technology rose over 10% [1][3] - The A-share market opened with all three major indices rising: Shanghai Composite Index up 0.48%, Shenzhen Component Index up 1.20%, and ChiNext Index up 1.75% [2][3] Group 2 - The Hong Kong market opened with the Hang Seng Index up 1.28% and the Hang Seng Tech Index up 2.06%, driven by gains in tech and pharmaceutical stocks [4][5] - WuXi AppTec saw a significant jump of 7% in its stock price after reporting third-quarter net profits that exceeded market expectations [4] - The central bank conducted a 7-day reverse repurchase operation of 337.3 billion yuan at an interest rate of 1.40%, with 189 billion yuan of reverse repos maturing today [5]

晓数点|一周个股动向:这只芯片股大涨超60% 五个行业获主力青睐

Di Yi Cai Jing Zi Xun· 2025-10-26 13:49

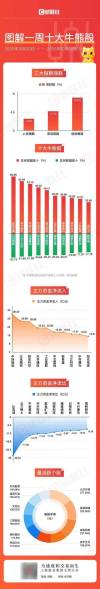

Market Performance - The three major indices rebounded this week, with the Shanghai Composite Index rising by 2.88%, the Shenzhen Component Index increasing by 4.73%, and the ChiNext Index gaining 8.05% [1][2]. - The semiconductor, consumer electronics, and components sectors showed significant gains, with CPO and PCB concept stocks performing actively [1]. Individual Stock Performance - A total of 18 stocks saw price increases exceeding 30%, with Yingxin Development rising over 60% and Yunhan Chip City increasing over 40% [3]. - The stocks with the highest weekly gains included Yingxin Development (60.98%), ShenKai Co. (55.94%), and Rongxin Culture (53.10%) [4]. - Conversely, 48 stocks experienced declines of over 10%, with Yitian Intelligent and *ST Yuancheng dropping more than 20% [3][4]. Trading Activity - 51 stocks had a turnover rate exceeding 100%, with Yunhan Chip City leading at 277.04% [5][6]. - The sectors with high turnover rates included electronics, machinery, pharmaceuticals, and petrochemicals [5]. Capital Flow - Major industries such as electronics, communications, and building materials saw net inflows exceeding 4 billion yuan, while the pharmaceutical sector faced the highest net outflow of 73.98 billion yuan [8][9]. - Notable stocks with significant net inflows included Zhongji Xuchuang (38.77 billion yuan) and Lixun Precision (31.41 billion yuan), while BYD faced a net outflow of 27.49 billion yuan [8][9]. Margin Trading - A total of 1,747 stocks received net margin purchases, with 105 stocks exceeding 100 million yuan in net purchases [11]. - Hanwujing-U topped the list with a net purchase of 27.66 billion yuan, followed by Shenghong Technology and Zhongji Xuchuang [11][12]. Institutional Research - 135 listed companies were researched by institutions, with Xinqianglian receiving the most attention from 189 institutions [13][15]. - The sectors of focus for institutional research included industrial machinery and electronic components [13]. New Institutional Interests - 53 stocks were newly favored by institutions, with six stocks receiving target prices [17][18]. - Notable mentions include LianTe Technology, which received a "Buy" rating with a target price of 107.37 yuan from Huatai Securities [17][18].

图解牛熊股存储芯片概念涨幅居前,CPO概念股异动拉升

Sou Hu Cai Jing· 2025-10-26 06:39

Market Performance - The three major A-share indices rebounded this week, with the Shanghai Composite Index rising by 2.88%, the Shenzhen Component Index by 4.73%, and the ChiNext Index by 8.05% [1] - The semiconductor, consumer electronics, and components sectors saw significant gains, particularly in storage chips, CPO, and PCB concept stocks [1] Storage Chip Sector - The storage chip concept experienced notable growth, with Yingxin Development rising by 60.98% and Yunhan Chip City by 40.55% this week [1] - Samsung Electronics and SK Hynix announced a price increase of up to 30% for storage products, including DRAM and NAND [1] - Morgan Stanley predicts a "super cycle" for the memory chip industry due to potential supply-demand imbalances in the storage sector next year [1] CPO Concept Stocks - CPO concept stocks also saw significant increases, with Yuanjie Technology rising by 38.00% and Zhongji Xuchuang by 32.23% [1] - Broadcom and Meta announced successful long-term testing of their co-packaged optical technology (CPO), achieving continuous operation for 1 million hours in a 400G test [1] - The demand for high-speed optical modules for data center interconnects has surged due to the "arms race" in computing infrastructure driven by large models, with speeds rapidly evolving from 400G to 800G [1] Capital Flow - Major net inflows of capital were observed in stocks such as Zhongji Xuchuang, Luxshare Precision, and Shenghong Technology, each exceeding 2 billion yuan [2] - Conversely, significant net outflows were noted in stocks like BYD, Northern Rare Earth, and Zijin Mining, each exceeding 1 billion yuan [2]

沪指再创十年新高 算力、芯片点燃科技股行情

Shang Hai Zheng Quan Bao· 2025-10-24 19:15

Core Viewpoint - The A-share market experienced significant gains, with the Shanghai Composite Index reaching a ten-year high, driven by strong performance in technology stocks, particularly in computing power and chip sectors [1][2]. Group 1: Market Performance - The Shanghai Composite Index closed at 3950.31 points, up 0.71%, while the Shenzhen Component rose by 2.02% to 13289.18 points, and the ChiNext Index increased by 3.57% to 3171.57 points [1]. - The total trading volume in the Shanghai and Shenzhen markets approached 2 trillion yuan, a substantial increase of 330.9 billion yuan compared to the previous trading day [1]. Group 2: Computing Power and Chip Sector - Computing power hardware stocks surged, with companies like Shengyi Technology and Fangzheng Technology hitting their daily limit of 20% increase, driven by strong earnings reports [2]. - Zhongji Xuchuang, a leader in optical modules, saw its stock price rise by 12.05%, reaching a historical high of 494 yuan per share, with a total market capitalization nearing 550 billion yuan [2]. - The optical communication industry anticipates a significant increase in CPO shipments starting from 2024, with a projected commercial launch in 2026-2027, primarily for large cloud service providers [2]. Group 3: Storage Chip Sector - The storage chip sector also performed well, with companies like Xiangnong Xinchuan and Purun Co. achieving a 20% increase in stock price [5]. - Major memory suppliers, including Samsung and SK Hynix, are expected to raise prices of DRAM and NAND products by up to 30% in Q4, driven by surging demand for AI-related storage chips [5]. - Analysts predict that the current cycle of rising storage prices will continue due to strong AI demand and limited overseas production capacity [5]. Group 4: Market Trends and Future Outlook - The market is experiencing rapid rotation of hot sectors, with technology stocks regaining strength after a period of focus on high-dividend assets like banks [6]. - Analysts suggest that the A-share market will continue to show a trend of upward movement, with a focus on technology sectors supported by strong earnings reports [6][7]. - There is an expectation of structural opportunities in the market, with a recommendation to balance investments between technology growth and dividend value [7].

10/24财经夜宵:得知基金净值排名及选基策略,赶紧告知大家

Sou Hu Cai Jing· 2025-10-24 15:56

Group 1 - The article provides a ranking of open-end funds based on their net asset value growth as of October 24, 2025, highlighting the top 10 funds with significant increases [2][4][7] - The top-performing funds include "东方阿尔法科技智选混合发起C" with a unit net value of 1.0531 and "永赢先锋半导体智选混合发起A" with a unit net value of 1.3162, indicating strong performance in the technology and semiconductor sectors [2][4] - Conversely, the bottom-performing funds include "招商中证煤炭等权指数A" with a unit net value of 2.1911, reflecting challenges in the coal sector [4][10] Group 2 - The article notes that as of October 24, 2025, a total of 29,066 funds have updated their net values, showcasing a competitive landscape in the fund market [3] - The market performance on the same day showed a rebound in the Shanghai Composite Index and the ChiNext Index, with a trading volume of 1.99 trillion, indicating overall positive market sentiment [7] - Leading sectors included semiconductors and communication equipment, with gains exceeding 4%, while sectors like liquor and real estate faced declines [7]

A股三大指数集体拉升,煤炭板块跳水

Zheng Quan Shi Bao· 2025-10-24 10:07

Market Performance - A-shares saw a collective rise in major indices, with the Shanghai Composite Index reaching a 10-year high, closing at 3950.31 points, up 0.71% [1] - The ChiNext Index surged over 3%, while the STAR 50 Index increased by more than 4% [1] - The total trading volume in the Shanghai and Shenzhen markets reached 199.18 billion yuan, an increase of over 33 billion yuan from the previous day [1] Sector Highlights - The semiconductor and chip sectors experienced significant gains, with stocks like Purun and Xiangnong Chip reaching their daily limit of 20% [1][4] - AI-related stocks, including CPO concept stocks, also saw substantial increases, with companies like Kexiang and Shengyi Electronics hitting their daily limit [9] - The satellite navigation sector rose sharply, with companies like China Satellite and Guanghe Technology reaching their daily limit [1] Coal Sector Decline - The coal sector faced a sharp decline, with companies like Antai Group and Yunmei Energy hitting their daily limit down [12][13] - Daya Energy saw a drop of over 6%, following a significant rise of nearly 150% in the previous 10 trading days [13][15] - Antai Group reported a cumulative increase of about 30% over the past six trading days, but warned of potential operational risks due to market volatility [15] Trading Volume Insights - Ten stocks in the A-share market had trading volumes exceeding 10 billion yuan, with Hanwujing and Zhongji Xuchuang leading at 23.4 billion yuan and 23.03 billion yuan respectively [2] - CITIC Securities recorded a trading volume of 8.89 billion yuan, with significant sell orders observed during the closing auction [2] Policy and Innovation Focus - The recent Central Committee meeting emphasized accelerating high-level technological self-reliance and innovation, aiming to enhance the national innovation system [6][7] - Key areas of focus include integrated circuits, advanced materials, and core technologies, which are expected to receive policy support during the 14th Five-Year Plan [7] CPO Technology Development - CPO (Co-Packaged Optics) technology is gaining traction, with expectations for commercial use between 2024 and 2025, and projected market revenue reaching $2.6 billion by 2033 [11] - Domestic companies like Zhongji Xuchuang and Xinyi Sheng are actively advancing CPO technology, alongside international players like Intel and Broadcom [11]

巨额压单!600030,尾盘突发

Zheng Quan Shi Bao· 2025-10-24 09:49

Market Overview - A-shares collectively surged on October 24, with the Shanghai Composite Index reaching a 10-year high, while the ChiNext Index and STAR 50 Index saw significant gains [1] - The Shanghai Composite Index closed up 0.71% at 3950.31 points, the Shenzhen Component Index rose 2.02% to 13289.18 points, and the ChiNext Index increased by 3.57% to 3171.57 points [1] Sector Performance - Over 3000 stocks in the market were in the green, with notable surges in the semiconductor and chip sectors, including companies like Purun Co. and Xiangnong Chip, which hit the 20% daily limit [2][4] - The AI industry chain stocks also saw collective gains, with companies like Kexiang Co. and Shengyi Electronics reaching the 20% limit [8] Notable Stock Movements - The stock of Chaoying Electronics, which debuted on the Shanghai main board, surged nearly 400%, closing at 84.99 yuan per share, with a peak of 99.77 yuan, resulting in a profit of over 41,000 yuan per share at the highest price [2] - The top two stocks by trading volume were Hanwujing and Zhongji Xuchuang, with transaction volumes of 234 billion yuan and 230.3 billion yuan, respectively [2] Coal Sector Decline - The coal sector experienced a significant drop, with companies like Antai Group and Yunmei Energy hitting the daily limit down, and Dayou Energy falling over 6% [11] - Antai Group's stock fell by 10.03% to 2.87 yuan, while Yunmei Energy dropped by 9.92% to 4.63 yuan [12] Policy and Economic Outlook - The recent meeting of the Communist Party emphasized accelerating high-level technological self-reliance and innovation, which is expected to enhance the overall effectiveness of the national innovation system [6][7] - The focus on "bottleneck" areas such as integrated circuits and advanced materials indicates a strategic push for technological advancement during the 14th Five-Year Plan period [7] CPO Technology Development - CPO (Co-Packaged Optics) technology is gaining traction, with expectations for commercial use starting in 2024-2025 and projected global port sales reaching 4.5 million by 2027 [10] - Domestic companies like Zhongji Xuchuang and Xinyi Sheng are actively advancing CPO technology, indicating a competitive landscape in this emerging field [10]

巨额压单!600030,尾盘突发

证券时报· 2025-10-24 09:40

Market Overview - A-shares experienced a collective surge on October 24, with the Shanghai Composite Index reaching a 10-year high, while the ChiNext Index and STAR 50 Index saw significant gains [1][4] - The Shanghai Composite Index closed up 0.71% at 3950.31 points, the Shenzhen Component Index rose 2.02% to 13289.18 points, and the ChiNext Index increased by 3.57% to 3171.57 points [1][4] - The total trading volume in the Shanghai and Shenzhen markets reached 199.18 billion yuan, an increase of over 33 billion yuan compared to the previous day [1] Sector Performance - The semiconductor and chip sectors saw explosive growth, with stocks like Purun Co. and Xiangnong Chip rising by 20% to hit the daily limit, while Jiangbolong surged over 16% [1][5] - AI-related stocks, including CPO concept stocks, also experienced significant gains, with Kexiang Co. and Shengyi Electronics both hitting the daily limit of 20% [1][10] - The satellite navigation sector emerged strongly, with companies like China Satellite and Guanghe Technology reaching their daily limits [1] Notable Stocks - The newly listed company, Chaoying Electronics, saw a dramatic increase of nearly 400%, closing at 84.99 yuan per share, with an intraday high of 99.77 yuan, resulting in a profit of over 41,000 yuan per share for investors [1] - Notably, the top two stocks by trading volume were Hanwujing and Zhongji Xuchuang, with transaction volumes of 23.4 billion yuan and 23.03 billion yuan, respectively [2] Coal Sector Decline - The coal sector faced a sharp decline, with companies like Antai Group and Yunmei Energy hitting their daily limit down, and Dayou Energy dropping over 6% [1][14] - Antai Group and other coal companies have faced significant losses, with Antai Group's net profit projected to be negative for the upcoming years [16] Policy and Future Outlook - The recent meeting of the Chinese Communist Party emphasized accelerating high-level technological self-reliance and innovation, which is expected to drive growth in advanced manufacturing and hard technology sectors [7][8] - The CPO (Co-Packaged Optics) technology is anticipated to enter commercial use between 2024 and 2025, with a projected market revenue of 2.6 billion USD by 2033, indicating strong future growth potential in the optical interconnect technology sector [12]

午后,寒武纪大涨

Shang Hai Zheng Quan Bao· 2025-10-24 08:04

Market Overview - The total trading volume in the Shanghai and Shenzhen markets approached 2 trillion yuan, a significant increase of 330.9 billion yuan compared to the previous trading day [2] - The top traded stock was Cambrian Technologies with a transaction volume of 23.403 billion yuan, followed by Zhongji Xuchuang, Xinyisheng, Shenghong Technology, and Sunshine Power with transaction volumes of 23.034 billion yuan, 19.93 billion yuan, 18.656 billion yuan, and 14.762 billion yuan respectively [2] Chip Sector Performance - The chip sector experienced a strong rally, with Cambrian Technologies seeing a surge of over 10%, closing at 1,525 yuan, marking a 9.01% increase [3][5] - Other notable performers included Huida Technology, Jiangbolong, Baiwei Storage, and Tuojing Technology, all rising over 10% [3] - The overall chip index rose by 5.12%, with significant gains from stocks like Jiangbolong (up 16.73%), Baiwei Storage (up 10.70%), and Tuojing Technology (up 10.55%) [4] Cambrian Technologies Financial Performance - Cambrian Technologies reported a revenue of 4.607 billion yuan for the first three quarters of 2025, a staggering year-on-year increase of 2,386.38%, with a net profit of 1.605 billion yuan compared to a loss in the previous year [8] - In Q3 2025 alone, the company achieved a revenue of 1.727 billion yuan, reflecting a year-on-year growth of 1,332.52%, and a net profit of 567 million yuan [8] - The company attributed its growth to continuous market expansion and support for artificial intelligence applications [8] Aerospace Sector Developments - The aerospace sector saw a significant rise following Elon Musk's first comments on the "Zhuque-3" rocket, which is expected to enhance China's reusable rocket capabilities [10] - Stocks in the aerospace sector surged, with Aerospace Zhizhuang hitting the daily limit, and other companies like Xice Testing and Aerospace Huanyu also seeing substantial gains [12] - The "Zhuque-3" rocket is designed for multiple reuses and aims to support various commercial launch scenarios, marking a significant advancement in China's space capabilities [14][15]

收评:创业板指大涨3.57%,半导体、芯片概念拉升,CPO概念等爆发

Zheng Quan Shi Bao Wang· 2025-10-24 07:45

Core Viewpoint - The A-share market experienced significant gains, with the Shenzhen Component Index rising over 2% and the ChiNext Index increasing over 3%, indicating a strong market performance driven by specific sectors [1] Market Performance - The Shanghai Composite Index closed up 0.71% at 3950.31 points - The Shenzhen Component Index rose 2.02% to 13289.18 points - The ChiNext Index increased by 3.57% to 3171.57 points - The STAR 50 Index saw a rise of 4.35% - Total trading volume in the Shanghai and Shenzhen markets reached 199.18 billion yuan [1] Sector Analysis - Coal, real estate, gas, oil, and liquor sectors experienced declines - The semiconductor sector saw significant gains, with notable performance in chip concepts, CPO concepts, consumer electronics, and military trade concepts [1] Long-term Outlook - Huajin Securities suggests that the long-term slow bull trend in A-shares may further solidify due to improving profit expectations and positive policies that could enhance A-share valuations [1] Short-term Outlook - The 20th Central Committee's Fourth Plenary Session emphasized achieving this year's economic growth targets, which may boost short-term profit expectations - There is a potential for increased liquidity easing, with expectations of interest rate cuts and reserve requirement ratio reductions by the central bank - This may enhance market risk appetite [1] Investment Opportunities - Huazhong Securities highlights the importance of enhancing technological self-innovation capabilities, suggesting investment opportunities in the new round of growth industries, particularly in AI computing infrastructure - Key areas to focus on include TMT sectors, computing (CPO, PCB, liquid cooling, optical fiber), applications (robots, gaming, software), and military industry [1]