芯片制造

Search documents

英伟达宣布将斥资10亿美元入股诺基亚

Sou Hu Cai Jing· 2025-10-29 00:30

Core Insights - Nvidia plans to invest $1 billion in Nokia, focusing on collaboration in 5G and 6G network software as well as AI infrastructure [1] Group 1 - Nvidia's investment is aimed at enhancing capabilities in advanced telecommunications and AI technologies [1] - Following the announcement, Nokia's stock price surged over 20% in both US and European markets [1] - Nvidia's stock rose nearly 5% on the same day, bringing its market capitalization close to $4.9 trillion [1]

中美贸易战按下暂停键,美国才顿悟:中国令美忌惮的,并不是经济

Sou Hu Cai Jing· 2025-10-28 18:42

Group 1: Trade Tensions and Tariffs - In 2025, under President Trump's administration, trade tensions between the US and China escalated, with punitive tariffs imposed on a wide range of Chinese imports, initially set at 10% and later increased to 145% [1][4] - China retaliated with high tariffs on US agricultural products and aircraft, reaching 125%, marking the beginning of a prolonged trade war [1][4] - A temporary agreement was reached in May, reducing US tariffs from 145% to 30% and Chinese tariffs from 125% to 10%, although the long-term implications of the trade war remained uncertain [5][7] Group 2: Impact on Industries - The trade conflict severely disrupted global supply chains, with US companies facing significant operational pressures and consumers experiencing rising prices [4] - Boeing was notably affected, with several aircraft orders canceled by Chinese airlines, leading to a substantial revenue decline for the company [4] - The tightening of Chinese rare earth exports impacted US high-tech industries, particularly in chip manufacturing and electric vehicle production, causing delays [3][12] Group 3: Economic Consequences - By July, inflation in the US surged to 4.2%, exacerbating the economic strain on farmers in key swing states reliant on exports to China [5][14] - Despite the ongoing trade tensions, trade volume between the US and China remained substantial, with a reported trade volume of 17.37 trillion yuan in the first nine months of the year [7][13] - The interdependence of the US and Chinese economies was highlighted, with significant implications for US agriculture and debt holdings in US Treasury bonds by China [13][14] Group 4: China's Global Positioning - China's diplomatic strategies, such as the Belt and Road Initiative, have strengthened its global trade relationships, with partner countries accounting for over half of China's total foreign trade [10][12] - China's manufacturing sector remains robust, contributing nearly 30% to global manufacturing value added, while the US struggles with high production costs due to offshoring [12][14] - In technology, China leads in patent applications and is making significant advancements in areas like 5G and artificial intelligence, posing a challenge to US technological dominance [14][15]

100%关税又不加了?美国有事急求中国,中方开始掌握谈判主动

Sou Hu Cai Jing· 2025-10-28 10:49

Core Viewpoint - The news highlights the contrasting strategic considerations of the U.S. and China in the context of their economic negotiations, with the U.S. focusing on short-term gains while China aims for long-term development [2][21]. Group 1: U.S. Strategic Interests - U.S. Treasury Secretary Mnuchin emphasized the favorable aspects of the agreement for the U.S., particularly regarding tariffs, which were initially set to increase by 100% on Chinese goods but are now temporarily shelved due to domestic economic pressures [4][18]. - The U.S. is heavily reliant on Chinese rare earth materials for its high-tech and military industries, necessitating negotiations for a delay in export controls imposed by China [6][18]. - The U.S. agricultural sector, particularly soybean farmers, is under pressure due to a significant drop in Chinese purchases, prompting the U.S. to seek increased soybean exports to stabilize domestic support [6][10]. Group 2: China's Strategic Interests - China is focused on reducing tariffs, aiming to lower the average tariff rate to below 25%, which is essential for the survival and growth of its export enterprises [10][21]. - China seeks the removal of sanctions on over 700 Chinese companies, advocating for a verification process instead of outright bans to facilitate international business expansion [12][21]. - In the high-tech sector, China aims to secure the continued operation of existing equipment, such as lithography machines, while it develops domestic alternatives, indicating a long-term vision for self-sufficiency [12][21]. Group 3: Negotiation Dynamics - The negotiations represent a time-based game, with China demonstrating greater resilience and a long-term strategy compared to the U.S.'s short-term focus, which is increasingly leading to domestic pressures [16][19]. - The U.S. is facing rising inflation, supply chain instability, and dissatisfaction among agricultural states, which could hinder its ability to engage in prolonged negotiations [18][21]. - China's approach appears more methodical, allowing it to maintain strategic stability while the U.S. may make hasty decisions driven by immediate concerns [19][21].

高通,大消息!中国资产,大爆发!

Zhong Guo Ji Jin Bao· 2025-10-28 00:15

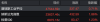

Group 1: Market Overview - The US stock market experienced a significant rally, with all major indices reaching new historical highs on October 27, 2023. The Dow Jones increased by 0.71% to 47,544.59 points, the S&P 500 rose by 1.23% to 6,875.16 points, and the Nasdaq composite climbed by 1.86% to 23,637.46 points [3][4]. - The Nasdaq China Golden Dragon Index saw a rise of 1.59%, driven by positive developments in US-China trade negotiations, which contributed to the strength of Chinese stocks listed in the US [11]. Group 2: Qualcomm's AI Chip Announcement - Qualcomm announced its entry into the AI data center market, launching a new AI chip, the AI200, which is set to begin shipping in 2024. This move aims to compete with Nvidia in the data center sector [8][9]. - Following the announcement, Qualcomm's stock surged by 20% during trading and closed up by 11.08%. The company is targeting significant new revenue streams through this initiative, with the AI200 chip expected to be available in various forms, including standalone components and complete server cabinets [9][10]. Group 3: Performance of Major Tech Stocks - Major technology stocks experienced gains, with Apple rising by 2.26% to nearly a $4 trillion market cap, and Tesla increasing by 4.30%. Other notable performers included Google (up 3.58%), Nvidia (up 2.78%), and Microsoft (up 1.51%) [5][6][7]. - The upcoming earnings reports from major tech companies, including Microsoft, Google, and Meta, are anticipated to be crucial, especially amid rising concerns about the risks associated with the AI bubble [6]. Group 4: International Gold Market - The international gold market saw a significant decline, with COMEX gold prices dropping below $4,000 per ounce. Analysts attribute this adjustment to reduced demand for safe-haven assets following positive US-China trade talks [13]. - The chairman of the London Bullion Market Association indicated that the recent price surge in gold was driven by speculative bubbles, suggesting a potential for further price corrections before a new upward trend [13]. Group 5: Nvidia and Deutsche Telekom Partnership - Nvidia and Deutsche Telekom are preparing to build a data center in Germany, valued at €1 billion (approximately $1.16 billion). This project is part of their strategy to enhance AI infrastructure in Europe [17]. - SAP SE is expected to be a key client for this facility, highlighting the collaboration between major tech firms to support AI systems [17].

VW's Lies urges quick diplomatic solution to Nexperia dispute

Reuters· 2025-10-27 09:34

Core Viewpoint - The trade dispute between China and the Netherlands regarding Dutch chipmaker Nexperia poses a significant risk to automotive production and requires urgent diplomatic intervention [1] Group 1: Industry Impact - The ongoing trade tensions could disrupt the supply chain in the automotive sector, which is heavily reliant on semiconductor components [1] - A resolution is critical to prevent potential production halts in the automotive industry, highlighting the interconnectedness of global supply chains [1] Group 2: Company Specifics - Nexperia, as a key player in the semiconductor market, is at the center of this dispute, which could affect its operations and partnerships [1] - The outcome of the diplomatic negotiations will have direct implications for Nexperia's production capabilities and market position [1]

海南省国资委党委书记、主任马咏华:以创新、绿色发展推动企业转型升级

Xin Hua Cai Jing· 2025-10-27 09:29

Core Insights - The ESG China Innovation Conference (2025) and the first ESG International Expo were held in Beijing from October 24 to 26, highlighting the progress of state-owned enterprises in Hainan Province [1][4]. Group 1: Economic Growth and Development - As of September 2025, the total asset scale of Hainan's state-owned enterprises reached 732.3 billion, which is 3.5 times that of 2020 [1]. - There are currently 18 state-owned enterprises in Hainan, with 8 of them having asset scales exceeding 10 billion [4]. Group 2: Innovation and R&D Investment - Hainan's state-owned enterprises have significantly increased their R&D investment, reaching 1.316 billion in 2025, over 10 times the amount in 2020 [7]. - The province is expanding its focus from traditional sectors to new productive forces, including commercial aerospace, semiconductor manufacturing, and underwater data centers [7]. Group 3: Green Transformation - Hainan's state-owned enterprises are actively pursuing green transformation in various sectors, including construction and transportation, aligning with national ecological development goals [7]. - The theme of the conference, "Full-chain Innovation Leading Green Transformation Future," aligns with the central government's directives for the development of Hainan Free Trade Port [7].

美国终于找到了反制稀土的新办法,接连出手三招,逼中方就范!

Sou Hu Cai Jing· 2025-10-27 04:41

Core Points - The ongoing US-China talks in Malaysia focus on three main issues, including China's stricter rare earth export controls, which the US fears could disrupt supply chains in critical sectors like semiconductor manufacturing and defense [3] - The US aims to pressure China into relaxing these export restrictions to ensure stable raw material supplies for industries such as electric vehicles and semiconductors [3] - The US also seeks to increase Chinese imports of agricultural products like soybeans to alleviate export barriers faced by American farmers [3] - A significant goal of these talks is to prepare for a meeting between the two countries' leaders at the upcoming APEC summit in South Korea [3] Measures Taken by the US - US Treasury Secretary Mnuchin announced that if China does not lift its rare earth controls, the US will collaborate with the G7 to impose software export restrictions on China, targeting its high-tech development [4] - The US has initiated an investigation into whether China has complied with trade agreement terms signed during Trump's first term, with potential additional sanctions if non-compliance is found [7] - Starting November 1, the US plans to impose a 100% tariff on Chinese goods, a measure linked to China's rare earth export controls, which could be used as leverage in negotiations [7] China's Response - China is portrayed as a responsible nation that has historically adhered to international agreements, contrasting with the US's inconsistent approach [9] - Despite the US's pressure tactics, China remains steadfast in its negotiation stance, having learned from past experiences where it made concessions that were not reciprocated by the US [9] - The US's traditional methods of negotiation, characterized by threats and tariffs, are viewed as ineffective against China, as evidenced by the reduction of a lengthy sanctions list during the talks [9] Conclusion - The resolution of US-China differences is suggested to require equal treatment and mutual benefit, rather than unilateral pressure and sanctions, as trade wars yield no winners [11]

这些芯片公司员工,收入飙升

半导体行业观察· 2025-10-27 00:51

Core Insights - The chip manufacturing industry is currently facing challenges despite the surge in valuations due to the AI boom, leading to significant increases in employee compensation tied to stock prices [3][4] - Companies like Nvidia, AMD, and Broadcom are implementing stock-based compensation strategies to retain talent, creating a "golden handcuff" effect that discourages employees from leaving [3][5] Group 1: Employee Compensation and Retention - Employees at chip manufacturers can take up to four years to fully vest their stock bonuses, with some already receiving substantial compensation due to rising stock values [4][5] - Nvidia's stock-based compensation has led some employees to adopt a "semi-retirement" mindset, as they weigh the benefits of staying in a high-paying job against the potential loss of unvested stock [4][5] - Broadcom employees have reported that their restricted stock units (RSUs) can be worth over six times their salary, indicating the significant financial incentive to remain with the company [4][5] Group 2: Impact of Stock Performance - Since January 2023, stocks of chip manufacturers like Broadcom, Nvidia, and AMD have outperformed other tech giants, with Nvidia employees seeing stock awards increase in value by over 350% since their hiring [4][5] - A former Broadcom employee estimated that unvested RSUs could be worth around $500,000, highlighting the financial implications of leaving the company prematurely [5] - Nvidia's CEO has emphasized the importance of stock-based compensation in employee retention, with the company's turnover rate dropping significantly [6] Group 3: Changes in Compensation Strategies - Nvidia has adopted a strategy similar to companies like Google and Uber, allowing for "early vesting" of stock options, which can attract top talent by providing immediate financial rewards [7] - The trend in the industry is shifting towards offering more stock options rather than higher salaries or bonuses, which aligns with employee preferences for equity compensation [7] - Broadcom has reported a voluntary turnover rate lower than the tech industry benchmark, attributing this to effective stock-based retention strategies [6]

AMD,起源于这颗芯片?

半导体行业观察· 2025-10-26 03:16

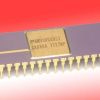

Core Viewpoint - The article discusses the historical significance of AMD's Am9080 processor, which was a reverse-engineered clone of Intel's 8080, highlighting its impact on AMD's growth in the CPU market and the financial success it brought to the company [4][7]. Group 1: Historical Context - AMD's Am9080 was developed through reverse engineering of Intel's 8080, leading to a licensing agreement between the two companies to avoid legal disputes [4][8]. - The Am9080 was first produced in 1975, with AMD manufacturing costs at $0.50 per unit and selling prices reaching $700, particularly to military clients [7][8]. Group 2: Technical Specifications - The Am9080 had multiple versions with clock speeds ranging from 2.083 MHz to 4.0 MHz, showcasing AMD's advanced N-channel MOS manufacturing process [10]. - The chip's design was more compact than the Intel 8080, allowing for higher clock frequencies, with the Intel 8080 never exceeding 3.125 MHz [10]. Group 3: Business Agreements - In 1976, AMD signed a cross-licensing agreement with Intel, which allowed AMD to become a "second source" for Intel's products, facilitating future collaborations and product developments [8]. - The agreement included a payment of $25,000 to Intel and an annual fee of $75,000, which also absolved both companies from past infringement liabilities [8].

高端车规MCU,芯驰官宣:规模化量产

半导体行业观察· 2025-10-26 03:16

Core Viewpoint - The mass production of the E3650 MCU by Xinchip Technology marks a significant challenge to established international competitors in the automotive MCU market, particularly in the domain control sector [1][3]. Product Overview - The E3650 has officially entered mass production and has completed AEC-Q100 Grade 1 reliability certification, positioning it as a core solution for next-generation vehicle area controllers (ZCU) and domain controllers (DCU) [1][3]. - The E3650 features a 22nm automotive-grade process, a high-performance ARM Cortex-R52+ multi-core cluster with a frequency of 600MHz, and 16MB of embedded non-volatile memory, establishing a performance benchmark in its category [5][6]. Competitive Landscape - Historically, the automotive MCU market has been dominated by international giants such as Renesas, Infineon, STMicroelectronics, and NXP. The introduction of the E3650 represents a new competitive force from a domestic manufacturer [1][3]. - The E3650 outperforms competitors in several key specifications, including a higher main frequency and more available I/O ports, which enhances its capability to integrate various functions [2][5]. Market Positioning - The E3650 is positioned as a solution for the evolving automotive E/E architecture, which demands higher integration and performance from fewer, more powerful controllers [12][15]. - The product has already secured multiple key projects and is being developed for future vehicle platforms aimed at 2027 and 2028 [6][17]. Application Scenarios - The E3650 addresses the challenges faced by manufacturers in integrating advanced functions into area controllers, particularly as the industry moves towards more complex architectures [9][10]. - It also supports the central computing unit for integrated cockpit and driving functions, providing enhanced processing capabilities and reducing the need for additional I/O expansion chips [10][11]. Ecosystem Development - Xinchip Technology has built a comprehensive ecosystem around the E3650, including high-function safety PMICs, efficient I/O expansion chips, and mature virtualization software, facilitating a smooth transition from chip selection to mass production [15][17]. - The E3 series products have already achieved significant market penetration, with millions of units shipped across over 50 mainstream production models, showcasing the company's capability in automotive applications [17].